As we reach the 2 year anniversary since Daz starting publishing articles on Medium. We take a trip down memory lane and will republish some of these articles from 2021. While his thinking, analogies and knowledge of Bitcoin have developed, with a lot of these concepts being covered in more depth in their recently released book B is for Bitcoin, it is interesting to look back into how he thought through the concepts underpinning this beautiful protocol….enjoy.

In previous articles, we have made the case that hard money should form part of any investment portfolio. We also highlight that hard money can serve as a good store-of-value. Hard Money can also act as a medium to long-term savings vehicle for those wishing to park their currency, somewhere that is protected from debasement through inflation. Precious Metals and Bitcoin serve as hard money and can all serve as good stores-of-value long-term.

In this article we will look at Gold and Bitcoin from the perspective of market supply/demand economics and how both assets behave while subject to price appreciation. In this regard, I will show how bitcoin serves as a better store-of-value as its price appreciates over time.

One of the key features of the bitcoin blockchain protocol is the difficulty-adjustment. You may have heard this term referenced in numerous publications and podcasts if you spend any time researching the space. It is the difficulty-adjustment that is one of the main features that makes bitcoin better as a store of value than gold.

Bitcoin Mining

To understand the difficulty-adjustment we first need to gain an understanding of Bitcoin Mining. Bitcoin mining is the process by which the distributed network of miners conducts the bitcoin mining function by guessing the solution to a complex mathematical problem. Miners are simply computers on the network, over time these computers have evolved from simple desktop PCs to advanced Application Specific Integrated Circuits (ASICs) whose sole purpose is to mine bitcoin (Figure 1). The mathematical problem these computers are trying to solve is so complex that the miners cannot compute the solution other than by guessing what that solution might be.

This solution once guessed correctly by a miner, is easily confirmed to be a true and correct solution by any verifier (other computers) on the network once that answer is known. This process is known as zero-knowledge-proof. The verifiers can confirm the answer to be a true-and-correct solution to the problem, however, they do not need to know the “work” done to derive the solution, the puzzle is extremely difficult to solve in the forward direction, but easily proven in the reverse direction.

Figure 1. ASIC Antminer

It is this complex mathematical puzzle that the network of miners must solve that is controlled by the difficulty adjustment. To have a controlled release of new bitcoin supply, bitcoin’s protocol controls the release of blocks and limits this release schedule to approx. 1 block every 10mins. The more computational power on the network, meaning the more miners that are online to solve the problem, the quicker these blocks are solved.

If the rate at which the miners solve blocks becomes faster than the target of ~10mins, the bitcoin protocol will automatically conduct a difficulty adjustment of the mathematical puzzle. The protocol will automatically adjust the puzzle, making the puzzle harder to solve. The protocol needs no intermediary, governing body or 3rd party of any kind to perform this function, it is an in-built, automated function. Brilliant. This difficulty adjustment occurs every 2016 blocks (approx 2 weeks @ 10min block time), constantly readjusting the difficulty rate to align with the computation power contributing to the network. As hash-rate drops off the network, like it has done mid-2021 due to the China bitcoin mining ban, the difficulty adjustment will ease as required.

But why do we need to control the rate of release of blocks?

Bitcoin mining expends a lot of energy. The computational power required to solve these mathematical puzzles is immense. But that is what gives bitcoin its value. Without this energy expenditure, there is no value. This is why bitcoin wins as the store-of-value solution within the cryptocurrency space, due to its network effect and the sheer amount of computational power directed at the bitcoin protocol. The energy expenditure is known as Proof-Of-Work. Specifically, it is known that an immense amount of work (energy) was done in order to solve the puzzles to build the blockchain. If this requirement for work didn’t exist, all of the coins could be mined in very quick succession, flooding the market with the supply and removing the value proposition of the coins. Compare this to Fiat Currency, it takes zero work to introduce currency and central banks do it by a click of a button. Fiat currency loses its purchasing power over time and is not a store-of-value.

