ENJOY THE FIRST EDITION OF THE SIGNAL FOR FREE

✌️ Welcome to The Signal, the newsletter that sets you up for the investing week in just a few minutes each Monday.

🚨 The Signal gives you a peek into my personal macro investing notebook at the beginning of each week, highlighting the most important market themes and developments I’m watching for, and why.

🧐 Focus on The Signal with me. Join here.

This Week’s Signals:

- Rearview Mirror

- The Fed Has Spoken

- ISM & Jobs Report

- Signposts Ahead

- Rubber to the Road

My Notebook:

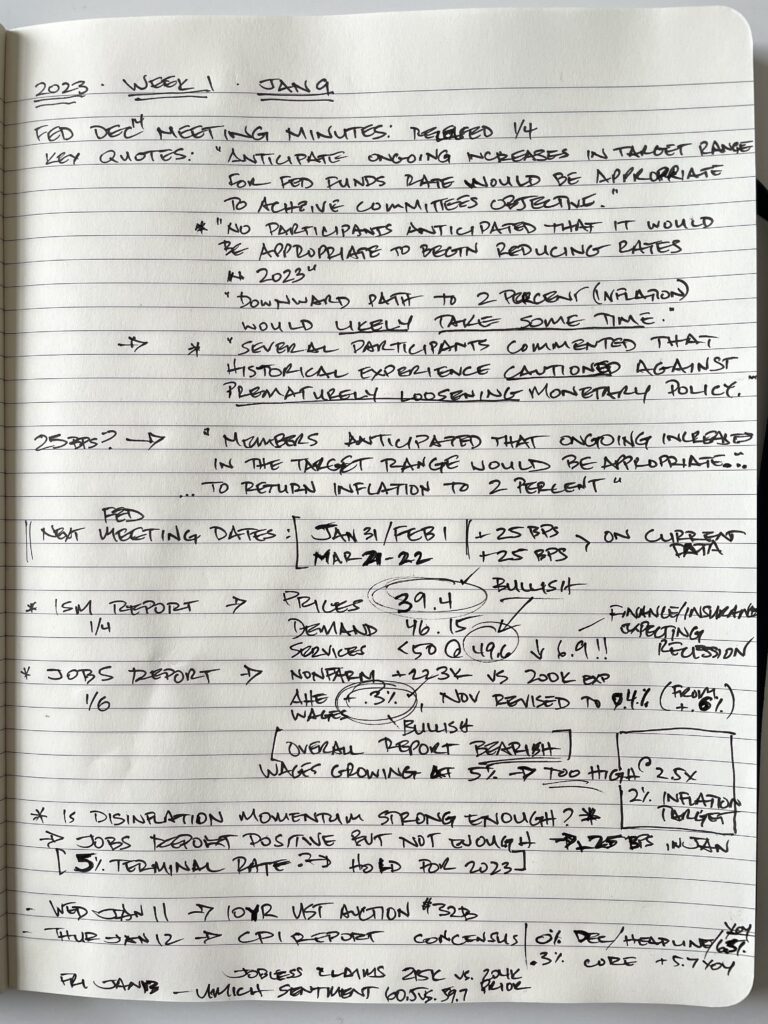

Here’s what I scribbled in my notebook this past week. Let’s break it down.

🏛️ The Fed Has Spoken

This past week, the Fed released the minutes from its Dec 14th meeting, and here are the notable statements from the transcript.

Key quotes:

- Anticipate ongoing increases in target range for Fed Funds Rate would be appropriate to achieve committees objective.

- No participants anticipated that it would be appropriate to begin reducing rates in 2023.

- Downward path to 2 percent (inflation) would likely take some time.

- Several participants commented that historical experience cautioned against prematurely loosening monetary policy.

- Members anticipated that ongoing increases in the (Fed Funds) target range would be appropriate to return inflation to 2 percent.

A few things here. First, I like to take the Fed at their word. That said, we need to also take that word with a hefty serving of salt, as we know just how royally they screwed up the inflation anticipation this past year. I mean, as of December 2021, the Fed expected rates at the end of 2022 to be at 0.806%.

That said, Powell has reiterated in recent press conferences that if they do over-tighten, they ‘have tools to reverse that.’

Reading the key statements above, they seem to reiterate this in the Dec meeting. In my opinion, the Fed will err on over-tightening to prevent runaway inflation.

Powell is hell bent on fixing the Fed’s screwups and leaving a positive legacy, and so he is all dressed up like Volcker—the ultra-hawk. He. Will. Keep. Tightening.

We have two meetings in Q1 this year:

Jan 31st – I expect a 25bp hike = Fed Funds 4.75% (top of range)

Mar 21st – I expect another 25bp hike = Fed Funds 5%

And this is where I believe they stop, and 5% will be the Terminal Rate for this cycle.

Barring any substantial change in the economic data (or Treasury market liquidity!) in the coming 6 or 8 weeks, this is the trajectory, IMO.

Now that we’re in the Fed’s mindset, let’s look at the most important data released last week…

🔍 ISM & Jobs Report

The markets got pretty (read: overly) excited about the data released this past week. We had ISM manufacturing and Jobs data.

