“Some people say, “Give the customers what they want.” But that’s not my approach. Our job is to figure out what they’re going to want before they do. I think Henry Ford once said, “If I’d asked customers what they wanted, they would have told me, ‘A faster horse!'” People don’t know what they want until you show it to them. That’s why I never rely on market research. Our task is to read things that are not yet on the page.”– Steve Jobs

During the early 20th century as the first automobiles came on the scene many people were dismissive of them and viewed them as a passing fad. In 1899 the Literary Digest Magazine made the following remarks about cars, “The ordinary ‘horseless carriage’ is at present a luxury for the wealthy; and although its price will probably fall in the future, it will never of course come into common use as the bicycle.” Three years later in 1902, the New York Times dished out a similar critique when they deemed “horseless carriages” to not only be impractical but that the price would never be low enough to make them as popular as bicycles. One critic from The Times put it this way:

“Automobiling is following the history of cycling with such remarkable closeness in almost every detail, both as a sport and an industry, that the question is often asked if the present period of expansion will be followed by a collapse as complete and as disastrous as was that of the cycling boom of a few short years ago.” (1)

A year after this article was published, in 1903, Detroit attorney Horace Rackham was given the following advice by the head of the Michigan Savings Bank, “The horse is here to stay but the automobile is only a novelty-a passing fad.” He ignored this advice and went on to buy shares in the Ford Motor Company becoming one of its original shareholders. The rest was history.

Once Henry Ford perfected the mass production of automobiles with the introduction of the assembly line, the price came down and cars took off and eventually became the dominant form of transportation. The Model T was launched in 1908 and by 1918 half of all of the cars sold were Model T’s. Ford Motor Company went on to make 15 million Model T’s between 1908 and 1927, the longest production run of any car model in history until the Beetle took the crown in 1972. (2) Not bad for a passing fad.

Model T

Every new invention or technology in history has always been met with scepticism and ridicule at its inception. The telephone, electricity, airplanes and even the internet were once upon a time dismissed as fads that were doomed to fail. In most cases the media takes centre stage in these attacks and the unfortunate part is a lot of people buy into misinformed narratives that the media will be propagating about new technologies. This is partly due to misplaced trust in the media fraternity coupled with apathy towards individual inquiry and research.

Worse still is that some of these media narratives are sponsored by people with ulterior motives and something to lose once the new technology becomes mainstream, as was the case with John D. Rockefeller’s attempts to discredit electricity as dangerous because it threatened Standard Oil’s monopoly in lighting homes. In recent times Bitcoin has come under heavy attacks from the media for various reasons but the most pervasive criticisms of them all is that Bitcoin wastes energy and is bad for the environment.

In December 2017 the World Economic Forum (Wef) tweeted that by 2020, Bitcoin would be consuming more power than the entire planet combined.

Four days prior to this tweet, Newsweek published a story with a similar headline to the Wef tweet, titled, “Bitcoin Mining on Track to Consume All of the World’s Energy by 2020,” and the article further states that, “The Bitcoin network’s energy consumption has increased by 25 percent in the last month alone, according to Digiconomist. If such growth were to continue, this would see the network consume as much energy as the U.S. by 2019, and as much energy as the entire world by the end of 2020.” (3) Nothing could be further from the truth.

