✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s a repo?

- What’s a reverse repo?

- Fed funds, overnight rate, discount rate…what’s the difference?

- What are the other types of repos?

- Counterparty risks of repos

Inspirational Tweet:

*The Fed’s overnight reverse repo is back above >$1.8T – it’s highest level YTD

This is significant as it shows banks are drowning in zero yielding assets (cash) while missing out on higher yielding assets (bonds) via years of Fed’s QE

This is basically a liquidity trap pic.twitter.com/68qD1vuaTO

— Adem Tumerkan (@RadicalAdem) April 19, 2022

You’ve no doubt heard the terms repo and reverse repo thrown around the last few months, both casually and, at times, suggesting there’s a deeper significance to the market than just the numbers themselves.

As Adem points out here, the numbers imply there’s too much liquidity (excess cash) in the system right now and no good places to put it.

How exactly does he conclude this? It all has to do with the overnight lending market. If that means absolutely nothing to you, no worries, we’ll clear it all up for you right here.

🤝 What’s a repo?

Put simply, a repo is a repurchase agreement between two parties. The term can be used in many different types of transactions, but we most often hear it used to describe the significance of transactions made in the open market operations of US Treasuries.

OK, so what does that mean?

Basically, when banks need cash to cover short term obligations, they can sell US Treasuries that they hold on their balance sheet to the Federal Reserve (in return for cash) with the agreement to buy them back 24 to 48 hours later at a slightly higher price. The difference between what the bank received and what it pays back is calculated to be the discount rate, or the cost for that ‘overnight’ borrowing from the Fed directly.

The Fed sponsored overnight lending market involving repos and reverse repos is called the temporary open market operation, and all purchases and sales are made by the New York Fed’s Open Market Trading Desk (the Desk).

As you can see, when banks need short term cash, they use repos, which inject extra cash into the system. So, your next logical question may be: what about when there is too much cash in the system?

Well, that’s where reverse repos come into play and what we’re going to cover next.

🤲 What’s a reverse repo?

Similar to a repo transaction, where the bank sells US Treasuries to the Fed, in a reverse repo, the bank buys US Treasuries from the Fed.

Why on earth would they do this?

Simple. When banks have too much cash on their balance sheets, when there is, in effect, too much liquidity in the system, they use reverse repos to generate a nominal rate on that cash in the overnight market.

This is known as parking cash at the Fed.

They do this in times where there is a dearth of opportunity to generate interest on the cash they have, and longer term investments in bonds or other securities are too risky for them for the return they may generate on those securities. This happens when the Fed conducts Quantitative Easing (QE), i.e., buying securities in open markets to add liquidity to the system and keep interest rates artificially low. And when interest rates are too low, US Treasuries and other fixed income securities do not pay enough interest for banks to assume the risk of buying and holding them with their excess cash.

To wit, in Adem’s Tweet above:

“…banks are drowning in zero yielding assets (cash) while missing out on higher yielding assets (bonds) via years of Fed’s QE.”

So they park that cash at the Fed, using the reverse repo window, instead. $1.8 trillion worth right now, to be exact.

🧩 Fed funds, overnight rate, discount rate…what’s the difference?

While close in price and similar in function, there are some important distinctions to be made between these rates we regularly hear quoted in financial-speak. So, let’s quickly define them.

First, the Federal Reserve (the Fed) sets what is called the Federal Funds Rate (Fed Funds), and this is what Powell and other Fed Chairmen refer to when talking about raising or lowering rates. This is a target rate that the Fed sets for banks to charge each other for overnight borrowing and lending.

For instance, if Wells Fargo needs a little liquidity overnight, it may borrow money from JP Morgan and pay it back with interest, using the Fed Funds rate as the basis for that lending rate. This is also known as the overnight rate.

The discount rate, the interest charged or paid by the Fed Desk in open market operations, is usually set slightly higher than the Fed Funds or overnight rate. The reason for this is the Fed wants to encourage banks to borrow from and lend to each other before turning to the Fed Desk and the open market operation for liquidity uses or needs.

💵 What are the other types of repos?

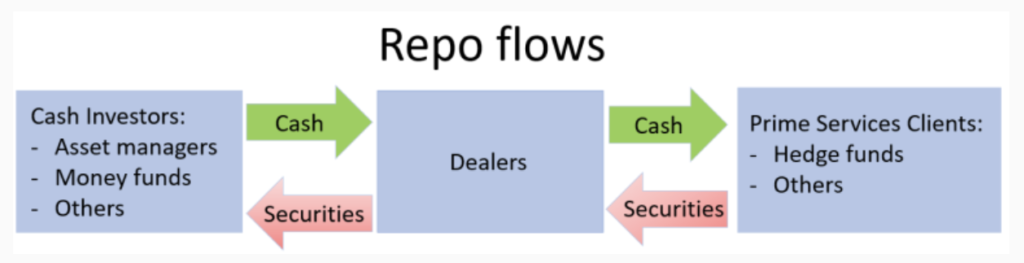

Even though we most often see statistics that have to do with the Fed and open market operations, repo and reverse repos often take place between two unrelated parties, not including the Fed. These transactions will typically include money market funds, large hedge funds and other asset managers, using an unaffiliated dealer such as JP Morgan or Bank of New York to facilitate the deal.

Of course, non-Fed Desk, two-party transactions bring with them an elevated type of risk that we don’t see in the Fed open market operations. Namely credit or counterparty risk.

🧐 Counterparty risks of repos

When repos do not involve the Fed and are settled between two parties, say banks, hedge funds or asset managers, the biggest risk is that the seller is unable or unwilling to repurchase the securities from the buyer at the agreed to maturity date. Of course, the buyer of the repo may then liquidate the securities they accepted as collateral, but the price may have moved enough to cause a loss, even overnight.

And what is the repo market disaster scenario?

If we suddenly see bond prices move enough to cause one or more large and highly leveraged counterparties to default, it is possible that contagion then sets in—the spread of negative consequences from one balance sheet to another, causing a sharp and unexpected rise in the overnight rate. This, coupled with the Fed conducting Quantitative Tightening (QT) and selling securities on the open market to remove liquidity from the system, could serve as catalysts to cause something of a collapse in the repo market.

Likely? No. But definitely possible, especially with how complex and interconnected our financial system is and just how much the Fed continues to manipulate markets with monetary intervention.

The obvious cure to this type of situation?

The Fed halting its QT program and stepping in as intermediary to provide a backstop of liquidity once again. More intervention and manipulation, underscoring the need for a system and a currency that is decentralized and cannot be manipulated.

The long-term answer?

Bitcoin. Immutable, fully decentralized, and anti-inflationary with a total supply limited to 21 million coins, it is as perfect a form of money that has ever been created. And it is the ultimate insurance against a total fiat collapse, as outlined in this thread here:

As a risk trader, I’m always concerned about 'Tail Risks'.

And #Bitcoin hedges against the biggest tail risk we’ve ever faced in the history of the modern financial world:

An all out collapse of fiat currencies.

How? Let’s break it down nice and easy here 👇🧵

— James Lavish (@jameslavish) February 15, 2022

That’s it. I hope you feel a little bit smarter knowing about repos and reverse repos, and the overnight lending markets are no longer a mystery to you.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James