“The man who puts all the guns and all the decision-making power into the hands of the central government and then says, ‘Limit yourself’; it is he who is truly the impractical utopian.” – Murray Rothbard

Back in 2013 the United States Department of Justice (DOJ) launched an initiative that they dubbed, “Operation Choke Point” and the aim of this initiative was to pressure banks to cut off politically disfavoured businesses, such as payday lenders and firearms dealers, from the financial system. The DOJ subsequently sent “administrative subpoenas” to financial institutions that were serving these businesses coupled with a list from the Federal Deposit Insurance Corporation (FDIC) of “high risk merchants/activities”.

The whole idea was to intimidate banks into dropping these merchants as clients, without any due process, and this is exactly what happened. No bank wants to deal with extra audits, endless investigations from regulatory agencies hence why they were quick to drop these lawful businesses as clients even if there were no legally justifiable grounds for doing so.

For example, Rep. Blaine Luetkemeyer (R-Mo.), who had been a strong opponent of Operation Choke Point since its inception, made the following remarks after more evidence surfaced of how the program was being weaponized against lawful businesses:

“In one example of blatant intimidation, a bank terminated its relationship with a legal business after threats from the FDIC. The bank eventually surrendered to the pressure, and when the bank notified the FDIC of the decision, they admitted that a risk assessment showed the business “pose[d] no significant risk to the financial institution, including financial, reputation, and legal risk,” yet they still terminated the banking relationship…For years, Office of the Comptroller of the Currency officials have continually denied any wrongdoing, yet in the newly-unsealed documents we see proof of a conscious decision to work in conjunction with the FDIC against payday lenders. These lenders were specifically targeted, not based on evidence of wrongdoing, but based on personal beliefs a decision to “suggest strongly that [banks] re-evaluate payday lending.”

Operation Choke Point set a dangerous precedent of using personal prejudice or preference as a standard for regulatory enforcement. While the program was officially shut down in August 2017, its legacy of disregarding due process for ideological reasons still looms large and has now morphed into something even far more dangerous. Though initiatives like Operation Choke Point were created to circumvent the legal system, they still for the most part relied on analogue methods of enforcement. Subpoenas still needed to be issued and regulatory directives still needed to be followed.

What if I told you that the central planners are hard at work to develop a financial control grid that can be enforced without subpoenas or any sort of explicit regulations on the books? A system that demands your compliance and absolute obedience not just to existing laws but also to certain political or ideological leanings, failure to which results in you being cut off financially until you bend the knee. A system where; every purchase is tracked, every movement you make is known, every spending decision is scrutinized by the state, everything you do or say that goes against the “current thing” of the day results in financial penalties and enforcement of these aforementioned penalties is algorithmic. This nightmare that I have briefly outlined is exactly what Central Bank Digital Currencies (CBDC’s) are being designed to usher in.

“Give me control over a nation’s money supply, and I care not who makes its laws.” – Mayer Amschel Rothschild

CBDC’s are programmable virtual fiat currencies that are issued directly by the central bank to the public, without flowing through the banking system. It’s important to note that a CBDC is just a new payment channel because a digital dollar is still a dollar and a digital yuan is still a yuan. With CBDC’s however, the currency never exists in physical form. It’s always digital, and ownership is tracked on a single database that is maintained by the central bank, instead of the multiple databases that exist today in different banks and payment processors. In other words with CBDCs; banks, credit card companies, and even PayPal are largely irrelevant. All transactions are processed by the central bank via a single digital wallet for payment and receipt. The best analogy to use to describe a CBDC is that of an electronic voucher that can be used to make purchases. Most of the key differences that distinguish CBDC’s from other forms of money are described in detail in my previous article “The Battle For The Future of Money: Bitcoin vs. CBDC’s” and I would strongly recommend you check that out, if you haven’t, for some very important background context.

