The banking system is not designed with your best intentions in mind. There have been numerous examples over the years of banks acting in bad faith, charging exorbitant fees, manipulating markets, investing in the questionable derivatives of financial instruments, being the subjects of Royal Commissions and being the creators of massive credit bubbles. Yet, we are still told that the safest place for our hard-earned currency is in the banking system. I am here to highlight today that this is no longer the case, and I will demonstrate that the best way for you to manage your money is to be your own bank.

GFC Mayhem

We need only look at the atrocities of the Global Financial Crisis circa 2008 as a demonstrably abhorrent example of the failure of the banking system to act in accordance with their fiduciary responsibilities. Massive government bail-outs ensued, paid for with tax-payer dollars. Out of all the corruption, greed, and financial mismanagement, only one person went to jail in the US.

Meanwhile, retirees or those close to retirement were the biggest hit. This event literally ruined millions of lower/middle income earners’ lives, while bankers got filthy rich. Michael Lewis’s book “The Big Short” does an excellent job of portraying the events that lead to what we now refer to as the GFC. He exposes the levels of fraud and corruption in the finance and banking system and highlights many of the key events. The film adaptation of Michael Lewis’ work by the same name also does an excellent job, I encourage everyone to watch/read “The Big Short” if you haven’t done so already. I simply cannot do it justice in this short-form article.

Money Laundering

Banks have been the subject of numerous investigations into money laundering. See the following articles for just a couple of examples within Australia alone.

https://www.abc.net.au/news/2020-09-24/westpac-money-laundering-austrac-fine-explained/12696746

https://www.afr.com/companies/financial-services/nab-and-cba-exposed-over-png-money-laundering-20210712-p588x2

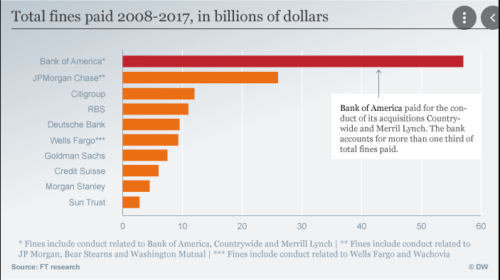

Fines

Many financial institutions have been fined for countless reasons, market manipulation being just one example. JP Morgan was fined in 2020 for interfering with the gold market. They were fined $920Million, many estimate however that this fine paled in comparison to what was profited. https://www.reuters.com/article/jp-morgan-spoofing-penalty-idUSKBN26K325. Figure 1 provides some insight into the banking fines of some of the world’s largest banks in recent years. These fines are often a small % of what they make in profits from their criminal activities. It is simply crazy to think about.

Figure 1. Bank Fines to 2017. Source: https://www.dw.com/en/financial-crisis-bank-fines-hit-record-10-years-after-market-collapse/a-40044540

Bankers and their fees

What about bank fee scandals? A quick google search reveals too many articles to mention where banks have been fined for overcharging customers, charging overdraw fees, charging students and pensioners outside of stipulated terms and conditions, charging fees in error, charging dead people…..the list goes on. Again, they are issued a small fine, “don’t do that again”, a slap on the wrist, and off they go to the next scam.

Too big to fail

“Too big to fail”. This is a term that we have heard many times since 2008. These banks are considered too important to economic stability. They get slaps on the wrist for misbehaving and they get bailed-out by taxpayers when they really f@!* up. Where are the disincentives? Why aren’t these crooks going to jail?

Government guarantees and bail-in

All the above is but a simple illustration of the truly deplorable behaviour of the banks, and they seem to get away with it endlessly. But here is where I wanted to focus our attention on for this article, I highlight the above issues to draw attention to just some of the ways that these banks are actually putting your capital at risk. I am talking about your deposits. The currency you swap your time for, the time you spend away from your families, the sweat and the efforts most of us spend 45+ years of our lives for. When we put that currency into the banking system, we are taking all of the risk.

You have been told all your life to put your currency safely in the bank. How safe is it? From the above examples, we can see that the banks are involved in some extremely dodgy dealings. Plus, they try and steal currency from wherever you turn through fees (don’t get me started on ATM fees). Some banks have very questionable balance sheets, and they create excess currency out of thin air through the fractionalised reserve banking system, inflating massive debt bubbles.