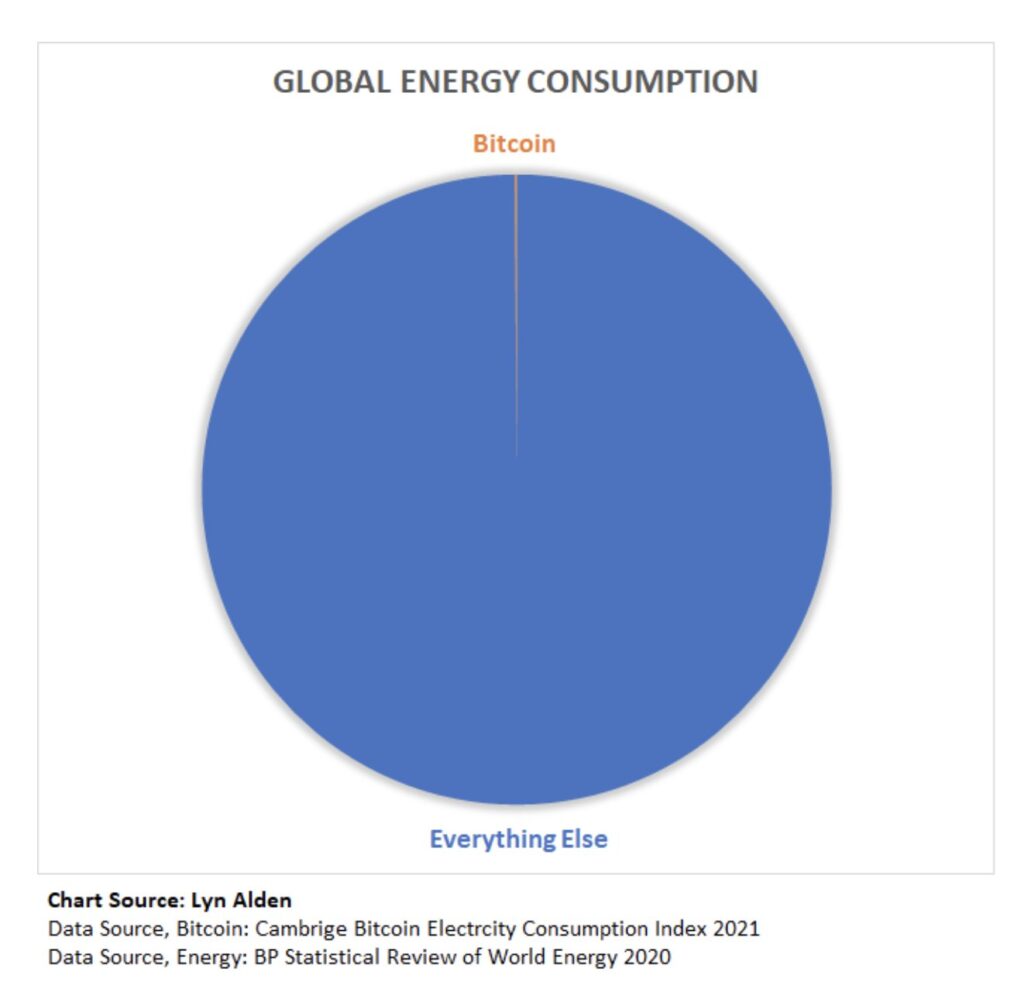

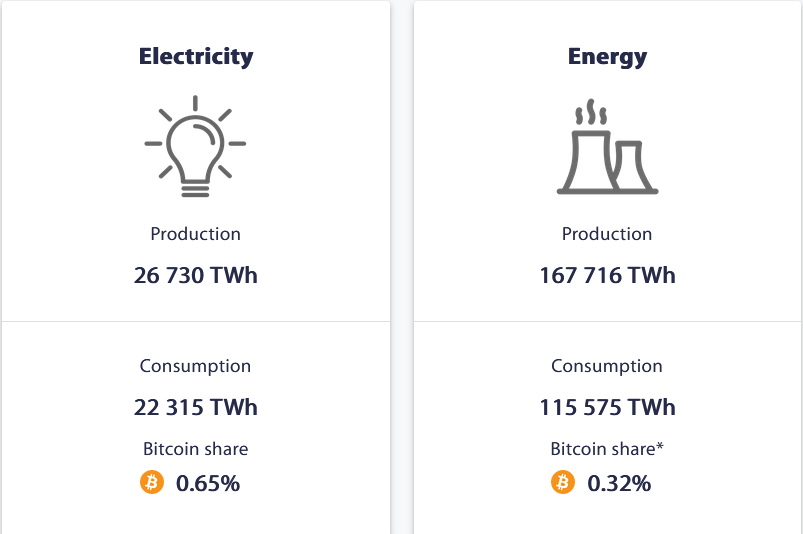

In reality Bitcoin today consumes just 0.32% of global power, way less than both the Wef and Newsweek predicted.

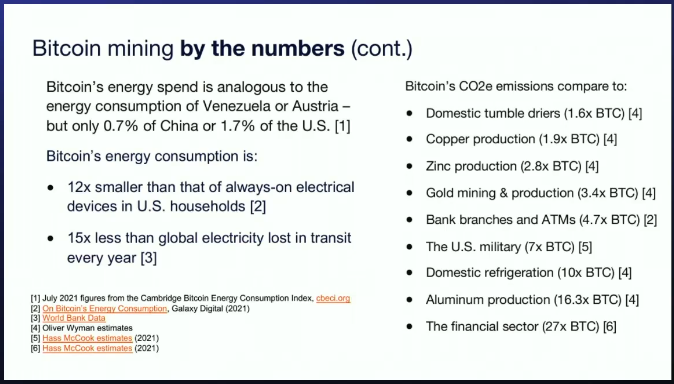

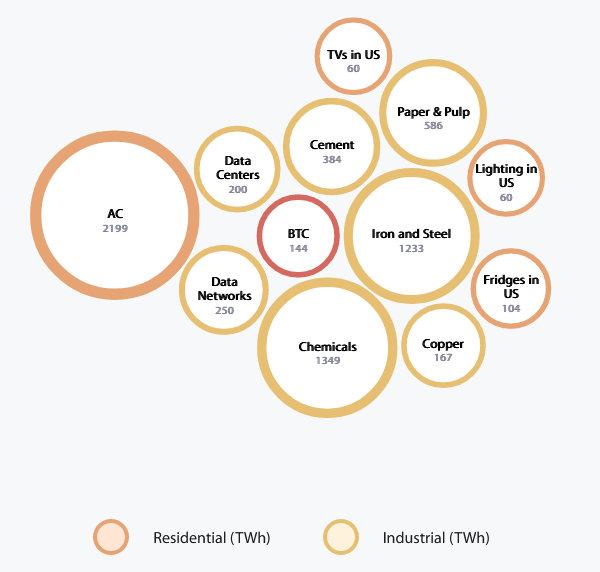

Another popular critique of Bitcoin on the energy front is that Bitcoin uses more energy than most countries. In fact in the Newsweek article cited above went on to say, “Analysis of how much energy it currently requires to mine Bitcoin suggest that it is greater than the current energy consumption of 159 individual countries, including Ireland, Nigeria and Uruguay. The Bitcoin Energy Consumption Index by cryptocurrency platform Digiconomist puts the usage on a par with Denmark, consuming 33 terawatts of electricity annually.” While it’s true that the Bitcoin network consumes more electricity than some countries, but the same is true for Google, Amazon, Netflix, the banking system, household drying machines, Christmas lights and the gold mining industry.

This argument is flawed because it inherently presupposes that energy consumption is bad and that electricity is a finite resource that once channeled towards Bitcoin mining deprives other people or more “useful industries” of it. Furthermore the claim that one usage of energy is more or less wasteful than another is completely subjective since all users have incurred a cost and paid full market rate to consume that electricity.