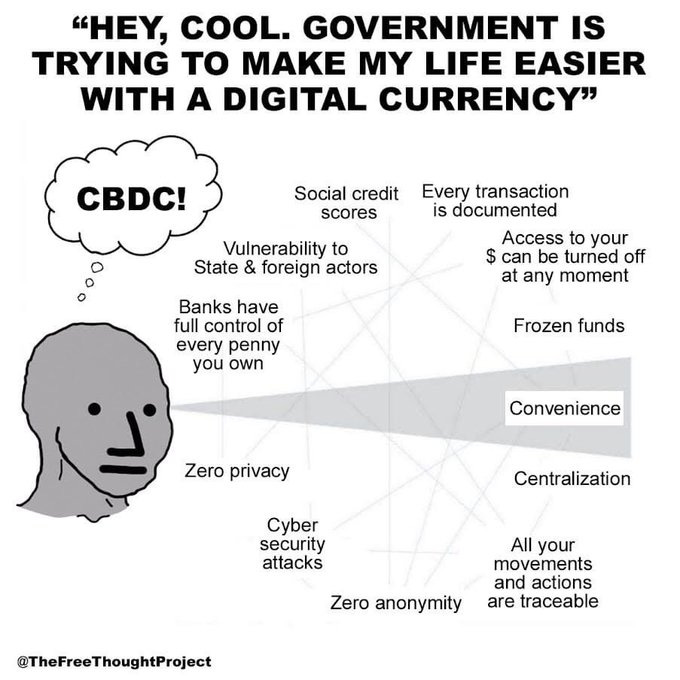

CBDC’s will come pre-packaged with some “amazing features” inspired by George Orwell’s classic novel, 1984. These include but are not limited to:

- Negative interest rates to discourage saving and encourage spending i.e. monetary repression

- Instant and automatic taxation and levying of fines

- Zero financial privacy, obviously meant to catch “criminals”. Every transaction is monitored and tracked, for your safety of course.

- Expiration dates on your money, as the state sees fit

- Being programmable money, restrictions of how and where they can be spent are easy to implement with a few keystrokes e.g. the state can freeze your money if they don’t like your political views

- They can be “turned off” at any time and for any reason in an effort to curb money laundering, tax evasion and all kinds of “illicit activities”

- Due to their digital nature, debasement happens much faster since “helicopter money” can be dispensed in real time by the state to its citizens

As a bonus, successful CBDC implementation will require the total elimination of cash. Just in case you hadn’t figured it out by now, none of the above will benefit you in any way. CBDC’s are tools of control and are one of the levers that are being set up to enable the state to have total control over every aspect of your life. Along with digital IDs they will become the backbone of a social credit system and will usher in a surveillance state unlike anything that has ever existed in history; as no empire in history has ever had as much power as governments will have in a CBDC world! Unlike Bitcoin which is designed to be a check on the central bankers’ power by separating money from state, CBDC’s are the exact opposite that seek to strengthen the bond between money and state in a very dystopian way.

While central bankers will try to hoodwink the public into buying into CBDC’s on the basis of either being a more efficient method of payments or the holy grail of financial inclusion, make no mistake about it, CBDC’s are not being rolled out en masse for these egalitarian purposes. The main goal is to tighten the state’s grip on the financial system and indirectly engineer, as well as influence the behaviour of their citizens. The powers that be will have the means to enforce whatever agenda they like and turn you into a digital serf who does as he/she is told. To drive this point home, during an IMF hosted conference in October 2020 Agustin Carstens, the head of the Bank of International Settlements (BIS), made this remark with regards to CBDC’s:

“For our analysis on CBDC in particular for general use, we tend to establish the equivalence with cash, and there is a huge difference there. For example in cash, we don’t know for example who is using a hundred dollar bill today; we don’t know who is using a one thousand peso bill today. A key difference with a CBDC is that the central bank will have absolute control on the rules and regulations that determine the use of that expression of central bank liability. And also, we will have the technology to enforce that. Those two issues are extremely important, and that makes a huge difference with respect to what cash is.”