“But Daz, haven’t you heard of the FCS Scheme (FDIC in the US), the government protects up to $250k, per account holder, per institution.”

Ahhh, yes it is a good point thank you for bringing it up. But for us Aussies, have you heard about the Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018 (Figure 2)? It is quite a mouthful, I can understand if you haven’t heard of it. It is otherwise known as the Bank Bail-In Law. Outside of Australia, search your jurisdiction for what they call it, if you live in a G20 nation, you will more than likely find similar legislation too. The following items follow the specific legislation in Australia, but it is worthwhile reading for people from other countries also.

Figure 2. Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018. Source: https://www.legislation.gov.au/Details/C2018A00010

Under the Australian Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018, the banking regulator APRA is given special powers to bail-in “certain instruments”. When this legislation was introduced to the Australian Parliament in 2018, clarity was sought on what “instruments” were explicitly included in this terminology “certain instruments”. Assurances were given that this would not include everyday savings deposits, however, while legal clarity was being sought, this bill was rushed through the Senate with only 7 of the 76 members present.

The legal interpretation of the bill has since been sought and it was indeed found that the bill, by not specifically excluding savings deposits, gives the banks the right to bail-in everyday savings deposits.

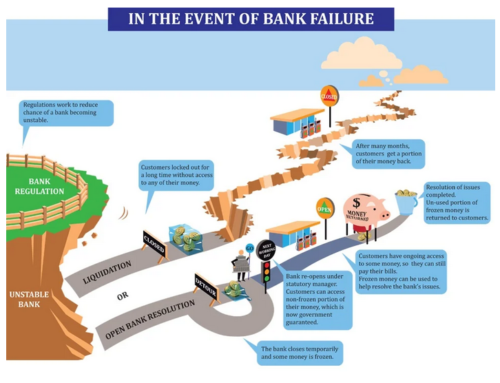

So what does Bail-In mean exactly and when would it occur? To give an example, say the banks are found to be playing around in the collateralised-debt-obligation/mortgage-backed-securities markets again, and we have another series of defaults on mortgages, that nightmare starts to unwind and mum and dad’s bank is caught right in the thick of it. The bank, on the brink of financial collapse, can seize mum and dad’s savings and issue a share in this (otherwise failing) bank. No permission need be sought, they can simply exercise this right should they need to.

Your life savings are sucked away in the blink of an eye. “But don’t worry, we have given you some shares in the bank”. I wonder what that share price looks like for an over-indebted, insolvent, failing bank? Figure 3 illustrates the anguish of the citizens of Cyprus circa 2013 as their savings were bailed-in by failing banks.

Figure 3. Cyprus Bail-in — Source: https://citizensparty.org.au/stop-bail-in

APRA still maintains that this bill “isn’t meant to include everyday deposits”. So Senator Malcolm Roberts tabled the Banking Amendment (Deposits) Bill 2020. This bill did nothing more and nothing less than simply seek to add the specific exclusion of savings deposits into the original Act. “There is no need to” was the response and the amendment was voted against. What is the harm in specifically excluding savings deposits by passing this bill if the original is not meant to include it? It makes zero sense, just vote it in. But alas it wasn’t, one must ask themselves what is their intent?

Conveniently, Australian banks have made changes to their deposit terms and conditions in what appears to be positioning the banks for legalised bail-in of deposits. Please understand the fact that this legislation is present and is in full effect. At least in New Zealand, they are upfront and honest about their intent. See Figure 4 for a graphic used to explain bail-in to their citizens.

Figure 4. New Zealand Bank Bail-in — Source https://www.buybullion.nz/bank-bail-ins/

Where did this bank bail-in-law idea come from? The G20, that’s where. Is your country part of the G20?, Have you checked your laws? The UK, USA, EU, Canada and New Zealand have all committed to bank bail-ins. If you follow the trail it leads from the G20 to the International Monetary Fund (IMF). In 2019 the IMF put pressure on the Australian Government to remove the façade and explicitly include savings deposits. And where do the politicians, executives and members of the IMF all converge? The World Economic Forum. A collective group of un-elected global elites forming global policies.

Bringing it home

It appears that banks can conduct criminal activities, rip-off depositors through fees, collect massive profits, reward their executives with bonuses and find every way possible to screw over the Average Joe; but it appears that it is the Average Joe that takes on all the risk. There must be a substantial reward for all this risk right? Yep, how about a nice big juicy 0.15% on your deposits. What? Say again?