Source: Nic Carter, Bitcoin Demystified

Last month The New York Times ran a story titled, “Bitcoin Miners Want To Recast Themselves As Being Eco-Friendly,” and claimed that “a single Bitcoin transaction now requires more than 2,000 kilowatt-hours of electricity, or enough energy to power the average American household for 73 days.” (6) Just like in 1902 they made a statement that is not only incorrect but insane to say the very least. To the average reader who isn’t well versed with the inner workings of Bitcoin such claims seem credible, and as a result they ignorantly join the crusade to attack Bitcoin’s energy usage without doing any additional research beyond hit pieces such as the one above.

In the famous 2005 commencement speech at Stanford University, the late Steve Jobs as he was reflecting on how dropping out of college shaped his journey towards building Apple said; “Of course it was impossible to connect the dots looking forward when I was in college. But it was very, very clear looking backward 10 years later. Again, you can’t connect the dots looking forward; you can only connect them looking backward.” (7)

The same is true for new inventions and new technologies. They seem weird and pointless when they first appear but obvious in retrospect once more people understand the problem that they are addressing and as the technology itself improves. Until that happens, the average person will be hoodwinked by cleverly constructed narratives and join the chorus of attacks against something with the potential to significantly improve their lives.

Most people who were born or grew up after 1971, when dollar convertibility to gold was ended by President Nixon, have only known and used fiat money; and as such are unable to diagnose the inherent flaws within it. All they are familiar with is a central bank dominated world where government issued money, inflation and currency collapses are the rule not the exception, thus they are conditioned to accept the status quo as normal. As a result when a better form of money emerged in the form of Bitcoin it’s easier to reject it than embrace it, despite the fact that most of these people had been harmed directly or indirectly by the fiat monetary system.

The million dollar question is, is Bitcoin’s energy use justifiable? A great follow up to that would be why does Bitcoin use so much energy in the first place? This essay will address these questions while also highlighting the fact that Bitcoin’s energy usage is an important feature not a bug of this decentralized monetary network. The aim of this essay is not to get you to agree with everything that I put forward, but to objectively and critically look at the data for yourself, and make up your own mind.

“I think it’s important to reason from first principles rather than by analogy. The normal way we conduct our lives is we reason by analogy. [With analogy] we are doing this because it’s like something else that was done, or it is like what other people are doing. [With first principles] you boil things down to the most fundamental truths…and then reason up from there.” – Elon Musk

Before digging deeper into all the energy stuff let’s start by going back to first principles and understanding the fundamental problem that Bitcoin was designed to solve. The majority of the people that complain about how much Bitcoin’s energy usage inherently assume that Bitcoin is useless and therefore the network is unnecessarily “wasting electricity” which is bad for the environment. In order to fully understand the justification for Bitcoin’s energy consumption one has to first appreciate the role that money plays in an economy.

Until the role that money plays in efficiently coordinating economic activities is fully grasped, the energy cost of Bitcoin as a solution will never seem reasonable or justifiable. Why consume so much electricity for an alternative monetary network when fiat currencies such as the dollar, euro and yen work just fine? That’s the thing, they don’t work. As stated earlier Bitcoin is a solution to fix a broken monetary system, a problem that is invisible and incomprehensible to most.

For example, since 2019 Lebanon has been dealing with an economic crisis that saw hyperinflation spiral and the Lebanese pound lost 90% of its value against the dollar. As of August 2021 inflation was a whopping 290%, the highest in the world, and as a result more than 75% of Lebanese citizens are now living in poverty. Rolling blackouts are now the norm due to fuel shortages as well the shortages of medical supplies and other basic goods.

On April the 4th 2022 the Deputy Prime Minister of Lebanon, Saadeh Al-Shami, appeared on the local channel Al-Jadeed and announced to the world that Lebanon was bankrupt. “The State has gone bankrupt as did the Banque du Liban, and the loss has occurred, and we will seek to reduce losses for the people,” Al-Shami said, and he went on to say that losses will be distributed among the state, banks, depositors and the Banque du Liban, the central bank.

The simplistic view would be to see this as fiscal mismanagement on the part of the government, while there may be some truth to this, hyperinflation and ultimately currency collapse is the end game of all fiat currencies. An unstable currency made it extremely difficult for Lebanon to effectively coordinate economic activities internally as well as to produce goods that required for trade within the global economy. Currency devaluation distorts the price mechanism of the currency in question, which leads to the creation of economic imbalances.

As the currency’s ability for economic coordination weakens, supply chain disruptions follow resulting in a decline in the supply of goods (e.g. food, medical supplies, etc.) as well as unbalanced supply and demand. Hyperinflation then sets in as real goods become relatively scarce compared to the supply of money and as the very function of money breaks down, people end up hoarding real goods while offloading the currency as quickly as they can. Economic destruction by monetary manipulation 101.

