✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s a Financial Zombie?

- G7 Zombieland

- Zombie Sovereign Apocalypse?

- Zombie Safehavens

Inspirational Tweet:

Interest on U.S federal debt is heading towards $1 trillion a year at an alarming rate.

It is now the same size as the annual US military budget.

That’s it. That’s the tweet. pic.twitter.com/z3LmNPokDK

— Genevieve Roch-Decter, CFA (@GRDecter) October 28, 2022

As Genevieve points out here, interest payments on US debt have nearly doubled in the last two years and are rapidly approaching $1T annually. Yep, about as much as the entire defense budget. For interest payments.

On debt that is growing exponentially.

If that doesn’t scare you, you’ve been watching too many horror movies this season and are desensitized to reality. Because it’s not just the US that’s become a zombie, we’re surrounded by them.

So buckle in, and I don’t blame you for peeking through your fingers while reading this one. It’s liable to scare you to death.

💀 What’s a Financial Zombie?

First off, a little slang explanation here. Zombie companies are ones that earn enough money to make interest payments and remain in operation, but not enough to pay off their actual debt. As such, they have to keep borrowing more and more to cover their expenses and continue operating.

They’re basically the walking dead. Zombies, trudging through one budget and financial crisis after another.

Sound familiar?

Sure, we’ve seen plenty of zombies recently, like AMC, Gamestop, Peloton, and Snap. And there will be more. As interest rates rise and borrowing costs exceed thresholds that keep companies profitable, borderline players will be bit by the debt monster and become zombies, too.

Remember that equity is secondary to debt, and all common stock is therefore, by definition, subject to being wiped out by leverage. And while this can be scary for portfolios, these are small monsters amongst us. Manageable.

After all, we can control these exposures by selling the weaker actors and buying only companies with solid balance sheets in our portfolios. Those that are in no danger of turning into zombies on us. Far too strong to be taken down by the debt monster.

So, I don’t lose sleep over these frights.

No, what keeps me up at night are the huge monsters. The gigantic indebted beasts of the financial world. So big, so powerful, so menacing, that they threaten to take down every single one of us with them.

The Sovereign Zombies.

🎃 G7 Zombieland

You’ve heard me and some others talk recently about the growing sovereign debt crisis we have on our hands these days. And while there are plenty of additional large and dangerous monsters amongst us, today we’re going to focus on some of the biggest ones and those closest to home.

The G7.

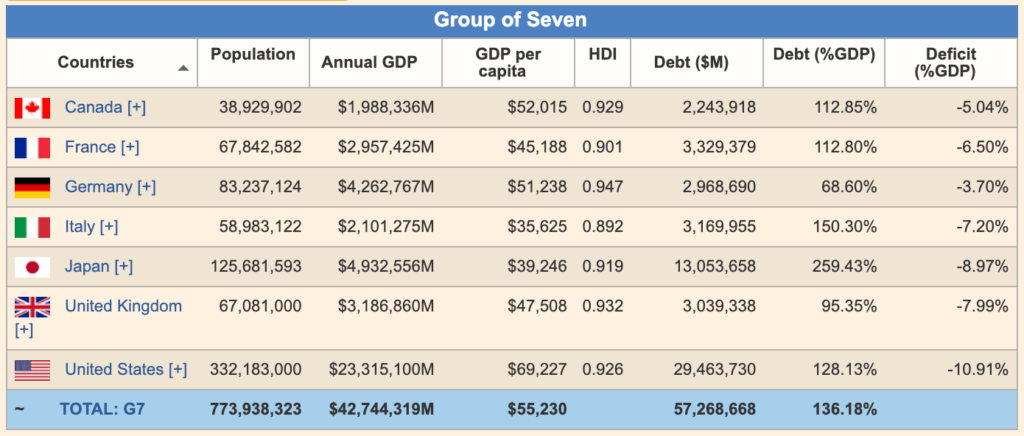

Not to be confused with the largest economies of the G20, the Group of 7 is a club that includes the United Kingdom, Germany, France, Italy, Japan, Canada, and the United States as its members.

We’ll get into why and how and all that in a future newsletter.

But for now, what’s important to note here is that these countries are some of the most important financial hubs of the entire world. Many are global leading economies, and they set the stage for monetary and fiscal policy that other developed and emerging market countries use to shape their own policies.

So, it can be surprising and quite frankly a little (read: a lot) disturbing how poorly run and fragile some of these countries’ balance sheets have become.

The chart below shows just how bad it was at the end of 2021. You can see in the far right columns, two measures that we will key in on to gauge the severity of the situation.

countryeconomy.com

First, the debt to GDP number as a percentage shows how much a country owes in debt in relation to how much it generates in productivity each year. This is a pretty good starting point to see just how strong or weak a country’s balance sheet may be.

For instance, Canada is showing a ~113% debt to GDP. It owes more in total than it generates in productivity each year. Germany and the UK are showing that they owe less in total debt than they generate in gross productivity each year, though the UK, with a fast growing debt problem of its own, has recently jumped over 100% this year, too.

