✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- The Fed Put and Quantitative Easing

- When has the Fed Put been used before?

- Can we expect the Fed Put to be used again?

Inspirational Tweet:

Behold the Great Reset: Real rates normalize from their repressed pandemic-era levels, equities see their Fed put repriced to a much lower strike, and the leverage gets sucked out of the more speculative corners of the market. Almost no asset class is immune. pic.twitter.com/cY5PhKyynp

— Jurrien Timmer (@TimmerFidelity) May 23, 2022

Jurrien points out here that as real rates (interest rates net of inflation) are allowed to move back to toward their natural state, all the extra capital and leverage is pulled out of the various markets. And equities should expect the Fed Put to be priced much lower, expecting more pain.

But what exactly is the Fed Put, anyway? And how does it impact equities?

If that has you scratching your head, no worry. That’s exactly what we’re diving into today!

🤑 The Fed Put and Quantitative Easing

To understand the Fed Put, let’s define what a put is, first. In the simplest terms, a put is an option that allows the owner to sell a security at a set price before it expires on a certain date. In other words, if you buy a put on a stock, say Twitter, then you have the right to sell TWTR shares at that agreed-to price before the put expires.

Why would you buy a put?

Well perhaps you are concerned that the current purchase of TWTR by Elon Musk will not go through, and the stock will fall in price quite a bit. So, the put provides you with downside protection in case the stock falls below the price of the put.

The key phrase here is downside protection, as the Fed Put is not an actual put bought by the Fed or the markets, but rather a function of the Fed’s actions that impact the markets.

In effect, the Fed Put represents the Federal Reserve stepping in to help markets when they are in distress. The way they do this is with three primary actions, all considered forms of what is called Quantitative Easing (QE):

- Lowering the Fed Funds Rate, enabling banks to borrow money at rates that are often negative in real terms (interest rate minus inflation rate),

- buying large amounts of US Treasury bonds in the open market at prices that lowers the yield, effectively handing Wall Street banks profits and excess cash,

- keeping the Fed repo-window open, thereby giving banks access to cheap overnight loans (that can be rolled over indefinitely) and providing them with even more capital to buy cheap assets in the markets themselves.

So how is this a put, then?

Well as you can imagine, when the Fed lowers interest rates, buys US Treasuries at high prices, and lends money indefinitely to banks, this injects a certain amount of liquidity into the markets and helps shore up the prices of all the assets that have sharply sold off. The Fed has, in effect, provided the markets with downside protection, or a put to the owners of the assets.

Problem is, the Fed has stepped in so many times recently, that markets have come to expect them to act as a financial backstop, helping prevent an asset price meltdown or even natural losses for investors.

😱 When has the Fed Put been used before?

We have all heard about the quantitative easing used in the Global Financial Crisis (GFC) after the housing market meltdown and the last two years after Covid-19 lockdowns, but what is not often talked about is the use of these actions before 2008.

In fact, the term was originally coined the Greenspan Put, as Federal Reserve Chairman Alan Greenspan first put it into action after the great stock market crash on Black Monday in 1987. The Fed immediately intervened and provided liquidity to the markets in order to stabilize them. But this was a small amount of open market purchases of US Treasuries by the Fed, nothing of the likes we have seen in recent actions.

Still, the stage was set and the tools were put in place.

Then, in 1998, when a grossly over-levered hedge fund called Long Term Capital Management (LTCM) collapsed, it threatened to take down a number of investment banks and much of the financial system with it.

You may have heard the saying, if you owe the bank a million dollars, it’s your problem, but if you owe the bank a hundred million dollars, it’s the bank’s problem.

Well, LTCM owed the banks over $100 billion.

So, enter the Fed to the rescue, and a nice juicy bailout for the geniuses at LTCM.

The Fed has intervened in numerous other instances, such as at the end of 1999 on the Y2K scare, and again after the September 11, 2001 attacks. But the largest interventions of the GFC and then Covid-19 have all but trivialized the previous amounts of QE and the size of prior Fed Puts.

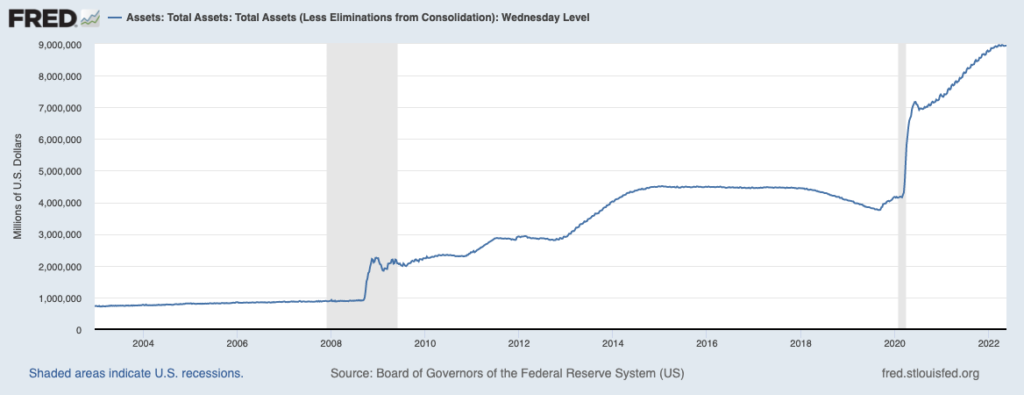

Problem is, QE was excessive in this last Fed Put, with an expansion of the Federal Reserve balance sheet from $4 trillion to just under $9 trillion. For context, during the large Fed Put of the GFC of 2008, the Fed expanded their balance sheet from $900 billion to $2.1 trillion. So, in both cases, the Fed more than doubled the amount of assets on its balance sheet, but the second time was for $5 trillion.