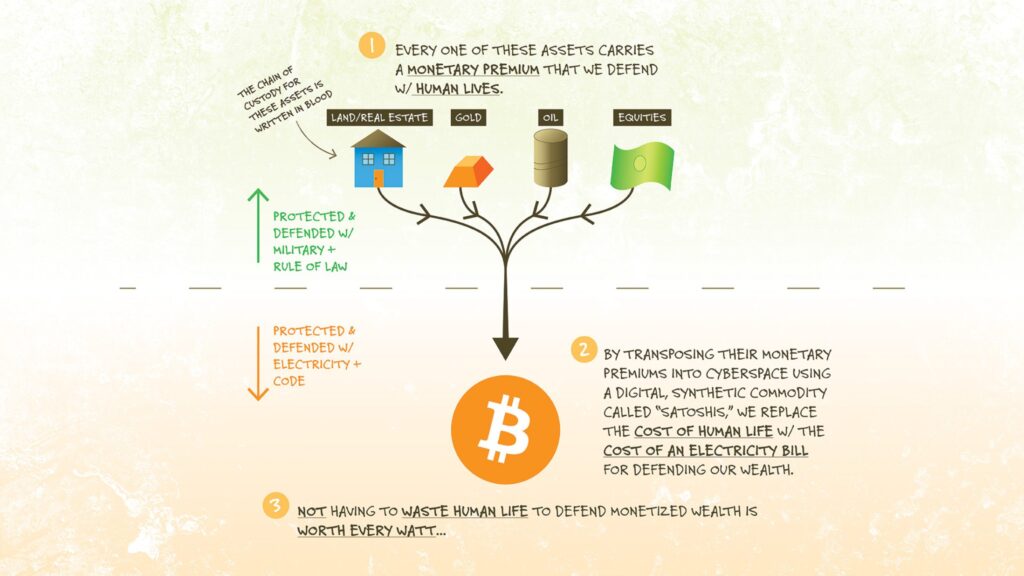

While it’s true that some economies are better managed than others the fact remains that all fiat currencies due to their common foundation eventually share the same fate as evidenced by the current increase in inflation globally. Bitcoin was designed to fundamentally fix this flawed foundation. Thus we now have an option between two financial systems: 1) a centralized currency with unlimited supply that is engineered to lose value over time or 2) a decentralized currency with a fixed supply that comes with cost in the form of energy consumption, but the positive externality being long-term economic stability. (8) Bitcoin exists to prevent more countries from ending up like Lebanon or Venezuela and is a lifeboat for at least 1.2 billion people worldwide for which hyperinflation is their present reality.

Bitcoin is a decentralized bearer asset and peer to peer payments system that isn’t reliant on any central authority for it to function. Bitcoin is also a permissionless append only ledger that is verifiable by anyone and “appendable” by anyone thus assuring the integrity of entire network and ensuring its censorship resistance. It is secured by a decentralized network of nodes (computers running the Bitcoin protocol) that validate and relay transactions; as well as validating and relaying blocks (time-stamped groups of transactions). In addition to all of the above, miners also perform Bitcoin’s proof of work function (PoW) through which blocks are generated, solved and transmitted to the rest of the network. In other words nodes validate transactions while miners, on a decentralized basis, perform a clearance function for them every ten minutes.

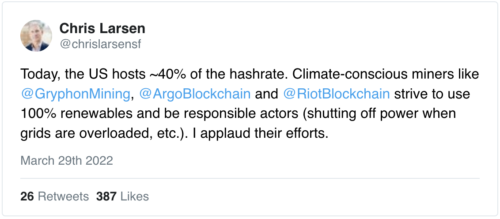

It is proof of work that riles up Bitcoin’s critics and ESG warriors the most as demonstrated by the recent “Change the code not the climate” campaign courtesy of Greenpeace, Sierra Club and Ripple co-founder, Chris Larsen, who has pledged $5m towards the cause. The aim of the campaign is to get Bitcoin to switch from the “wasteful” PoW consensus algorithm which consumes a lot of energy; by rolling out media campaigns against its use in publications like The New York Times (no surprises there), Bloomberg, Wall St Journal, Politico and Facebook to name a few. According to Coindesk the campaign will also target Bitcoin supporters such as Elon Musk, Jack Dorsey and Fidelity Ceo, Abby Johnson. In a Twitter thread Larsen said,

“On the other hand, plenty of miners are repurposing old coal & gas plants and not being responsible stewards of the amount of power they’re increasingly using (jacking up energy bills for residents/sucking power from the grid regardless of overload). This is unacceptable…Miners pledging 100% green energy use is a great start. But IMO, not a fool-proof *long term* solution because PoW simply incentivizes finding the cheapest energy, not what is the right thing to do…” (9)

It would take another article or two to unpack the flaws in Chris’s reasoning but what I can say for certain is he just lost $5m. The question of whether proof of work is wasteful or not can’t be answered without fully grasping the problem it solves. Without an understanding of proof of work, understanding Bitcoin will prove to be difficult especially where its energy usage is concerned. Unlike centralized systems, decentralized systems, do not have a single source of truth. This simply means that because there is no gatekeeper to verify the accuracy of new transactions that are being added to the blockchain, they rely on a distributed network of nodes to validate incoming transactions and add them as new blocks onto the chain.

The whole point of proof of work in Bitcoin is to create an irrefutable history of transactions and by incorporating proof of work, Satoshi built a system that made it possible to have an economic incentive for all participants to zero in on the same truth independently in a trustless manner. In other words proof of work is a consensus mechanism that enables anonymous entities in decentralized networks to “trust” one another and it ensures that blocks are only regarded as valid if they require a certain amount of computational power to produce. You could also think of it as a means for the physical world to validate something in the digital world. Thus proof of work utilizes the conversion of energy as evidence of work done.

For example, websites make you verify that you are human by solving a CAPTCHA as a type of “proof of work.” Given that the task is difficult for a bot to complete when the correct answer is provided the website knows you are human. In Bitcoin, work is computation. Computation is the bridge that connects the digital realm of bits to the physical realm. Computation expends energy thus energy is the bridge. Remove this bridge to the physical world and you will not have an irrefutable history of transactions.