We as depositors, lend the bank our physical currency. They, in turn lend it out at some multiple through fractional reserves, charge us exorbitant fees, play around in financial derivatives, partake in money laundering practices AND have the right to bail-in our savings when (not just a matter of “if”) they stuff up, but they give us near 0% interest for the privilege? WTF are we doing? Let’s factor in inflation and not only are we not getting rewarded, but we are also going backwards at an alarming rate. While this is happening the banks roll around in profits that should be awarded to us for taking on the risk!!

What the hell can you do? Be your own dam bank that’s what. Bitcoin fixes this.

Bearer Assets

Let’s detour briefly and examine “what is a bearer asset?” A bearer asset is an asset that doesn’t have any counterparty claim and is considered settled once in possession. A $20 note in your hand is a bearer asset. A gold nugget is a bearer asset. There are no other claims to these assets, they have finality. The asset is yours because it is in your hand and it is final because it represents some value in its ability to be exchanged. Being in the possession of a bearer asset is the most secure form of asset possession, as it can’t be confiscated by indirect methods.

When you put your cash in the bank, you no longer are in possession of this bearer asset. You are giving up your claim to the asset. The bank turns your deposit into an IOU. Nothing more.

The bank then goes and builds credit on top of this bearer asset and the deposit becomes a liability of the bank. The very real and possible danger of holding your currency in a bank is this credit system. There are more claims to cash than there is physical cash. If we all went to the ATM’s/Branches tomorrow and attempted to withdraw all of our claims, the banking system would collapse. This is why they put limits on ATM withdrawals.

Have you ever gone to your bank and tried to take out $10k? They ask you all sorts of questions about 1. why, 2. what it’s for, 3. when do you need it? Ummm 1. None of your business, 2. None of your business, give me my cash, 3. Now. What about if you want to buy a car privately and want to transfer $30k? You have to do it in small increments, ask the bank for permission to increase your limits, transfer and wait for them to settle. All of this can take days to complete.

Banks are required to keep tight tabs on the physical movements of cash, their whole structure depends on it. If they catch wind of a lack of confidence in the system, they close the branches, shut down the ATM’s and reduce withdrawal limits. They control every aspect of your access to your own deposits. At any time, of their own volition, they can stop you from getting access to your own currency.

Be your own bank

Bitcoin gives you the power to be your own bank. Bitcoin is decentralised and permissionless. And, Bitcoin is a bearer instrument. When you hold bitcoin, there are no other claims on it. It is final. If I send someone bitcoin, once it is confirmed on the blockchain, it is completely final and I, nor any other 3rd party have any claim to it. The person in possession of the keys to unlock that bitcoin on the ledger is the holder of the bitcoin as a bearer instrument.

What makes Bitcoin even more powerful is the fact that there is no need for intermediaries and it is completed permissionless. If I want to send someone $10 or $1,000,000,000 worth of Bitcoin there is nobody that can intervene and nobody I need to ask, as long as I have the balance and hold the keys to unlock this balance. The ledger is duplicated and distributed among the nodes, the transactions are validated and updated to the ledger by the miners and anyone can verify the details of any transaction that has ever occurred. Nobody can stop anybody from spending their coins. Nobody can stop where these coins are sent to and in what amounts. I can’t highlight these points enough, they fail to make an impact sometimes, but compared to the system we operate in now, this is extremely empowering.

Transactions can be made on the main chain, which takes around 10mins to be confirmed, for a small fee (it is recommended to wait for 6 block confirmations ~60mins for the transaction to be deemed final and completely irreversible). Alternatively, payments can be sent on the second layer lightning network, instantaneously and for free (there is actually a small fee, but the fee is so low, a fraction of a cent we can ignore it). This terminology and the mechanics behind the main chain and second layer solutions will be the subject of future articles, for now, think of the lightning network like Visa and the main-chain as the Wire system/bank-to-bank transfer layer. Large and important transactions should be done on the main chain, normal back-pocket/wallet transactions should be done on lightning. Buy a car on the main chain, buy a coffee on lightning, pretty simple.

Banking the unbanked.

