Note before jumping in: If you find this article interesting feel free to follow Kudzai on Substack.

“Gold is money everything else is credit”

J.P. Morgan

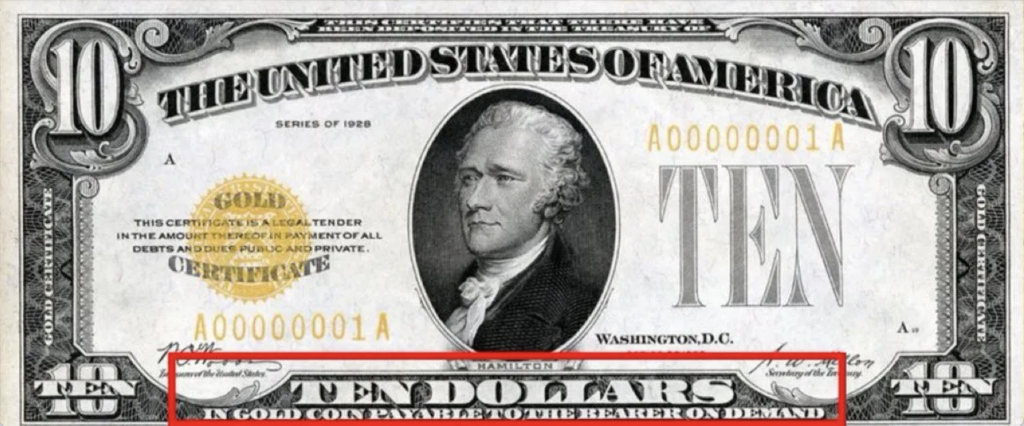

From the 1830s the US was on a de facto gold standard and de jure gold standard since 1900. The Federal Reserve was legally obliged to convert dollars for gold on demand at a fixed price of $20.67 per ounce of gold since every bank note was a gold certificate. For a while the Fed had enough gold to satisfy any redemption requests that occurred and the system worked perfectly until the great stock market crash of 1929 which ushered in the Great Depression. During the Great Depression, the Fed was plagued with large gold outflows as people dumped dollars for gold which was a more reliable store of value. This was a global phenomenon and as a result, a lot of countries abandoned the gold standard and were no longer redeeming their currencies for gold.

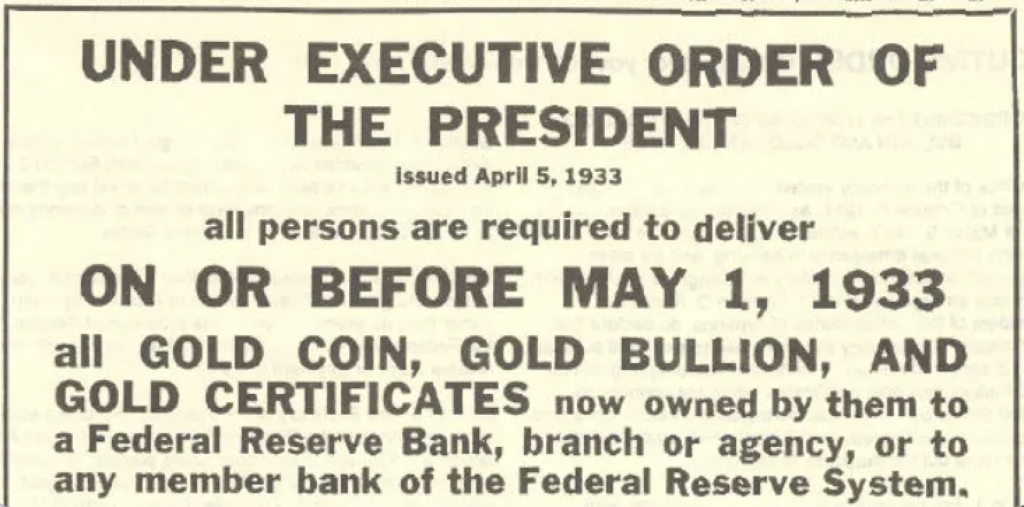

When President Roosevelt was elected in 1933 the US had the largest gold reserves of any country on the face of the earth. A few days after assuming office, on March the 8th 1933, Roosevelt assured the nation that the gold standard was safe, only to issue an executive order three days later that prohibited gold payments by banks since the Fed was now unable to honour its commitment to convert dollars to gold. In reality this was a sovereign default by the US and as a result, on April the 5th 1933, Roosevelt signed Executive Order 6102 which outlawed the owning of more than $100 worth of gold by private citizens. The people were to surrender all their gold which would be purchased by the government at $20.67 per ounce and despite assurances by Roosevelt that, “the order is limited to the period of the emergency”, it remained in effect till 1974.

