A recent posting from Bitcoin Magazine on Zero Hedge had me thinking about the different paths of facilitating change. Rarely now, does a day go by without a new protest, riot or worse, an act of extreme violence. All are indications of a dysfunctional political and economic system, perhaps as the result of a dying credit based monetary arrangement. However you look at it, change is afoot, like it or not. Those who have read “The Fourth Turning” by William Strauss and Neil Howe were forewarned that this decade lies in a fourth turning; the tumultuous season of a repeating cycle in humanity. The most recent fourth turning was from 1929-1945, and saw the Great Depression as well as World War II. As described in the article above, Guy Fawkes was arrested on November 5, 1605, which is now celebrated as Guy Fawkes Day. His crime was a plot to blow up parliament, for which he was tortured to reveal the identity of his accomplices. Fawkes subsequently jumped off the gallows ladder, hanging himself rather than submitting his life to the authorities. His resistance to the end may explain the popularity of his mask in some circles.

Having read the story, a question arose: Through a Bitcoin lens, what are some potential avenues to navigating these difficult times; maybe even facilitate some positive societal change? Might an exploration of some possibilities yield any insight? This is my attempt for what it’s worth. What follows are a few alternatives that surfaced, not the only ones for sure, and a bit strange some might think. We’re just trying to understand the same things from a different perspective. You might treat any of the ideas presented like your wardrobe. Try on whatever you feel like and see how it fits, or go shopping for something new and better.

- The Gray Person solution

- The Guy Fawkes route

- The Teddy Roosevelt / Kwai Chang Kane approach

- The Bucky Fuller / Jeff Booth reality

1. THE GRAY PERSON

For those who don’t know; becoming a Gray Person is the active effort to blend in. It means becoming as untraceable both physically and digitally as possible in order to hide from undesired recognition. It’s about knowing how to act and dress so as to become “an antelope in the herd”. Attention is avoided by being uninteresting and disappearing in the crowd. Most of us have seen or read of this as romanticized in spy thrillers, and we may even have met some Gray People without knowing it. For the Gray Person, finances are opaque, as are interests and associations. Awareness of one’s situation is always acute and escape routes planned ahead. Avoiding physical attractors like purple hair, facial tattoos and standing 6’3” tall are a must. Public relationships must be limited and superficial. It’s not a lifestyle for everyone, and at its extreme, a bit like the Spy VS Spy cartoon in Mad Magazine. Levity aside, showing off your Bitcoin Lambo while flashing your Bitcoin Rolex, besides questions of taste, might draw unwanted attention.

In truth, there must be many amazing Gray People in the Bitcoin community, obviously more than we’ll ever know. A lot of them are out there helping us all, by anonymously facilitating positive change behind the scenes. To those people, we owe a huge debt of gratitude. Notably, first on the Gray Person hero list is Satoshi Nakamoto who’s “disappearance” was foundational to Bitcoin’s decentralization. The efforts of “he” and those other hidden heroes who have followed might very well be helping us transit this “Fourth Turning” into a better and more hopeful future. To anyone already in or wanting to join those gray ranks, all we can say is “thank you, we don’t know you, but thank you anyway”. Certainly, for Bitcoiners, cold storage, having more than one passport, and your private keys memorized, are steps in the direction towards Grayness. There are many more steps to take if you wish, though not my aptitude to describe so the more technical commentators can weigh in on that. To learn more about becoming a Gray Person one could also seek the subject out on “prepper” sites for fun. If so, rest assured, more suspicious eyes are probably finding the same sites. A bit like the lion looking for the antelope wearing the plaid shirt and horn rimmed glasses.

