*If you find this content interesting, sign up to my weekly newsletter, The Qi of Self-Sovereignty.

We tend to think of the world as the past, present and future, these distinguished moments in time. However, as we intuitively know, this is not the case. Instead, we are always in a state of flux, this slow progressive evolution in order to suit humanity’s growing needs, knowledge and demands. However, with change comes adjustment, and what we are facing right now is an adjustment to the digital realm, the world of Bitcoin and our digital identity. A crossing of the chasm, a state change away from the physical realm of traditional finance, legacy structures and the world as we know it. This article is meant to highlight some of these critical hurdles brought up by Raoul Pal and RobertBreedlove in an effort to get the collective consciousness thinking about how we can transition to this digital realm with minimal volatility and entropy.

Where do we start?

One thing Raoul and Breedlove bring up many times throughout the talk is the metaverse. Therefore, let’s first ensure we are on the same page when it comes to the metaverse. We often hear the metaverse is the future; however, what most deep down the rabbit hole may argue is that the metaverse has been blossoming into existence since the birth of the internet. However, we are only just starting to define it now. Let’s go deeper…

Most of us tend to interpret the metaverse as this digital environment where we hang out in this virtual world, the world Mark Zuckerberg is pushing with his FaceBook ads… my apologies, Meta. But, I would argue that the metaverse is not this virtual world that it is made out to be, but rather a digital interface to one’s digital self. It is our digital identity where we interact with our online social community, manage our digital possessions and store our digital wealth, to name a few. With that being said, this osmosis into the metaverse is not a movement of people from the physical world into the digital world but rather a transfer of wealth and identity from the physical realm to the digital realm. Although many people already do and will continue to spend time in digital worlds in video games and social platforms, most of us will still very much be rooted in the physical world for the time being.

Building on this idea, what will happen to physical assets? An asset’s value is subjective and is worth something because it provides value to us in some way or another. At the moment, our physical assets offer greater perceived value than our digital assets. This explains the discrepancy between the value of physical vs digital assets globally, e.g. real estate is worth some $300 trillion while the complete cryptocurrency market cap sits at $2.5 trillion. The question now is, how does this value shift over into the metaverse? This, I believe, is a demographic shift. As our population ages, those in earlier generations, with limited exposure to the digital realm (i.e. digital identity, digital assets or digital possessions), will slowly bequeath their wealth to their offspring, which will find greater value as technology evolves in the metaverse. However, it should be noted that you will find utility and value in different areas and offerings within the metaverse depending on your age, values, interests, gender and location. Some people may choose to stay primarily in the physical world as the metaverse doesn’t provide ample value. Others may dive in headfirst.

Where are we now? We are currently in a state of limbo, one toe in the digital plane and the rest of the body out. Most of us have exposure to the metaverse when it comes to our digital identity, but only a handful of us find greater value in digital assets over physical assets, although this is quickly changing. However, as we see greater adoption, we will also encounter greater hurdles (technological, political, financial etc.). Taking this into account, this shift towards the metaverse isn’t something that will happen overnight. As previously mentioned, it is a generational demographic shift that has been underway since the invention of the internet. The transition from handwritten letters to email and social media was just the start. Now we will continue to see the transition of wealth, jobs, and identities to the digital plane.

When can we safely say the metaverse is our reality? Just like inflation impacts everyone differently, as it is dependant on your consumption habits, what you classify as the metaverse is unique to you. There are many ways to measure your presence in the metaverse, i.e. time, wealth, reputation, interests, job, hobbies or knowledge. With that in mind, some people may argue that we are already in the metaverse due to the amount of time we spend engrossed in technology. On the other hand, others may say we haven’t reached that inflection point just yet, the metaverse will become our reality when:

- We spend more time connected to the digital realm than the physical realm

- When digital wealth surpasses physical wealth

- When we’re able to vote for our politicians in this digital world

- When the majority of jobs are in the digital plane

- When we can digitally upload ones consciousness

…and some will say the metaverse will never become our reality.

My personal belief is that the metaverse is supplemental to our physical existence, and it is not one or the other. The metaverse eases our physical existence by dematerializing our limitations and constraints, such as distance, time, ageing, wealth, connection etc. However, there is and will continue to be an abundance of value in the physical world. But, ultimately, this decision of whether we are or aren’t or what is, what isn’t the metaverse is not for me to decide. I’ll pass that one onto you.

Opinions aside, although the definition of what constitutes the metaverse may be subjective, what’s not so subjective is that we are and will continue to face hurdles as we see greater adoption.

The Chasm

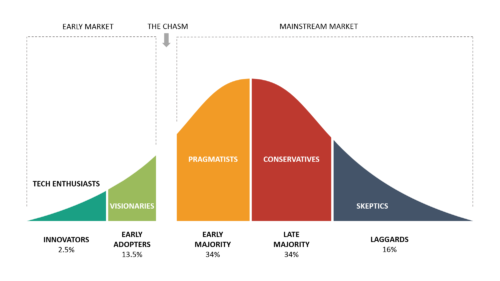

Chart Source

Every new technology has to cross the chasm if it ever wants to reach mainstream adoption (the chasm is detailed in the image above). During this crossing of the chasm, we see creative destruction take hold, where legacy systems collapse and new technology changes the way we interact with the world. All new technology has some form of disruption. It’s just some technology is more disruptive than others.