After the government had successfully confiscated the majority of the gold in private hands, Roosevelt raised the price of gold from $20.67 to $35 per ounce thus devaluing the dollar by approximately 60% in one day. Executive Order 6102 was neither the first nor the last confiscation of gold by a nation state in history. In 1959 the Australian government legalized gold seizures from the citizenry if “expedient to do so for the protection of the currency or the public credit of the Commonwealth of Australia.” In 1966 it became illegal for British citizens to privately import gold as well as to own more than four gold coins dated after 1837. If you had more, you had to obtain a collectors license from the Bank of England. This law was only lifted in 1971.

Despite gold’s superior monetary properties, the gold standard was eventually replaced by the fiat standard. The failure of the gold standard as highlighted by the brief and overly simplistic historical context above can be mainly attributed to one thing; its vulnerability to centralized control. Due to the fact that gold is difficult to safely store or transport, gold owners usually delegated this responsibility to centralized custodians like banks. Bank notes were born out of this shortcoming of gold and they started out as fractional representations of gold i.e. an IOU or a receipt that could be redeemed for gold at any time.

As discussed in What is Money it is this portability limitation that led to gold custody being centralized by the banks and over time they gradually issued more “paper receipts” that exceeded the amount of gold in custody. This was usually done to finance wars and the state would subsequently devalue the currency by raising the gold price in an effort to conceal this imbalance, thus confiscating the wealth of their citizens via inflation.

Modern day fiat currencies also share this same weakness, albeit on a larger scale, as unlike gold they are derivatives of the credit system and can be produced at zero cost with a few keystrokes. Furthermore, unlike gold, fiat currencies are someone else’s liability; either a central bank or a commercial bank. All bank deposits are assets to depositors but liabilities to the banks that hold the deposits and the currency in circulation being the liability of the central bank that issued it. Gold on the other hand is a bearer asset that is no one’s liability.

The advent of Bitcoin in 2009 posed a significant threat to fiat currencies as this was the first time in history that a natively digital, non-sovereign currency had ever been successful. Just like gold, Bitcoin is a bearer asset that is no one’s liability that doesn’t require a third party like a bank to transmit it or store it and it’s no surprise that Bitcoin is also referred to as “digital gold.” Unlike gold, however, Bitcoin can be transmitted at the speed of light, is fully decentralized and cannot be seized via legislation or coercion. This did not go unnoticed by the central banks that are keen on maintaining their power thus resulting in the outright ban of Bitcoin in some countries but this did not dent Bitcoin’s adoption, in fact this has had the opposite effect.

In an attempt to try replicate some of Bitcoin’s unique attributes that made it successful, central banks around the world have begun developing their own digital currencies, known as Central Bank Digital Currencies or CBDC’s for short. In this essay we will explore the good, the bad and the ugly of CBDC’s and see if they are a viable alternative to Bitcoin.

“A government big enough to give you everything you want is a government big enough to take from you everything you have.”

