✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s an LBO?

- History of LBOs

- Today’s LBO Market

- Does it all blow up?

Inspirational Tweet:

A deal frenzy that included Elon Musk’s Twitter takeover has left Wall Street banks struggling to revive the lucrative business of backing big mergers

Read The Big Take ⬇️ https://t.co/xqIM2DM495

— Bloomberg (@business) January 14, 2023

Perhaps you’re old enough to remember the term leveraged buyout or LBO from the good old Gordon Gecko days of 1980’s Wall Street. But if not, or if you’re wondering how those go-go days may matter today, no worry. We’ll get you all sorted here with this morning’s Informationist.

So, let’s take a few minutes to walk through all this nice and easy, as always, shall we?

🎯 What’s an LBO?

Remember in the movie Wall Street, when Michael Douglas playing Gordon Gekko stands up at the annual meeting of Teldar Paper, and gives his Greed is Good speech?

If you don’t recall the fictional Teldar Paper circumstances or somehow haven’t yet seen this classic finance movie (highly, highly recommended BTW), I’ll give you the TL;DR.

What Gekko is saying, or rather doing, here is simple. He is making his case for a hostile takeover of the company, and to do so, he needs two things: the money and the votes.

The money comes from the bankers. The votes come from the shareholders.

Here, he’s pleading with the shareholders to trust him. Trust him that if they vote in favor of his buyout offer, then they will not only stop losing money as the stock continues to bleed at the hands of the bureaucrat executives, but they will actually make a little money off of the buyout he is proposing.

The takeover premium.

After all, greed is good.

The second group of people that Gekko must convince is the bankers. This is because in order to buy all of Teldar paper’s stock, Gekko has to borrow a massive amount of money to do it.

The Leveraged Buy Out. or LBO.

While not explicitly shown here, the scene implies that Gekko will fire most of, if not all, of the 33 vice presidents that do little more than ‘shuffle paper between themselves’, thereby cutting costs, and returning the company profitability again.

In other words, Gekko will borrow a load of money from bankers, cut costs, make the company profitable again, and in turn, make those bankers a nice sum of money for in both transaction fees and high-interest debt.

Sound familiar?

Gekko rhymes with Musk, and Teldar rhymes with…Twitter?

We’ll get to that, but first a brief history of the LBO and where we stand today.

🔍 History of LBOs

The movie Wall Street was loosely modeled after a few hedge funds and LBO barons of the 80’s, like Carl Icahn, Ronald Perelman, and KKR.

This wave of leveraged buyouts was started by Michael Milken, a young aggressive banker at Drexel Burnham. Milken created the high interest / high risk bonds which are now commonly referred to as junk bonds.

Massive buyouts of TWA, Revlon, and RJR Nabisco are a few examples of gargantuan (at the time) takeovers using enormous amounts of leverage.

Note: If you are interested in this history, a fantastic book called Barbarians at the Gate written by investigative journalists Bryan Burrough and John Helyar, details KKR’s takeover of RJR Nabisco and the world of LBO buyouts of the 80s.

The idea is to use leverage (borrow tons of money), take over the company, and then cut costs through layoffs or selling divisions or assets of the company. This helps pay off the massive debt and lower the risk for the bankers.

So, why would a banker do this deal? Why would they lend all that money for something that seems so risky?

It’s pretty simple really, and it all comes down to fees.

To demonstrate, we will go back to Wall Street and Gekko, this time entering the boardroom where Gekko’s investment officer is negotiating with bankers and attorneys to get them to agree to lend him enough money to take over Bluestar Airlines.

Here’s the play:

Gekko wants to buy Bluestar and raid it’s corporate treasury. How?

