✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s going on in Europe?

- What is YCC?

- What’s an anti-fragmentation tool?

- What risks does using it create?

Inspirational Tweet:

ECB said they're going to hike rates. Bond yields skyrocket. Spreads between north and south blow out.

3 days later: Emergency meeting to announce a new type of QE tool. An "anti-fragmentation instrument"

Now: Yields fall, bond market signalling recession, and no belief in ECB pic.twitter.com/PheO00Jfy7

— Stack Hödler (@stackhodler) July 6, 2022

Stack Hödler hits the proverbial nail on the head here with the recently announced ECB ‘anti-fragmentation instrument’ and the dilemma the ECB and Europe now faces.

If the phrase anti-fragmentation instrument has you all mentally gnarled up, no worries. We’re going to pick that apart nice and easy today. So, let’s get to it.

🧐 What’s going on in Europe?

You may have heard that the last collective inflation estimate for the Eurozone countries came in at a mind-numbing 8.6% in June. This is after a whopping 8.1% increase in May. Inflation and prices are clearing running hot and high and are veering out of control. There are many factors going into this that we won’t get into here today, but suffice to say that endless money printing after underinvestment in energy production and de-commissioning nuclear facilities all coupled with the war in Ukraine have put major upward pressure on the cost of energy, and hence…the cost of pretty much everything in Europe.

But that’s not the worst of it.

No, the crazy part is that the European Central Bank (ECB) has been watching this evolve and progress and it has done absolutely nothing yet to slow, no less stop, the progression. It is the first week of July, and the ECB has yet to make a single raise in the central bank target rate for Europe.

None. Zilch. Nada.

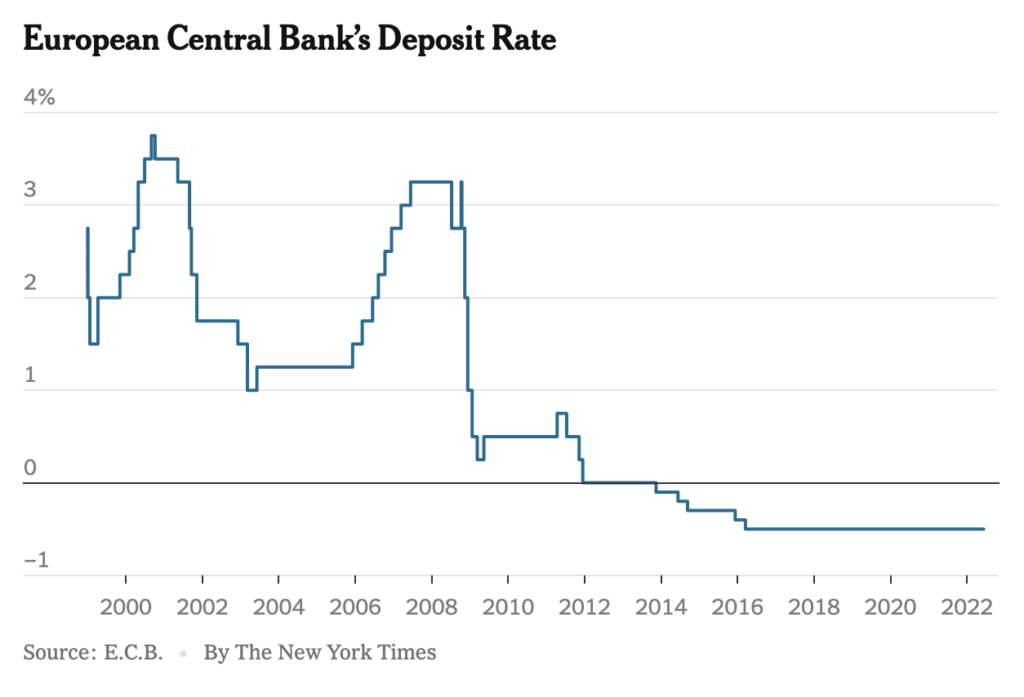

The ECB’s main policy interest rate is currently at -0.50%. You read that right. It is still below zero.

In fact, they haven’t raised the target rate in over 11 years.

