“Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, and every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right.” – George Orwell

In 399 B.C. Socrates, the Greek philosopher, who is considered to be the father of western philosophy, defied the Athenian state by continuing to teach his philosophies. He was later charged with “corrupting the minds of the youth” and for irreverence towards the Athenian gods. After being found guilty on all charges he was sentenced to death by poisoning. He was made to drink hemlock.

Almost 20 years ago Israel was forced to cancel the Chinese edition of an exhibition honouring the life of legendary physicist and scientist Albert Einstein. This happened as a result of a demand by the Chinese Ministry of Culture to “delete” part of the text that stated that Einstein was a Jew that supported the creation of the state of Israel who at one point in time had declined an offer to be its first leader. The Israelis flatly declined to honour this demand on the basis that they “couldn’t change history” and opted to move the exhibition to Taiwan instead. The Ministry of Culture declined to explain why they wanted parts of the exhibition to be censored despite the fact that it mainly consisted of Einstein’s personal effects like his books, notebooks and pictures.

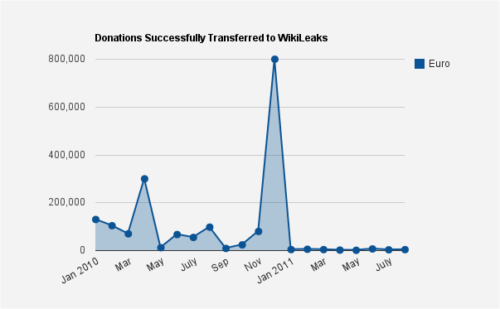

After releasing a large amount of diplomatic cables in November 2010 the controversial whistleblower website, Wikileaks, found itself in a bit of a fix. Bank of America along with payment processors like PayPal, Visa, MasterCard and Western Union blocked donations to Wikileaks. Bearing in mind that Visa and MasterCard combined have a 90% market share globally in the card payments space and that they are the middlemen that control the payment rails between banks, merchants and their customers; the effects of this action were financially devastating.

In what Wikileaks described as a “financial blockade”, they lost tens of millions worth of potential donations which amounted to 95% of their revenue. No official charges were laid against Wikileaks by the US authorities and the Secretary of the Treasury at the time, Timothy Geithner, confirmed that there were no grounds for blacklisting Wikileaks further fuelling suspicion that Wikileaks was being unjustly targeted. Wikileaks managed to circumvent this blockade by turning to Bitcoin and started to receive donations through a medium that was censorship resistant.

(Wikileaks)

There are many more examples of censorship that we could continue to explore but the overarching point here is to highlight the dangers of censorship. Censorship is still alive and well in the 21st century especially as more interactions happen online via social media. In fact it’s been on the increase in recent years and has been massively accelerated by cancel culture. The negative effects are there for all to see from the rise of thought police i.e. “fact checkers”, to videos being taken down for spreading Covid-19 “misinformation” (a term whose definition is ever changing and expanding) that violates YouTube’s “community guidelines”, to shadow-banning opposing political views and the deplatforming of a sitting president. If it was no big deal for Twitter and Facebook to ban the “leader of the free world” it’s pretty much open season on everyone else.

Once a society starts to go down the path of arbitrarily restricting the free flow of information and ideas, no matter how well intentioned the censors think they are, tyranny is not far off. After all the road to hell is often paved with good intentions. When in history have the people that instigated book burning and censorship ever been the good guys?

The convergence of digital platforms and banking has led to the rise of another more dangerous form of censorship; financial censorship. The financial blockade of Wikileaks is a perfect example of what financial censorship looks like, where your ability to transact in any way is restricted with the intention of financially choking an individual, organization or even a country (i.e. sanctions). As was the case with Wikileaks the decision to block their donations was unilaterally taken without warning and there were no legal charges against the organization that could warrant such an action but it happened anyway. It actually seems like they violated a parallel opaque and unwritten “code of conduct.” Such cases are not only time-consuming and expensive to resolve, but they are also a huge inconvenience but I guess that’s the point. At the end of the day running an organization has costs and cutting that organization’s financial lifeline is an effective way of crippling them financially or even bankrupting them.

