✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What is the DXY?

- How is the DXY Calculated?

- What’s causing the strength of the USD?

- What’s the Dollar Milkshake theory?

Inspirational Tweet:

US dollar index (DXY) hits a 20-year-high

Chart: Trading View pic.twitter.com/1uKdeSUq2m

— Blockworks (@Blockworks_) July 11, 2022

If you’ve been following macro news lately, you’ve undoubtedly heard that the USD is super strong right now vs. other currencies. But what exactly is the so-called DXY Index, and what does it mean for the US Dollar and other currencies?

We’ll answer all that and more in just a few minutes of simple explanation below!

💵 What is the DXY?

First, the DXY is a Bloomberg ticker symbol for what is known as the US Dollar Index (USDX). The DXY is often referred to as the Dixie by foreign exchange (forex) traders and institutional investors.

At the core of it, the DXY is a measure of the US Dollar’s strength against foreign currencies. Not every currency, of course, but a select few. Namely, the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc.

So, the DXY basket uses the following exchange rates: USDEUR, USDJPY, USDGBP, USDCAD, USDSEK, and USDCHF (remember that although Sweden and Switzerland are part of the Europe, their currencies are not part of the monetary euro).

The index was created in 1973 after the Bretton Woods Agreement was dissolved. If you recall, the end of Bretton Woods meant the end of the gold standard and the beginning of floating exchange rates.

The index is calculated by the Intercontinental Exchange Group (ICE), an exchange and clearing company that operates futures and OTC exchanges and is the parent company of the New York Stock Exchange (NYSE).

OK, now that we have the basics mapped out, let’s dig into how ICE actually calculates the DXY.

🔢 How is the DXY Calculated?

First, the index was started back in 1974 with a base value of 100, and the rise and fall of the strength of the USD is measured against this base. In other words, if the DXY is trading at 110, then we know the USD has gained 10% versus the other currencies in the basket. And if it trades at 90, then the USD is 10% weaker against the other currencies.

Using fixed weightings, the index is calculated using a weighted average geometric mean (performances are multiplied against each other and then averaged using weightings).

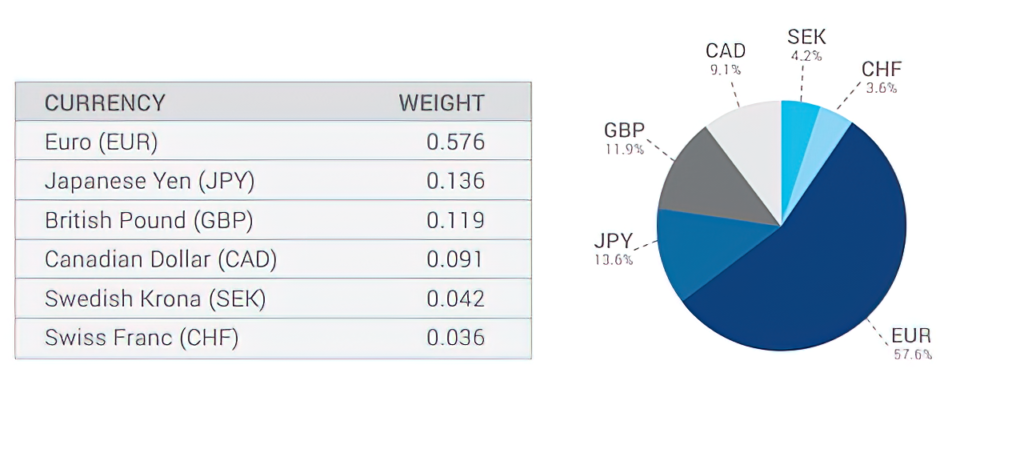

The currency weightings are:

www.finance.yahoo.com

ICE calculates the index every 15 seconds and then pushes this dynamic price out to data vendors, such as Bloomberg or Reuters.

As noted in the Twitter post by Blockworks above, the USD is currently trading at a 20-year high, according to the DXY index.

Question is, why?

Let’s look into that next.