That said, the bond market has already begun to price in some hikes and European bonds now yield above zero, across the board. But, anticipating the ECB raising rates eventually, investors have begun to worry about certain countries’ exposures to financial risks.

Mainly Greek and Italian banks.

This is due to worries that banks in those regions have exposure to companies that will have a hard time continuing to operate profitably once rates go high enough and borrowing becomes too expensive for them.

It’s known as a debt death spiral. If enough companies fail, then banks fail. If enough banks fail, sovereigns fail.

So, a few weeks ago, as investors around the world began to take notice, the 10-year Italian government bonds began to sell off rapidly, pushing the yields above 4%. This pushed the spread between the Italian and Greek government bonds and the German 10-year bunds (bonds) to 2.5% and 3%.

This is telling us that investors are worried about the increasing possibility of Italian or Greek sovereign defaults. And because when you sell a bond, it puts downward pressure on the price and upward pressure on the yield, it becomes a self-fulfilling prophecy that borrowing costs increase, as does default risk for shaky companies.

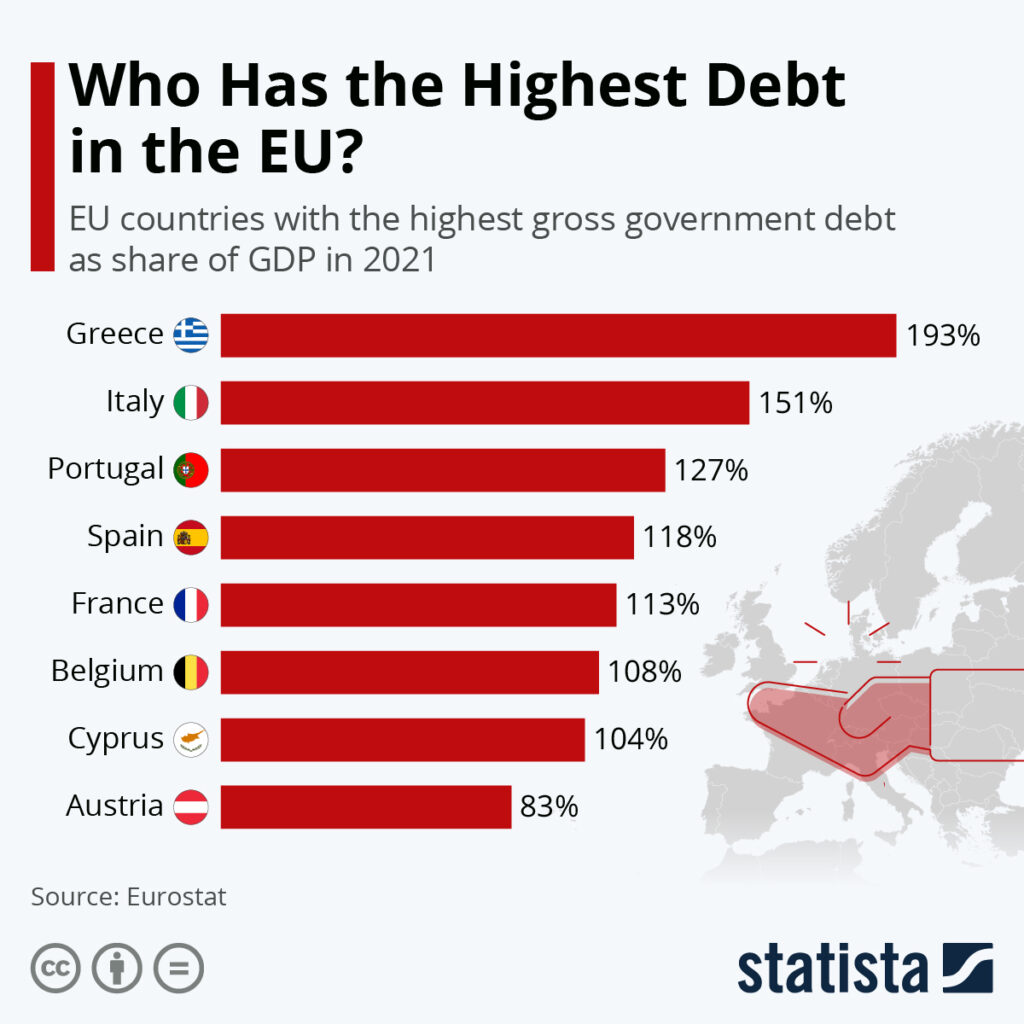

And as you can see here, Greece and Italy have the lowest balance sheet strengths of all the European countries right now.

www.statsta.com

High debt to GDP basically means low revenue to debt. In other words, these countries are not making enough money to pay off their debts.

