✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What exactly is correlation?

- How is beta different?

- What do these have to do with risk management?

- Anything else you need to know?

- Thoughts on Bitcoin

Inspirational Tweet:

Bitcoin <> Nasdaq 30-day correlation at 0.82. $BTC $QQQ pic.twitter.com/oGoMrlgPdL

— Dylan LeClair 🟠 (@DylanLeClair_) January 19, 2022

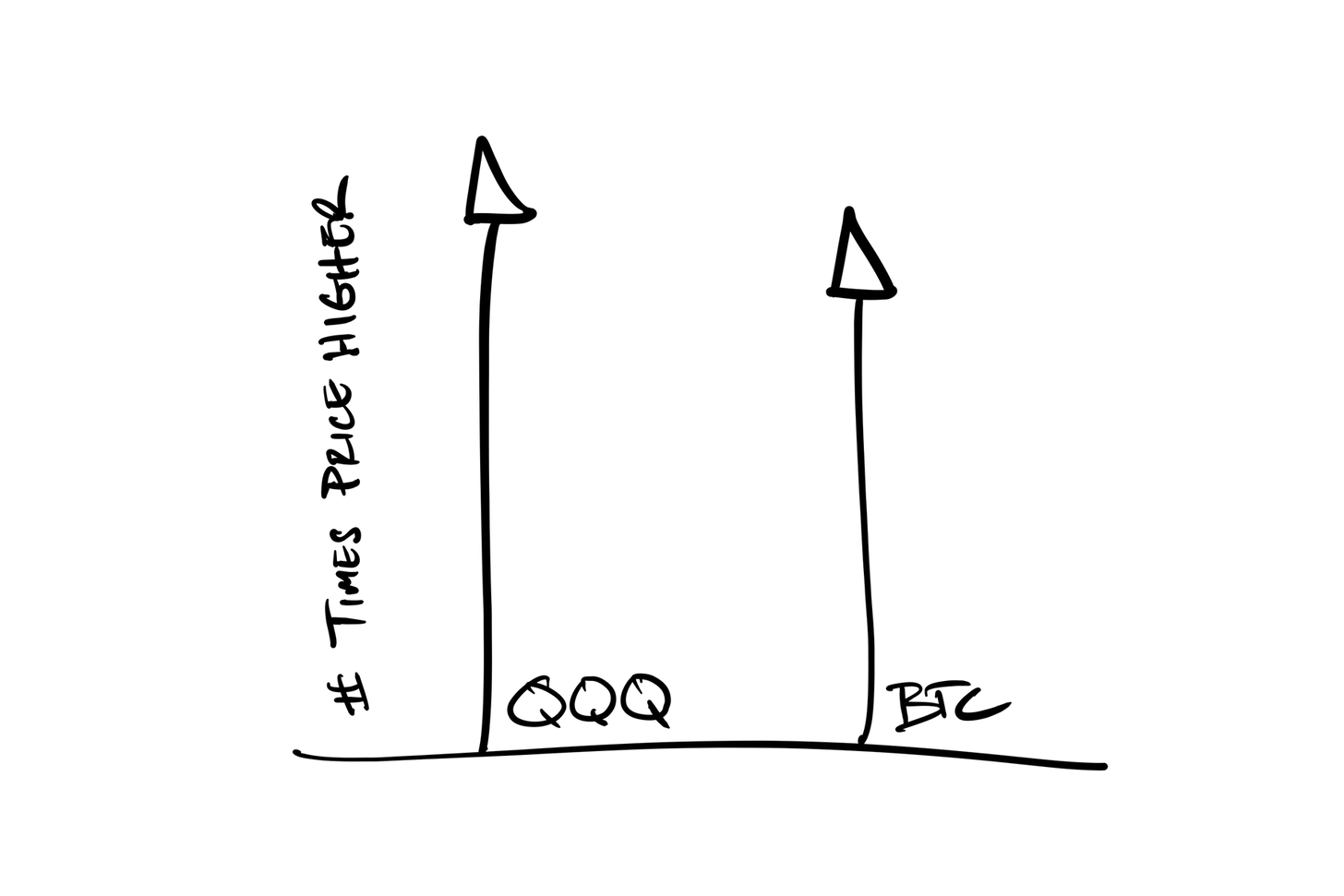

Dylan points out here that Bitcoin has been moving much in the same direction of the NASDAQ market (QQQs), and this infers that Bitcoin is acting more like a tech stock than an independent store of value (SoV).

