✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- Treasury Market Temperature

- Supplementary Leverage Ratio (SLR)

- Short Paper Pivot

- Exchange Short Paper for Long

- Foreign Swaps and a Dose of Reality

Inspirational Tweet:

THE US TREASURY HAS ASKED MAJOR BANKS WHETHER IT SHOULD BUY BACK SOME US GOVERNMENT BONDS IN ORDER TO IMPROVE MARKET LIQUIDITY.

— Breaking Market News ⚡️ (@financialjuice) October 14, 2022

There’s been a lot of talk recently about the US Treasury market and its overall health, especially after seeing a developed market like the UK falter in the last few weeks. Question is, could volatility in the UST market lead to similar problems? And what can the Fed and the Treasury itself do to prevent this from happening?

Let’s break it down quickly and easily, as always, right here today, shall we?

🤒 Treasury Market Temperature

First off, let’s have a peek at how the US Treasury market is acting recently, you know, take its temperature.

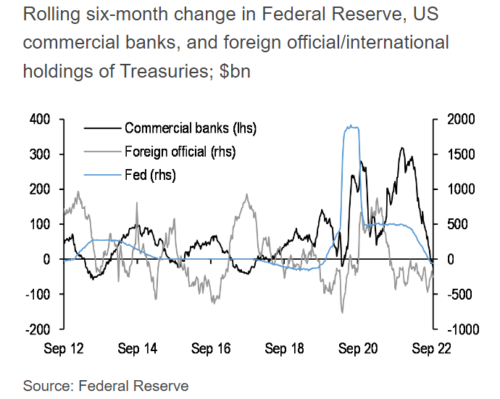

There are a few things we look at when determining the health of the Treasury market, one of them being the overall demand of USTs globally. With foreign government buyers fading and major holders like Russia, Japan, and China actively selling USTs for various reasons this year, we know that foreign demand is down.

But it isn’t just foreign country buyers who have faded from bidding, it’s also commercial banks, and since it has begun executing quantitative tightening (QT), the Fed itself has stopped buying USTs and has become a net seller.

Here’s the result of all that demand drying up:

Source: JP Morgan via Bloomberg

So, when we look at the UST auctions themselves, it’s no surprise that they’ve been less than stellar. The most recent benchmark 10yr UST auction was held last week, and the results, while not terrible, were not exactly great. In short, the final demand and pricing of them was less than ideal, with yet another tailing auction, the 6th in a row.

If you want a deeper understanding of the auction process and metrics, a recent issue of The Informationist covered this and more. You can find it here.

Next, we can start to look at the open market itself, where our greatest concern is depth of book (the number and dollar amount of bids and offers above and below the market price).

As you can see here, the Bloomberg Liquidity Index shows that liquidity has been decreasing steadily over the course of this year (higher number = worse).

This naturally feeds into the next measure: volatility.

Volatility also implies lack of market depth and weakening bids and offers. In other words, a less liquid market means fewer buyers and sellers with lower amount of demand. This can become particularly problematic in market shocks, where there is just not enough liquidity to soak up a large seller.

One way we can measure volatility is with the MOVE Index (ICE Bank of America U.S. Bond Market Option Volatility Estimate Index).

A higher volatility number is worse here, and you can see the direct correlation between liquidity and volatility, comparing the two charts.

Doing so, you can also see that we are nearing liquidity and volatility measures we haven’t seen since the onset of the pandemic market shock back in March, 2020.

In fact, Goldman Sachs strategists this week warned that any volatility shock will lead to further deterioration in market liquidity, something that global central banks are unlikely to tolerate…with top-of-book market depth in several places close to its worst levels in five years.

Bottom line, there are growing fears of US Treasury market illiquidity, and concern for the need of some sort of Fed or Treasury intervention.

So, what could those interventions be, and how would they help provide the much needed liquidity in the UST market?

Let’s run through these quickly, as you’re likely to hear about one or more of these in the coming months.

💪 Supplementary Leverage Ratio (SLR)

The Supplementary Leverage Ratio, or commonly known as the SLR, was introduced by the Basel Committee in 2010.

For reference: The Basel Committee on Banking Supervision (BCBS) is a committee of banking supervisory authorities established by central bank governors of the Group of Ten countries in 1974.

