When I bought my first motorbike with no previous experience of engines, I took myself off to a motorcycle maintenance class so I could look after my bike with some level of competence, if not quite Zen. The portly gentleman who taught the class and looked like he’d walked off the set of Easy Rider, introduced me to the four-stroke internal combustion engine in which the piston completes four separate ‘strokes’ to turn the crankshaft, with a stroke referring to the full travel of the piston, up and down, inside the cylinder. He memorably summed up the process as suck; squish; bang; blow.

Most economic cycles can be likened to a combustion engine including bitcoin, which has the added advantage of fitting neatly into a four-year cycle in line with the halvings and, as it turns out, in line with the US presidential elections.

Let’s look at them in turn.

SUCK:

The intake phase is also known as induction, or suction. The stroke of the piston begins at top dead centre (TDC) and ends, would you believe, at bottom dead centre (BDC). In this stroke the intake valve must be in the open position while the piston pulls an air-fuel mixture into the cylinder by producing a partial vacuum in the cylinder through its downward motion.

This stage is akin to the expansion phase of the economy. The economy fills with activity and potential. Interest rates are often low, increasing consumers and businesses borrowing. Demand for goods and services builds and businesses ramp up production to meet consumer demand. More workers are hired or capital invested to expand operations. Profits start to rise along with stock prices and GDP. It’s economic Spring-time and everyone has a spring in their step.

Bitcoin is impacted by the broader economic energy. The needle on the ‘fear and greed’ index shifts towards greed. Bitcoin businesses, that have been building slowly through the last trough, draw new interest, new users and new people into the industry at a rapid rate. ‘Strong men’ and women are building up new and existing businesses, creating good times.

Bitcoin miners, particularly those that are publicly listed, enjoy increased revenue, with transaction revenue making up a greater percentage of the total, while new miners, seeing opportunity, get set up.

In terms of price action, Richard Wyckoff, the renowned American investor and technical analyst of the early 20th century, called this the Markup Phase. The market moves higher at an increasing rate. New groups of market participants enter the markets along with a notable increase in volume. Market participants start to become optimistic after a tough few months or years, and companies and media start publishing positive headlines. Demand starts to outweigh supply. Prices and value increase. The upwards spiral of a bull market is on.

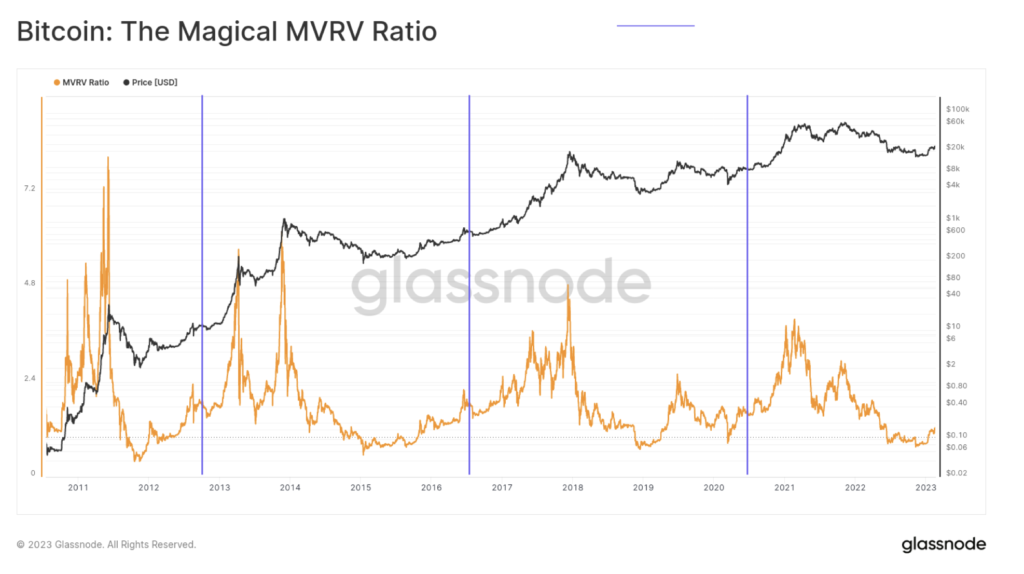

On-chain analysis, which analyses data we can extrapolate from transactions on the blockchain, shows even more clearly than the (logarithmic) price chart, that unrealized profits (the market price vs the price at which people bought bitcoin) during bull markets typically peak 12-24 months after the halving.