- Gekko gets the bankers to agree to loan him enough money to buy the whole company

- The bankers get a bunch of other bankers and investors to line up and buy the debt from them (i.e., the main bankers act as agents)

- The main bankers then get paid a transaction fee (typically 2 to 3%) on the whole pile of debt

- Gekko buys the company and immediately liquidates the hangers and the planes

- He pays off the money that the banks loaned to him (the debt)

- He keeps Bluestar’s overfunded pension (the treasury)

- Gekko makes a $70 million profit on the deal

Not bad for a month’s work, as they said in the movie. Though Bud Fox scuttles this plan, that’s the gist of how it would go if Gekko succeeded in the LBO.

Ok, but where’s the risk, then, you may ask?

Good question, and it has to do with volatility of interest rates and investor appetite for risk.

Aha! Now you may see the connection to today.

Let’s dig into that next.

✍️ Today’s LBO Market

Today, we are obviously experiencing interest rate volatility. Rates are moving around all over the map as the Fed fumbles with both their policy and their messaging to the public about said policy.

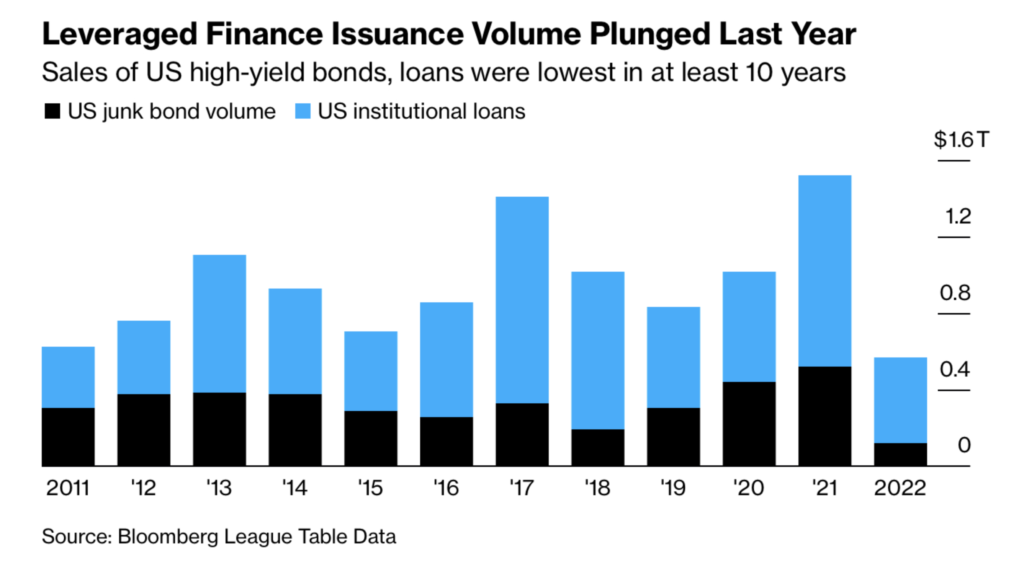

That said, up until last spring, bankers still had an appetite for high yield and junk bonds. After all, they enjoyed the fees for doing transactions and had little problem laying off the risky debt to other banks and investors.

But, after a record year of junk bond issuance in 2021, that appetite has been falling in inverse correlation with the rise in interest rates.

And so now, after providing all that debt to unprofitable companies and LBOs, big banks are struggling to sell that debt to investors or other banks. It’s stuck on their books.

See, they agree to buy the debt in the LBO or from the struggling company with hopes of re-selling that debt to other banks or institutional investors. But sometimes the market dries up, and the facilitating banks are left with it on their own books. This is called hung debt.

One LBO in particular has become a big stinking pile of hung debt.

Tweet Tweet.

Question is, do the banks pull through here unscathed, or do we have what we call a credit event looming on the horizon?

🧠 Does it all blow up?

Here’s the main problem. As rates rise, debt that is on these banks’ books becomes worth less. This is both because of simple math (rates go up, bond prices go down) and because of the implications of higher rates.

Higher rates means higher borrowing costs for consumers and companies.

Higher borrowing costs means less activity from consumers and lower profits for companies.

Lower profits or losses means higher risk.

