✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s OIS?

- Why TED, and What’s the Spread?

- Clues of Credit Stress

- Contagion & Bill and TED

Inspirational Tweet:

Rut roh…funding pressures in the banking system…time for an @jameslavish letter on the TED spread, a time tested measure of building contagion stresses…#btc is credit protection. Few. pic.twitter.com/1fNLyyiqmM

— Greg FOSS – Free Open… 🇨🇦 (@FossGregfoss) June 21, 2022

As usual, Greg Foss (@FossGregfoss) has picked up on a clue that banks are starting to feel the pressure of credit tightening, and this can lead to what we call contagion—the spread of distress from one entity to another.

That all may sound confusing, and I realize bonds and credit can be a bit intimidating for macroeconomic newcomers, so let’s keep this one super simple, shall we?

OIS first…

🌒 What’s OIS?

To understand the TED spread, you first have to understand the two measures we’re using to calculate the spread itself:

- 3 month T-Bills (US Government Treasury Bills)

- OIS (Overnight Indexed Swap)

You all understand what the T-Bill is, just a 3-month long government note. But what the heck is an overnight indexed swap?

First, a swap is just a contract between two parties with a predetermined amount of cash to be exchanged between them on a specified date or set of dates. The swap often involves either a fixed or variable interest rate to determine the amount of cash to be exchanged. And an overnight indexed swap uses an overnight rate index, such as Fed Funds or LIBOR (London Interbank Offered Rate), as the rate to price the swap for the specified time period, in this example 3 months.

*It’s important to note, the length of the swap is not overnight, that’s just the rate that that’s used to price the swap. The overnight rate the banks are using is keyed off of Fed Funds.

Bottom line, the OIS 3 month rate is the average interest rate banks are charging each other for three-month loans.

And so why do we look at the TED spread?

🤏 Why TED, and What’s the Spread?

First, where does the name TED come from? Is it named after a mathematician or a celebrity financier?

Hardly.

TED is just an acronym derived from T-Bill and ED, the Eurodollar futures contract ticker symbol.

And though the rates for the OIS side of the TED equation are quite similar to the Eurodollar rates, EDs are no longer the typical quoted side of the TED spread. Most institutions have replaced the ED side with either the SOFR (Secured Overnight Financing Rate) or OIS.

Why? Because EDs are priced off of LIBOR (London Inter-Bank Offered Rate), and there have been problems with LIBOR being manipulated (surprise, surprise). So, it’s being phased out of many calculations today in favor of something called the Secured Overnight Financing Rate (SOFR).

But let’s put that controversy on ice for now, as we’ll get into all that in another newsletter in the near future.

The important thing to understand is that spread is calculated as the difference between the interest rate banks lend to each other over a three-month time frame and the interest rate at which the government is borrowing money for a three-month period.

I.e., if the 3 month T-Bill is trading at a 1.50% yield and the OIS rate is 1.60%, the calculated TED spread would be .10% or 10 basis points.

Then, if the 3 month T-Bill begins to trade at 1.60% yield and the OIS rate is suddenly 2.60%, the TED spread would be 100 basis points, having widened significantly.

Why does this matter?

🔍 Clues of Credit Stress

Well, if the TED spread is increasing, it means banks believe that the counterparty banks they are lending to have an increasing risk of default on the loans. In response, they are charging higher interest rates to compensate for this risk. This points to the credit markets tightening and the expectations of economic contraction.

And if the TED spread is decreasing, it means those banks believe that the counterparty banks they are lending to have a decreasing risk of default on the loans. And in response, they are charging lower interest rates, offsetting this risk. This points to the credit markets loosening and the expectations of economic growth.

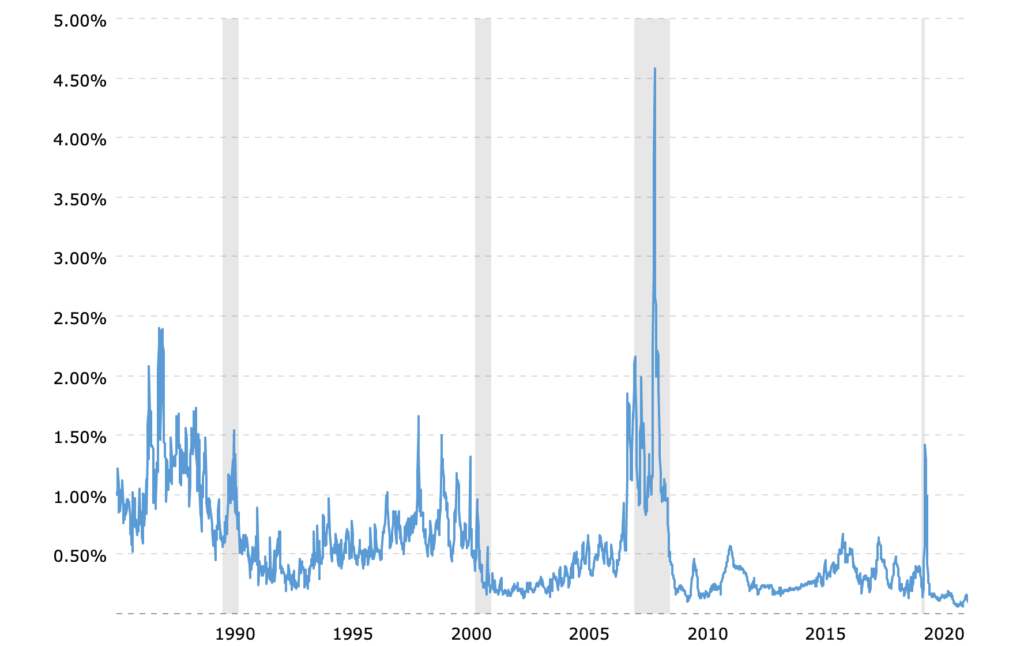

And when the TED spread starts to widen rapidly, as we saw back in 2008 and 2020:

www.macrotrends.net

This points to signs of stress in the credit markets, decreasing confidence in counterparties, and rapidly increasing risk of default by not just one party, but possibly more.

Contagion.

🦠 Contagion & Bill and TED

You may have heard me talk about contagion before, but if you haven’t, it’s a straightforward yet devastating concept. I wrote about it in an earlier Informationist Newsletter:

Contagion is pretty simple and just means that when there is a default on debt from one company or debt issuer (country, etc.) there will be a contagious effect that will be passed on to similar or related companies or countries.

Like dominoes falling or a string being pulled from a sweater, they cause subsequent dominoes to fall or strings to become loose and/or fall out of the sweater.

When Lehman failed, Bear Stearns (who similarly sold a lot of CDSs) also ‘failed’, and many other banks would have—if they had not been bailed out by the US Government (and your tax dollars). They were all interlinked and exposed to the same risks to varying degrees.

Contagion.

And so you can see, when banks begin to fret over credit risks, they are not just thinking about the counterparty’s underlying risk, but also the risk that the counterparty could also be negatively affected or even impaired by other banks in a contagion scenario.

As a result, the TED spreads begin to widen, sometimes quite rapidly. When you see this, you now know that, as Theodore Logan, aka TED, said in Bill and Ted’s Excellent Adventure:

Strange things are afoot at the Circle-K.

And you’d be wise to take note.

That’s it. I hope you feel a little bit smarter knowing all about TED spreads, clues of credit stress, and signs of financial market contagion.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James