In the last two decades weaponization of the financial system against individuals, organizations and countries has been on the rise. What started out as a well intentioned tool to stop criminals and other bad actors from financing their nefarious activities has now morphed into a tool for silencing critics, oppressing dissenters, harassing whistleblowers as well as indirectly controlling spending habits of people. Wikileaks’ donors, for example, were prevented from donating money to support an organization and a cause they believed in. You don’t have to like Wikileaks or agree with what they do to realize the dangers of financial deplatforming and how it centralizes power in the hands of big tech and bankers.

In a world where the definitions of what constitutes “acceptable speech or appropriate behaviour” are moving targets, who knows when you may end up having your bank accounts frozen. Will it be for having a different perspective or for something you posted on social media ten years ago? Will independent thought result in financial retaliation? What’s the best way to protect yourself from such a growing risk? In this essay we will explore the dangers of financial censorship as well as how and why Bitcoin is perfectly designed to be censorship resistant.

“When we can secure the most important functionality of a financial network by computer science rather than by the traditional accountants, regulators, investigators, police, and lawyers, we go from a system that is manual, local, and of inconsistent security to one that is automated, global, and much more secure.” – Nick Szabo

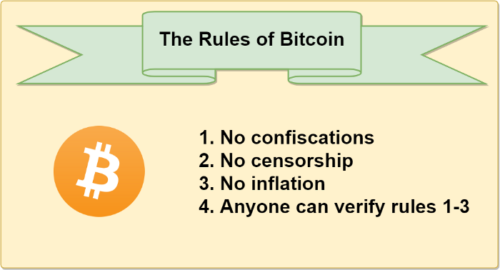

Bitcoin is a global fully decentralized, trustless, permissionless, non-sovereign and censorship resistant form of money. It exists beyond the control of the state or any corporation and functions perfectly without the need for coordination by any centralized third parties. Of the many attributes of Bitcoin, censorship resistance remains one of the most unappreciated yet very important in this age of pervasive surveillance and financial censorship.

Censorship resistance is the ability of a currency to be stored and transacted unhindered and unencumbered. Censorship resistant money is immune to confiscation, freezing, or interception by any third party. Anyone can access Bitcoin because it’s permissionless and as it scales, it becomes more decentralized and therefore harder to censor. Valid transactions that are processed on the Bitcoin network are uncensorable and no third party can block them or blacklist a wallet address. Users are protected from asset seizures by the state or freezing by private corporations, in short it is neutral money that is governed by rules and not rulers. If Wikileaks had been receiving donations via Bitcoin from day one the financial blockade they experienced would never have happened.

The Bitcoin architecture is by design built to be censorship resistant as this ensures that no arbitrary changes to its monetary policy or to the protocol itself can be made unilaterally, thus guaranteeing the stability and integrity of the network. Without this attribute in place what would be the guarantee that the maximum supply cap of 21 million Bitcoin will not be increased unilaterally in future? As Parker Lewis aptly puts it, “Censorship-resistance reinforces scarcity and scarcity reinforces censorship-resistance.” Bitcoin’s absolute scarcity is the foundation for every financial incentive that makes the Bitcoin network functional and valuable; thus without censorship resistance built-in, the entire system is compromised.

To put things in perspective, I will use an overly simplified example. Let’s assume that there was a third party that wanted to block a 0.0013 BTC ($50) donation to Wikileaks on the Bitcoin network. To pull this off the entity attempting to do this would need to retrospectively alter the Bitcoin blockchain and this would require them to control 51% of the total computing power on the entire Bitcoin network (aka 51% attack) before this alteration can take place.

The reason for this is that every transaction is validated by at least 51% of the network before it’s added to the blockchain. Due to the massive computing power that currently exists on the Bitcoin network the financial cost (approximately $15 billion) of attempting to block a single transaction to a single party far outweighs the value of the transaction. If you do have $15 billion lying around you are better off buying Bitcoin instead of trying to block a $50 transaction.