Nikolai Yezhov, pictured right of Stalin, was later removed from this photograph at the Moscow Canal. (Credit: Fine Art Images/Heritage Images/Getty Images & AFP/GettyImages)…

In the absence of a central authority that decides which transactions are valid (i.e. a valid block), work is the arbiter of truth and the longest blockchain is the one with the most work put into it; which is therefore recognized as truth by the rest of the network based on the code. This is what is known as the Nakamoto consensus. Proof of work is absolutely essential as trustless digital money cannot function without it. (10) Hugo Nguyen summarized it perfectly when he said:

“Fundamentally, I believe the idea of “attaching energy” to blocks is the right one & probably the only way to simulate immutability virtually…By attaching energy to a block, we give it “form”, allowing it to have real weight & consequences in the physical world. We can also think of PoW as the magic that brings a bunch of 0s & 1s into life. In other words, PoW is the bridge between the digital & the physical.” (11)

In other words without energy as an anchor, a self-evident truthful history of transactions would be impossible. This is diametrically opposed to proof of stake (PoS) which is reliant on human validators to achieve consensus and their voting power is based on how many tokens they have staked. It’s this consensus mechanism that people like Larsen favour because it’s less energy intensive. The only problem with it is that it’s a political system which is another form of central banking that trusts humans to validate transactions. In other words it enables centralization due to the fact that network participants like Larsen that are insiders with access to “pre-mined coins” can stake more and thus control the underlying blockchain to their benefit.

Unlike fiat currencies, bitcoins are “mined” and not printed. Even though we refer to “mining bitcoins”, please bear in mind that it isn’t bitcoins that are mined. Blocks are mined, and miners are currently rewarded with new bitcoins if they find a valid block, because finding new blocks is inherently difficult. Distinguishing between “mining bitcoins” and “mining blocks” is very important because it clarifies a few things:

Firstly the rate at which bitcoins are mined is independent of Bitcoin’s energy use. This is because the rate of supply is fixed, and is not altered by how much energy you choose to expend for mining. Satoshi combined proof of work and a difficulty adjustment to that proof of work to ensure this pace remains constant no matter what. The mining difficulty is adjusted after every 2,016 blocks have been mined, which occurs every two weeks on average. This is what’s known as the difficulty adjustment, where the difficulty to mine new bitcoins is adjusted upwards or downwards depending on the combined computing power of all the miners on the network.

Think of it as a thermostat that regulates the network to maintain a consistent 10 minutes between blocks. Without this difficulty adjustment in place, the average time to find a block would drop if more miners joined the network. The reverse is also true; if the number of miners decreased significantly then there would also be a significant increase in the time it takes to find a block.

This means that every two weeks regardless of the combined computing power being contributed by miners to the network the average time between blocks may increase or decrease but it is reset back to 10 minutes. This adjustment maintains consistent block production and therefore a consistent supply schedule for the mining of new bitcoin. Presently miners are rewarded with 6.25 bitcoins for every successfully mined block and even if they decided to double their mining energy input, the number of bitcoins mined would remain unchanged at 6.25 bitcoins per block. It is the failure to understand this important aspect that leads many to believe the misleading and incorrect energy cost per transaction metric that is often touted in the media. The Cambridge University’s Centre for Alternative Finance explained it this way:

“The popular ‘energy cost per transaction’ metric is regularly featured in the media and other academic studies despite having multiple issues. First, transaction throughput (i.e. the number of transactions that the system can process) is independent of the network’s electricity consumption. Adding more mining equipment and thus increasing electricity consumption will have no impact on the number of processed transactions. Second, a single Bitcoin transaction can contain hidden semantics that may not be immediately visible nor intelligible to observers. For instance, one transaction can include hundreds of payments to individual addresses, settle second-layer network payments (e.g. opening and closing channels in the Lightning network), or potentially represent billions of time-stamped data points using open protocols such as OpenTimestamps.” (12)

In short, dividing “bitcoin’s total energy usage” by the “number of transactions” to determine “energy used per transaction” is based on the incorrect assumption that your decision to spend bitcoin or hold it has an impact on the energy expenditure of the bitcoin network that day, while in reality it has none at all.

Secondly apart from bringing new bitcoins into existence, miners are also responsible for maintaining the security and integrity of the network, confirming transactions, and signalling their support or rejection of network changes, to name a few. Performing this work is energy intensive by design and requires massive amounts of computing power contributed by miners all over the world, running 24/7. It is the work in proof-of-work and is absolutely essential. Without an understanding of the mining process, it is easy to equate the energy-intensive process of finding valid blocks with “finding new bitcoins”. This particular view makes it seem like all this electrical energy is transmuted into new bitcoins. The energy utilized is the security layer which protects the public ledger and the “creation of new bitcoins” is just a side-effect.

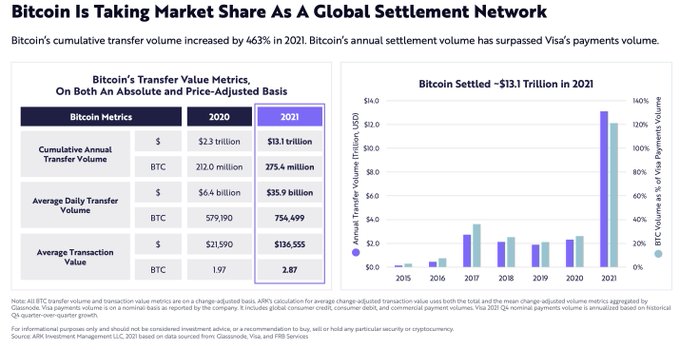

Bitcoin’s public ledger is secured by its combined computing power: the sum of all energy expended to do the work in its proof-of-work chain. Bitcoin’s energy consumption acts as an electrical barrier that secures all bitcoin balances of all users, both in the present and in the future. In 2021 Bitcoin’s annual settlement volume surpassed Visa’s payments volume, at $13.1 trillion according to Ark Invest’s Big Ideas 2022 report. This is a staggering 463% surge from the previous year’s volumes. (13) Is this not critical financial infrastructure worth protecting? For Bitcoin, those who understand the societal benefits of sound and censorship-resistant money answer in the affirmative. (10)