Bitcoin is banking the unbanked. According to a 2017 World Bank Report(Ref 1), 1.7 Billion adults remain un-banked globally, compared with 2billion in 2014. That’s still ¼ of the world population. Financial Technology is opening up access to a basic human right of financial inclusion. Bitcoin and the Lightning Network are opening up completely decentralised and permissionless access to basic banking services, payment rails and the ability for people to transact and store digital bearer instruments with payment finality. These technologies are opening up remittance payments whereby the receiver no longer has to pay a large percentage through the fees of the traditional systems. A $10 fee doesn’t mean much to the western world, but it means a whole lot more if you live off $10 a month.

Capital Flight

Bitcoin empowers people to hold their wealth entirely within their heads (not recommended, but nonetheless possible). Never before have people had access to a bearer instrument technology that can be held and carried with you wherever you go and whatever border you cross, totally undetected. Have you ever been overseas and had to tick the declaration that you are not carrying any more than $10,000 in cash? Do you know why that is? Most likely it has to do with capital controls and the risk of capital flight. Governments do not like it when their citizens travel with considerable wealth. Especially if that wealth is likely to end up in other countries. If you packed a suitcase full of gold and tried to cross a border with it, how far do you think you could get? Would you want to let it out of your sight? Or cash for that matter, what would customs say if you had $20,000 in cash in your carry-on luggage?

What if your country was exercising some sort of social policy that didn’t align with what you wanted in life? What if they were hyperinflating their fiat currency and you wanted to seek citizenship somewhere with a stable currency? What if there were dictators implementing socialist/communist controls and you had enough? Are any of these situations that might be one where you might want to escape? With bitcoin, you can carry your entire wealth entirely within your head. Pretend you are going on a holiday and start a new life where you want. If you can remember 12 or 24 words, you can cross the border, get access to a mobile phone and internet connection and start this new life, taking your entire wealth with you.

You might be in a developed country reading this and say, “as if…. who cares”. But ask yourself, “what if”? What if World War III starts?

For us Australians, what if we are invaded for our vast minerals and resources? What if you had to, within a few hours notice flee your home? Wouldn’t you want to at least understand this technology and understand the possibilities it enables? I honestly hope I never have to be placed in a position where I would need to access the full suite of functionality that bitcoin provides, but these capabilities are illustrative of the use cases we are seeing in real-time around the world.

What if the government decided that they didn’t like what you have been searching on the internet and decided to freeze your bank accounts? It’s exactly what they do in China. “But we are nothing like China”……. aren’t we? I won’t start on a rant about censorship and media manipulation here, you can do your own homework in this regard. Since 2020 we have seen these censorship behaviours increase alarmingly. Who knows what is next. Perhaps, one day we are pushed to a point where we want to opt-out. It is nice to know we can.

Central Bank Digital Currencies

Have you heard about Central Bank Digital Currencies? The EU, US, Ukraine and Australia, to name a few, have already said they are close to rolling one out (figure 5), China already has one. China uses social credit scoring to manipulate and coerce its citizens. If you do as you are told, you might get a low-interest rate on your home loan, if you don’t, well maybe they just freeze your accounts. Maybe they tell you where and when you can spend your money.

Figure 5. Digital Euro — Source https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html

In the western world, a CBDC will mean you have an account directly with the Fed/Central Bank. Bypassing the traditional banking system. The ECB’s president, Christine Lagarde, was quoted by the IMF outlining some of the features a CBDC may provide. An example she provided was that you may have a certain credit score if you eat organic broccoli but a different credit score if you like beer and pizza. Social coercion may be coming and it will be implemented through the monetary (currency) system. Fiat currencies days are numbered, they know it. I suspect, though CBDCs, they will try and buy themselves some more time with a narrative about how CBDCs are different from a fiat system. Don’t be fooled, CBDC’s are just a tech-enhanced version of the same fiat currency system. A system designed to make you poorer, but with the added features of them “rewarding” good behavior.

CBDCs will more than likely be deployed through a money drop, a digital stimulus check. People will love it, it’s free money. They will then tell you how long you have to spend it, and in which outlets you can spend it. But you won’t care, it was free money, and this is how they start down the slippery slope of complete currency controls. This sounds hyperbolic and a tad on the conspiracy theorist side, but this is well documented. Spend some time looking at it. Whether you believe what I am saying or not, simply ask yourself, what could you do to protect yourself if something like this does come into play?