President Gerald R. Ford

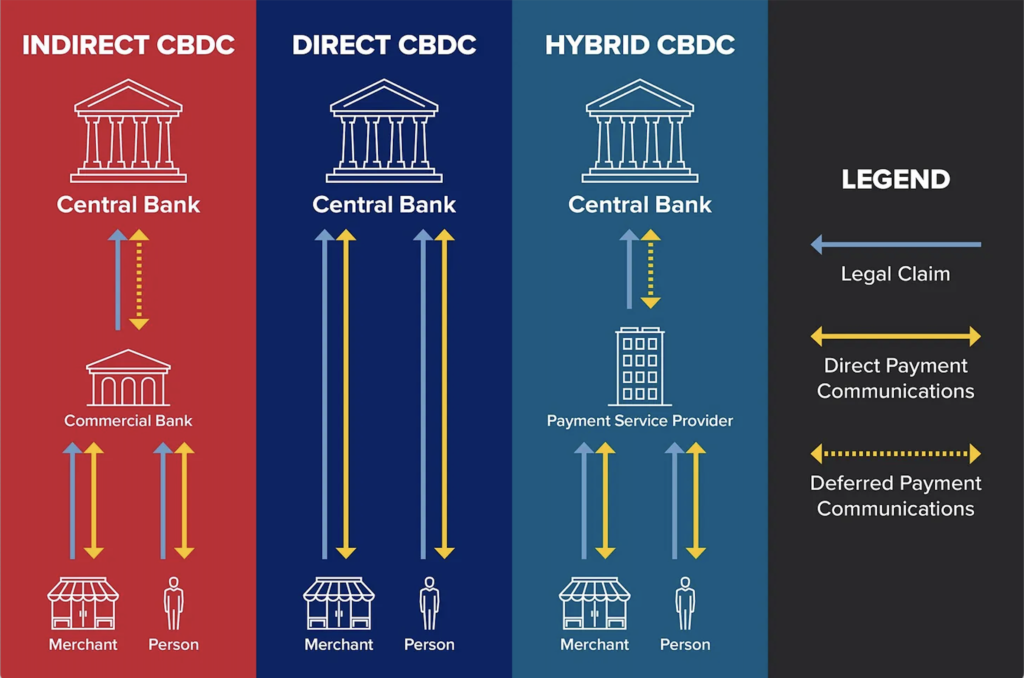

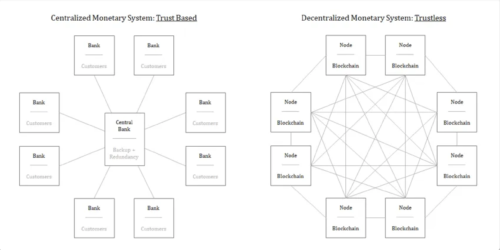

Currencies today exist mainly in two forms; physical (bank notes and coins) and digital (account balances in banks and payment processors like PayPal) with the latter making up the bulk of the supply. If most of the money is already digital, why do we need a CBDC and how is it different? CBDC’s are digitally native fiat currencies that are issued directly from the central bank to the public, and are transmissible on a peer to peer basis without (1) flowing through the banking system. In short these are digitized central bank liabilities that are “airdropped” directly to the public by the central bank. This makes CBDC’s much more efficient as they eliminate middlemen, unnecessary friction and guarantee instant settlement of transactions. They could also potentially accelerate financial inclusion of the unbanked or underbanked segments of the population.

The biggest distinction that sets CBDC’s apart from the current forms of digital money is that all monetary data is accessible from a single database. In other words instead of having multiple separate databases at the various commercial banks, all of this data is centralized and maintained directly by the central bank on one database. The ramifications of this are more concerning than most people realize.

For example imagine a scenario in which a social credit system similar to the one in China is implemented in your country. If an algorithm that is monitoring your social media accounts downgrades your “social credit score” for any reason, the money in your CBDC wallet can be algorithmically turned off instantaneously with zero friction. Under such a system the financial censorship of political opponents, activists and protesters as well as their immediate family, “co-conspirators”, sympathizers, supporters can be easily done at the push of a button. CBDCs give the state near total authoritarian power not to just to freeze or turn off anyone’s money but to also monitor every single transaction. What could possibly go wrong?

The Australian Strategic Policy Institute after studying the Chinese CBDC (aka DCEP which stands for digital currency and electronic payments) had this to say:

“It has the potential to create the world’s largest centralised repository of financial transactions data…it would also create unprecedented opportunities for surveillance. The initial impact of a successful DCEP project will be primarily domestic, but little thought has been given to the longer term and global implications. DCEP could be exported overseas via the digital wallets of Chinese tourists, students and businesspeople. Over time, it is not far-fetched to speculate that the Chinese party-state will incentivise or even mandate that foreigners also use DCEP for certain categories of cross-border RMB transactions as a condition of accessing the Chinese marketplace.” (2)