Source:Ark Invest. Big Ideas 2022…

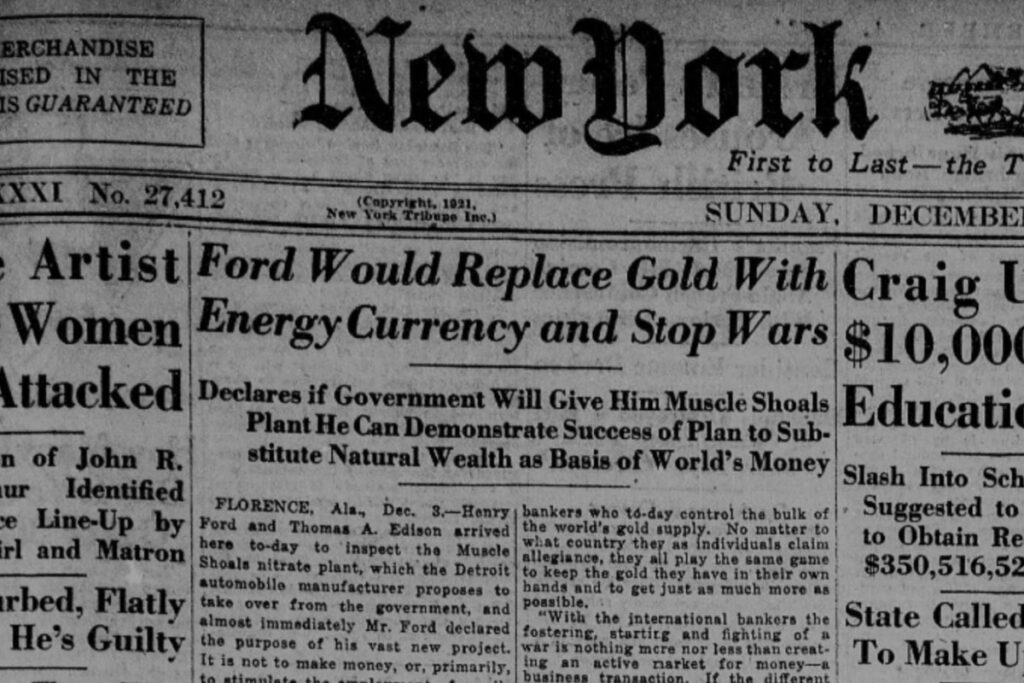

“Under the energy currency system the standard would be a certain amount of energy exerted for one hour that would be equal to one dollar. It’s simply a case of thinking and calculating in terms different from those laid down to us by the international banking group to which we have grown so accustomed that we think there is no other desirable standard.” – Henry Ford

In 1921 Henry Ford came up with a proposal to create a new currency that would be backed by energy as opposed to gold. Ford’s disdain for gold was no secret as he was quoted to have said, “The essential evil of gold in its relation to war is the fact that it can be controlled. Break the control and you stop war…Gold is the most useless thing in the world. I am not interested in money but in the things of which money is merely a symbol.”

According to an article that was published by the New York Tribune that year, Ford’s goal was to end wars which he believed to be connected to the control of money.

New York Tribune, December 4 1921

His reasoning was that wars could be ended since every country could back its currency with its “imperishable natural wealth” of energy resources. He spent the next three years trying to bid for the Muscle Shoals dam to launch this grand vision but was unsuccessful and eventually threw in the towel and said the following statement in disappointment:

“A simple affair of business which should have been decided by anyone within a week has become a complicated political affair.”

Fast forward to 2022, we now have a currency and monetary system that far surpasses what Ford envisioned in 1921 and that’s Bitcoin. After looking at why Bitcoin consumes so much energy let us look at Bitcoin’s share of the world’s total yearly electricity production and consumption with a reference to global energy production and consumption being included as well.

The above comparison that was calculated by the Cambridge Centre for Alternative Finance clearly shows that Bitcoin’s energy consumption whether measured against total electricity produced or total energy produced globally is a rounding error, at 0.65% and 0.32% respectively. Next let’s compare Bitcoin with other energy intensive industries as well as residential uses of electricity.

I don’t know about you but I can’t seem to remember the last time I read complaints in the media against the paper and pulp industry for their high energy consumption.

One thing that most ESG warriors and Bitcoin critics alike are unaware of is the fact that Bitcoin mining monetizes stranded energy assets that cannot be productively put to use. You could think of it as Bitcoin mining acting as a global battery for otherwise idle generation facilities. In such cases, Bitcoin miners are not in competition with other industries or residential users for the same resources, but instead they take advantage of surplus energy that would otherwise have been lost or wasted. Put simply Bitcoin mining recycles wasted energy, mitigates capital destruction, and provides a mechanism to rescue stranded energy no matter where it is in the world. Unlike other consumers of energy that require power to be transmitted to them Bitcoin miners are unique energy buyers in that they are location agnostic, requiring only an internet connection and they are flexible enough to easily handle interruptible load.