(Hasu)

“Liberty once lost, is lost forever.” – John Adams

In 2014 Li Xiaolin, a Chinese lawyer, lost a defamation suit and was ordered by the court to issue a written apology, which he did in April 2015. Ten months later when he was away on a business trip, thousands of miles away from home, he found out that he couldn’t buy a return plane ticket to Beijing because he had been blacklisted under China’s social credit score system. He hadn’t received any advance warning or official explanation for the blacklisting prior to this incident and it took three weeks to get an official explanation for this. The court had ordered his blacklisting because they had deemed that his apology was not sincere enough. He wrote a second apology and only then was he removed from the blacklist in 2016. A year later when he tried to get a credit card, the bank declined his application as he was still on their blacklist. Even though Li’s name was eventually cleared and the bank updated their records the following day, he had spent over a year trying to resolve this matter plus he had to write a third apology letter.

In a similar incident that occurred in 2013, Liu Hu a Chinese investigative journalist also lost a defamation suit and the court stated that they would publish an apology on his behalf and at his expense in one of the newspapers. He wired the money to the court but to the wrong account and the court didn’t get the funds; this mishap was not communicated to him at the time. A few months later he found out that he had been blacklisted when he was unable to buy plane tickets and not only that but he was also barred from taking out a loan, buying property, purchasing tickets for high speed trains to name a few. It’s at that point that the court notified him that his payment wasn’t received and Liu immediately corrected the mistake, but he still remained on the blacklist. In a statement to The Globe and Mail Liu said,

“There was no file, no police warrant, no official advance notification. They just cut me off from the things I was once entitled to. What’s really scary is there’s nothing you can do about it. You can report to no one. You are stuck in the middle of nowhere.”

Kanye West ( now known as Ye) was just recently served with a letter by his bank, JP Morgan Chase informing him of the bank’s decision to shut down his bank accounts. No reason was stated in the letter for this, but he was given a little over a month to take his business elsewhere. Regardless of what your opinion on Ye may be and whether you agree with him or not, the point here is that the fiat system coerces compliance through censorship, and Ye is being made an example of so that everyone else falls into line. If they could come after him, what could stop them from coming after you for disagreeing with the school board? Or for your religious beliefs? Thank God for Bitcoin, as we now have the option to resist and opt out.

Earlier today I learned that @kanyewest was officially kicked out of JP Morgan Chase bank. I was told there was no official reason given, but they sent this letter as well to confirm that he has until late November to find another place for the Yeezy empire to bank. pic.twitter.com/FUskokb6fP

— Candace Owens (@RealCandaceO) October 12, 2022

In an op-ed piece titled, “Get ready for the ‘No-Buy’ List” David Sacks the founding COO of PayPal wrote,

“Kicking people off social media deprives them of the right to speak in our increasingly online world. Locking them out of the financial economy is worse: It deprives them of the right to make a living. We have seen how cancel culture can obliterate one’s ability to earn an income, but now the cancelled may find themselves without a way to pay for goods and services. Previously, cancelled employees who would never again have the opportunity to work for a Fortune 500 company at least had the option to go into business for themselves. But if they cannot purchase equipment, pay employees, or receive payment from clients and customers, that door closes on them, too.”

This statement and observation is 100% accurate as highlighted by Li and Liu’s personal experiences. Even more so now that PayPal just announced a policy through which they intend to fine users $2 500 if they share “misinformation”. The comrades over at PayPal then issued a statement, citing that the policy was put out erroneously and that they will not be going ahead with it. Well, maybe not yet. What we have just witnessed was a test for the roll out of a CCP_style social credit system. Take this as an early warning especially in this era where “software is eating the world” and everything from banking to shopping is migrating to digital platforms. In the essay What is money? I defined money from mostly an economic and financial perspective, however I would like to add another definition that can aid in understanding the dangers of financial censorship.

In addition to being a medium of exchange, unit of account and store of value; money can also be defined as a common language for expressing and communicating value. Money is a form of speech that is utilized in the marketplace which means that financial censorship is a weapon for silencing the expression of value; the foundation of all financial transactions. By applying pressure on this one chokepoint the expression of other freedoms is also curtailed, whether it’s freedom of expression or freedom of movement as they all contingent on one’s ability to transact. As Satoshi said, “The root problem with conventional currency is all the trust that’s required to make it work”, in other words the fiat monetary system cannot work without a trusted third party, whether it be a central bank or a PayPal. This trust is the single point of failure that is then violated and frequently abused when it’s weaponized against ordinary people like Liu and Li.

