“Freedom can run a monetary system as superbly as it runs the rest of the economy. Contrary to many writers, there is nothing special about money that requires extensive governmental dictation.“ – Murray Rothbard

The signing into law of the Bank Secrecy Act (BSA) in 1970 by president Richard Nixon ended the confidentiality that had always existed between banks and their customers. The BSA requires financial institutions to assist law enforcement agencies in curbing money laundering by maintaining records, as well as filing reports on currency transactions and “suspicious activity” with the government.

More specifically, financial institutions are obligated to report daily transactions that exceed $10 000, which at the time of passing the act was a significant amount of money that is now equivalent to approximately $78 000 when adjusted for inflation. This means that over time as inflation reduces the value of that limit, more and more transactions will be covered by the act resulting in even more financial surveillance.

With the adoption of similar laws globally, financial institutions have now become a de facto branch of the government that can financially censor anyone without any due process. Know your customer (KYC) regulations, government agencies like the Financial Crimes Enforcement Network (FinCen) and draconian government programs like Operation Choke Point are all by-products of the BSA that have tightened the state’s grip on the financial system; while slowly eroding the financial privacy of individuals. Financial surveillance is now the rule not the exception. In other words thanks to laws like the BSA and their accompanying regulatory agencies, money has now morphed into a system of control.

For example Custodia Bank’s application for membership into the Federal System (i.e banking license) was denied in January this year, mainly due to its proposed focus on crypto assets, which the Fed deemed to be “inconsistent with safe and sound banking practices”. The Fed went on to release an 86 page report outlining their reasons for turning down Custodia’s application. Of the myriad of reasons given for the denial the one that stood out was when they stated;

“…the Board has broader concerns about proposals to issue a token that represents a dollar deposit and circulates indefinitely on an open, decentralized, or similar network where (i) persons unknown to the issuing bank can hold the asset; and (ii) neither the bank nor its contracted vendors have control over the governance and policies of the network, including, for example, consensus mechanisms for processing transactions.”

In other words the Fed doesn’t like the idea of “KYC-free” money circulating on networks they do not control. Despite the Federal Reserve Board (FRB)’s own admission that, “Custodia appears to have sufficient capital and resources to sustain initial operations”, as well as Custodia’s proposed low-risk business model of being fully capitalized, holding $1.08 in cash for every dollar deposited by customers; the desire to exert control won the day. This denial makes even more sense when one considers the threat that Custodia would pose to FedNow, the Fed’s new instant payment service set to launch this year in July.

Central Bank Digital Currencies (CBDCs) are another example of the state’s desire to maintain control over the financial system. They grant surveillance as well as censoring capabilities to the state beyond any financial tool or law in existence today. A fact that Christine Lagarde, the head of the European Central Bank (ECB) admitted to in a widely shared prank call, that she thought was with Ukrainian president Volodymyr Zelensky. In the video Lagarde acknowledges her support for the digital Euro while also saying the quiet part out loud that the digital euro will give the ECB control over payments but in a “limited way”. At its core the fiat system is very much incompatible with the preservation of financial privacy and can be easily used to financially censor those who are defined as enemies of the state at any point in time; people like Julian Assange or the Canadian truckers.

In this second iteration of “Why I Bitcoin”, it’s my intent to explore a second reason for this decision, which is; Bitcoin is freedom.

“Government achieved full control over paper money with the passage of legal tender laws, which dictate to people what their legal money can be…In fact, once legal tender laws are enacted and enforced, debt repudiation through monetary depreciation becomes a common practice of government finance…Legal tender legislation is one of the great evils of our time, the necessary basis of inflation and monetary destruction. It gnaws at the moral and economic foundations of economic society, largely because it is misunderstood and ignored.” – Hans Sennholz

Personal freedom and economic freedom are two sides of the same coin, as you cannot have one without the other. This is the foundation upon which financial censorship of individuals and sanctioning of countries rests upon. By restricting one’s ability to transact freely the exercise of all other freedoms is curtailed. As we saw in Canada in February 2022, the Truckers’ protest was quelled when the government ordered their bank accounts to be frozen, effectively shutting them out of the financial system. Their freedom of speech as well as their right to peacefully assemble and protest were suppressed by cutting off their ability to transact. There is no personal freedom without economic freedom.