SQUISH:

After the suction comes the compression stroke, from bottom to top. The intake and exhaust valves are closed and the piston compresses the air-fuel mixture til it peaks near the top, in preparation for ignition.

And ‘peak’ is exactly where we are in the economic cycle. The economy reaches a maximum rate of growth. As consumer demand rises, so do production and input costs including wages so that businesses may no longer be able to ramp up production and supply to match demand, or at least, not without increasing consumer prices to compensate.

It culminates in a ‘topping-off’ of profits despite charging higher prices. Inflationary pressure builds to a bubble and the long summer of the economy begins to overheat.

The Federal Reserve might at this stage hike interest rates in an attempt to combat rising prices and cool the economy but the measures lag in the face of the economic momentum.

In the financial markets, sentiment is at peak euphoria and ‘greed’. New punters seeking quick wins, enter the market and pump the price. The stock-market and bitcoin are at all time highs. Good times are making for weak men & women, not motivated by the same inspiration and aspiration, coming in with limited understanding and keen for a fast buck.

The smart money smells blood. Some buyers become sellers. Wyckoff calls this the Distribution Phase. Buyers believe the bull market has more to go. Sellers are locking in profits.

This creates tension between the bulls and bears. While there’s still high trading volume, there’s an equilibrium between buyers and sellers so that prices trade within a limited range, waiting for a breakout.

Those late to the party and experiencing FOMO might shift from bitcoin – which has had a big run and is looking expensive, or at least high on the risk/reward scale – to alt-coins, and so, relatively late in the piece, alt-coin season takes off and bitcoin dominance drops.

BANG:

While the piston is at the end of the compression stroke at TDC, the compressed air-fuel mixture is ignited by a spark plug (in a gasoline engine) and boom! Combustion forcefully returns the piston to BDC. This stroke produces the mechanical (proof of) work from the engine to turn the crankshaft.

Just as the combustion releases energy in the engine, so the contraction phase in the economy sees a release or decline in economic activity.

Costs are high. The impact of interest rate hikes kick in. Corporate profits and consumer spending, particularly on discretionary and luxury goods, drops away. Fall is here, and as the leaves drop so does demand. Production slows and GDP contracts. Employment and income may decline as businesses implement hire freezes or lay off workers. Economic activity slows, and a recession, or at worst, a depression ensues.

The Fed may lower interest rates. Policy makers may reduce taxes. Economic stimulus measures may be implemented. But not only is there a lag but the more they have interfered over the years, the more extreme the cycle highs and lows have become – a subject for another time.

Shares and bitcoin prices correct for the exuberance of the bull market and investors shift their funds into perceived ‘safer’ investments like fixed interest and cash.

Bitcoin miners lose revenue while the price of mining hardware drops. Older, less efficient machines that can’t achieve the same hash power per joule of energy, may even be squeezed out of the market altogether.

In Wyckoff terms we’re in the Markdown Phase or bear market, which is the scariest phase for most market participants except of course, the short-traders. The outlook becomes increasingly negative and fear takes over from greed, leading to more selling pressure, sensationally negative headlines and a downward spiral of stock & bitcoin valuations.