2. THE GUY FAWKES ROUTE

As we know, violence has been a method of forcing change since ancient times, Et tu, Brute? Over the ages, there have been events remembered as successes that involved violence, such as the American Revolution, and the fall of the Berlin Wall, but also miserable failures in terms of lives lost, like the Cambodian genocide. Acts of protest have failed resulting in the ultimate sacrifice as we’ve seen with Guy Fawkes, or with the 3,000 protesters murdered in Burma in 1988. Mahatma Ghandi and Nelson Mandela were able to change the course of history through persistent peaceful protest; there should always be a place for that. The right to protest is enshrined by law in many democracies with the knowledge that proper government is “by the people for the people”. As we’ve seen however, those laws protecting citizens can be trod upon by fearful governments. We witnessed this recently during the Canadian Truckers Protest, where there was a dangerous overreach of political power that was both noticed and derided around the world. It was also a test case for Bitcoin with some dedicated Bitcoiners achieving what the fiat system simply could not.

As there should be, there are rightful questions around acts of wilful damage that involves innocent victims. At the same time however, it should be noted that the second amendment of the American Constitution enshrining the right to bear arms, was written in part, to protect citizens from the actions of their own government. So, there’s a lot of gray area as you see.

Psychologist Jordan Peterson asks [and I paraphrase] before you make your signs and go out to demonstrate, have you cleaned your room? It’s a suggestion that one might want to have their immediate world in order before setting out to change the outer world.

For those in the Bitcoin community, it would seem that protesting the existing financial system is like punching water. They know that more fiat money and more rules are bound to be produced to defend that system, thus deepening the spiral. Of course, the shining alternative thanks to Satoshi, is to simply exit the failing system by adopting a personal Bitcoin standard. Money is power, and with Bitcoin, for the first time in history you can de-fund abusers, recover personal sovereignty and facilitate positive economic change.

3. THE TEDDY ROOSEVELT / KWAI CHANG KANE APPROACH

Teddy Roosevelt

U.S. president Teddy Roosevelt was known to favour the aphorism “WALK SOFTLY AND CARRY A BIG STICK”, a principle he applied to foreign policy. As he practiced them, his principles might include the following:

- Prepare by engaging in intelligent forethought as situations begin to unfold.

- Have the resources to act decisively.

- Use aggression only when there is no other option.

- When forced to act, do so fully and without hesitation.

- Never bluff or lie.

- Act justly towards all other parties involved.

- Do not continue to punish your adversary after their retreat or defeat.

Kwai Chang Kane

For those who are too young to have seen any episodes of “Kung Fu” a television series from the 1970’s or its later re-make from the mid 1990’s, a very brief description is in order. In the series, Kwai Chang Kane is a Taoist Shaolin monk who has relocated to the west and finds himself repeatedly in situations of aggression. His Shaolin training has prepared him mentally, physically, and spiritually to succeed. He does his best to avoid conflict, but acts with creativity and superior skills when it cannot be avoided, after which he fades into the background and is gone. Worth noting, is that the principles behind the martial arts featured in this series bear some similarity to Roosevelt’s approach, thus the title. Of course, we must remember that Hollywood loves to put action first and principles second.

Here are some Taoist principles as they might apply to facilitating positive change:

- Act from a place of aware stillness, be patient and wait for opportunity to present itself, upon which move without hesitation, and afterwards return to stillness.

- Keep the body firm and the mind pliant.

- Pursue the clarity and wisdom which comes from quiet reflection.

- Like a stream, find a path around resistance and when blocked, allow the pressure to build until resistance is overcome.

- To be martial requires discipline, courage and perseverance. Begin by overcoming your own demons.

- Look beyond outward appearances.

- Understand that you are not separate, and help others when the opportunity arises.

The Roosevelt/Kane approach, for Bitcoiners, might look something like this:

- Keep stacking your Sats but remain humble along the way. It’s not about who has more or less.

- When the opportunity to help others arises, do so with no expectation of gain or strokes to the ego.

- In dealing with others, act with simplicity, honesty and strength of character.

- Continue to educate yourself, and refrain from judging others, they may simply be acting from a different position along their path of knowledge.

- Live a life congruent with longevity, in that way you can appreciate the fruits of your efforts longer.

- When shit happens, keep your balance. Remember that shit makes good fertilizer, so use it to grow something better. Times of crisis are also times of opportunity; this after all, is the lesson that Satoshi Nakamoto gifted humanity in 2009.