A few months later, in June 2021, the Bank of England echoed Mr Carstens’ remarks when they alluded to the programmability of CBDC’s as an important feature that would ensure that money is spent on goods that the government or employer deems to be sensible. In other words the state or your employer gets to control how you spend your money. CBDC’s will make initiatives like Operation Choke Point seem infantile in comparison as the state will now have the mechanism and tools to cut off “enemies of the state” from the financial system at will. Oh and yes, they get to define who these enemies of the state are, and should you happen to land on a government blacklist for whatever reason, you instantly get frozen out of the financial system with little to no legal recourse. In short, CBDC’s are Orwellian money.

Given the dystopian nature of this form of money, it then begs the question, how far are we from living in a CBDC dominated world? Renowned investor and author, Doug Casey, in a recent interview predicted that 2023 would be the year of the CBDC, a sentiment that has been echoed by economist and author Jim Rickards, among many others. The Atlantic Council CBDC tracker also reports similar data citing that this year alone, more than 20 countries will launch a CBDC pilot. Japan, UAE, Australia, Thailand, Brazil, India, South Korea and Russia intend to continue or begin pilot testing in 2023. Russia and Japan are both set to roll out their retail CBDC pilots from April 1st 2023.

Early this month, The Bank of England also announced that the UK will have a CBDC ready by 2025. Dubbed “Britcoin”, the digital pound is expected to, “maintain public access to retail central bank money and..also promote innovation, choice and efficiency in domestic payments.” The Deputy Governor for Financial Stability of the Bank of England, John Cunliffe, said:

“Our assessment is that on current trends it is likely that a retail, general purpose digital central bank currency — a digital pound — will be needed in the UK.”

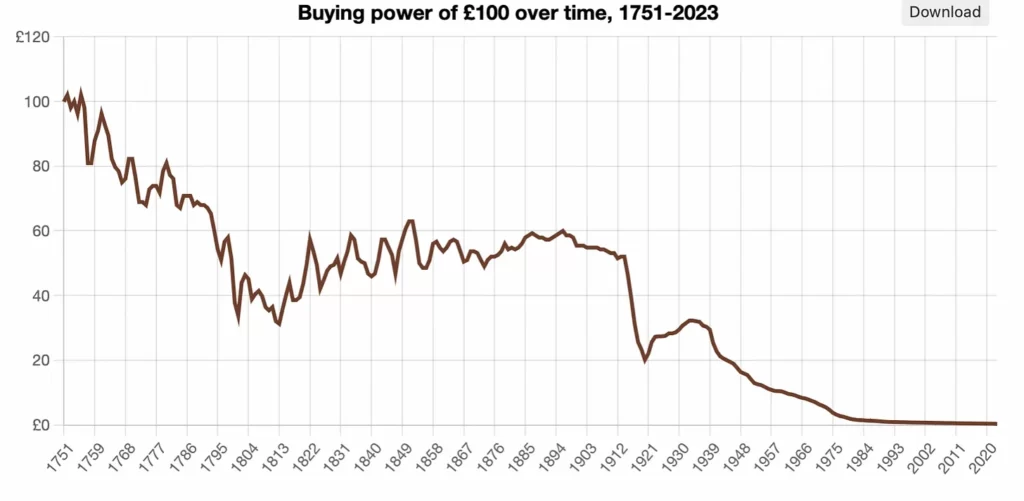

The Bank of England is also toying with the idea of capping holdings of the new digital pound to between £10,000 to £20,000 once it comes into existence and making it non-interest bearing. They also castigated Bitcoin describing it as a “volatile unbacked crypto asset that isn’t a safe store of value and reliable unit of account”, while hailing Britcoin as the safer alternative. The chart below outlines just how safe your purchasing power is when stored in the pound.

The BIS also reports that over 90% of the world’s central banks are actively conducting feasibility studies with regards to launching a CBDC; while countries like China and Nigeria have already launched their CBDC’s and are actively stepping up their efforts to foster adoption of these CBDC’s.