🎯 What exactly is correlation?

First, let’s clear up what correlation is, exactly. Basically, when we say that two variables are correlated, we mean that they often move up or down in the same direction. For instance:

The windier it gets, the more waves you will likely find in the sea.

Their correlation factor is the likelihood (not the amount that) they move in the same direction.

You can see in Dylan’s chart above, as the NASDAQ (QQQ) moves up and down over the last 30 days, on average, Bitcoin moves in the same direction ~82% of the time (the coefficient calculation is a bit more involved, but this suffices for simplification).

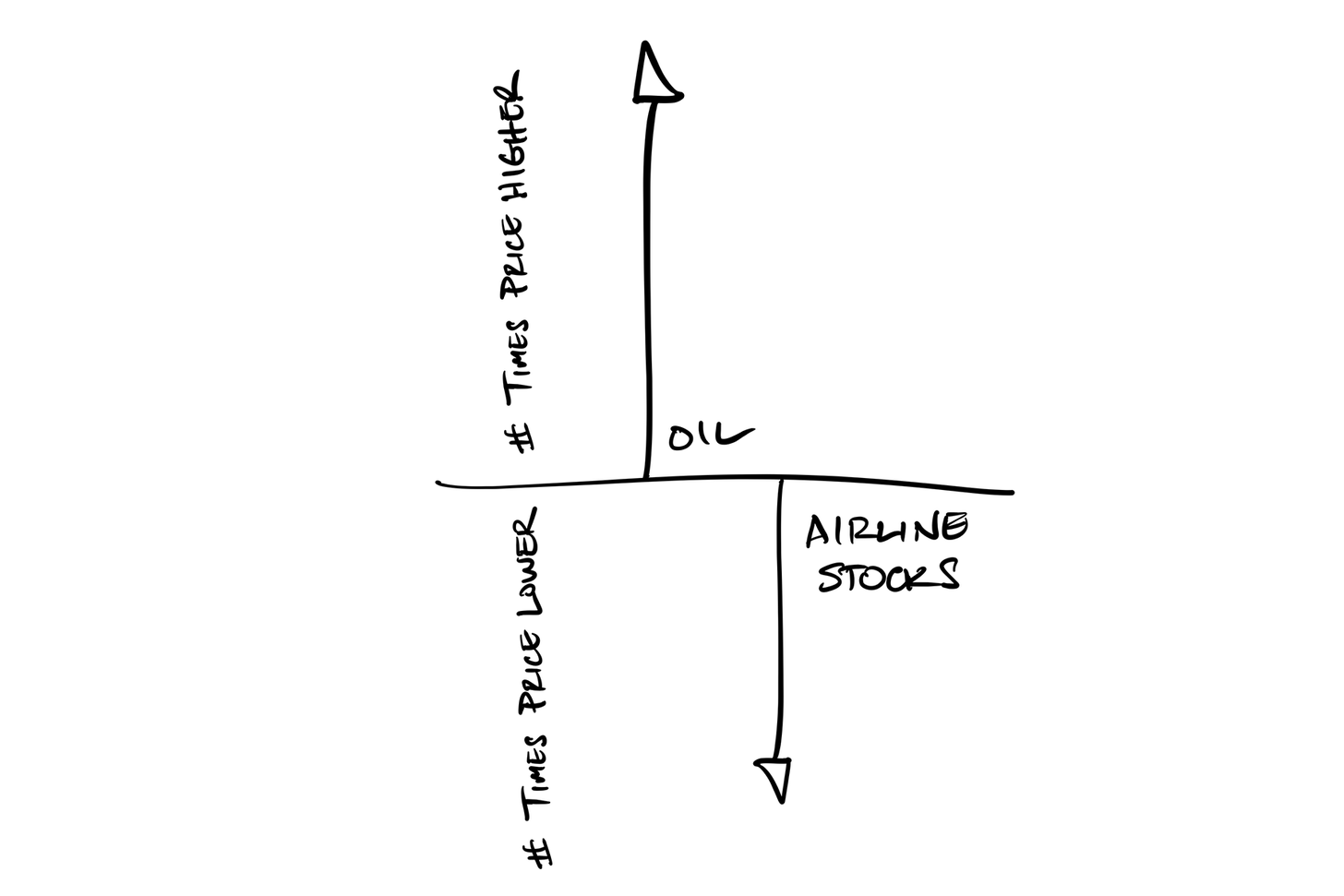

For securities that often move in opposite directions (think oil futures and airline stocks, for example), they are said to be negatively correlated.

To sum up:

- Securities that always move in same direction: Correlation = +1

- Securities that move in random directions: Correlation = 0

- Securities that always move in opposite directions: Correlation = -1

Simple, yes? OK, let’s take it a step further.

🔍 How is beta different?

By now you may have guessed it…beta takes into account both the directional link between securities and the volatility relationship (size of the moves). We usually see beta as a measure when looking at how much a security moves versus an index.