First, ISM:

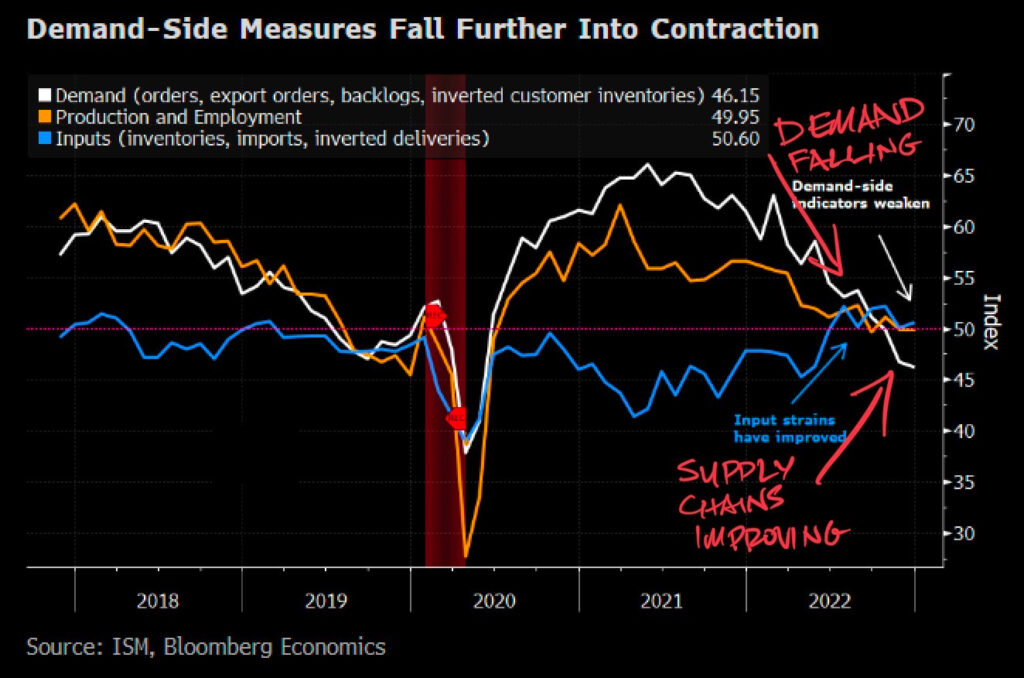

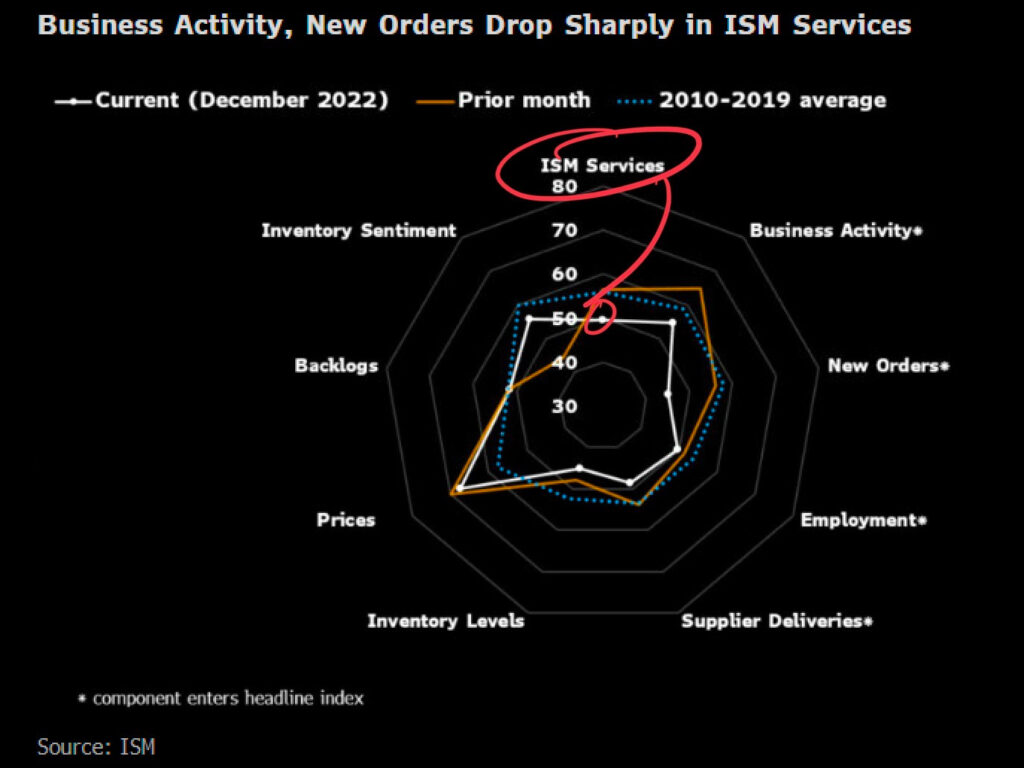

Numbers came in a little mixed, but the significant moves were in the Prices at 39.4, Demand at 46.15, and Services at 49.6. This services number was the most significant, having dropped 6.9 from the last report.