- Be aware, and act immediately when the opportunity to trigger positive change arises.

- Be aware, and act immediately when the opportunity to prevent crisis arises.

- Avoid the traps of clinging to the past or being paralyzed by the future.

- The appreciation of life does not require wealth or plenty, it requires only true gratitude, which is magnetic to abundance.

4. THE BUCKY FULLER/JEFF BOOTH ALTERNATIVE

Bucky Fuller

Buckminster Fuller and Jeff Booth share a lot of similarities despite having been born a lifetime apart. Both might be thought of as visionaries who, each in their own fashion, and in their own era, have pointed us toward the future.

Fuller, who preferred to be called Bucky, had a window onto the modern age, starting before the turn of the twentieth century. His quotations offer us a glimpse through that window: “I was born at an extraordinary moment. In 1895 the year I was born the X-ray was discovered. When I was three, the electron was discovered. At seven, the first automobile drove into the city of Boston. I was brought up being told that it was inherently impossible to fly. When I was eight, the Wright brothers flew. By the time I was eleven, Marconi’s wireless was in use to signal S.O.S. When I was fourteen, man got to the North Pole. When I was sixteen, he got to the South Pole. So,” IMPOSSIBLES” were happening seemingly every day.”

Fuller went on to invent a 3 wheeled automobile named the Dymaxion in 1933. Unlike other cars, it was aerodynamically streamlined, fuel efficient for the day, and could carry 12 passengers. It could reach 110 miles per hour and could turn in its own length. Though initially very popular, sales crashed after a single Dymaxion crashed (I wonder if Elon knows that).

Bucky is best known for his invention of the Geodesic Dome which was unlike anything seen prior. His dome was exceedingly light and strong, fast to build, and enclosed the largest volume with the least materials. The marines could even deploy them by helicopter. A huge dome that functioned as the U.S. pavilion was the show stopper at Montreal World Expo 67, an event happening shortly after Jeff Booth had been ushered into the world.

Worth repeating, is a Bucky quote particularly applicable to what Bitcoin can do to our value system at this moment in time:

“YOU NEVER CHANGE THINGS BY FIGHTING THE EXISTING REALITY. TO CHANGE SOMETHING, BUILD A NEW MODEL THAT MAKES THE EXISTING MODEL OBSOLETE”

Jeff Booth

Before setting out to introduce Jeff Booth, allow me to observe three points. Buckminster Fuller died in 1983 and cannot criticize my description of his accomplishments. Jeff Booth is very much alive, in his prime, and lives about 30 kilometers away. Given that, I have to tread with caution so he doesn’t come over and chew me out for something that I wrote (fingers crossed). Jeff also writes for The Looking Glass, so please absorb his articles, you’ll undoubtedly get more out of them. My writing is fluffier, though hopefully beneficial in some way.

Like Bucky, Jeff Booth is also a visionary, and his book “The Price of Tomorrow” will be opening eyes for many years to come, it’s a must read…and repeatedly. The quote cited above from Bucky Fuller, could have just as easily been uttered by Jeff. Jeff’s career as a serial entrepreneur put him at the leading edge of technological change, and it was the adoption of new technologies that helped him achieve success with an interesting parallel to one of Bucky’s both involving housing construction. Shortly after the Second World War Bucky saw that there was a desperate need for housing, and sought to produce pre-fab housing units using new technologies borrowed from the aviation industry. It was seemingly a good fit, as there was a surplus of workers and materials left over from the war effort.

In Jeff’s case it was an attempt to streamline a stagnant building industry through the use of modern technological solutions. Jeff was making construction more efficient and less expensive; an inherently deflationary process. At the same time, the financial system that he was working within was based on fiat currency credit; an inherently inflationary process.