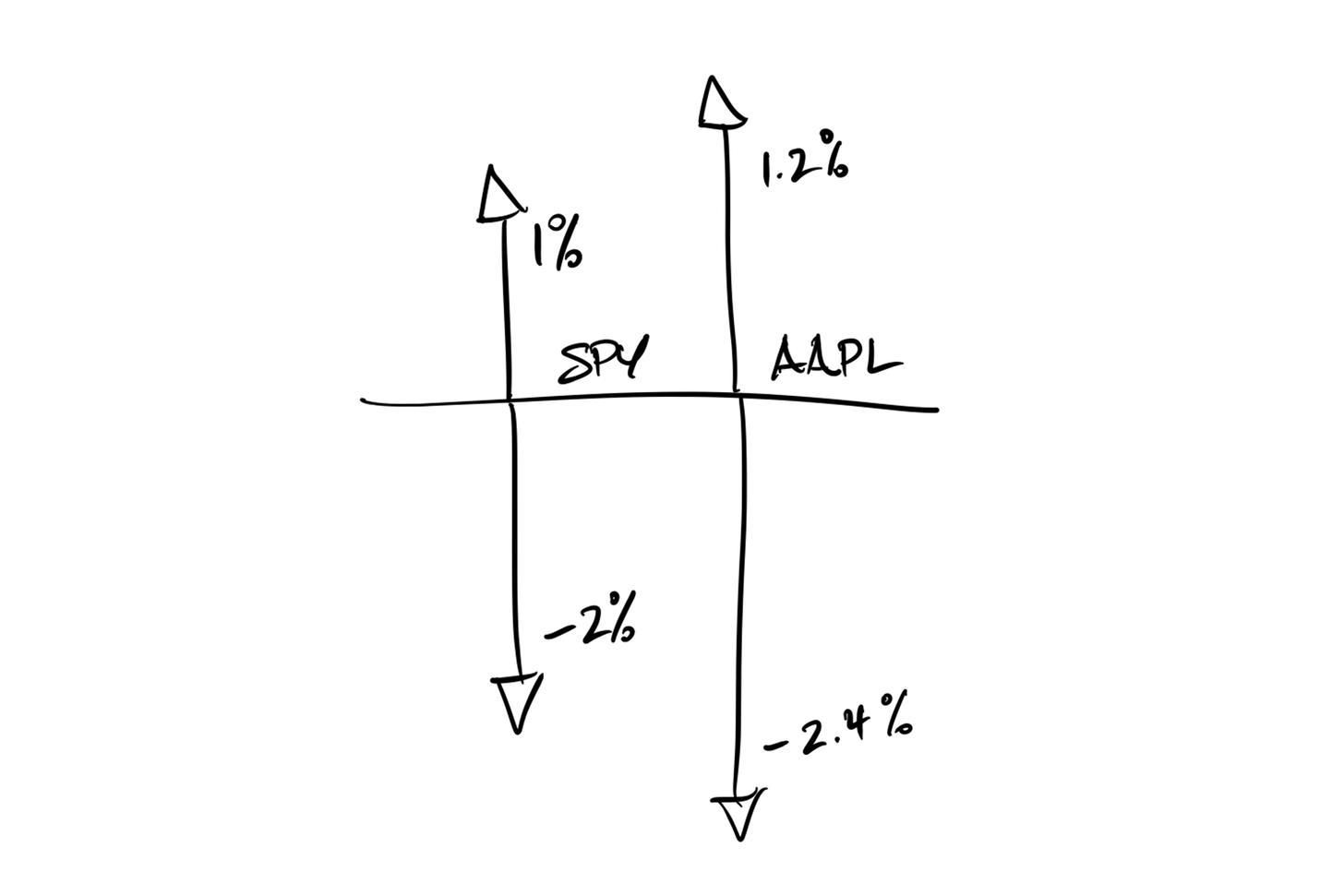

For example, Apple (AAPL) currently has a beta of 1.2 versus the S&P 500 Index.

This means if the S&P 500 rises 1%, AAPL should rise 1.2%. And if the S&P 500 falls 2%, AAPL should fall 2.4%, etc.

In sum:

- Securities that have no relationship to index: beta = 0

- Securities that move more than the overall market: beta > 1

Ok, let’s put it all together.

✍️ What do these have to do with risk management?

These are both important, because as a portfolio manager (whether it is for a billion dollar pension fund or your own retirement account), you want to ensure that you don’t have a portfolio full of securities that are all highly correlated to each other.

Rather, you want some that have negative correlations to each other to offset the impact of external factors on your portfolio as a whole.

