✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- How does the Fed make money?

- Is the Fed currently profitable?

- What can the Fed do about it?

Inspirational Tweet:

“The Fed cannot go broke, and the operating loss will go away when the Fed cuts rates during the next downturn. The optics of a money-losing Fed aren't good, though.” https://t.co/btus8NPgDn

— Danielle DiMartino Booth (@DiMartinoBooth) October 10, 2022

As Danielle DiMartino Booth points out here, the Fed losing money doesn’t look good. But is the Fed profitable or not, what does it mean if it isn’t, and what can it do about it?

Let’s have a peek into the Fed books today, shall we?

🤑 How does the Fed make money?

First, let’s review the Fed’s balance sheet and exactly how it (supposedly) makes money.

If you’ve been reading the Informationist, you may have recently read the piece called The Fed and its Pickle. This article explains how the Fed is structured and generally operates. If you haven’t yet read that and want to understand the Fed better in general, you can find it here.

Another recent article talks about Debt Jubilees and the Fed’s balance sheet, in particular. How that is generally structured. You can dive into that one here.

TL;DR: The Fed has numerous branches that operate much like a commercial bank, but all feed into one big balance sheet. This balance sheet of assets and liabilities can impact its costs and revenues, especially if these are interest bearing line items.

Two of the largest interest bearing assets on the Fed’s books are US Treasuries and Mortgage Backed Securities (MBS). The Fed accumulated most of these during the last two years, when it executed what is now well known as Quantitative Easing (QE).

So, the US Treasury printed money, then gave that money to the Fed, the Fed used it to buy bonds in the market, and now the US Treasury pays the Fed interest on the majority of those bonds (the USTs).

Amazing what they don’t teach you in school, isn’t it?

Moving on.

So, then what are the liabilities? What is the Fed paying interest on, then?

Good question, with a relatively simple answer.

Over 5,000 banks, credit unions, etc. have accounts at Federal Reserve Banks and maintain balances in these accounts to make and receive payments.

These are known as reserves, and the Fed pays the depositors interest on these reserves at a rate known as the interest rate on reserve balances (IORB rate).

More on that in a bit.

The second major liability on the Fed’s balance sheet are in the form of reverse repos.

See, all that cash sloshing around the commercial banks after the Fed bought these bonds from them is stuffed in the banks’ corporate treasuries. And rather than sit on the cash and watch it just melt away with inflation, the banks use the Fed overnight window instead.

Reverse Repo.

Banks park the cash at the Fed each night and make what is called the Discount Rate on those deposits.

This cash is moved onto the Fed’s balance sheet as a liability. And the Fed pays interest to the banks on the deposits.

To recap:

The Fed receives interest on the USTs and MBS it owns, and it pays interest on the deposits and reverse repo cash banks park at the Fed.

Question is, how healthy is that balance sheet now?

🤕 Is the Fed currently profitable?

First let’s have a peek at those assets to see just how much interest the Fed is being paid.