Congratulations?

And look at Japan, boasting a whopping 259% debt to GDP.

Whoa.

And of course, we know the US is also in the 100%+ debt to GDP club, hefting a 130% number. This, too, has gotten worse, and comes in closer to 140% now.

But the numbers that are really eye opening are in the last column to the right.

The deficit as a percentage of GDP. This is how much money every single one of these countries is losing every year versus their gross productivity. They can’t pay down their debt, because they’re operating in a deficit. I.e., they need to borrow more every year just to keep going.

By definition, they are all zombies.

And with interest rates going higher in every single one of these regions (yes, even Japan, while they are trying to manipulate them lower), these deficits are rising. They are getting worse. Debt to GDP is growing. Interest payments are growing. Borrowing is growing.

And every single one of these zombie countries is getting closer to actual fiscal death.

😱 Zombie Sovereign Apocalypse?

Wait, wait, wait.

Are you telling me that they’re all going to go bankrupt? Collapse? Their currencies will become worthless? For real?

Well, not exactly.

First, these zombies are all developed countries that have debt that is denominated in their own currencies. Because of this, they can literally print money and buy their own bonds to keep their ridiculous zombie existence going. As long as people have confidence that the government will keep up the charade, they will use their currency and not flee it. This can go on for many years.

Take Japan, for instance.

The Bank of Japan has been doing this for so long and has been so active (read: manipulative) in the Japanese financial markets, that they now own over 50% of all Japanese government debt. You read that right. The BOJ is now the largest holder of its own bonds.

I’ll let that sink in for a second while you pry your fingers back open for another peek.

So you know, I’ve written about the yen and BOJ manipulation in recent newsletters, one of which you can find here, if you’d like to know more about that situation.

TL;DR and a bit of an update: as the globe loses confidence and the BOJ loses a handle on the situation, the yen is bound to hyper-inflate and either be reset or disappear altogether in the not-too-distant future, IMO.

Moving on to Germany, Italy, and France, all part of the Eurozone, they have unique problems, too. Which I wrote about here.

TL;DR: their biggest issues have to do with the sizable difference in deficits between countries and how they are dealing with that. I believe this causes Germany to give up the Euro dream and leave the EU and Euro within the decade. Again, IMO.

Two future currency casualties. Four of the G7 zombies.

What about the UK? Canada? And what currency will they all use?

This remains to be seen in the near future, but the reality is that they are on virtually same path as the debt monster takes over each of their regions and their currencies, too.

It’s just math.

And as each central bank continues to print money and buy their own bonds to ‘fund’ their government, global investors will eventually lose confidence in the (ponzi) scheme and flee the currency.

This will someday cause the yen, the Euro, the pound, and the Canadian dollar to each hyperinflate and end up being swallowed by the US Dollar.

The Brent Johnson Dollar Milkshake Theory. I explained that one here.

TL;DR: the US Treasury is the global reserve asset and the US Dollar is the global reserve currency, and as the entire current global financial system is based on these, the USD will swallow everything in its path and be the very last currency to fail.

Which it will someday, too.

IMO, of course.

⚰️ Zombie Safehavens

OK, so the monsters are here, they’re dangerous and will take down everything and everybody in their paths. What can you do? How can you protect yourself?

Is there a shed not full of chainsaws somewhere to hide out for a bit?

Good questions.

If you’re in one of the non-US G7 countries (or really any other, for that matter), then it makes sense to own hard monies to protect yourself against near-term possibilities of hyper-inflation. And even as the money supply in each of these regions expands exponentially while the countries print money to keep it all going, these hard monies should protect against that M2 expansion and devaluation of the currencies.

Hard monies for me include gold, silver, and Bitcoin.

Even though I live in the US, I own each of these to protect against the reality that the US Treasury needs to keep expanding the money supply here in order to issue more and more debt and keep markets liquid ‘indefinitely’.

Yes, the US is also in a long-term debt spiral.

We all know that forever is a long time, though, and even as I think it will take many years or decades to happen, I do believe that even the mighty mighty US Treasury-fed zombie will someday die, too.

And when it goes down, I will be protected with those hard monies.

So, while there may not be a happy ending to this horror movie for everyone—there never is—you can create a safe place and happy ending for you and your family instead.

That’s it. I hope you feel a little bit smarter knowing about zombie sovereigns and how you may protect yourself.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

Thanks again and talk soon!

✌️James

Hi James

thank you so much for you work. My question is: why don’t you recommend real estate as a hedge?

thanks

Stanley

Hey Stanley,

I own real estate as part of my asset portfolio, and I do believe it is a good long term investment. That said, for the purposes of these recent articles, I am really focusing on hard money and having a closer hedge for melting fiat. Gold, silver, and Bitcoin are all relatively easy to buy in small increments and transfer readily. They are all highly liquid and portable.

That said, I believe Bitcoin is the hardest money, easiest to store, protect, and travel with, so this is my personal choice of primary allocation for this portion of my portfolio, along with physical gold coins.

Hope that helps, and thanks! James