In other words, in addition to existing on a centralized ledger, CBDC’s are tools of surveillance and control. The bad news is that it’s not only the Chinese that intend to use CBDC’s to create a programmable society. The head of the Swiss-based Bank of International Settlements (the central bank of central banks), Agustin Carstens, echoed similar sentiments during a virtual conference that was hosted by the IMF on October 19 2020 titled “Cross Border Payments-A Vision For The Future”, when he said:

“For our analysis on CBDC in particular for general use, we tend to establish the equivalence with cash, and there is a huge difference there. For example in cash, we don’t know for example who is using a hundred dollar bill today; we don’t know who is using a one thousand peso bill today. A key difference with a CBDC is that central bank will have absolute control on the rules and regulations that determine the use of that expression of central bank liability. And also, we will have the technology to enforce that. Those two issues are extremely important, and that makes a huge difference with respect to what cash is.” (3)

CBDC’s are not purely about creating a more efficient financial system but as part of their design they are surveillance tools that also give the powers that be the ability to control how, where and when you spend your money. Remember, every fiat currency is a liability of the central bank that issued it and according to Mr Carstens, in a CBDC world, it’s up to the central bank (not to you) to determine how you can transact using their liabilities. While CBDC’s have potential benefits like faster payments, reduced transaction costs, real-time settlement, they also carry significant risks of financial censorship, loss of privacy through total financial surveillance, and ceding of individual financial sovereignty to the state.

“The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.”

Ben Bernanke

When the Covid-19 pandemic hit in early 2020 many governments around the world rolled out economic stimulus packages to cushion their citizens from the loss of income that came about as a result of the lockdowns. These trillions of dollars worth of stimulus packages were all “created out of thin air” by central bankers. The US government for example, spent a total of $5.2 trillion on Covid relief by mid 2021. To put this in perspective the US government coughed up the equivalent of $4.7 trillion in today’s dollars to fund the most expensive war in history, World War II.

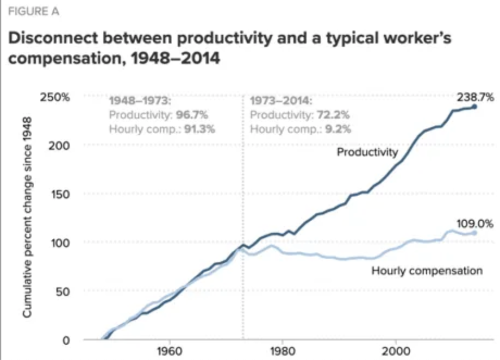

The issue that I am pointing out here is one of the fundamental flaws of fiat currencies, which is that their supply can be manipulated and inflated easily, for whatever reason, leading to the slow destruction of their purchasing power over time.

Money is the bedrock of all economies as it’s a mechanism for coordinating all economic activity, communicating and transferring value. When the economy is experiencing turbulence it’s usually a signal that the money isn’t efficiently coordinating economic activity i.e. economic performance is a reflection of the quality of the money. The fly in the ointment is the money and this is a problem that many people experience everyday but are unable to accurately diagnose.

Why does cost of living continue to skyrocket in a world of increasing productivity and abundant technological tools? Why is it that despite receiving annual salary increases you still have to work twice as hard and get into debt just to maintain your current standard of living? Why does economic inequality continue to rise despite the numerous policies that have been put in place to address this? Is it the fault of corporate greed or the billionaires that won’t pay their “fair share” of taxes? The real problem is that the money that is supposed to be coordinating the “economic orchestra” is manipulated thus the foundation of the economy is broken.

Central banks and their policies of monetary debasement by default have created a world, in which it’s normal for money to lose value, when in reality money is supposed to store value not lose it. As the economist John Keynes accurately noted, “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.”

The net effect of this is that any value created today is guaranteed to be worth less tomorrow as the money supply is arbitrarily increased. This in turn gives rise to the Cantillion Effect which results in the consolidation and centralization of wealth. Economies have been structurally and permanently altered as a function of money creation. A CBDC does not address or solve this fundamental flaw because it is still a fiat currency and therefore has all the inherent flaws that are present in the current monetary system. It’s merely a, efficient digital layer being built on top of a flawed monetary foundation.