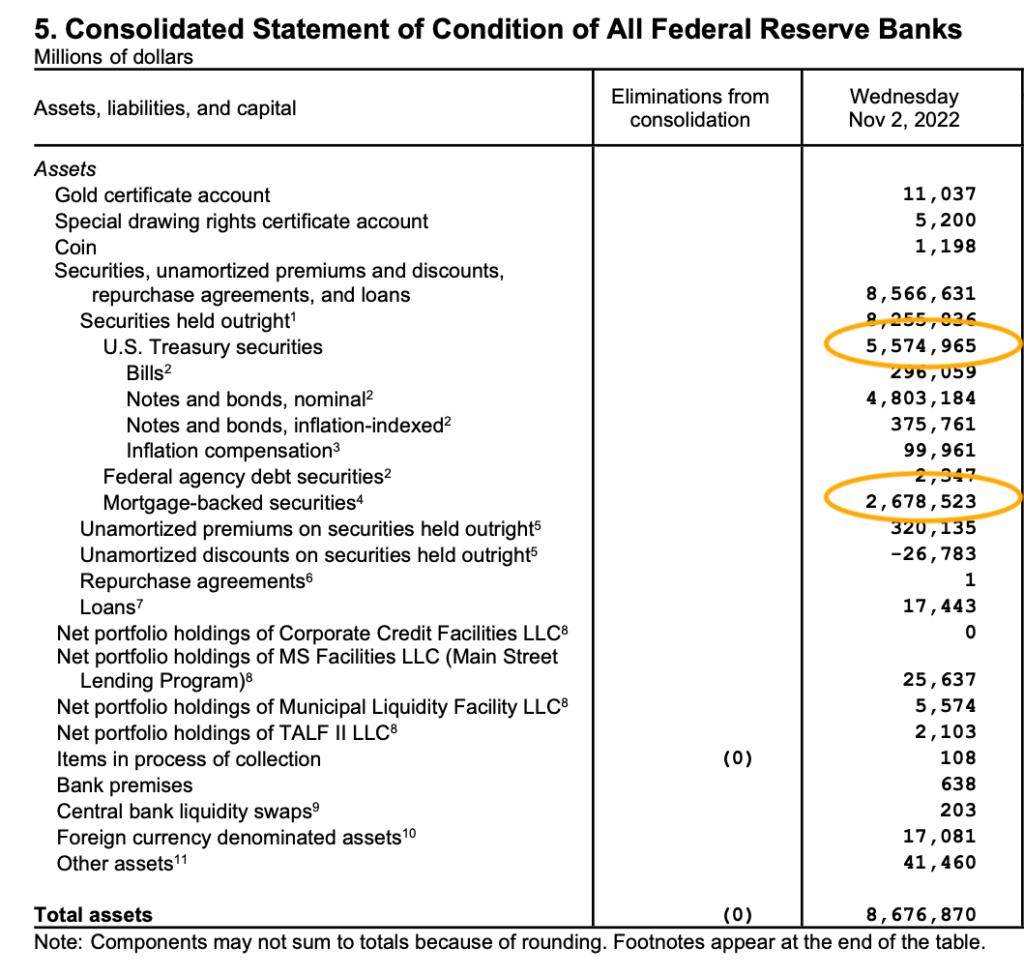

At last count on Nov 2nd, it totals up to $8.3T of interest bearing assets on the Fed books right now.

FederalReserve.Gov

According to the Wall Street Journal, this debt pays an average rate of 2.3% today.

Some quick math gets us to about $190B of interest payments the Fed receives on all these bonds each year. Remember: this number should only decrease, as the Fed is working to reduce its balance sheet assets by selling these securities in the open market.

What about the liabilities?

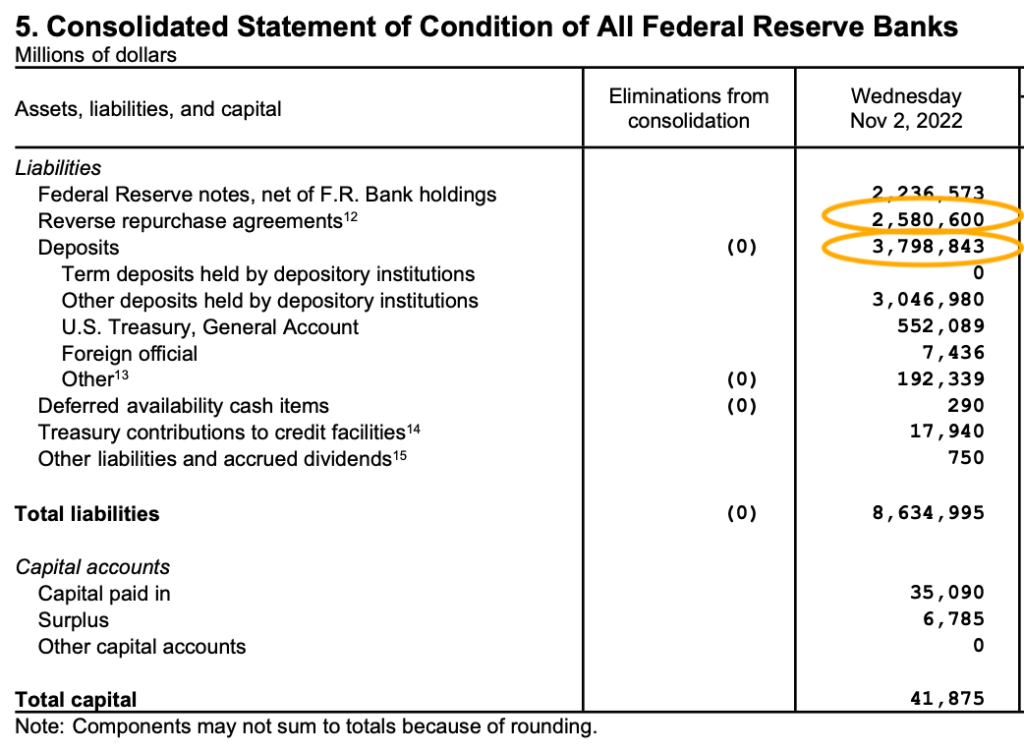

Taking a look at the big ticket items on the Fed balance sheet, the deposits or reserves and the reverse repo cash parked at the Fed, we see this totals up to approximately $6.4T.

