“Energy is the only universal currency” – Vaclav Smil

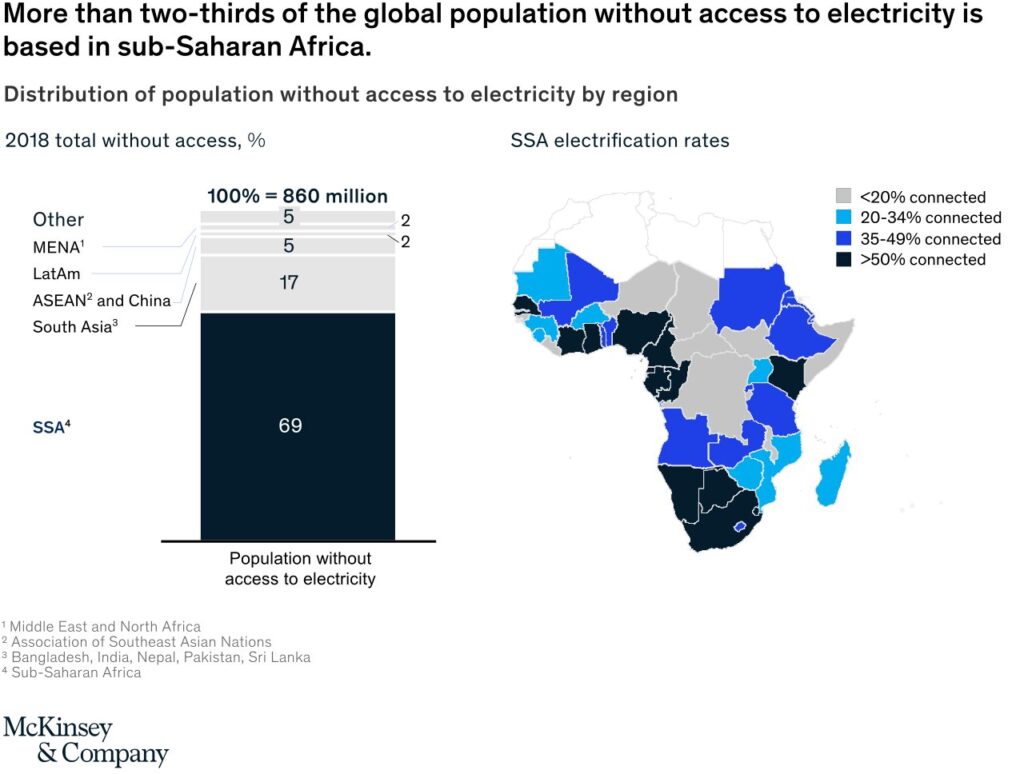

Energy is the lifeblood of human existence. An energy abundant society is a prosperous society and in most parts of the world today, the demand for energy continues to increase. Less energy production amplifies existing problems while creating new ones. It results in fewer economic opportunities, reduced food production, poverty and higher costs of living, which result in civil unrest and ultimately societal collapse. More, not less, energy production is the solution. Today, Sub-Saharan Africa (SSA) is faced with a serious electricity deficit, with at least 600 million people without access to basic electricity. That’s at least 43% of Africa’s population or just over two-thirds of the global population that is without power.

Whether one is looking at energy access, installed capacity, or overall consumption, SSA’s energy sector is severely underdeveloped. Given the fact that there is a direct correlation between supply of electricity and economic growth, nations with electrification rates of less than 80% of the population consistently suffer from reduced GDP per capita. According to the latest IEA report on Africa, at least 80% of the electricity deprived populace live in rural areas which means in order to cater for them, existing electrical infrastructure has to be expanded or new infrastructure has to be built.

In many African countries there are vast solar, wind, geothermal, natural gas and hydro resources, even though they are usually underdeveloped due to inadequate financial resources. According to McKinsey, “There is 1.2 terawatts of capacity; including solar, there is a staggering 10 terawatts of potential capacity or more. There is potential for about 400 gigawatts of gas-generated power, with Mozambique, Nigeria, and Tanzania alone representing 60 percent of the total capacity; about 350 gigawatts of hydro, with the Democratic Republic of the Congo (DRC) accounting for 50 percent; about 300 gigawatts of coal capacity, with Botswana, Mozambique, and South Africa representing 95 percent of this; and 109 gigawatts of wind capacity, although it is relatively expensive compared with other sources. The proven geothermal resource potential is only 15 gigawatts, but this is an important technology for Ethiopia and Kenya, which hold 80 percent of it.”