A lot of oil deposits usually also have associated natural gas that is either dissolved in the oil or as a gas cap above the oil in the reservoir. According to Steve Barbour, a Canadian oil and gas engineer, and founder of Upstream Data;

“When you start producing oil, the natural gas sort of breaks out, if that well is close to a pipeline, that associated gas can be sold to a power plant or used to heat homes. But some wells are a long way from pipelines, and it doesn’t make economic sense to connect them. That gas is called stranded. If they can’t use it and they can’t sell it, then they burn it, generally, and sometimes they vent it. Burning it — often called flaring — is bad for the environment. It’s all the carbon dioxide with none of the benefits. Venting it straight into the atmosphere is worse because methane traps more heat than carbon dioxide, thereby accelerating the warming of the planet.” (14)

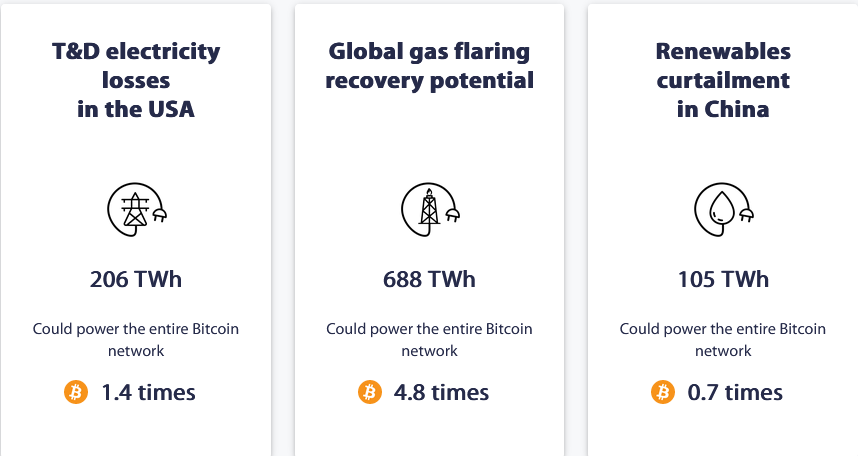

Stranded gas accounts for 40-60% of all the world’s current proven gas reserves. In a 2020 natural gas report by the US Energy Information Administration, they estimated that at least 1.48 billion cubic feet of gas per day was flared in the US throughout 2019. According to macro-analyst, Lyn Alden, this is the equivalent of 150 TWh of energy which was more than enough energy to power the entire Bitcoin network throughout 2021; just on US stranded natural gas alone. (4) North Dakota, for example, has a lot of stranded natural gas and flares 20% of all the gas it produces according to the EIA. Fortunately companies like Exxon Mobil and ConocoPhilipps have seen the light and are now selling excess gas to Bitcoin miners as opposed to flaring it.

Gas Flaring

Mining Bitcoin with this idle stranded gas not only provides an additional income stream but also allows oil companies to remain regulatory compliant while at the same time reducing negative environmental impact of their operations. This in turn also provides Bitcoin miners with a cheap energy source creating a win-win scenario in the process. Based on the comparison below, the amount of natural gas that has been flared globally so far this year is enough to power the entire Bitcoin network 4.8 times.

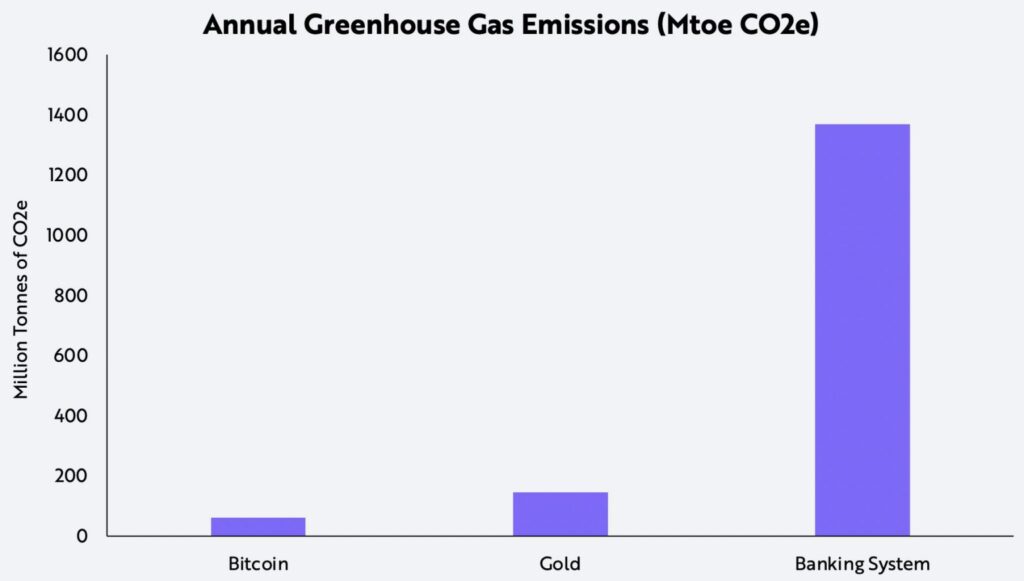

Finally on the issue of Carbon emissions, despite the fact that Bitcoin mining is energy intensive, it only accounts for 0.1% of all carbon emissions globally. The reason being that in addition to all the factors we have discussed thus far regarding, the majority of Bitcoin mining utilizes renewable energy sources. (15)

Source:Ark Invest. Debunking Common Bitcoin Myths

“The most basic question is not what is best, but who shall decide what is best.” – Thomas Sowell

In conclusion based on the findings I presented in this essay, along with many others I left out, my answer to the question, does Bitcoin waste energy is a resounding no. Most of the fud floating out there usually comes from people that have not taken the time to understand how Bitcoin works under the hood or in some cases people with a hidden agenda that will be derailed should Bitcoin replace the fiat monetary system.

The energy cost of a decentralized non-sovereign monetary network is not only negligible but justified all things considered as Bitcoin has been a financial lifeboat to people in Nigeria, Lebanon, Ukraine, Afghanistan, Venezuela, Cuba and Turkey to name a few. Unlike the fiat monetary system that is backed by guns and propped up with conquest, Bitcoin is anchored in the universal currency of all, energy and backed by the laws of physics.