In November last year the New York Federal Reserve announced that it too was beginning a 12 week digital dollar pilot program in conjunction with Citibank, HSBC, Mastercard and Wells Fargo, to name but a few. The NY Federal Reserve press release further states that pilot program is “not intended to signal that the Federal Reserve will make any imminent decisions about the appropriateness of issuing a retail or wholesale CBDC, nor how one would necessarily be designed,” but given all the CBDC excitement going around, its abundantly clear what happens next after the pilot. Within the same month of November the International Monetary Fund (IMF) in collaboration with MIT’s Digital Currency initiative published a paper titled, “A Multi-Currency and Exchange Contracting Platform”, in which they outlined how a global centralized ledger for cross border payments in which central banks, banks and payment processors, dubbed X-C platform, would work. According to the paper this X-C platform would not just centralize payments and settlement, but would also enable a foreign exchange (FX) market, hedging and compliance with existing laws. The main goal being the reduction of friction in cross-border payments when using different CBDC’s from different countries.

As if on cue, Red Date Technology, a Hong Kong based tech firm which also happens to be the architect of China’s state-backed Blockchain-based Service Network (BSN), announced the launch of, “Universal Digital Payments Network (UDPN)” at the 2023 edition of the World Economic Forum (WEF) Annual Meeting in Davos. The UDPN’s goal is to enable different companies from different countries to transact and settle CBDC based payments denominated in different currencies. In short they want to be the SWIFT for CBDC’s, in lockstep with what the IMF paper outlined. As you might have already guessed, non-sovereign currencies like Bitcoin are barred from the UDPN. The icing on the cake, however, was the publication of a report by Bank of America (BofA) in January this year hailing CBDC’s as “the future of money and payments”. According to the report, central banks are going to be the drivers of the “digital asset revolution” and CBDC’s are set to revolutionize global financial systems, ultimately making them the most important technological advancement in the history of money. I almost spilled my coffee when I read the preceding statement.

It’s clear from the above examples that central bankers are taking the development of this Orwellian money very seriously and it wouldn’t be far-fetched to assume that every major central bank will have a CBDC in circulation by the end of the decade.The million dollar question of the day is, why is there so much interest in launching CBDC’s all of a sudden? Is it really just because of the threat of Bitcoin that they have suddenly decided to spur into action or there is something else to it? While Bitcoin and initiatives like Facebook’s now defunct Libra project (which was later renamed Diem) have been major factors in this seemingly sudden awakening by central banks to accelerate the development of CBDC’s, they aren’t the only factors.

“History shows that epidemics have been the great resetter of countries’ economy and social fabric. Why should it be different with COVID-19?” – Klaus Schwab

The World Gold Council in a recently published report cited 2022 as a record year for gold purchases by central banks. Gold demand from central banks alone totalled a whooping 1,136 tonnes in 2022, making it the highest level of gold purchases by central banks on record! Furthermore Q4 2022 purchases were 12 times higher than Q4 2021 purchases, with only 25% of the purchases being reported to the IMF. Geopolitical uncertainty (especially given the seizure of Russian foreign reserves) and rampant inflation (which ironically they caused) were cited as the key drivers for these purchases. In other words the era of sovereign debt as a “safe-haven asset” has come to an end, and the central banks know it.

A global economy increasingly addicted to money printing and the artificial inflation of financial assets can only spell disaster. With total global debt hovering at just over $300 trillion or 349% of global GDP, and rising, the central banks have read the writing on the wall and are aware that a global monetary reset is imminent. Just like in 1971 when President Nixon closed the gold window and ushered in a new monetary order of fiat money backed by US sovereign debt instead of a neutral reserve asset like gold, the monetary reset on the horizon will be built on a CBDC foundation.

What this reset will look like remains to be seen but if history is any indicator main street is still largely unaware of what’s on the horizon and as such will be left holding the bag when (not if) the reset happens. Given everything we know so far about CBDC’s, it is very likely that the urgency to roll them out is being driven more by the fact that the credit driven global economy, which is a giant ponzi scheme, is on the brink of collapse. This isn’t an unfounded “conspiracy theory” but certain key events in 2019 will help put things in perspective.

