✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- The Overnight Rate

- The Discount Rate

- R-Star or Neutral

- The Terminal Rate

Inspirational Tweet:

Is the Fed going restrictive? The neutral rate is 2.5% per the Fed’s dot plot, but: If the “natural” rate of interest (R-Star) is approaching 1% (real), then neutral may be closer to 5%. Neutral is not a static concept. It’s a moving target, and it’s moving higher. pic.twitter.com/9amqyJtUXK

— Jurrien Timmer (@TimmerFidelity) September 14, 2022

Jurrien really knows how to pack the info into 280 characters, doesn’t he? So, if you’re confused at what he’s saying or maybe have no idea at all, no worries.

Let’s unpack and clarify some Fed speak today, shall we?

😴 The Overnight Rate

With so much focus on the Federal Reserve lately, most of you may generally know what the Fed Funds rate is, but there’s definitely some confusion around the nuances of the Target Rate.

First, the Fed Funds Target Rate is not actually a rate, rather it is a range of suggested rates that the banks should be charging each other for overnight transactions. The Fed sets this rate in order to manage (read: manipulate) liquidity and availability of cash for the economy, by either loosening policy (lower borrowing rates, more liquidity) or tightening policy (higher borrowing rates, less liquidity).

The Fed has been tightening this year (raising rates), and the current Fed Funds Target Rate (range) is 2.25 to 2.50%.

This is what we keep hearing quoted on CNBC and Bloomberg, etc., except we rarely hear the range being quoted, and instead get either the average of the range, i.e., 2.33% or the high end of the range, 2.50%.

Then, after the Fed makes its move, we start hearing traders and commentators quote the actual rates that banks are charging each other for overnight deposits. The Overnight Rate, which is also known as the Effective Fed Funds Rate, usually sits in the middle of the Fed Funds Target Range.

If we check today, the average Overnight Rate, the effective Fed Funds Rate, sits at 2.33%. Pretty close to the mid-point of the range.

You may ask, why are banks borrowing and lending to each other in the first place?

In the fractional reserve banking world, at the end of each business day, banks add up all their funds and reserves and determine whether they have a surplus or shortage of funds and/or reserves. Banks with surpluses will lend them to (or deposit them with) other banks. The borrowing banks will pay the lending bank the overnight rate.

Two important notes: the overnight rate is always quoted as an annualized rate (these banks are not making 2.33% off each other in a night), and these loans can be for more than just one night—but they’re typically within a 72 hour window.

🤑 The Discount Rate

Sometimes you hear commentators and others interchange the word discount with the word overnight, and this is typically a mistake.

We already know that the overnight rate is for loans between banks. The Discount Rate is the rate that the Federal Reserve charges banks to borrow from the Fed itself in the overnight, or discount, window.

This rate is typically higher than the overnight rate.

Exactly, it is the opposite of a discount. Surprise, surprise.

The reason for this is that the Fed would rather banks lend to each other and keep liquidity flowing in the market than soak up liquidity at the Fed, thereby removing liquidity from the economy.

Offering a higher rate to borrow from them, the Fed incentivizes banks to transact with each other instead.

Low and behold, if we check the Discount Rate, we see it is currently quoted at 2.50%, the high end of the Federal Reserve Target Range.

You may ask if .17% really makes enough of a difference to incentivize banks to transact with each other rather than the Fed.

Let’s put it this way, if JP Morgan has $1.8 billion in excess reserves to lend out, that .17% difference equals about $3M a year. That’s enough for a hospitality tent and VIP tickets to the Masters Tournament for the whole C-Suite!

They’ll take it.

😐 R-Star or Neutral

So then, what does it mean when Chairman Powell says the Fed Funds Rate is neutral?

Also referred to as r-star, the neutral rate is the real rate of interest that equilibrates the economy in the long run. In other words, this is where the federal funds target rate neither constricts the economy nor accommodates it.

Put even more simply.