“I think that the Internet is going to be one of the major forces for reducing the role of government. The one thing that’s missing, but that will soon be developed, is a reliable e-cash – a method whereby on the Internet you can transfer funds from A to B without A knowing B or B knowing A.”

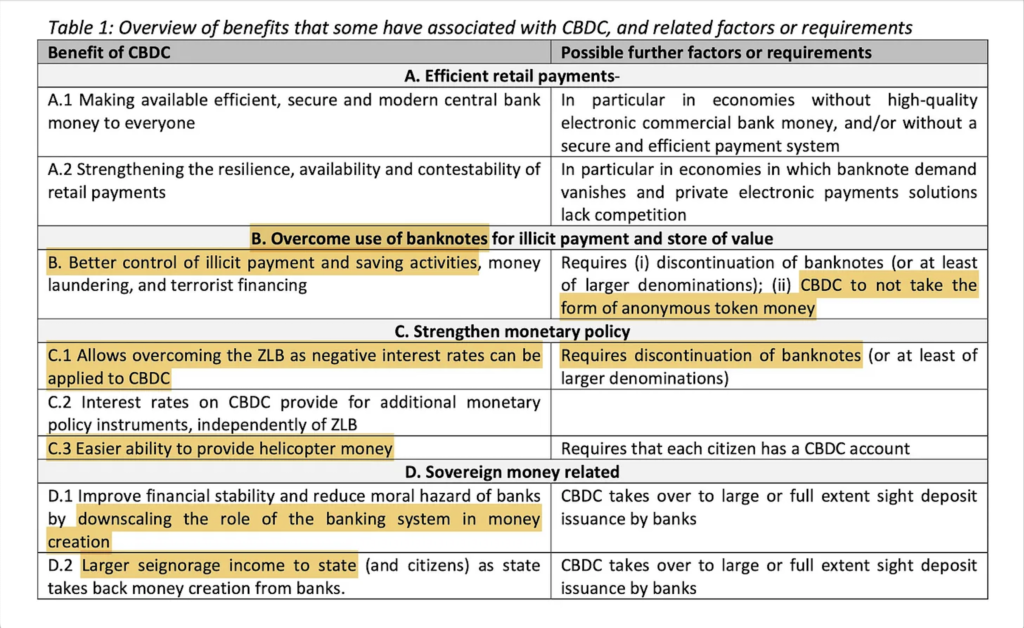

In January 2020 the European Central Bank (ECB) released a working paper titled, “Tiered CBDC And The Financial System” which highlights a few key ideas that are under consideration for designing a CBDC aka “digital Euro” namely; the elimination of cash, zero privacy, better control of “illicit payments”, efficient payment systems, easier provision of “helicopter money”, negative interest rates on cash and larger seigniorage income to the state. (4)

Using the above as a blueprint, the ideal CBDC for the ECB would allow them to:

- Set expiration dates on the money held in CBDC wallets

- Debase the money even faster through the application of negative interest rates on CBDC wallet balances

- Replace cash with a trackable digital currency that leaves a financial footprint every time it’s used

- Controlling savings

- Nationalize the financial infrastructure.

If this isn’t Orwellian I don’t know what is. When the central bank controls how much money you can save, as well as to set “expiration dates” that require you to spend the money within a specific timeframe, it is not your money. If you don’t control how much you can have or where and when you can spend, you don’t own your money. The blueprint outlined above will guarantee it. Centralized financial systems are every authoritarian’s dream and CBDC’s paired with a digital ID will grant the power of financial omniscience to the state.

Bitcoin on the other hand is a trustless, permissionless and fully decentralized monetary system. Transacting is also done peer to peer but the fundamental difference being that no third party or central authority is required to facilitate value transfer within the Bitcoin network. A combination of cryptography, a transparent monetary policy based on consensus rules which are enforced by a network of decentralized nodes (A full node is a computer that maintains a full version of the Bitcoin blockchain), and an immutable ledger of transactions whose integrity is guaranteed by a network of miners; reinforces and secures the monetary properties of Bitcoin.