Just before Covid-19 (C19) was officially declared a pandemic in March 2020, trouble had already started brewing in the financial markets as early as September 2019. The financial system had been on the verge of yet another massive meltdown, as evidenced by the sudden spike in repo rates from 2% to 10.5%. Repo is short for repurchase agreements which are basically short-term collateralized loans that are typically used to raise short-term capital and these occur when a dealer sells treasuries to investors, usually on an overnight basis, and buys them back the next day at a slightly higher price. That small price differential is the implicit overnight interest rate. Since they are the main source of funding for traders in the majority of markets, especially derivatives traders, a lack of liquidity in the repo markets can spell disaster for all major financial pillars of the economy.

As usual the Fed responded to this threat by pumping billions of dollars into the financial system on a weekly basis in an effort to avert disaster. The Fed is estimated to have quietly pumped in approximately $6 trillion into the repo market between September 2019 and January 2020!

In June 2019 before the repo markets went into a tailspin, the BIS in their annual economic report were the first to sound the alarm when they stated, “overheating […] in the leveraged loan market”, where “credit standards have been deteriorating” and “collateralized loan obligations (CLOs) have surged – reminiscent of the steep rise in collateralized debt obligations [CDOs] that amplified the subprime crisis [in 2008].” In other words the financial industry was once again in trouble.

They followed this up with another working paper published on 9 August 2019 in which they recommended central banks to use unconventional monetary policy measures such as bypassing commercial banks to lend directly to troubled firms during a financial crisis. Almost a week later, Blackrock, the world’s largest asset manager, published a whitepaper titled, “Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination,” in which they instructed the Fed to directly inject money into public and private hands “when the next downturn” happened; which coincidentally showed up a month later in the repo markets.

Every year, the top 120 of the financial industry’s global elite, most of whom are central bankers, meet in Jackson Hole, Wyoming, to discuss current events and make plans for the future ahead. BlackRock presented their proposal at this event and they even acknowledged the fact that their proposal was radically different from the usual response to crises by the Fed:

An unprecedented response is needed when monetary policy is exhausted and fiscal policy alone is not enough. That response will likely involve “going direct”: Going direct means the central bank finding ways to get central bank money directly in the hands of public and private sector spenders. Going direct, which can be organized in a variety of different ways, works by: 1) bypassing the interest rate channel when this traditional central bank toolkit is exhausted, and; 2) enforcing policy coordination so that the fiscal expansion does not lead to an offsetting increase in interest rates.

An extreme form of “going direct” would be an explicit and permanent monetary financing of a fiscal expansion, or so-called helicopter money.

In a nutshell the actions taken by the Fed from March 2020 were identical to the plan laid out by Blackrock a few months earlier, before a pandemic had been declared by the WHO. To be frank the plan had already been in motion but thanks to the pandemic, the plan was shifted into high gear. In 2019, the global economy was suffering from the same disease that led to the 2008 financial crisis; it was being smothered by an unsustainable mountain of debt. “Zombie companies” were on the rise as numerous public companies were staying afloat only by taking on new debt. The meltdown that ensued in the repo markets in September 2019 must be viewed from this lens. In short the stock market did not collapse (in March 2020) because lockdowns had to be imposed; rather the reverse was true, lockdowns were imposed because financial markets were collapsing. In other words, executing Blackrock’s radical plan was contingent on the global economy’s engine being turned off thus accelerating the pre-existing macrotrend of monetary expansion, while postponing inflationary damage. The rest of the world’s central bankers followed the Fed’s Blackrock playbook resulting in the massive expansion of money supply leading to the devaluation of their currencies. For more details I recommend checking out this article by Fabio Vighi as well as this one by John Titus.

