✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What are Forward Exchange Rates?

- What is Interest Rate Parity?

- Implications for the Yen

Inspirational Tweet:

Sounds like someone else besides JT doesn’t care to understand monetary policy and interest rate parity 😂 https://t.co/yDheY5EcwH

— Martin Pelletier (@MPelletierCIO) June 14, 2022

@MPelletierCIO is making a tongue in cheek observation here that the Japanese Prime Minister along with Justin Trudeau (JT), don’t understand the basic driving force behind currency movements. This force is known as interest rate parity and is the reason the Yen has been so weak lately.

If that sounds like Greek (er, Japanese) to you, no worries. We’ll get you all sorted on interest rate parity today!

🤝 What are Forward Exchange Rates?

To understand interest rate parity (IRP), we must first understand the two primary quotes that currencies trade in: the spot exchange rate and the forward exchange rate. The spot exchange rate is the current rate that you can buy a currency and is what you normally see quoted everywhere:

i.e., EUR/USD 1.04 or USD/YEN 134, etc.

The forward exchange rate is a quote for a currency exchange rate at a specific time in the future, anywhere from overnight to ten years (or longer for specialty contracts). Both spot and forward rates are available from banks and currency dealers.

Digging a little deeper here, you should also know that the difference between a forward rate and a spot rate is known as the swap point. In other words:

If forward rate minus spot rate is positive, then this is a forward premium,

And if forward rate minus spot rate is negative, then this is a forward discount.

A currency with higher interest rates will trade at a forward discount compared to a currency with lower interest rates. Like the USD versus the EUR.

Why is this?

Well, let’s get into what we call interest rate parity to explain.

⚖️ What is Interest Rate Parity?

In the most basic terms, the interest rate parity rule implies that the expected return on domestic deposits (assets) will equal the exchange rate-adjusted expected return on foreign deposits (assets). In other words, investors cannot arbitrage currencies by borrowing in a country with low interest rates, changing into a foreign currency, and investing in that foreign country’s higher rates. The difference they would gain is mitigated by the losses they would realize when exchanging back into the original currency at the maturity of the investment.

For example, let’s say we have the following quotes in the market:

- EUR/USD Spot Currency Exchange = 1.04

- EU (German) 1yr Treasury interest rate = 1.5%

- US 1yr Treasury interest rate = 3.0%

- EUR/USD 1yr Forward Currency Exchange = 1.0554

These rates show parity:

- Convert €1,000,000 to $1,040,000 at EUR/USD spot rate

- Invest $1,040,000 at 3.0% to mature in 1 year at $1,071,200

- Convert $1,071,200 back to €1,015,000 at 1.0554 EUR/USD 1yr Forward

- This would be the same as investing your original €1,000,000 at 1.5% and maturing at €1,015,000 after 1 year.

Parity.

The premise of interest rate parity is that it prevents investors from locking in an arbitrage of interest rates and currency exchange rates for profit.

And how exactly does that explain the recent activity and moves in the Yen?

Good question. Let’s unwrap that next.

😮 Implications for the Yen

First, and most importantly, let’s discuss current policy actions the Bank of Japan and the Federal Reserve have made and then we can see how these actions are affecting both countries’ currencies, due to IRP.

As you most likely know, the Federal Reserve (Fed) has been raising the Fed Funds Target Rate in order to fight inflation and most recently raised it by 75 basis points (0.75%). In response, and in anticipation of further rate raises, the US 10yr Treasury is now trading with a yield of over 3%.

In contrast, the Bank of Japan (BoJ) has not only not been raising rates, but it has instead announced its intent to keep the 10yr Japanese Government Bond (JGB) yield at 25 basis points (0.25%). In order to do this, the BoJ has declared it will buy every single 10yr JGB bond on the market to maintain the 0.25% yield target. This is a classic Yield Curve Control measure and has many implications for Japan, its government debt, its debt to GDP ratio, and more, but today we will focus on its specific impact to the Yen.

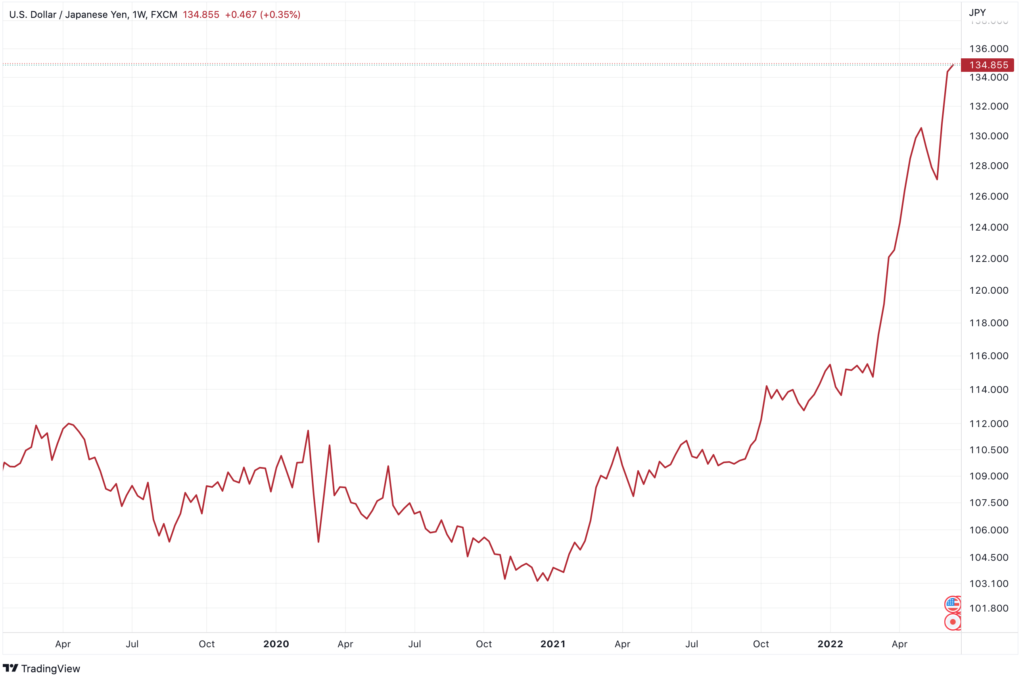

You may have also seen that the Yen has weakened considerably versus the US Dollar recently.

After reading the above explanations of IRP, you can guess why the Yen is weakening.

You got it. With the BoJ keeping interest rates artificially low, while at the same time the US Fed is raising interest rates, there is an arbitrage created between the two countries. In other words, you can borrow Yen at .25%, sell the Yen for US Dollars, and invest the USDs at 3%.

As you now know, the forward currency exchange rates will prevent extensive arbitraging and locking in a profit. But, as the US rates continue to rise and remain higher, this exerts a great amount of pressure on the Japanese Yen with investors selling Yen to invest in higher yielding US Treasuries.

A general rule of thumb is that higher interest rates increase the value of a country’s currency. And so, with the BoJ keeping the rates artificially low with Yield Curve Control, they are encouraging investors to sell Yen denominated debt and buy foreign denominated debt (in this case, US Treasuries) instead.

The bottom line is that the pressure is building between Japan and US central bank policies, and the Yen is the unfortunate escape valve.

That’s it. I hope you feel a little bit smarter knowing about interest rate parity and how it affects currency exchange rates around the world.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James