Unlike Visa or PayPal, Bitcoin is both a currency issuer and a settlement layer and hypothetically speaking any successful attempt at censorship would spell doom for the network. Using Bitcoin wouldn’t have prevented Wikileaks from being financially deplatformed by Visa or stopped Liu and Li from being blacklisted, however they definitely wouldn’t have been financially vulnerable to these injustices. From a purely financial standpoint Bitcoin is a great investment as one opts out of the fiat system, which is an inferior monetary network, it’s also a mechanism to defend your freedom against potential future attacks on your livelihood. Even if this threat never materializes you will sleep better at night knowing you have insurance against it.

“Nothing is so permanent as a temporary government program.” – Milton Friedman

The Freedom Convoy protests by Canadian truckers who were protesting against Covid-19 vaccine mandates clearly demonstrated how third-party payment platforms and banks can be pressured by the state to financially cut off individuals without due process. Through the crowdfunding site GoFundMe the truckers managed to raise approximately $7.9 million in donations. GoFundMe then decided to withhold and later refund the donations to the donors citing, “a violation of their terms of service against the promotion of violence.” Not long after that Prime Minister Trudeau invoked the Emergency Act, which allowed the government to freeze the bank accounts, suspend insurance policies, and withhold other financial services from the protestors and their donors.

The Deputy Prime Minister who is also the Finance Minister, Chrystia Freeland, during a press conference soon after the announcement of the invocation of the Emergency Act made the following remarks,

“…The government is issuing an order with immediate effect, under the Emergencies Act, authorizing Canadian financial institutions to temporarily cease providing financial services where the institution suspects that an account is being used to further the illegal blockades and occupations. This order covers both personal and corporate accounts…As of today, a bank or other financial service provider will be able to immediately freeze or suspend an account without a court order. In doing so, they will be protected against civil liability for actions taken in good faith. Federal government institutions will have a new broad authority to share relevant information with banks and other financial service providers to ensure that we can all work together to put a stop to the funding of these illegal blockades”.

The Canadian government chose to shut down the protests by nuking the protestors’ financial infrastructure. Financial services providers were given the green light to do so without due process and were given legal cover by the state for any blow-back that could result from enforcing this decree. Furthermore the government intends to extend these measures and make them permanent. Mr Friedman’s quote above was proved true in this case. While I am not making a case for or against the truckers, it is very obvious that using financial censorship to resolve domestic dissent is a terrible precedent to set.

On the flip side the weaknesses of state controlled money were exposed in full view for all to see. This incident was the best Bitcoin commercial ever made as it simultaneously showed the weaknesses of centralized financial platforms while proving the utility of a decentralized currency like Bitcoin. At the stroke of a pen, thousands of people were denied access to their own money and it was all “perfectly legal.” The message was clear; reliance on a centralized financial system that is biased is very risky. Following the action taken by GoFundMe a Bitcoin fundraising campaign dubbed “Honk Honk Hodl” was started on Twitter with the intention of raising 21 Bitcoin ($1 100 000) for the truckers and the funding goal was reached successfully and as of time of writing 14.6 Bitcoin ($764 000) have been successfully distributed to the truckers.

The weaponization of financial systems that underpin our modern society against individuals by the state or private companies without due process is a concern that urgently needs to be addressed. Some may cheer and support when it happens to a group they disagree with like the truckers or Wikileaks of this world, but make no mistake about it once that genie is out of the bottle it’s not going back. As long as this threat exists you will always need insurance in the form of a financial asset like Bitcoin that is beyond anyone’s ability to censor or seize. Bitcoin is the most censorship-resistant monetary network that exists in the world today that anyone who is concerned about maintaining their financial independence in a cancel culture driven world. As Satoshi said, “It might make sense just to get some in case it catches on.”