FederalReserve.Gov

As for the deposits (or reserves), the Fed is currently paying the IORB rate of 3.9%, which works out to be approximately $150B, annually.

And as for the reverse repo cash parked at the Fed, this rate is currently set at 3.8%. So, that adds another $100B of interest the Fed is paying.

Uhm.

Revenues = $190B

Costs = $250B

Well, well. The Fed is, in fact, losing money now. And you can see how quickly this happened, and how it is directly tied to the rising interest rates that the Fed itself is setting.

This makes sense, because the interest the Fed is receiving on its assets are fixed. These are bonds and mortgage securities that virtually all have a fixed rate attached to them.

On the other hand, the interest they are paying on the liability side of their balance sheet is floating. And as the Fed itself drives these rates higher, the payments grow larger.

On top of all this, the assets that the Fed is currently selling, the bonds and MBS have fallen in price, also due to the increase in interest rates. So, these are now worth less than what they were when the Fed bought them.

The Fed will be taking a loss on these if they sell them here.

So this problem, as they say in Texas, is just fixin’ to get worse.

😏 What can the Fed do about it?

Let’s be clear, these don’t interfere with the Fed’s ability to conduct monetary policy. So, don’t lose any sleep over that. Yet. 🙄

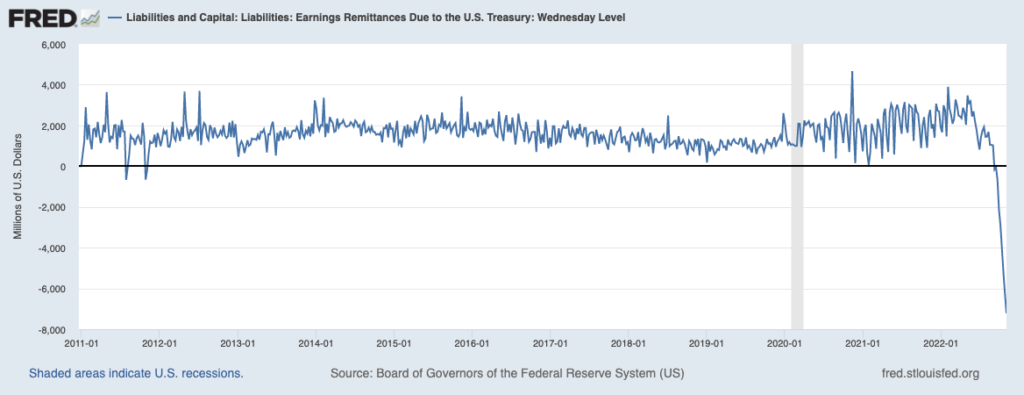

But, the Fed usually sends profits back to the Treasury in the form of remittences. And as this appears to not be getting better any time soon, what the Fed will do is create something of an IOU to the Treasury, to be paid back when it once again turns profitable.

This will be called a deferred asset, and placed on the Fed’s balance sheet.

A hole to be filled later.

Problem is, these losses are coming after many years of profits that the Fed sent back to the Treasury in the form of remittences. About $100B per year worth. This means the Treasury will have to issue more bonds and it only add to the growing mountain of debt the Treasury is already sitting on.

It also just looks bad. Terrible optics, as the Fed will be sustaining losses while sending banks interest payments on trillions of dollars of reverse repo cash parked at the Fed to the tune of $100B+ annually.

This could be seen as US taxpayers footing the bill for egregious bank executive profits and bonuses. All facilitated by the Fed.

But hey, maybe the US Treasury market will get so illiquid soon that the Fed will change rules in order to get that reverse repo market soaked up by USTs instead. This would just send the bill on to the Treasury, kick the can back up road, as they say.

But either way, the big banks still get their profits.

Funny how this whole system works, isn’t it?

That’s it. I hope you feel a little bit smarter knowing about how the Fed operates and makes or, in this case, loses its money.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

Thanks again and talk soon!

✌️James