With the introduction of the digital camera, we witnessed the dismantling and disruption of the traditional film market. But from this, we saw the boom of photography and documentation. However, when it comes to cryptocurrencies, we have only just started to scratch the surface of what is possible. Here is an example of some of the sectors this new technology has the potential to disrupt:

- The financial system (Banking, remittances, micropayments, credit markets to name a few)

- Social media and digital interaction

- The internet (our digital footprint)

- Voting

- Insurance

From everything mentioned so far, it should be evident that we are in the middle of a major global state change, a transfer of identity, wealth, possessions and interactions from the physical realm into the digital realm. As Raoul and Robert eloquently explain, with this state change in place, we have to overcome some major hurdles. We need to ensure we are heading in the right direction collectively. Therefore, we should ask ourselves, how do we get there safely, without a consolidation of power or the crippling of our economy? These are a few key questions we have to figure out before conquering the chasm of adoption. Let’s touch on a few key hurdles we have to face:

Transaction

If an asset, such as Bitcoin, is our primary currency and store of value and it is wildly outperforming the majority of other investment opportunities, then we will be disincentivized to transact and spend. Yes, there will be opportunities here and there, but in general, the majority of the world we know will be starved of capital. This will push central banks to intervene and over regulate in order to stop this capital flight from traditional assets to digital assets, but in doing so, it’ll only lock people into our failing system, delaying the inevitable and amplifying its negative effects down the line.

Eventually, if we can predominately move across into the digital realm, this problem of capital flight will be solved. At this point, Bitcoin will reach saturation, similar to gold today, where it protects purchasing power but is no longer an asymmetric bet on technology and a failure of the current system. But, in the interim, how do we take advantage of Bitcoin’s positive properties while also promoting the exchange of Bitcoin between one another?

Taxation

In the short term, if we were to see a seismic shift of capital away from traditional assets and into digital assets, this starvation of capital from traditional assets would create sizeable losses. As it stands, around 10% of IRS tax revenue comes from capital gains. Suppose traditional assets start facing major losses, while at the same time, there is a lack of transacting in digital assets, creating a reduction in realized gains, we have a problem on our hands. We could see a significant decrease in capital gain revenue and an increase in capital losses, further eroding the tax base. This could push policymakers to implement overbearing regulation, resulting in measures such as taxation on unrealized gains. This would stifle the prosperity in the metaverse and limit the transition of individuals to the digital realm.

In the long term, if we embrace a currency such as Bitcoin as a legal tender:

- The government will no longer receive capital gains tax from any appreciation in the value of Bitcoin. This would be in line with the fact that a countries legal tender is not subject to taxation if it is to appreciate/depreciate.

- We live in an inherently deflationary world (more details here), whereby technological advancement allows us to get more for less. Over time this advancement increases productivity and efficiency, causing the cost of goods, services and assets to decline slowly. However, this is only possible under a currency with a fixed money supply (such as Bitcoin). The lack of monetary expansion causing dilution would allow the currency to capture these technological gains. This may sound positive; however, over time, most assets may decline in price, resulting in increased capital losses, reducing tax revenue.

With that being said, one could argue that by adopting a currency such as Bitcoin, the government will no longer be spending in a currency that loses purchasing power one day to the next. Therefore, all tax revenue will go further, making up for this reduction tax revenue. If that is the case, then this may all come out in the wash. However, we should still be conscious of these potential taxation issues. With that in mind, how do we ensure that assets such as Bitcoin are taxed appropriately as not to restrict their potential as a solution to our fragile system? And, how do we take into account an increase in capital losses?

Support

We are in the middle of one of the biggest revolutions in human history, and alongside this revolution, we face an assortment of immense deflationary forces such as:

- Demographics (An ageing population with limited purchasing power)

- Our major debt burden consuming productive capital

- Technology such as artificial intelligence (AI) and robots consuming jobs

- Competition in the workforce due to overcrowding of what jobs remain

- Currency debasement, destroying our purchasing power

- Monetary intervention suppressing interest rates and traditional asset returns

- Capital flight into the digital realm putting strain on the traditional system

As these forces become more pervasive, it becomes harder and harder for the lower and middle-income segments of the population to survive. This is a big issue! The majority of the population is under immense pressure as they are being squeezed from all angles. How do we give them a voice, meet their needs and stop them from revolting?

One potential option Raoul proposes is embracing central bank digital currencies (CBDC), allowing easier implementation of fiscal stimulus such as universal basic income (UBI). By doing so, we could redirect the flow of the capital away from asset owners and into the hands of the most at risk. This will aid in bridging the gap between the physical and the digital realm for the lower and middle wealth percentiles, allowing them to support themselves as these deflationary pressures take hold.

My worry with this view is that CBDC’s have the potential to give governments globally immense power and control. If this power is used in the ways mentioned above, then I am all for it. However, if CBDC’s are used with the interests of the few in mind, this will only further consolidate wealth and power and could potentially end this utopian decentralized vision of the metaverse. Therefore, is there a way to implement CBDC’s but somehow define the boundaries for which they can be used, preventing misuse and the centralization of power?