If the Federal Funds Rate is determined to be at r-star, then it does not help or hurt GDP, the unemployment rate, inflation, etc. The economy (in theory) is in a state of equilibrium.

After the July meeting, when the Fed moved the Target Rate up 75bps to 2.25-2.50%, we heard Chairman Powell state that he believed the Fed Funds Rate was now at neutral level. Though there has been a lot of debate about whether this is actually true, Powell was stating that the Fed believed they were no longer contributing to the expansion of prices, but were not yet restricting them.

Translation: since the CPI inflation reading at the time was 8.5%, he was saying that the Fed needed to tighten more in order to bring that rate down.

The only problem is, there are many interpretations as to what the actual r-star level is now, as Jurrien points out in his Tweet above.

Remember, the r-star/neutral rate is a real rate of interest measure.

And also remember that real rates include the impact of inflation:

interest rate – inflation rate = real interest rate

And herein is why many experts and investors were calling foul on Powell’s claim. After all, he was essentially saying that the neutral rate was -6%.

Federal Funds Rate (2.5% at the high end!) – Inflation Rate (8.5%) = Neutral Rate (-6.5%)

Yeah, negative 6.5 real rate seems pretty accommodative still, and is a no for me, too.

☠️ The Terminal Rate

So, if the Neutral Rate is actually higher, and we can take Powell at his word that he’s serious about crushing inflation, where are rates really going? Perhaps most importantly, where are they going to stop?

This, my friends, is known as the Fed Funds Terminal Rate, and it represents the peak level that the Fed Funds Rate reaches during any monetary policy cycle.

Boy, has there been a lot of debate about what this cycle’s Terminal Rate is, and it seems to also be a moving target, much like and because of the elusive Neutral Rate.

That said, we do get some insight from the Federal Governors themselves. Or we used to, anyway.

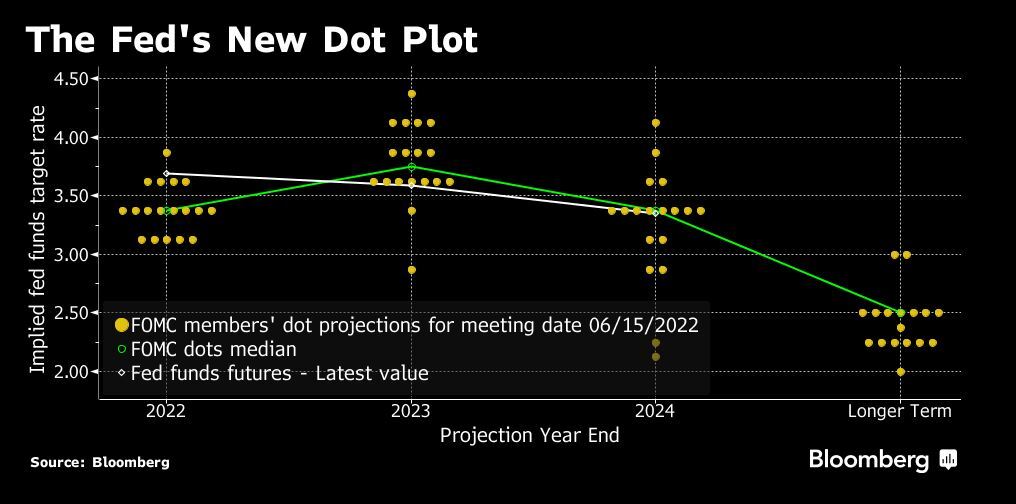

Because Powell stated at the July meeting that the Fed would no longer be offering clear guidance on future rate moves. This guidance includes the expectations of where rates will be according to each Fed Governor. These estimates are assembled into what we call the Fed Dot Plot, and this chart graphically displays the 18 governors’ estimated Federal Funds Target Rate (high end) by quarter or year.

Here is the last Dot Plot chart assembled from the Fed Meeting guidance in June:

As you can see, the Fed Funds Target Rate was estimated to reach 3.75% (according to the average of the 18 governors) in 2023.