Higher risk means investors demand higher ROIs (returns on investments) or interest on loans and debt.

A self-perpetuating problem.

In other words, the days of easy and free money are pretty much over right now. See Japan as an example. The last bastion of free money is free no more. Interest rates are rising there, along with the cost of capital across the world.

The times of selling risky debt are coming to an end here (at least for the next few quarters).

Big banks are taking huge write-downs (mark to market losses) on the hung debt sitting on their books.

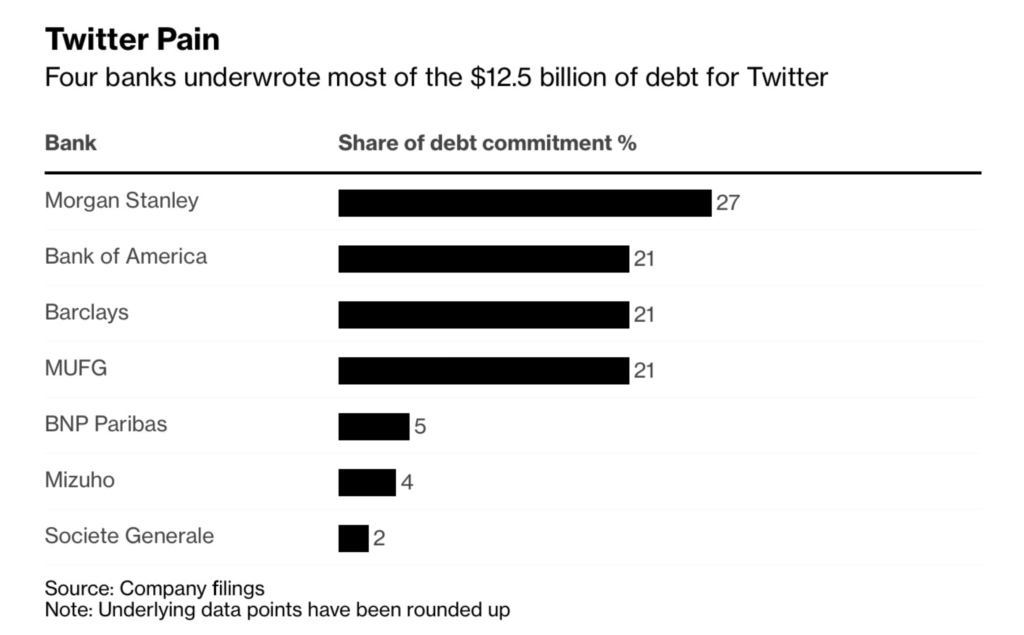

Twitter alone has caused about $4 billion in paper losses for these banks just this past few months.

In a dangerous game of musical chairs, Morgan Stanley has been left standing without a seat, saddled with about $1 billion of losses themselves and nobody to sell it to.

While funds are reportedly willing to pay 60c on the dollar for the debt, bankers have yet refused to sell below 70c.

A stalemate of sorts. And the bankers are playing a game of chicken, betting that either interest rates stop going up or Elon succeeds at turning a profit at Twitter in the near term.

Either way, the appetite for risk from institutional investors must increase, or the entire market dries up.

Consequently, with every single basis point that the Fed tightens as the US heads into a recession, the probability of a credit event rises exponentially.

At some point, a large company or bank runs into a liquidity issue and will need to borrow money to keep it going. However, with investor and bank appetite for risk all but evaporated, the money…the help…will not be there.

In turn, the risk of a company blowing up raises the risk of a bank blowing up, thereby raising the risk of multiple banks blowing up, thereby raising the specter of a government-led bailout of sorts.

Credit + Leverage + Illiquidity → Contagion.

These are all closely related words. Ones that should put the fear of God into any banker who is currently hung with billions of dollars of leveraged debt.

Especially if it is unsecured and Twitters’.

That’s it. I hope you feel a little bit smarter knowing about LBOs, their history, and where the leveraged market currently stands.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James