Enter the ECB.

🤨 What is YCC?

You may have heard me talk about yield curve control (YCC) on a podcast recently, specifically referring to Japan. If you haven’t, or need a refresher on what YCC is, I wrote a whole newsletter about that which you can find here.

For the TL;DR crowd, YCC basically means that a country’s central bank manipulates (even further) the yields of its own bonds. This is beyond raising and lowering the target or overnight rate that is used to price all other bonds. In YCC, the central bank actually targets a certain bond, usually the 2-year or 10-year, and buys or sells in the open market to ensure that the bond yields a certain rate.

Why would they do this?

Simple. They want to control the rate to either ensure low borrowing costs and further stimulate the economy, or inversely to ensure higher borrowing costs and tighten the economy.

Right now, we are seeing Japan hold their 10-year JGB bonds at .25%, buying every bond that is offered in the open market to ensure this. And as a result, the Japanese government now owns over 50% of all JGB bonds in circulation.

Astounding.

But you may ask, ‘OK, I can see Japan or the US Fed doing this, because all of their bonds are issued by their central federal government. But European bonds are in different countries…doesn’t this negate the possibility of a central bank YCC, then?”

You would think so, right?

Yet, as you read in @stackhodler’s post above, the ECB came up with a new ‘instrument’ to help them ‘manage’ (read: further manipulate) their monetary system.

The new instrument is called the ‘anti-fragmentation tool’.

🙄 What’s an anti-fragmentation tool?

When the Italian and Greek 10-year bonds began to sell off in price a few weeks ago, causing the interest rates to rise rapidly and the spreads between them and the German 10-year bunds to blow out wide, the ECB immediately entered defensive mode. Worried that investors would push bond prices low enough (and yields high enough) to cause the self-fulfilling prophecy we spoke of above, they scrambled to calm the markets and ensure investors that the ECB has (or will have) everything under control.

How?

By announcing the move towards adoption of the so-called anti-fragmentation tool, which is just a fancy way of saying, ‘individual country bond yield curve control’.

The ECB announced that they would once again ‘do whatever it takes’ to ensure that all member countries of the ECB remain strong and solvent. They’ve done this before, of course, in the southern European debt crisis of 2011, when the ECB bought debt in numerous struggling countries.

The difference here, though, is that the ECB would now further manipulate the process by specifically targeting certain countries and maturities to keep rates and spreads at certain levels.

Seems a bit fiscally unfair to those countries that have strong economies and low debt and are overall healthy, doesn’t it?

To say the least.

😵 What risks does using it create?

Put simply, the model is not perpetually sustainable. It merely kicks another looming debt crisis can down the road. By piling poor credit on the ECB balance sheet, to be shared by all nation states, the entire balance sheet weakens. The Euro weakens. The entire Eurozone weakens.

Sooner or later one member country balks (Germany? Sweden?) or one causes a collapse of confidence in not just its own financial strength (Greece? Italy?) but the entire Eurozone balance sheet as a whole.

Not to mention, that by manipulating even further like this, the ECB prevents the orderly progression of debt induced reconciliation. Put plainly, it allows fiscally irresponsible nations to continue to act irresponsibly without adjusting their behavior, without correcting their risks.

It’s like Germany and Sweden are the parents, and their 45 year old unemployed and entitled son is still living in their basement, eating their food, drinking their wine, and using their credit cards. At some point, one parent gets fed up with the situation and kicks him out.

Question is, who stands up to the ECB first?

That’s it. I hope you feel a little bit smarter knowing about anti-fragmentation, Europe and the ECB, and the fiscal problems they are currently facing.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James