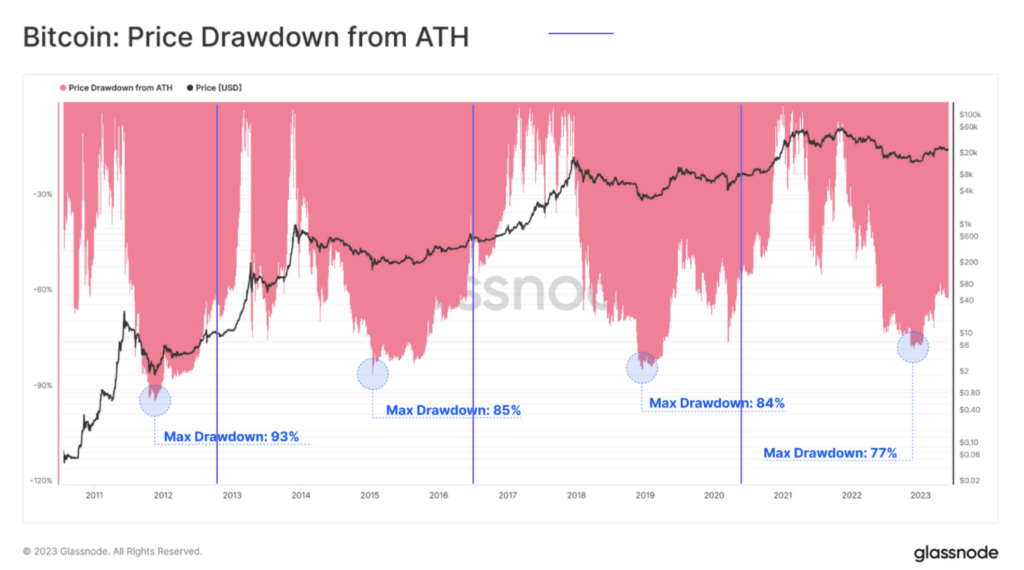

On-chain analysis shows these draw-down (selling) periods appearing roughly every four years, taking place often 12-18months before the halving, and it also shows the duration of the bear markets spanning between 500 to 800 days from top to bottom (around 2-years)

Long-term bitcoiners like to think of this as a ‘healthy’ retracement after an exponential growth cycle.

Alt-coins lose over 90% of their value at this time, most of them never to return. Ponzi schemes and scams that thrived through the bull market are exposed, become insolvent and wipe out all their investors in the process. Weak men and women looking for easy gains with no proof-of-work, are creating bad times. Participants in their first cycle may despair. Those who felt like genius traders in the bull market find out otherwise. Some however, start to discern between alt-coins and bitcoin and new, true-believers are born.

Luckily, like every phase, the markdown phase passes, and with it, the start of a new economic and bitcoin market cycle.

BLOW:

During the exhaust stroke, the piston, once again, returns from bottom to top with the exhaust valve open to expel the spent air-fuel mixture through the exhaust pipe.

This is the trough in the economic cycle. Exhaust-ed from the emotions of the business and stock-market collapse, winter frosts destroying any last vestiges of the previous seasons, the economy clears out inefficiencies and sets the stage for a new round of growth. Hard times create, or bring to the fore at least, strong people.

Stock markets bottom out and begin the cycle anew. Policies enacted during the contraction phase begin to bear fruit. Businesses that retrenched during the contraction begin to ramp up again. Stock values tend to rise as investors see greater potential returns in stocks than bonds. Production ramps up to meet rising consumer demand and with it, business expansion, employment, income and GDP.

Newly minted bitcoiners, forged in the hellish fires of the mark-down period, looking for ways to contribute to the protocol and community, are absorbed into the Bitcoin eco-system. Needs and gaps identified but unaddressed in the frenzy of the bull and bear markets trigger new businesses and opportunities for venture capitalists and job-seekers.

Wyckoff calls this the Accumulation or Consolidation Phase, which generally marks the end of the downtrend. Some market participants may still consider it an uncertain time to enter the market, as it can be hard to deduce whether assets will continue trending lower. But from another perspective, longer-term holders often look at the accumulation phase as the precursor to what they hope will be the start of a bull market.

This period is especially attractive for long-term users who are looking to buy and hold. For short-term traders, however, patience is key, as this phase can last anywhere from weeks to months or even years.

There’s a beautiful line that Robert Jordan uses to open each of the 14 ‘Wheel of Time’ novels. “The Wheel of Time turns, and ages come and pass, leaving memories that become legend. Legends fade to myth, and even myth is long forgotten when the Age that gave it birth comes again…There are neither beginnings or endings to the turning of the Wheel of Time. But it was a beginning.”

The markets will always do what they’ve always done, rotating through their four-stroke cycle and so we must roll with it, trying not to feel overly encouraged or discouraged by the mood of the market. ‘Zen and the art of owning bitcoin’ would suggest that there’s no need for craving or aversion, excessive fear or greed. The path of maximum equanimity knows that the engine cycles on, markets revolve, seasons come and go and human psychology, that drives the market cycles, continues to be driven by the same motives it always has…and always will.