However, regardless of which route we chose to bridge the chasm, Raoul does bring up a good point which is if we are able to transition over to a decentralized metaverse and democratize this incredible technological boom in productivity and innovation, then we may be able to implement a natural form of UBI, where we could monetize our own digital identity. Although this is currently not possible, as our online corporations’ current structure is to capitalize off our data by monetizing our every move, a decentralized metaverse shifts this power and revenue generation into the hands of the user.

Decentralization

As technology advances, we are and will continue to see robots and AI replacing our jobs. Additionally, as energy costs slowly trend to near zero, we should see the cost of living slowly decline. Adding in the fact that we are witnessing a giant demographic shift where people have fewer children due to the costly environment we live in, this should cause GDP per capita to skyrocket. This could mean we are about to face one of the most productive periods in human history.

However, with costs slowly working their way to near zero and jobs being replaced by technology, resulting in more time on our hands, will this considerable increase in productivity bring about:

- A decentralized open-source world where we push for equality of opportunity and where technology is shared freely. If so, this could result in a renaissance period with a focus on culture, art, and science leading to immense prosperity, innovation, and growth.

- A darker, more centralized productivity boom where the vast majority of the patents pertaining to this powerful technology that now governs our lives is under the control of a few key players. In this case, we would most likely see significant poverty and some of humanity’s more challenging times ahead due to the centralization of power and wealth.

On top of all that, we are currently seeing major global exploitation of our digital identities. Not only are we seeing our online data being used in for-profit activities, but we are also seeing targeted media leading to psychological manipulation allowing these large monopolistic entities to sway the population.

Unfortunately, with everything mentioned above, the free market isn’t going to solve these hurdles we face in the way we want. It is going to solve them with the total accumulation of wealth in the hands of the few. Therefore, what can we do to ensure this powerful technology of the future is in the hands of the people while also promoting the continuation of free markets?

With all that being said, how we approach these tough questions will define our future. Will crossing the chasm result in:

- Decentralized Metaverse – A bright future where creative destruction is encouraged. Where there is a dispersion of power within a decentralized metaverse, brought about by rules and regulations that prevent the destruction and manipulation of the free markets, all while suppressing the overbearing powers of monopolies that asphyxiate competition. It should be noted that we may still have nation-state fiat currencies, but globally, we embrace an immutable decentralized asset as our world reserve currency. This would lower the cost of living and democratize technology and finance, reducing wealth inequality. But more importantly, it would restrict the centralization of power with a technology that complements our deflationary world.

- Centralized Metaverse – Similar to the current state of play, where a handful of large corporations have overwhelming control over our data and access to vast sums of capital, allowing them to lobby, protect their interests, and influence politics. In addition to the suppression of creative destruction, will we follow in China’s footsteps and see the rise of CBDC’s and social credit scores. This would give the government unfettered access to all our personal data, laying the foundation for the destruction of free markets and suppression of capital flows into any technology that imposes a threat to the government’s power.

Or will we walk the middle ground just like we have done many times throughout history? A give and take between centralization and decentralization.

Conclusion

We tend to think that new technology, such as Bitcoin and the metaverse, appears, we all jump on board, and everything is hunky-dory. However, the reality is, if certain events had not happened the way they did, we might not have many of the innovations and advancements we see today. These technologies don’t just appear. They are years in the making, a culmination of previous technological progress and human endeavours. They emerge from our experiences, needs and desires, and they are a byproduct of decisions we made ten, fifty, one hundred years ago. With this in mind, coming together as a collective, and understanding the unintended consequences of our choices will help guide us in making more efficient and productive decisions for the future.

The future is bright… if we make it.

Great article. I am a HUGE fan of both Breedlove and Pal, and I remember how excited I was for their podcast together that you’re referencing here. What’s your favourite Breedlove article and/or piece? “The Number Zero and Bitcoin” blew my mind. He did a podcast with Brandon Quittem about a month ago that really made me think, but honestly… everything he does makes me think.

When it comes to technology, it’s impossible to predict how things will play out. Nobody could have possibly imagined social media, the smart phone, or Bitcoin back in the 1990s. Like most people, I have concerns with the metaverse, CBDCs, and other futuristic layers of the internet…but the actual future will probably be less scary than most of us fear. Humans tend to be more pessimistic about the unknown than optimistic, but we’ve always been that way.

Hey Cory!

Hope you’re doing well! I couldn’t agree more. When the What is Money episode with Pal came out I believe I listened to it 3 times back to back as it was so good. It is nice to have clarity as to how we got here, not only from a monetary and fiscal standpoint but also from a demographics standpoint. Everything is so interconnected!

To answer your question, I would say “Masters & Slaves of Money” would be up there.

As for the second half of your comment, I agree. I think when new technology/ideas emerge, we naturally race to think up these utopian/dystopian models of what the future may look like. But, the reality is that it is usually somewhere in the middle, less scary than most of us fear, as you say.

Thanks for the comment!