The International Energy Agency (IEA) further pointed out that micro-grids are the most viable solution but the governments usually lack the resources for such capital-intensive infrastructure projects. An estimated annual investment of $28 billion is required to close the energy access gap in SSA. In an essay for Bitcoin Magazine, Alex Gladstein, chief strategy officer at the Human Rights Foundation, stated the problem this way:

“Billions of people in developing nations face the stranded power problem. In order for their economies to grow, they have to expand their electrical infrastructure, a capital-intensive and complex undertaking. But when they … build power plants to try and capture renewable energy in remote places, that power often has nowhere to go.”

With this in mind the billion dollar question is, how would all this be financed? Bitcoin mining is a potential solution to closing this funding gap by not only enabling new power plants to start generating revenue right away before any customers are connected, no matter how remotely the power plant is located; but by also financing the construction of the power plant itself. Allow me to explain.

African governments can float Bitcoin-backed bonds, following in the footsteps of El Salvador, and the raised funds are used to build new power plants, as well as to purchase Bitcoin mining equipment. Once the plant is up and running, the proceeds from Bitcoin mining are then channeled towards setting up transmission and distribution infrastructure as well as repaying bond holders. Setting up transmission and distribution infrastructure along with connecting customers are two of the biggest financial hurdles faced by energy companies.

Previously, electricity generation made economic sense in areas that were relatively closely located to the site of consumption (i.e. human settlements), but Bitcoin mining has now enabled the development of power plants in remote but energy-rich locations and monetize the energy by directing it to the Bitcoin network. Think of Bitcoin mining as a permissionless “energy vortex” that allows anyone with access to cheap power to plug in their mining machines at any time and start generating revenue.

For example, Virunga National Park in the Democratic Republic of Congo (DRC), which is the second largest rainforest in the world after the Amazon, has a 13 MW hydroelectric plant located within it which was financed by Howard Buffet. The initial investment was only enough to build the power plant and as a result, only 2.5 MW of the plant’s 13 MW capacity were being used since transmission infrastructure was yet to be installed due to financial constraints. In the absence of an alternative energy source the 5 million people that live around the park relied primarily on charcoal and wood, which meant continued deforestation of Virunga. As noted in the IEA report, the most economically viable option to provide electricity to people like those who live near Virunga is through the creation of new small decentralized networks (i.e. micro-grids). These networks can be subsidized by Bitcoin mining, thus generating the revenue required to keep the plant operational and to fund the set up of transmission infrastructure. It’s for this reason that, in 2020, the park’s management began mining Bitcoin with the surplus energy.

Another example is Ethiopia which has the potential to generate well over 60 000 MW of electricity from “renewable” sources but currently has only 4 500 MW of installed capacity. 90% of its electricity is being hydro generated with geothermal, solar and wind making up the difference; however acute energy shortages continue to bite with only 44% of the country’s 110 million people having access to electricity. With projects like the Grand Ethiopian Renaissance Dam (GERD) under construction, which is projected to generate an additional 5 150 MW, the government expects to have a total of 17 000 MW of installed capacity in the next 10 years.

Despite the energy deficit domestically, the Ethiopian government exported $66 million worth of electricity to Sudan and Djibouti in 2019. Comparatively Iran earned approximately $1 billion from Bitcoin mining alone over the same period according to Blockchain analytics firm Elliptic, from an estimated 600 MW of electricity. Had the Ethiopian government taken a similar approach, the revenue generated from Bitcoin mining would have tremendously boosted forex reserves and funded these electricity infrastructure projects. A position also shared by Ethiopian based Bitcoin lobby group, Project Mano.

It’s my firm belief that Bitcoin nation state adoption in developing countries can be accelerated by initiatives in which the Bitcoin network or a part of its ecosystem addresses an immediate developmental need; case in point accelerating electrification, as is the case with Bitcoin mining. Bitcoin mining is a location agnostic activity that financially incentivizes the discovery of cost effective ways to harness energy, independent of consumer demand or other historical impediments to energy generation. SSA countries can leverage Bitcoin mining to “close the energy access gap” much quicker and finance renewable grids from mining revenues, without relying on donor altruism or loans from the likes of the IMF and World Bank; thus lifting their citizens from poverty.