Anything under 50 means retraction.

On the survey of the report, managers in finance and insurance are particularly concerned about an incoming recession.

All in all, the numbers were negative for the economy and positive for the Fed (perhaps their tightening is working).

A few things to remember: the economy shifted hard into demand for goods during lockdowns and then migrated back to demand for services this past year and a half. Services now contracting is significant.

Though, as you can see here, Services prices (not to be confused with overall ISM pricing) is still high…I expect this to lag and come down pretty hard this year, as people tighten belts and reign in discretionary spending.

Reminder: Fed wants prices lower across the board.

Next:

The Jobs Report came out Friday, and this got the markets all lathered up. The markets chose to focus on the decrease in hourly earnings growth.

The gist of it:

Non-Farm Payrolls came in +223K vs +200K expected → so we are still at full employment, not great for inflation worries or the Fed slowing the economy.

Average Hourly Earnings only increased by 0.3%, and the November blowout number of 0.6% was revised backwards to just 0.4%. This is good for inflation pressure, good for the Fed (and of course bad for workers).

But it sent the market into a fury, thinking the Fed will just fold up its tent and stop the rate raises.

S&P 500 rose 2.3%, NASD jumped 2.6%.

No they won’t. Not yet.

I personally sold into the rallies.

Why?

Wages are still growing at 5% annualized. This is over 2.5X the stated inflation target. The Fed doesn’t care about your wages catching up to inflation. It worries about you using those wages to continue flaming the inflation fire.

Wages have to stop going up for the Fed to back off, IMO.

🪧 Signposts Ahead

This week, we have:

Wed, Jan 11th:

10YR US Treasury Auction:

I’m looking closely at the demand here:

What’s the Bid to Cover Ratio? 2.31x on the last auction, does it come in better or worse this week?

Does the auction tail again? 4bps last auction, and these have been tailing a lot recently → bad sign for demand and liquidity.

And what’s the primary dealer participation? Are they soaking the issue up with lower international demand?

Thur, Jan 12th:

CPI Report:

Headline CPI: Consensus → 0% MoM and +6.5% YoY

Core CPI: Consensus → +0.3% MoM and +5.7% YoY

Housing and shelter pricing seems to have peaked.

New and used cars are going down in price.

That said, overall prices will need to decelerate substantially to give the Fed enough comfort to back off further rate raises here. On the contrary, if this CPI reading is a surprise to the upside, the market could be in a world of hurt with the prospect of a 50bp Fed Funds hike at the end of the month.

The market priced in a positive report in my opinion, leaving risk is to the upside on CPI and downside in the market.

Jobless Claims:

The market is looking for 215K initial jobless claims vs 204K last week.

The Fed needs this number to be higher to back off raising rates.

Fri, Jan 13th:

UMichigan Consumer Sentiment Index:

UofM surveys consumers to see how they are feeling about the economy going forward.

Bloomberg Professional

Market is actually looking for this to go up to 60.5 vs. 59.7 last month, with consumers feeling more confident that inflation is easing soon.

I don’t get too caught up in this reading, as it is a bit of a noisy survey IMO and does not really drive any Fed decisions.

🛞 Rubber to the Road

Let’s glue this all together and get our heads on right for the week.

The question we are asking is: Is the disinflation trend strong enough yet to get the Fed to back down?

The jobs report was mildly positive (anti-inflationary), but not enough.

ISM was a tick in the right direction, but not yet enough, either.

CPI could help, but would have to be a substantial move downward (under 6%) for the Fed to back off here. And if it goes the wrong way—higher—the Fed could raise another 50bps this month.

Watching the UST auctions and overall bond market liquidity. This is where the Fed could be forced into easing sooner than expected because of deteriorating market conditions. They don’t care about the stock market. In fact, they want it lower. They only care about the Treasury market, as this is where the liquidity for the government itself comes. The easing, though, will come in backing off QT and maybe supporting the bond market with Fed purchases.

Bottom line:

At this point, I am watching for signs of a recession taking hold of the economy. I think inflation will continue to ease and with the sheer amount of debt and borrowing by consumers, we could very well see a snowball effect and possible sharp downturn in the economy.

This is the greatest risk, in my opinion, and the market expecting the Fed to just pivot on the first sign of inflation waning will be proven wrong.

This is why I’m personally net short the market, continue to hold plenty of cash, and am staying away from stocks with high beta (i.e., Technology and Discretionary), while watching for opportunities in those with lower beta (i.e., Consumer Staples and Utilities). I’m also opportunistically buying gold, silver and Bitcoin, as hard monies tend to do well in stagflation and recessions.

That’s it. I hope you feel informed and organized and are ready hit the investment ground running this week!

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James

I hope you enjoyed this first edition of The Signal newsletter.

🚨 For weekly access to The Signal, throughout the year, join here:

Upgrade to paid here.