Conclusion

Bitcoin gives you the power to have finality in transactions and allows you access to a natively digital, completely permissionless bearer asset. No government, bank or institution can stop you from spending what you want when you want and to whomever you want. Bitcoin, when managed appropriately cannot be confiscated. To shut down Bitcoin would be akin to shutting down the entire internet globally, including the satellites broadcasting the blockchain from space. Bitcoin is financial freedom. When push comes to shove, people will choose how they want to transact in this world, it might take some time, but I am convinced people will choose a decentralised and permissionless, open monetary network. Open systems always win. Bitcoin wins in the long run. Maybe you are still not 100% convinced, but ask yourself, what if what I and many others are saying is right? Do you want zero exposure? Start dollar-cost-averaging into bitcoin, iron out the volatility, get some skin in the game and start your educational journey.

With Great Power Comes Great Responsibility.

Bitcoin allows you to become your own bank. Once you buy bitcoin you have the choice to decide how far you want to go in becoming your own bank. There is a saying in Bitcoin, “Not your keys, not your coins”. If you buy bitcoin on an exchange and you keep your balance on the exchange, you are leaving yourself open to a possible attack of that exchange and the permanent loss of your coins. This cannot be reversed, because it permissionless and censorship-resistant, nobody can reverse any transaction. There are a number of bitcoin wallet solutions we will introduce in the coming weeks, but a little time searching the net will show you that a hardware wallet (figure 6) is the most secure way of storing your bitcoin. I highly recommend taking custody of your own coins and your own keys, I personally use Ledger hardware wallets due to their ease of use, flexibility and interface. Always buy your hardware wallets directly from the manufacturer.

Backups and key management play an important role and the security of those backups needs serious consideration also. If someone stumbles across your seed-phrase (the phrase that is used to create your wallet, kind of like a really long password), they have access to your keys. As mentioned we will deep dive into wallets in the coming weeks, but there is no better time to start researching than now. There is plenty of information available on YouTube.

Figure 6— Ledger Hardware Wallet. Source: https://www.investopedia.com/best-bitcoin-wallets-5070283

One drawback of being your own bank is the “finality” of payments we have mentioned earlier. While there are many many pros for this finality of settlement there is one slight drawback, transactions cannot be clawed back. A mistake made in an address can mean permanent loss of the coins sent. A hack of an exchange cannot be reversed. With great power comes great responsibility, it isn’t hard to manage, it just takes some work and some education. But there is nothing more empowering than knowing that you are in complete control of your wealth and there is no 3rd party that can do a goddam thing about it.

You are taking a significant risk storing your wealth in currency in the banking system. Swap your currency for hard money (bitcoin) that goes up in purchasing power over time, store your coins on a hardware wallet, take ownership of this digital bearer asset and become your own bank.

Thanks for reading.

References

- The Unbanked, 2017 Findex Report. The World Bank, viewed 17/07/2021 https://globalfindex.worldbank.org/sites/globalfindex/files/chapters/2017%20Findex%20full%20report_chapter2.pdf

- https://citizensparty.org.au/media-releases/government-sneaks-through-apra-bail-law-fuels-anti-bank-revolt

- https://www.legislation.gov.au/Details/C2018A00010

- https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/BankingDeposits/Report

- https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210714~d99198ea23.en.html

- https://www.imf.org/en/News/Articles/2018/11/13/sp111418-winds-of-change-the-case-for-new-digital-currency

Dazbea

some truly interesting information, well written and broadly user genial.

Thanks for the tips on credit repair on this excellent web-site. A few things i would offer as advice to people should be to give up the actual mentality they can buy now and pay later. As a society all of us tend to repeat this for many things. This includes getaways, furniture, as well as items we want. However, you must separate one’s wants out of the needs. When you are working to raise your credit score actually you need some sacrifices. For example you are able to shop online to save money or you can turn to second hand suppliers instead of costly department stores for clothing.

Well said, thanks for sharing your thoughts.

We believe this is one of the areas that our education system falls short. Student exit the school system without a grasp on concepts such as needs, wants, credit, time preference, debt, pulling earning from the future….If they did, we believe the world would be in a better place.