✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What exactly is the VIX?

- Then what’s the VXX?

- Other ways to trade volatility

- Shorting volatility

- Bitcoin a better long-term play?

Inspirational Tweet:

Consensus Hedge Fund positioning took down their longs at VIX 36 and chase the close at VIX 26#embarrassing

— Keith McCullough (@KeithMcCullough) March 16, 2022

Keith is saying that hedge funds were selling their equities when VIX was high (market already panicking) and re-entering the trades when VIX was low (market already calm)…basically missing the chance to get out of positions on the way down and chasing returns on the way back up.

Don’t worry, this will all make sense to you in a couple of minutes. Let’s break it down, shall we?

💥 What exactly is the VIX?

You’ve probably heard that the VIX represents volatility in the markets, but what does that mean, exactly?

First, the VIX is a volatility index listed on the CBOE (Chicago Board of Options Exchange), but it is an estimated volatility measure of the S&P 500, not actual. You see, by using the prices of S&P 500 options (calls and puts on the S&P 500 Index itself), the VIX measures implied volatility, not actual volatility.

In other words, by taking the prices of these options, the CBOE can infer what the market’s expectations for volatility are for the next 30 days for every single move of the VIX price.

Put another way, if options prices are expensive, then traders expect the price of the S&P 500 to fluctuate quite a bit—or be quite volatile. And typically, high volatility is inversely correlated to equity index returns. When the VIX spikes in price, the S&P 500 drops, and vice versa.

The Fear Index.

Great, so then investors should be buying the VIX when they expect the market to become volatile (sell off), right? Or maybe always own some, just in case. This would be a great hedge!

The problem is, just as you can’t trade the S&P 500 Index directly (you have to trade an ETF or mutual fund), you can’t trade the VIX Index directly, either. And while you can trade actual futures or options on the index, these are poor substitutes for capturing current volatility.

And this is where securities like the VXX come into play.

🧨 Then what’s the VXX?

Much like the SPY ETF (Exchange Traded Fund) on the S&P 500 Index, the VXX is an ETN (Exchange Traded Note) on the VIX. The difference is that while the SPY owns actual shares of the companies in the S&P 500, mimicking the index nearly exactly, the VXX owns futures contracts on the VIX in an attempt to mimic the current movements of the VIX.

You see the problem, right?

Exactly. If you own futures, then you don’t own the current volatility of the VIX, but instead own the expected future volatility of the VIX.

Your next logical question may be, ‘then why doesn’t the VXX just buy the options themselves and capture the actual volatility’?

Good question. The reason they don’t do this is that it would be exceedingly difficult to buy and sell the actual underlying options that the VIX uses without impacting the price of the VIX itself.

As a result though, there is a cost associated with this daily rolling of futures, and holding the VXX long term eats this cost. Also, because the VXX is buying futures on the VIX, when the VIX is high, futures will be underpriced (expecting volatility to decrease in the future), and when the VIX is low, the VXX will be overpriced, (expecting volatility to increase in the future).

In periods of super high volatility, the disparity between the VIX and the VXX can become quite large.

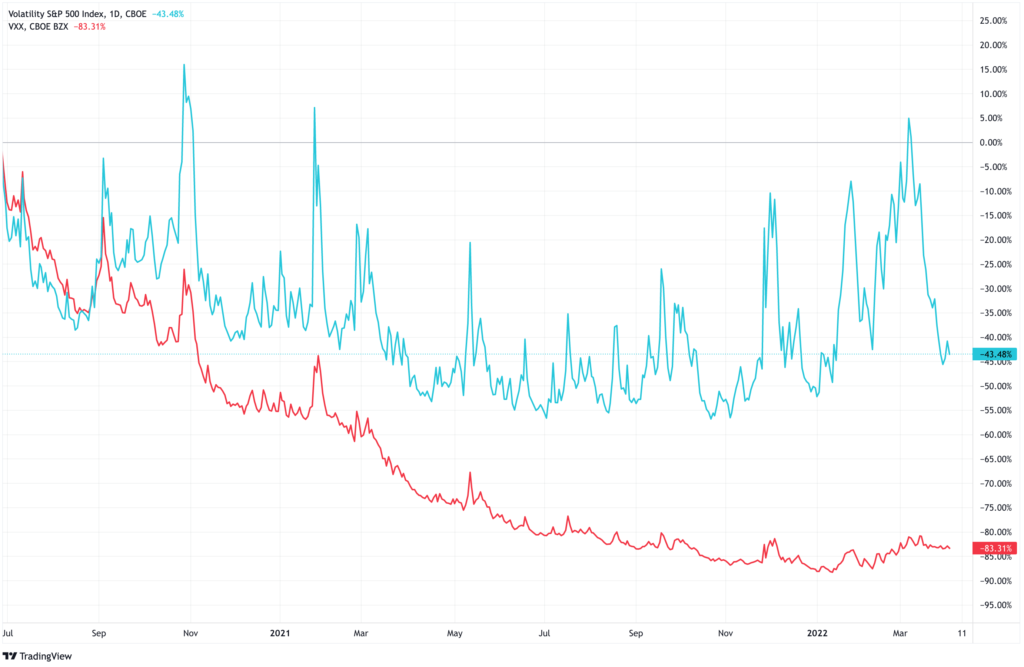

You can see here that when the VIX (blue line) began to spike higher, the VXX (red line) was truly unable to capture that current volatility, and in fact lost considerable ground vs the VIX, especially in the recent spike of volatility, i.e., when you would have needed it most!