While laws like the BSA bestow upon the state the legal right to censor and conduct financial surveillance on its citizens, legal tender laws are far worse. In fact, without legal tender laws it’s highly probable that “the BSA’s” of this world would be non-existent. According to the dictionary, legal tender is anything recognized by law to settle public or private debts, which legally obligates any creditor to accept the legal tender towards the settlement of a debt. National currencies are legal tender by default. While this definition is correct, it’s incomplete as it conceals the diabolical nature of legal tender laws. Austrian economist Hans Sennholz defined legal tender as,

“Legal tender is the legal obligation to accept Federal Reserve notes at their nominal value, no matter how much their purchasing power has fallen or is expected to fall,” or “legal tender is the legal obligation, enforced by courts and police, of every creditor to accept Federal Reserve notes of uncertain and usually depreciating value.”

Legal tender laws empower the state to coerce its citizens into accepting a currency that only the state has the right to create, manipulate, obtain seigniorage and expropriate private property through debasement of the currency. Without this government monopoly over money creation, inflation, seigniorage, and currency manipulation would be non-existent; as good money always drives out bad money. The market doesn’t need the state to declare what money is or isn’t. For most of us who have been born into the world of fiat currencies this may be a very radical position but it’s the most rational.

There is a reason why every fiat currency in history has always failed. The majority of people today believe inflation is an unavoidable consequence of a productive economy. If inflation is a form of theft then the bigger question should be; why is theft a feature of a productive economy? How does a guaranteed 2% loss in purchasing power raise standards of living? That’s antithetical to how free markets ought to work and the government controlled fiat monetary system is the root cause.

Thanks to legal tender laws people are denied the right to use the best sound money available thus their personal liberties are curtailed. If you are legally obligated to accept unsound fiat money as payment are you really free? Ludwig von Mises in his book “The Theory of Money and Credit” wrote:

“It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights.”

Unsound money backed by legal tender laws is the basis for which dictators are able to control the lives of their citizens. This combination is what has enthroned central banks as an institution thus making central planning more palatable and state interventionism in the economy the norm. Are you really free if the value of your time, the most scarce resource you have, can be devalued by government bureaucrats at will? Are you really free when you have to explain to the bank manager why you want to withdraw $15 000 of your own money? Are you really free if cash transactions above €1 000 are outlawed? Are you really free if your bank account can be frozen without due process? Are you really free if faceless supranational organizations like the IMF, World Bank and the Financial Action Task Force (FATF) can impose their will on your country?

I think it’s the recognition of these problems that prompted Satoshi to release Bitcoin anonymously. In a world where money is a system of control, launching Bitcoin any other way would have jeopardized the entire project by creating a single point of failure; which would have been Satoshi himself. Julian Assange and Edward Snowden are perfect examples of what happens when individuals decide to tell the truth in an empire built on lies, how much more the creator of an alternative monetary system that threatens to topple central banking. By concealing his meatspace identity he not only safeguarded his own life but also ensured that Bitcoin would be fully decentralized and distributed; thus making it more resistant to state attacks.

Satoshi also understood that freedom is never given voluntarily by the oppressor therefore he didn’t incorporate a company or a foundation, partner with a bank, raise venture capital funding or ask for permission to reinvent money. Had he done any of these, Bitcoin would have probably not existed.

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.” – Frédéric Bastiat

After Executive Order 6102 (EO 6102) was issued, which outlawed the owning of gold by American citizens, only Federal Reserve notes and coins were to be recognized as legal tender. In accordance with EO 6102, on the 5th of June 1933, a joint congressional resolution nullified the right of creditors to require payment in gold in all contracts public and private. The Supreme Court later upheld this resolution in 1935. As I pointed out earlier, once fiat money has been bequeathed with legal tender status the whole political and legal system becomes a shield to defend that status quo.