In the Bitcoin whitepaper Satoshi expressed the importance of a trustless monetary network with the following statement, “What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” (5)

Unlike CBDC’s which are centrally controlled and designed to give more power to the state, Bitcoin is fully decentralized by design with no single point of failure and is designed to empower the individual. Due to the centralized architecture of the fiat monetary system it requires us to trust central banks and commercial banks to manage the financial system with integrity. Unfortunately history is filled with countless evidence of this trust being violated, and it is the single point of failure in our current financial system; something Nakamoto also highlighted in the Bitcoin whitepaper when he said:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

There is no central bank or company that runs the Bitcoin network and there is therefore no need to trust any institution. Nodes in the Bitcoin network do not need to trust any other nodes because each node independently audits the complete history of Bitcoin transactions according to a common set of rules, allowing the network to converge on a consistent and accurate version of transaction history on a trustless basis.

Each node in the network is a check and balance on the rest of the network, and without a central source of truth, the network is resistant to attack and corruption. This is the most secure computing network in the world not only because it’s accessible to anyone but it is also 100% trustless. As the number of nodes on the network increases, Bitcoin becomes more decentralized thus increasing resistance to corruption and censorship. This is how the Bitcoin network eliminates trust and centralization by any third-party; a critical feature that every CBDC lacks.

Furthermore with a preset supply limit of 21 million Bitcoin that is enforced by the network in a decentralized manner, the power to manipulate the currency is removed from any central authority. This attribute of absolute scarcity is the foundation for every financial incentive that makes the Bitcoin network functional and valuable; thus without censorship resistance built-in, the entire system is compromised. CBDC’s have no supply limit and just like current fiat money they are engineered to lose value over time.

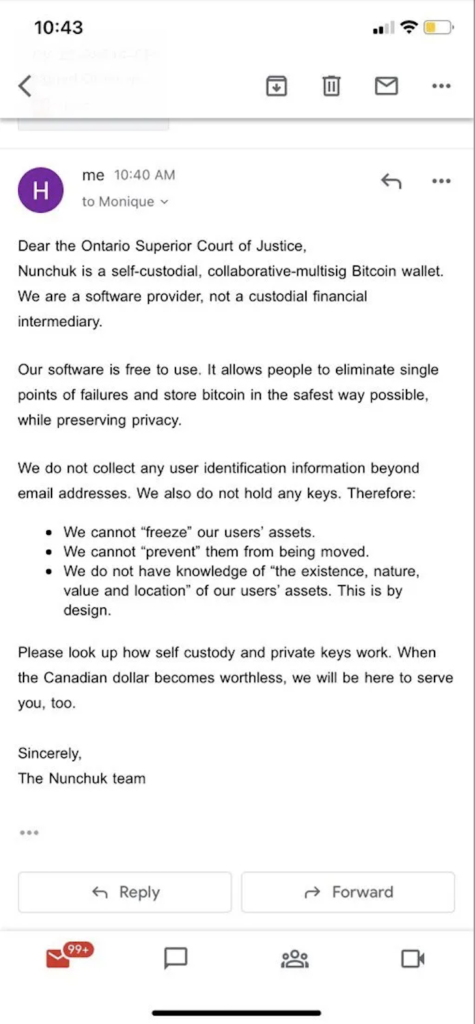

Bitcoin also gives users the option to self-custody their money thus making the seizure of the Bitcoin like what happened with the confiscation of gold via Executive Order 6102 unenforceable and therefore highly improbable. For example during the Trucker Protests aka Freedom Convoy Movement in Canada earlier this year, the Ontario Superior Court of Justice asked self-custody wallet provider Nunchuk to disclose user information and freeze Bitcoin wallets of its users in accordance with a government decree that had been issued after the Emergencies Act was invoked. This was the official response from Nunchuk:

Once again Bitcoin’s censorship resistance passed the test, had this been a CBDC wallet it’s quite obvious how this story would have ended. In summary, unlike CBDC’s, Bitcoin actually fixes the broken monetary system as well as the economic foundation such that everything else can then begin to fix itself.