While the information presented here is in no way conclusive, I do hope that at the very least you will do your own homework with regards to Bitcoin and not let your opinion be shaped by the mainstream media. Everything in our world has a cost in terms of time and energy, Bitcoin is no different. The bigger question is, are the costs justifiable? Are they worth it? Alex Gladstein summarized the overall societal benefit of Bitcoin perfectly in the following quote:

“We’re at the outset of great digital financial transformation, where the money we use on a daily basis is evolving from a bearer asset—one that doesn’t reveal anything about us—into a mechanism of surveillance and control. This is more urgent for some people in this world, and maybe less urgent for others, depending on the political regime they live under. When I’m looking at this new form of money that’s not controlled by governments or corporations, I’m thinking about the big picture of today’s world, where we have 4.2 billion people living under authoritarianism and 1.2 billion people living under double- or triple-digit inflation. When we talk about the fact that money is broken, this isn’t theoretical, and it isn’t just about one country.” (4)

Acknowledgements

As a closing note i would like to personally recognize and thank the following amazing people: Der Gigi, Lyn Alden, Saifedean Ammous, Dan Held, Steve Barbour, Michael Saylor, Alex Gladstein, Allen Farrington, Nic Carter, Ross Stevens, Uncle Marty Bent and Parker Lewis. This essay would have been a mammoth task to write had i not tapped into some of your writings.

Sources

1. The New York Times. AUTOMOBILE TOPICS OF INTEREST: Many Amateurs Are Building Machines from Purchased Parts. The New York Times. [Online] 1902. [Cited: 9 April 2022.] https://www.nytimes.com/1902/07/13/archives/automobile-topics-of-interest-many-amateurs-are-buuding-machines.html.

2. History. Ford Motor Company Unveils The Model T. History. [Online] [Cited: 9 April 2022.] https://www.history.com/this-day-in-history/ford-motor-company-unveils-the-model-t.

3. Newsweek. Bitcoin mining on track to consume all of the world’s energy by 2020. Newsweek. [Online] 11 December 2017. [Cited: 9 April 2022.] https://www.newsweek.com/bitcoin-mining-track-consume-worlds-energy-2020-744036.

4. Alden, Lyn. Bitcoin’s Energy Usage Isn’t a Problem. Here’s Why. Lyn Alden Investment Strategy. [Online] December 2021. [Cited: 10 April 2022.] https://www.lynalden.com/bitcoin-energy/.

5. Carter, Nic. Demystifying Bitcoin. The B Word. [Online] 2021. [Cited: 10 April 2022.] https://www.thebword.org/c/track-1-demystifying-bitcoin.

6. The New York Times. Bitcoin Miners Want To Recast Themselves As Being Eco-Friendly. The New York Times. [Online] 22 March 2022. [Cited: 9 April 2022.] https://www.nytimes.com/2022/03/22/technology/bitcoin-miners-environment-crypto.html.

7. Jobs, Steve. ‘You’ve got to find what you love,’ Jobs says. Stanford News. [Online] 14 June 2005. [Cited: 9 April 2022.] https://news.stanford.edu/2005/06/14/jobs-061505/.

8. Lewis, Parker. Bitcoin does not waste energy. Unchained Capital. [Online] 16 August 2019. [Cited: 9 April 2022.] https://unchained.com/blog/bitcoin-does-not-waste-energy/.

9. Larsen, Chris. Chris Larsen. Twitter. [Online] 29 March 2022. [Cited: 10 April 2022.]

10. Gigi, Der. Bitcoin’s Energy Consumption – A shift in perspective. Der Gigi. [Online] 10 June 2018. [Cited: 10 April 2022.] https://dergigi.com/2018/06/10/bitcoin-s-energy-consumption/.

11. Nguyen, Hugo. The Anatomy of Proof Of Work. Medium. [Online] 11 February 2018. [Cited: 10 April 2022.] https://bitcointechtalk.com/the-anatomy-of-proof-of-work-98c85b6f6667.

12. University of Cambridge. Cambridge Bitcoin Electricity Consumption Index. Cambridge Centre For Alternative Finance. [Online] 10 April 2022. [Cited: 10 April 2022.] https://ccaf.io/cbeci/index/comparisons.

13. Ark Invest. Big Ideas 2022. s.l. : Ark Invest, 2022.

14. Marketplace. Crypto miners use natural gas “stranded” in wells to power energy-hungry rigs . Marketplace. [Online] 25 March 2022. [Cited: 10 April 2022.] https://www.marketplace.org/2022/03/25/crypto-miners-use-natural-gas-stranded-in-wells-to-power-energy-hungry-rigs/.

15. Nic Carter, Ross Stevens. Bitcoin Net Zero. s.l. : NYDIG, 2021.

16. Ark Invest. Debunking Common Bitcoin Myths. Ark Invest. [Online] 29 June 2021. [Cited: 10 April 2022.] https://ark-invest.com/articles/analyst-research/bitcoin-myths/.

17. Ammous, Saifedean. The Bitcoin Standard. s.l. : John Wiley & Sons, 2018.

18. Lowrey, Jason. Twitter. [Online] [Cited: 12 February 2022.]

Few understand…#Bitcoin pic.twitter.com/qBlefa14AM

— Jason Lowery (@JasonPLowery) February 10, 2022

19. Held, Dan. Proof of Work is Efficient. Medium. [Online] 2018. [Cited: 10 April 2022.] https://danhedl.medium.com/pow-is-efficient-aa3d442754d3.

20. Harper, Colin. Oil Field Alchemy: How Bitcoin Can Turn Waste, Emissions into Proof-of-Work. Bitcoin Magazine. [Online] 8 May 2019. [Cited: 10 April 2022.] https://bitcoinmagazine.com/business/oil-field-alchemy-how-bitcoin-can-turn-waste-emissions-proof-work.