💣 Other ways to trade volatility

Okay, so if the VXX isn’t a great way to trade volatility, then what else is there?

Some ETFs, like the VXZ, use longer dated futures that average five months to maturity. This means the VXZ is truly a play on future volatility and makes a poor substitute for owning (or shorting) volatility in the near term.

You also have some leveraged ETFs, like the UVIX, which is equal to 2X VXX exposure. This, of course, just doubles your bet on future, not current, VIX-measured volatility.

Bottom line, the VXX and its counterparts are less than perfect ways to capture volatility and hedge portfolios, short and long term, against market volatility.

🧐 Shorting volatility

Let’s say the market has suffered a major disruption, and volatility is through the roof, pricing in full-on trader fear and doom. If you then expect the volatility to calm down, once the markets have settled, how can you take advantage of that?

Can you short the VIX?

That’s where the SVIX ETF comes into play. Somewhat mimicking a short on the VIX, the SVIX takes inverse positions on VIX futures. The ETF uses longer dated futures, though, and so you have to time your positioning pretty much perfectly to avoid any negative roll factor (remember, this is the cost of closing one future contract before it expires and buying the next one).

And so, the longer you hold the position, the more the underlying value bleeds away, leading to a large negative impact to the profits you could make, even if you are right.

🧠 Bitcoin a better long term play?

You may have heard some of the biggest proponents of Bitcoin (BTC) describe it as a long volatility investment. How can that be, you ask, when the equity (risk-driven) markets sell off, BTC seems to be correlated to risk markets and also sell off.

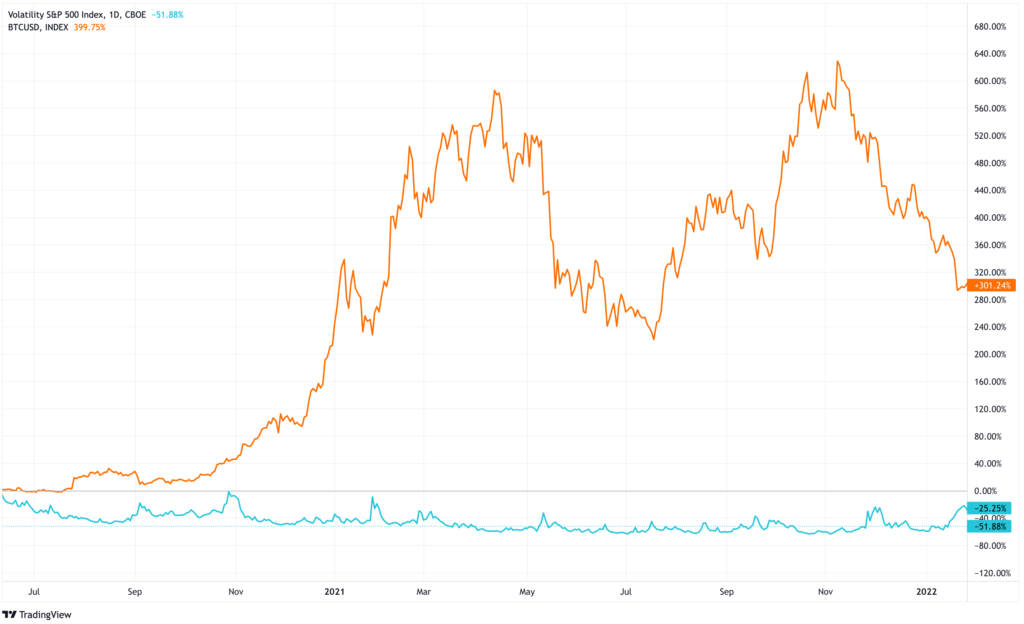

While this is absolutely true, using short term metrics, when we zoom out and plot BTC against the VIX, it becomes clearer.

What is important to note here, is that during the VXX deviation from the VIX in the exact same time period plotted above, BTC has proved a much stronger long-term hedge against market volatility than even the VIX itself.

One thing to remember, volatility is only a risk with short-term investment horizons and volatility in appreciating assets actually drives positive impact to performance in the long term. This is why you hear BTC proponents like me encouraging investors to lengthen their time horizon and look at Bitcoin as a long, long term investment, not a trade.

Furthermore, as BTC grows in market value, short-term volatility will begin to dampen naturally, as it will take much more capital to move the market with larger amounts of liquidity. Also, as investors begin to widely and deeply understand Bitcoin and how it is truly unique from any other asset, BTC will take the leading role of the purest and safest store of value (SoV) in the world.

Most importantly, because Bitcoin is an actual asset without an underlying set of futures or options, you can buy and hold BTC for a long period of time without the deterioration of value, unlike the VXX and other options to capture volatility listed above.

That’s it. I hope you feel a little bit smarter knowing about VIX and volatility and how Bitcoin can be a long-term hedge against volatility in the markets.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James

Do you use any other volatility measures? The past month or two have been quite volatile, and I’ve noticed a lot of INTRA-DAY volatility, even in the S&P… the ups and downs are in crazier when you go sector by sector. Is there an intra-day volatility measure you would recommend?

Hey Cory, I sill think the VIX is a solid indicator of volatility, even intra-day, IMO. And it’s still my favorite overall measure.

It’s just not available as a hedge and the VXX is problematic, as you now know.