Most central banks as well as other fintech companies are under the impression that by utilizing blockchain technology (or distributed ledger technologies, a moniker they prefer) they will be able to not only replicate but surpass Bitcoin’s success. This is what gave rise to the “blockchain not Bitcoin” narrative that for the most part still plagues the financial services industry. What they fail to understand or choose to ignore is that Bitcoin’s success and value is not a derivative of blockchain technology alone. The blockchain is one piece of the puzzle that Satoshi used to solve the problem with the fiat monetary system where a trusted third party is required to transact; and as a trustless peer to peer payment system, Bitcoin is the antithesis of this. As Parker Lewis wrote,

“In practice, Bitcoin (the currency) and its blockchain are interdependent. One does not exist without the other; Bitcoin needs its blockchain to function and there would not be a functioning blockchain without a native currency (Bitcoin) to properly incentivize resources to protect it. That native currency must be viable as a form of money because it is exclusively what pays for security, and it must have credible monetary properties in order to be viable…A blockchain on the other hand is simply an invention native to Bitcoin that enables the removal of trusted third parties. It serves no other purpose. It is only valuable in Bitcoin as a piece to a larger puzzle and it would be useless if not functioning in concert with the currency. The integrity of Bitcoin’s scarcity and the immutability of its blockchain are ultimately dependent on the value of the currency itself” (6)

In other words the blockchain is what enables decentralized control of the Bitcoin and makes no sense when used by a central authority. This is a point that is often ignored and challenged by central bankers when designing and developing their CBDC’s. Furthermore in addition to the decentralization the technology around Bitcoin such as its game theory dynamics, proof of work, 21 million Bitcoin supply cap, preset issuance schedule and the mining difficulty adjustment are important parts and contributors to Bitcoin’s superior monetary properties. Take these away, and all you have left is a slow, inefficient and distributed database i.e. the blockchain. It’s for this reason that whether or not CBDC’s are built on “distributed ledger technologies” i.e. blockchain, they are dead on arrival and are no match for Bitcoin.

“Privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary such system. An anonymous transaction system is not a secret transaction system. An anonymous system empowers individuals to reveal their identity when desired and only when desired; this is the essence of privacy…We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence. It is to their advantage to speak of us, and we should expect that they will speak…We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place. People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.”

Eric Hughes

There are at least 87 central banks worldwide that are seriously exploring CBDC’s at the present moment while other countries like China and Nigeria have already launched their CBDC’s. The central banks of Australia, Malaysia, Singapore and South Africa along with the Bank of International Settlements recently wrapped up a pilot on March 22nd for a cross border CBDC platform. Dubbed Project Dunbar, one of the main aims of the pilot was to explore in practice how cross border CBDC payments would be implemented. It does seem very likely that over the next few years CBDC’s will be rolled out and will likely become the new dominant base money for fiat currencies.

In a world where digital payments are the rule not the exception it is critical to have payment systems and tools that are sufficiently decentralized as well as efficient in order to maintain the protection of privacy. As greatly efficient as CBDC’s are, in their current form, they are a huge threat to individual sovereignty and liberty. If the freedom to transact is fundamental to exercising all other freedoms it is of grave concern that tools like CBDC’s, that give greater financial censorship and surveillance power to the state, are being developed and deployed.

The question is what can we do about it? Do we lobby government against developing them? Or vote for politicians who share our view of CBDC’s? Perhaps we can do both, right? In my view while public-driven policy reform can be helpful it has a limited scope in the protection of digital financial privacy rights on a global scale. More so in a world that is leaning more towards authoritarianism.

So what’s the alternative? The above quote from the Cypherpunk Manifesto that was penned by Eric Hughes holds a clue; “We must come together and create systems which allow anonymous transactions to take place.” As governments around the world build their CBDC platforms, Satoshi Nakamoto gave us a head start with the creation of Bitcoin, the onus is now on us to continue to build tools that strengthen Bitcoin’s censorship resistance and enhance its privacy. Incorporating privacy coins like Monero where it makes sense is also not a bad idea given the magnitude of the challenges ahead.

While it may prove difficult to avoid using CBDC’s initially especially when they are enforced as legal tender, owning Bitcoin in the interim is the best insurance that can give you an opt-out when required. For most that are not developers or cryptographers unbanking yourself with Bitcoin is the best form of defence. Who knows if you will be permitted to buy Bitcoin using a CBDC. Remember, forewarned is forearmed.