Avoiding from getting too technical here, the SLR is basically a risk measure born from the Great Financial Crisis meant to limit banks from taking on too much leverage. But the measure produces challenges for banks because of its limitations.

See, the SLR compares a bank’s equity to the value of its assets without respect to the underlying risk of those assets. So, a bank that increases its holdings of low-risk assets like USTs or even cash, sees an increase in its required capital under the SLR.

This means all assets held by a bank are subject to the same capital requirements regardless of their risk. And if a bank receives customer deposits then holds them in cash reserves or invests them in USTs, their SLR is negatively impacted.

Hence the lack of demand from commercial banks for US Treasuries.

As a fix to this, the Fed could adjust the requirements and definitions to allow for banks to buy and hold USTs without negatively impacting their SLR, or the Fed could adjust the SLR risk definitions to account for them as lower risk.

This simple move could open up trillions of dollars of demand for USTs within the commercial banking alone. We know this, because banks are currently depositing over $2.3T of extra cash in the reverse repo window nightly. Adjusting the SLR could open this capital up for UST demand instead.

More demand equals more liquidity, and more liquidity equals a stronger Treasury market.

🤩 Short Paper Pivot

Another thing the government could do, this time on the US Treasury side, is start issuing shorter paper in auctions in lieu of longer maturities. By auctioning T-Bills instead of longer dated Treasury Bonds, the Treasury may entice banks to use some of the excess capital that is sloshing around in the reverse repo market for a slightly higher interest rate offered by T-Bills instead.

This would seem to make utmost sense, as the Treasury has quite an ongoing deficit problem on its hands, and by issuing shorter paper, they can look to refinance that at lower rates instead of having long-dated high interest payments on their books.

This, of course, requires no legislation or Basel Committee approvals, just an internal adjustment to Treasury auction policy and activity. I would actually expect this to be a first move by the Fed, with or without formal announcement.

😉 Exchange Short Paper for Long

As referenced in the Tweet above, one move the US Treasury could make—and is reportedly considering—is to buy Treasury bonds from commercial banks. To do this, they would reportedly sell those same banks short term paper, or T-Bills, to pay for the exchange.

But why would they do this, and how does it help?

In essence, the bonds they are discussing buying are known as off-the-run, meaning they are older and less liquid issues. By injecting capital into the more liquid and shorter-dated paper, the Treasury can help the overall market liquidity.

This could also help open the door for the Fed to enter the open market and sell some bonds off their own balance sheet in their QT program, though that remains to be seen.

As the Fed is trying to peel USTs off its own balance sheet, they have yet another tool in the monetary policy chest to use in order to help ensure liquidity in the Treasury market.

Liquidity Swap Lines.

🤫 Foreign Swaps and a Dose of Reality

Another way the Fed can help provide liquidity is indirectly through what is called a liquidity swap agreement, or simply swap lines. These are basically agreements between Fed and other central banks to borrow USD when in need of them.

By having open borrowing facilities like this, the Fed can prevent the need of foreign countries from selling US Treasuries in order to raise cash. Specifically USD. It is a set and ready way for central banks to borrow cash against their holdings of US Treasuries.

This way, instead of selling them in the open market, they can simply borrow USD and pay the line back later. Yet another way the Fed can ensure continued liquidity.

So, here’s the bottom line. While the US Treasury market may be showing signs of stress or volatility from lower liquidity, there remain a number of ways the Fed and the Treasury itself can help maintain an orderly market.

Because the US Treasury bond is still the primary global reserve asset, there are many players with incentive to work with the Fed to ensure liquidity remains along with stability.

So, even if the $2.3T of reverse repo cash is soaked up, the Treasury exchanges long paper for short and pivots to issue short paper, swap lines are open and used up, and the Treasury market begins to falter, there are most likely other creative ways the Fed and Treasury can work with commercial banks and foreign buyers to ensure the UST market remains liquid and orderly.

Because while it’s a non-zero chance that the US Treasury market completely breaks, if it does, it means the entire global sovereign debt system would ultimately be insolvent and collapse along with it.

Something virtually no developed market wants to see.

That’s it. I hope you feel a little bit smarter knowing about the Treasury market and how the Fed can ensure it remains liquid and orderly.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

Thanks again and talk soon!

✌️James