Flash forward to today, and we’ve had quite a bit of economic data since these plots were graphed, as well as endless comments from Powell and the other governors. Persistent inflation, in particular, has pushed up investors’ expectations of the ultimate rate the Fed hikes to.

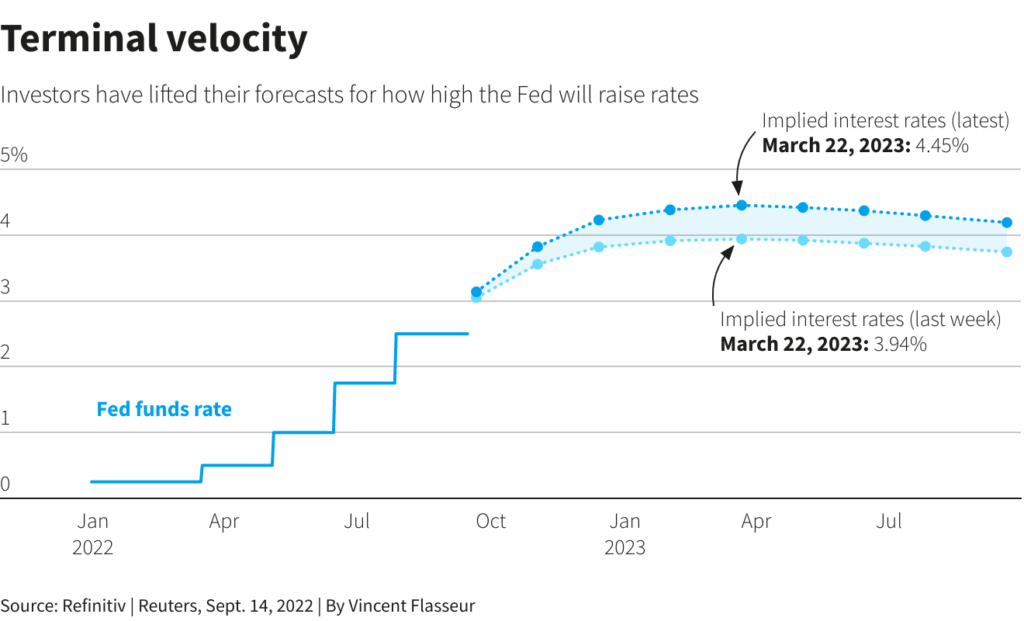

To that point, here is the latest estimated rate path, assembled by Refinitiv, a market data provider company:

You can see that the forecast jumped this week, after we received the latest CPI reading of +8.3%. And now, using Fed Funds futures and other derivative inputs, the forecasted Fed Funds Terminal Rate is ~4.5%.

Now, nobody truly knows, of course. Not even Powell himself—he’s already declared that he and the Fed are reactionary. They take the data that is collected re: the economy and they analyze it and act accordingly.

And so, as the majority of investors now expect the Fed to raise by 75bps this next week, we will soon be at 3.25% (high end of range) Fed Funds Target Rate (see beginning of plot curve on the above chart). Looking forward, the estimated Terminal Rate of 4.5% implies another 1.25% of raises by March, 2023.

Again, whether or not the Fed actually goes that high that fast will depend on the additional economic data we see in the coming months. It will also depend on how successful the Fed is at selling the Treasuries it still has on its balance sheet, and how much this quantitative tightening affects the liquidity of the bond market. This, and the impact it has on the money supply and availability of debt and borrowing for the overall market may end up forcing the Fed to back off from further raises sooner rather than later.

But at this point, Wall Street is betting on later. And if right, then the markets have a fair amount of pain ahead of them, both stocks and bonds.

So, my best advice is to remain well diversified and in times like this. It is absolutely prudent to hold some cash—especially for short term liquidity needs—and to slowly and carefully add to high conviction investments opportunistically when they present themselves.

That’s it. I hope you feel a little bit smarter knowing about all the federal funds rates and estimates and plots, and are ready to start interpreting these charts yourself.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

Thanks again and talk soon!

✌️James