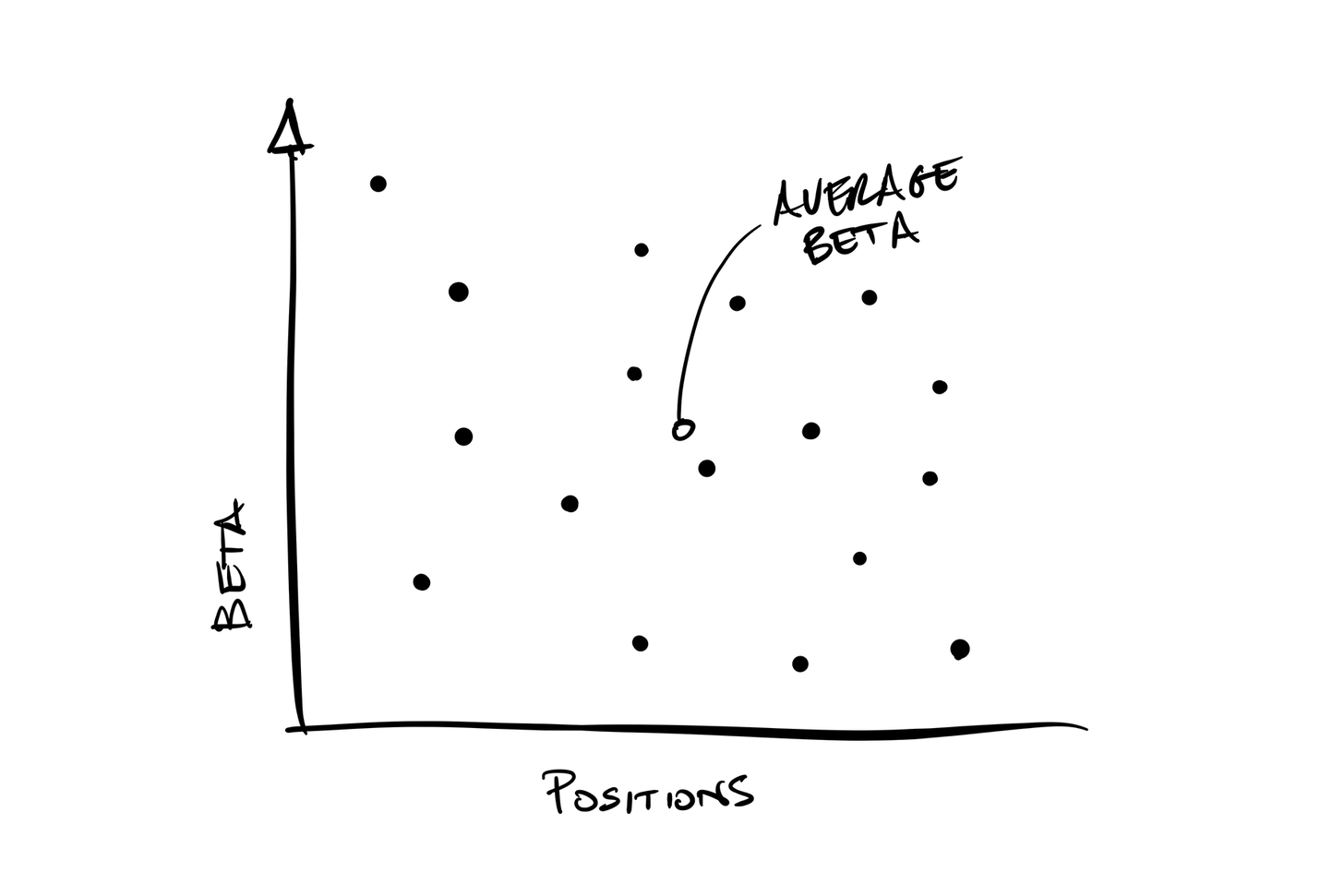

Second, you want to be sure that you understand exactly what your portfolio beta is, so you are not over-exposed to large market moves (a recent example of this would be ARKK investments ETF, which carries a whopping 1.61 market beta 🤯). And so, if you have a lot of high beta stocks in your portfolio, ones that have a beta above 1, then you can average that out by adding lower beta stocks into your portfolio.

FYI, most trading platforms include securities’ beta data, or you can find them on Yahoo finance for free. Then just multiply these by the % size of each position in your portfolio, and add them up for your total portfolio beta.

🧠 Anything else you need to know?

One thing to keep in mind is that in times of market shocks or distress, most risk assets gravitate to a correlation of +1. In other words, they all move together.

This happens because the tendency of investors is to reduce exposure to the overall market as it is falling. Whether they are avoiding large drawdowns, trying to time the market to enhance returns, or freeing up cash to meet margin calls, they sell any and all securities they own.

Fear, greed, or pain. Doesn’t matter.

This is why we often see securities that are oversold, priced far below their fundamental value, during a market shock. Knowing this, savvy money managers watch for opportunities to buy these undervalued securities when markets crash.

Having positioned their own portfolios to weather the storm by balancing their betas and maintaining liquidity, they can step in and take advantage of disjointed markets.

🧐 About Bitcoin…