Through his subsequent successes, as well as failures, he became acutely aware of a pending tectonic collision between the deflationary forces of technological advancement, and the inflationary forces driven by the credit based fiat monetary system. It became obvious that the collision of those forces could have profoundly negative consequences for all of us. He knew that governments would fight to preserve the existing system using the same tools that are causing it to fail. The consequences of this pending collision have the potential to amplify a fourth turning style unravelling of our society. He realized that what is required, is a non-inflationary form of money that can cope with the exponential onslaught of technological advancement. Jeff’s introduction to Bitcoin, led to an understanding of what is the best option to make the transition to a better future. A value system locked in mathematics, and verified through effort, one which at its base could neither be inflated nor manipulated. In other words, a frictionless system of exchange well suited to a deflationary future. Armed with that knowledge, he has become one of the leaders in Bitcoin education for the benefit of all, while continuing to be deeply involved with leading technologies.

One of Jeff’s biggest challenges in leading us “ACROSS THE BRIDGE TO A NEW SYSTEM” as he describes it, is the sticky mindset of “Fiat Thinking”*. Trying to explain a different kind of thinking, “Bitcoin Thinking”* is something akin to explaining a better kind of water to fish. All that we have ever known if we haven’t lived with at least, a functioning gold standard, is money that is elastic; not anchored to anything. This means that governments can stretch money by creating more, and manipulate interest rates with central bank dials and levers. For decades we’ve been told repeatedly that inflation is good, and a 2% inflation target is the sweet spot. That message has become so pervasive that we fail to realize that at very minimum, it’s a 2% hole in our money bucket, or like a 2 mile per hour headwind while riding our bicycle. The challenge is, that for many, the bridge that Jeff describes requires a paradigm shift in order to “see” (understand) what is so new and transformative about Bitcoin.

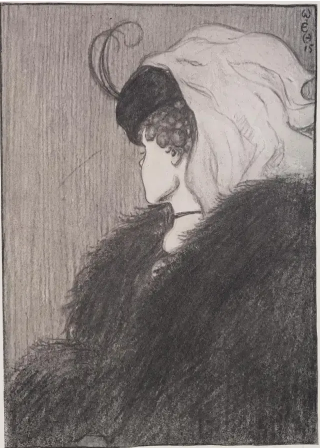

Below is an illusion that many people may have seen before, representing two views of the same thing. The drawing represents either a grandmother or a beautiful young woman depending on your point of view. Imagine if you will, growing up in a house with the picture of Granny Hilda on the wall. For years, you heard the many stories about her and her children, that she loved to knit uncomfortable wool socks for them, had grown up on a farm and had lived to 92 years old with eighteen grandchildren and twenty three great grandchildren. Then one day, a stranger comes into the room and says, “Goodness; I love that drawing of a beautiful young woman” to which you respond “you mean Granny Hilda?” You wonder what on earth they’re talking about and an argument ensues. The challenge is that you’re trapped in one paradigm (view) and have difficulty in seeing (or thinking) differently. What Jeff Booth is so diligently working at, is presenting the other image, one requiring a “Paradigm Shift”. Once we fully see (understand) what he’s pointing at, it will be easier to un-stick and quickly cross that bridge. All it requires is letting go of some one-sided pre-conceptions (views). It might take a bit of work but well worth it. If we do successfully cross the bridge to “Bitcoin Thinking”* some powerful things occur:

- We’re acting to mute, maybe even halt that tectonic collision between the forces of inflation and deflation for the betterment of all.

- We’re helping to level the monetary playing field for people worldwide.

- We’ve plugged the inflationary leak in our value bucket.

- We’re adopting a system where value can move securely, without friction at the speed of light and with little to no cost.

- We’re accelerating the rate of technological improvement for the benefit of everyone and the planet.

- We’re facilitating positive change by wresting some control over the government spending and the debt that is leading to so much unrest.

Granny Hilda or beautiful young woman?

Which do you see first?……Can you see both?…..it might take some time but well worth it.

If you can fully appreciate the differences… apply it to value and… Welcome To Bitcoin Thinking*

*“Bitcoin Thinking” and “Fiat Thinking “are terms borrowed from Simon Dixon another leader in Bitcoin education.