What has all this got to do with CBDC’s you may ask? Well it’s simple, thanks to the pandemic digital ID’s, which are the very backbone of a CBDC system, were rolled out in the form of vaccine passports. These made it possible to enforce employer vaccine mandates as well as restricting access to public spaces such as restaurants, theaters and gyms if a person was not fully vaccinated, as per prevailing definition of fully vaccinated. In reality this was actually a pilot program for a CCP-style social credit system, even though at this point it was only using vaccination status as a singular metric of ensuring compliance.

Furthermore Blackrock’s plan wasn’t meant to be a once-off policy response but it was proposed as a permanent measure for dealing with any future financial crisis or as John Titus puts it, “This is the ultimate outcome of BlackRock’s “going direct” plan: controlling both the population and the economy through money pipes with valves that open and close in accordance with whatever “stringent conditions” the money supplier chooses to impose.” Therefore if “helicopter money” is to be provided directly to the public in future, what better way to do it than via CBDC’s?

“The worship of the state is the worship of force. There is no more dangerous menace to civilization than a government of incompetent, corrupt, or vile men. The worst evils which mankind ever had to endure were inflicted by bad governments. The state can be and has often been in the course of history the main source of mischief and disaster.” – Ludwig von Mises

A year after the launch of the eNaira, the Nigerian CBDC, in October 2021 less than 0.5% of Nigeria’s 225 million citizens were using it. This is against the background of increasing Bitcoin adoption which has led to Bitcoin trading at a 60% premium in the West African nation. In a bid to save face and force people into digital serfdom, the Nigerian central bank first limited bank withdrawals to a maximum of $225 a week. They later doubled down and decided to replace all high denomination notes in circulation. The ultimate goal being restricting cash usage just like India did in its 2016 demonetisation campaign, and this has resulted in a massive cash shortage. The Nigerian central bank stated that the demonetisation campaign is intended to mop up excess cash liquidity, keep counterfeiters in check and tighten their control of Nigeria’s money in circulation, with more than 85% of it existing outside the country’s banking system.

Similar to India, the results of this policy have been chaotic with endless lines at ATMs, stranded commuters and many small businesses, which represent the lion’s share of the economy, and predominantly rely on cash payments, grinding to a halt. Despite these disastrous results the Nigerian Central Bank governor, Godwin Emefiele, has hailed the policy as a success and the Finance Minister, Zainab Ahmed, concurred, saying: “The only sore point is the pain it has caused to citizens.” As a result of the cash shortages, riots have broken out in Nigeria in protest, with reports in some cases of lethal force being deployed against the rioters. CBDC’s are so good that they have to be forced on people who don’t want them.

In a recent interview on Bloomberg, Mr Carstens of the BIS, declared that fiat had won the battle against crypto citing the FTX fallout as the final nail in the coffin that he anticipates will ignite a regulatory response soon. He went on to assert that “technology doesn’t make for trusted money” and that “..only the legal, historical infrastructure behind central banks can give great credibility [to money],” He then went on to make a magnificent suggestion of having a “unified blockchain” where one central bank (ie the BIS) underpins trust in CBDC’s. One ledger to rule them all. It’s abundantly clear that the battle for the future of money and freedom is only just beginning. The likes of Mr Carstens are definitely not going to voluntarily give up their powers of liquidity creation and in the coming months they will deploy every regulatory power at their disposal to restrict Bitcoin adoption as much as possible until their weapons of digital fascism, aka CBDC’s, are ready.

While it’s obvious that the CBDC train has already left the station and seems to be gathering momentum, that should be motivation for us to double down in building an alternative economy around Bitcoin. It’s incumbent upon us to start building Bitcoin circular economies and make exchanges obsolete as a source of acquiring Bitcoin, because given Mr Carstens’ comments, they are going to be the first attack vector for regulators, a form of Operation Choke Point 2.0. From a technological and economic standpoint Bitcoin already won and the central planners know that; even though it’s a reality they are unwilling to accept. The real battle isn’t just about competing monetary systems but it’s a battle between freedom or slavery. The CBDC’s are indeed coming but the question is when they do, will you be enslaved or will you be free? The choice is yours.