In a February 1995 email, Wei Dai, the cryptographer who invented B-Money which was one of the first references in the Bitcoin whitepaper, perfectly captured the spirit of the above solution when he wrote the following:

“There has never been a government that didn’t sooner or later try to reduce the freedom of its subjects and gain more control over them, and there probably never will be one. Therefore, instead of trying to convince our current government not to try, we’ll develop the technology that will make it impossible for the government to succeed. Efforts to influence the government (e.g., lobbying and propaganda) are important only in so far as to delay its attempted crackdown long enough for the technology to mature and come into wide use. But even if you do not believe the above is true, think about it this way: If you have a certain amount of time to spend on advancing the cause of greater personal privacy, can you do it better by using the time to learn about cryptography and develop the tools to protect privacy, or by convincing your government not to invade your privacy?” (7)

With CBDC’s on the horizon, Wei Dai’s words still ring true today.

If you found this article interesting feel free to follow Kudzai on Substack.

Sources

1. Gladstein, Alex. Financial Freedom and Privacy in the Post‐Cash World. Cato Institute. [Online] 2021. [Cited: March 27, 2022.] https://www.cato.org/cato-journal/spring/summer-2021/financial-freedom-privacy-post-cash-world#freedom-privacy-through-technology.

2. Australian Strategic Policy Institute. The Flipside of China’s Central Bank Digital Currency. Australian Strategic Policy Institute. [Online] [Cited: March 27, 2022.] https://www.aspi.org.au/report/flipside-chinas-central-bank-digital-currency.

3. IMF. Cross Border Payments- A Vision For The Future. IMF. [Online] [Cited: March 27, 2022.] https://meetings.imf.org/en/2020/Annual/Schedule/2020/10/19/imf-cross-border-payments-a-vision-for-the-future.

4. European Central Bank. Tiered CBDC and the Financial System. European Central Bank. [Online] [Cited: March 27, 2022.] https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2351~c8c18bbd60.en.pdf.

5. Nakamoto, Satoshi. Bitcoin: A Peer-to-Peer Electronic Cash System. Bitcoin. [Online] [Cited: February 3, 2022.] https://bitcoin.org/bitcoin.pdf.

6. Lewis, Parker. Bitcoin not Blockchain. Unchained Capital. [Online] [Cited: March 28, 2022.] https://unchained.com/blog/bitcoin-not-blockchain/.

7. Dai, Wei. Law vs Technology. Cypherpunks. [Online] February 10, 1995. [Cited: March 28, 2022.] https://cypherpunks.venona.com/date/1995/02/msg00508.html.

8. Lewis, Parker. Bitcoin is not backed by nothing. Unchained Capital. [Online] [Cited: January 23, 2022.] https://unchained-capital.com/blog/bitcoin-is-not-backed-by-nothing/.

9. Alden, Lyn. What is Money Anyway? Lyn Alden Investment Strategy. [Online] March 2022. [Cited: March 27, 2022.] https://www.lynalden.com/what-is-money/.

10. Federal Reserve. Money and Payments: The U.S. Dollar In The Age of Digital Transformation. Federal Reserve. [Online] January 2022. [Cited: March 27, 2022.] https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf.

11. Bank of International Settlements. Project Dunbar International Settlements using Multi-Cbdc’s. Bank of International Settlements. [Online] March 22, 2022. [Cited: March 27, 2022.] https://www.bis.org/press/p220322.htm.

12. Bank of England. Central Bank Digital Currencies: Opportunities, Challenges and Design. Bank of England. [Online] March 2020. [Cited: March 27, 2022.] https://www.bankofengland.co.uk/-/media/boe/files/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design.pdf.

13. Waal, Ben de. Your blockchain project will fail because you don’t understand Bitcoin. Thoughts on anything and everything. [Online] November 15, 2018. [Cited: March 28, 2022.] https://bdw.home.blog/2018/11/15/your-blockchain-project-will-fail/.

14. Federal Reserve History. Roosevelt’s Gold Program. Federal Reserve History. [Online] [Cited: March 27, 2022.] https://www.federalreservehistory.org/essays/roosevelts-gold-program.

15. Bovard, James. The Great Gold Robbery. FEE. [Online] June 1, 1999. [Cited: March 27, 2022.] https://fee.org/articles/money-the-great-gold-robbery/.