💪 What’s causing the strength of the USD?

Again, if you’ve been paying attention to current macro economics, then you also know that many countries are experiencing inflation. And because of this, some of their central banks are raising their target interest rates in an attempt to manage the inflation lower. The United States Federal Reserve has been quite vocal and one of the most active central banks to do so.

But not all have.

In fact, two in particular have been slow to act. Namely, Japan and Europe. And Japan has not just been slow to act, the Bank of Japan (BOJ) has actually doubled down on quantitative easing in that they are buying their own bonds to maintain low interest rates. Meanwhile, Europe has experienced record inflation, yet has maintained target interest rates that are still below zero.

What does this all mean?

Two things in particular. First, investors of these regions have been selling Japanese and European bonds in search of higher yield. If you’re still getting a negative yield on a 2-year bond in Japan and barely positive yield on 2-year German Bunds, then it stands to reason that you would sell those investments and buy US 2-year Treasuries to get over 3% return.

And when you sell one country’s bonds to buy another country’s, then you sell the currency you were holding and buy the new one.

I.e., sell JPY or EUR and buy USD.

The second major factor in the strength of the US Dollar is a flight to safety. As investors become concerned with both the policies of foreign central banks, such as Japan and Europe, as well as the underlying economic strength of those countries, they choose to move their own currency into the USD for risk management and protection.

Of course, this becomes something of a self-fulfilling prophecy.

How?

As the USD strengthens and other currencies weaken, this puts pressure on countries who have US Dollar denominated liabilities (think payments for oil or energy that are set in USD) or issue US Dollar debt. The weakness of their own currency relative to the US Dollar negatively impacts their ability to meet the obligations or interest payments. Ultimately, it forces certain countries in emerging markets to either print more of their own currency to buy more US Dollars (which eventually leads to hyperinflation) or simply adopt the USD as their base currency.

That’s right, their currency disappears as the US Dollar swallows it.

The US Dollar Milkshake Theory.

🥤What’s the Dollar Milkshake Theory?

Let’s say you have a milkshake, and you’re sitting at another table, all the way across the room. Now let’s say I have a straw. A really long straw. So, even though you’re all the way across the room, I can plunk my straw into your milkshake and drink it.

This is what the US Dollar can do in the Dollar Milkshake Theory.

The milkshake, in this case, is a foreign currency. The straw is US Dollar denominated liabilities, US Dollar denominated debt, Eurodollars, central bank and major global bank liquidity, government bond interest rate differences, etc.

The one doing the drinking, of course, is the US Dollar itself.

And so, as weaker foreign currencies fall prey to the concerns and structural issues above, they eventually become consumed by the US Dollar. And eventually most, if not all, currencies are folded into the US Dollar.

Will this actually happen?

I do believe it will at some point in the future. That said, these are major events, and so I also believe it will happen a little slower than many would argue. These structural issues often take long periods to play out. That, plus the US Dollar has its own issues that will play a factor as well, causing short-term counter-fluctuations in the currencies.

All that said, the amount of debt on top of the GDP of many of these countries will prove too much of a burden for their economies, and some will absolutely collapse. As a good friend of mine, Greg Foss, likes to say, risk happens fast.

And if one domino falls, this could cause a cascading event that leads the US Dollar to swallow a number of them whole.

That’s it. I hope you feel a little bit smarter knowing about the DXY index and how it’s calculated, as well as the Dollar Milkshake Theory.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James

Excellent Summary… Thanks, James!

And as the US swallows all other countries in to it’s hellscape all the psychopath that is the US(all the corruption, all the power tripping, all the ignorance, all the ego, etc) government will be laid to bare across the world…and there will be no world. Once the US government(or rather those that control it) controls the world who will stop them? They will expand their empire to consume everything. They will hire people who will sell their souls for a buck, there will be no place to run. There will be no law, no justice, no equality, no sanity. It will simply be the pharaohs and the slaves building the pyramids for them. Power corrupts, in fact, it destroys. All power strives for absolute.