There’s been a lot of press lately about how Bitcoin is acting just like your average technology stock and not like a true store of value (SoV). The correlation factor to the S&P 500 and NASDAQ has indeed risen to levels that suggest this.

The fact is, Bitcoin, along with the rest of the cryptocurrency space, is still seen by TradFi as a risk-on asset. Something that is speculative and volatile, and hence it is sized in portfolios and traded as such. When markets rise rapidly, Bitcoin has tended to do quite well, as evidenced in 2020 and early 2021.

But when markets fall, Bitcoin is one of the first assets that institutions in particular begin to sell. This makes it a bit of a leading indicator for risk assets in the short term.

In other words, I personally expect Bitcoin to lead the markets higher on a recovery.

But then, when will Bitcoin become a true store of value and form of money it is meant to be, and decouple from risk-on assets to not just be less correlated but not correlated at all?

Good question.

I personally believe Bitcoin will need to have a broader and deeper understanding in the institutional investment community before this happens. Once enough managers “get it”, they will allocate accordingly. This will cause the price to appreciate and hold a value that reduces volatility and entices more investors to allocate to Bitcoin. And at this point, the price stabilizes to a level that it is able to decouple from its risk-on heritage.

Exactly when this happens is anyone’s guess.

That’s it. I hope you feel a little bit smarter knowing about correlation and beta and are ready to start incorporating them into your own portfolio and risk management approach.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James