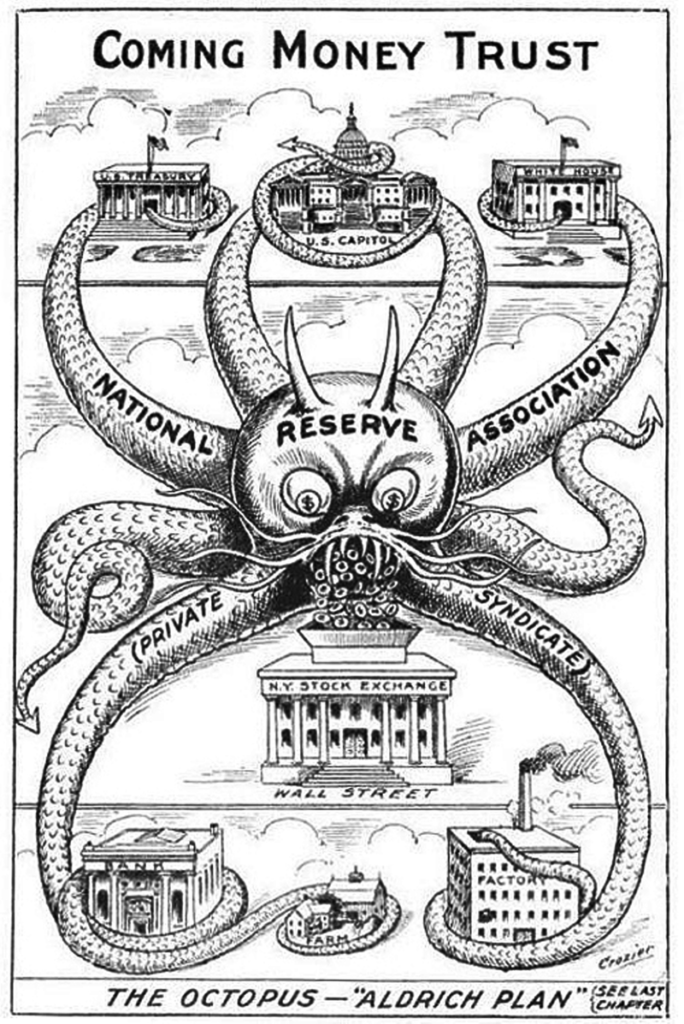

The state becomes legally empowered to transfer wealth from one group of people to another and society at large begins to curry favour with the state in order to be beneficiaries of this legalized theft. Once the Federal Reserve Act of 1913 was passed, the Federal Reserve became the de facto issuer of currency on behalf of the US Government and established a financial system that is today penalizing new entrants like Custodia Bank for choosing to do business differently.

The marriage of money and state that was cemented by central banking is one of the biggest threats to individual sovereignty in our world today. As long as this union exists, man-made poverty will continue to be pervasive and politics will continue to dominate our lives more than it should. Whoever controls your money controls you.

Bitcoin is the solution for the separation of money and state. By cutting this umbilical cord between money and state, power hungry bureaucrats lose one of the critical levers they use to control the lives of their citizens. While Bitcoin is also a censorship-resistant monetary network, it’s also resistant to corruption by those that wish to turn it into another system of control. It’s the largest and most successful peaceful protest in the world today against central bank tyranny that transcends national borders, race, religion and political affiliation. Bitcoin succeeded where Occupy Wall Street failed by offering anyone and everyone the option to voluntarily exit the fiat ponzi. This stateless money was created to replace the current immoral financial system along with its fiat currencies and institutions.Bitcoin is freedom.

Bitcoin is a parallel, permissionless monetary system that was engineered from the ground up and everyone who holds bitcoin today does so freely. No state compulsion or legal tender laws required. The Bitcoin network confers upon each participant equal irrevocable property rights regardless of their financial status. It’s a global, neutral money accessible to all.

Bitcoin has no counterparty risk, Bitcoin is not controlled by any government or corporation, Bitcoin is permissionless, Bitcoin doesn’t require KYC, Bitcoin cannot be inflated, Bitcoin is provably scarce, Bitcoin has no yield and Bitcoin is freedom money. The government monopoly on the issuance and control of money is the root of all monetary evil; and Bitcoin is the antidote.

As a self-policing transparent monetary network that is neither reliant on the current legal system nor dependent on political favours, Bitcoin effectively challenged the legal privileges of central banks to be sole currency issuers. By creating an internet native financial system anchored in cryptography instead of trust that allows any two parties to willingly transact with each other, Satoshi gifted the world with one of the most potent tools of economic freedom.

As the banks fail left, right and centre, while the insolvency of the financial system becomes even more obvious by the day, the first question you have to ask yourself is how will you protect your wealth? As the digital prisons are being built in the form of CBDC-powered social credit systems and digital ID’s, the second question you must ask yourself is how will you protect your individual freedom? Without freedom you can’t have wealth because what good is wealth that you can’t protect from seizure or that requires you to obtain permission before you can use it? Encapsulated within Bitcoin is wealth you can truly own and the freedom to spend it as you see fit.

Great and spot on!