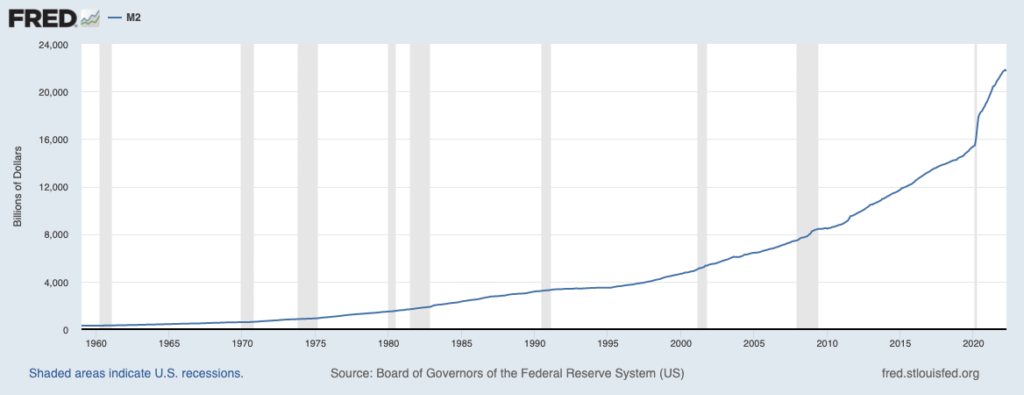

Even more remarkable is the sheer amount of money that was created (printed) in the last Fed Put, to the tune of $6 trillion dollars versus $500 billion in 2008.

OK, that was a lot of numbers, so here are two charts to show the effects of the expanded QE and Fed Put.

Total Assets of the Federal Reserve:

Total Money Supply (M2) of US Dollars:

So, where does that leave us now, and will the Fed step in to save the markets one more time?

😬 Can we expect the Fed Put to be used again?

As Jurrien stated above, it is appearing that the markets are wary that the Fed will step in any time soon to backstop the fall in asset prices. They are lowering their expected level of a safety net. To wit, current Fed Chairman Jerome Powell has stated that the primary focus of their current monetary policy actions is to bring down inflation.

Surprise, surprise, all that excess money printing and asset purchasing may have helped in the short term, but eventually had an adverse effect on the economy in the form of runaway inflation. With so much liquidity (read: money) in the system, asset prices such as homes and cars, wood, copper, steaks, and anything else really, skyrocketed over the last two years. In effect, everything from food to gas to clothes have increased in price.

To be fair, some of this has been due to supply chain issues, but there is no arguing the fact that printing trillions of dollars was the base factor in the severe rise in cost of everything.

To fix this inflation problem, the Fed must stop all QE and institute what is known as QT. You got it, Quantitative Tightening. And here we are, having raised rates just twice by a total of 75 bps or 0.75%, and the Fed has not even begun to sell assets off their balance sheet, yet markets have crumbled across the board. Stocks, bonds, real estate, gold, Bitcoin. You name it. We’ve seen the S&P 500 fall 20%, the NASD drop 30%, Bitcoin slide over 40%, and even US Treasuries down over 20% so far.

When will the Fed Put kick in, then?

The prices of goods and services, inflation itself, has yet to recede.

Remember, the Fed has not yet even begun to sell the assets on its balance sheet (as you can see in the top chart above). And Powell has made it clear that he will allow the markets to continue to sell off and drift lower while he focuses on raising rates and selling assets in order to curb inflation.

Thing is, the stock market is intimately tied to the US economy, and a crash could shove the country out of the trajectory of a recession and into a depression. Powell knows this, the market knows Powell knows this, and Powell knows the market knows he knows this.

Mind bendy, I know.

And this all means that the market still expects Powell to step in at some point in the near future and save it once again. Especially since it is an election year and there will be tremendous political pressure on Powell and the Fed to avoid an all out market crash and any hint of a financial depression.

Lo and behold, we are starting to hear hints from Fed governors about the possibility of pausing the QT program in the fall, so it is clear they are wary of the market moves as well.

Bottom line, the Fed has painted itself into a corner with a barrel of green bills, and knows it has no good choices to make from here. The only thing it can do is ensure the market does not implode on itself, or it will eventually have to step in with yet another (probably even larger) Fed Put. Even if this means they accept a higher ongoing inflation rate, continue to expand the Fed balance sheet, and hope the world doesn’t call them out on it.

At least not before their terms end.

That’s it. I hope you feel a little bit smarter knowing about Quantitative Easing and Tightening, and understand the market dynamics behind the possibility of another Fed Put.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James

Kudos on detailing the processes of deception out from our very own Fed! Elusive a bit before your article, now much clearer.

Been stacking bitcoin from October ‘21 ( yes, on the highs for sure ) as I inherently felt that deception took precedence in our financial news coverage!

Will continue daily to build my sats bag.

Thanks again.

Thanks for reaching out and for the feedback Jeff. Ahh, that is such is shame to have to experience such a draw down as your introduction into Bitcoin. Many Bitcoiners benefit from taking the dollar-cost-average (DCA) approach to smooth out that volatility, so it sounds like you have the right approach*. And big Kudos for you to come to the realisation something is wrong and for taking action, and even bigger Kudos to you for not freaking out after such a massive draw-down.

On the plus side, it takes many Bitcoiners a whole cycle (4 years) to come to the realisation of what role Bitcoin can play as protection. You have come a long way in such a short period. Bravo Sir.

Daz

*Not financial advice 🙂