Value and Block Rewards

Now let’s compare bitcoin with the gold market. Large amounts of energy are expended to dig gold out of the ground. Why? Because it is valuable, and it is hard to find. It’s the same with Bitcoin. It is valuable, and it is hard to find (read: solve by way of mathematical puzzles). Vast amounts of energy is required to find, dig and process gold, it is what makes it valuable (alongside its scarcity). It is the same with bitcoin, it is valuable and finitely scarce. Unlike gold, we know exactly how many bitcoin there are currently and how many there will ever be.

21Million Bitcoin total. That’s it. To elaborate on the previous point, miners are incentivised to mine bitcoin for the potential of receiving the block reward. As of 2021, the block reward for each block is 6.25BTC per block. Each block is mined approx. every 10mins, so that is approx 900BTC released each day.

Therefore $27,000,000USD of value is up for grabs each and every day (at the current price of $30k USD/BTC, July 2021). Each block also contains transaction fees for the transactions included within that block.

That is a very attractive proposition for the miners. Only one miner will be awarded the block reward and the associated transaction fees. It only takes one miner to solve the puzzle, once found it is presented to the network and it is agreed that the solution is true and correct, and the new block (which contains transactions from the MemPool) is added to the blockchain and the block reward is awarded.

Most mining operations (farms, see figure 2) try and run many mining rigs to increase their chances of solving blocks. Many of these mining rigs are coordinated in pools. For example, I run a mines from home, I join a pool and contribute my hashing to this pool (hashing is a term used to describe the computational power allocated by a computer attempting to solve the puzzle), and as a member of the pool, it doesn’t matter which specific rig solves the problem, we all share in the reward, with my share being calculated based on how much hash-power I contributed to the overall pool. If you have access to cheap power (less than $0.08USD/kWh is often considered the base rate) this might be an option for you. I have done the math for my personal situation in Australia and come to the realisation that in most instances, I am in a better position by dollar-cost-averaging (DCA’ing) into bitcoin and running a node to support the network. I offset my energy costs when I do run miners with solar energy generation and backup battery supply.

There will be more discussion on nodes in future articles, for now, nodes can be run on normal PCs, it is simply software and a copy of the ledger. They cost very little to run and help run the bitcoin protocol and keep everyone honest. Nodes are the backbone of the bitcoin network and are the arbiters of truth.

Figure 2: Bitcoin Mining Farm — Source: https://spectrum.ieee.org/computing/networks/why-the-biggest-bitcoin-mines-are-in-china

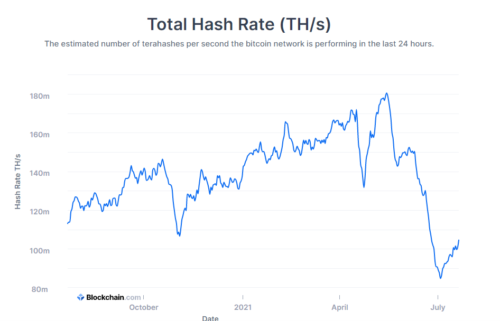

The computational power behind the bitcoin blockchain can be interrogated as a function of the difficulty adjustment and rate of release of the blocks, this metric is a good insight into the security behind the bitcoin blockchain. The higher the hash-rate, the more secure the network is. We can see in Figure 3 that the hash-rate has dropped off significantly in recent months (June-July 2021) due to the mass exodus of miners out of China. The Great Mining Migration.

China banned bitcoin mining, more than likely due to the threat Bitcoin poses to the Chinese Digital Yuan. Bitcoin removes money from state. China does not like this. Most of the Chinese-based mining operations are migrating to other jurisdictions in the search of cheap power.

Figure 3. Bitcoin Hash Rate — Source: https://www.blockchain.com/charts/hash-rate

The Halving

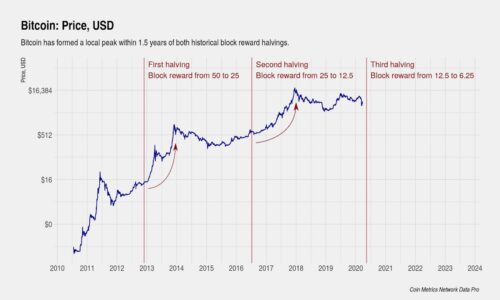

Every 210,000 blocks (approx. every 4 years), the Bitcoin block reward is halved. The block reward of the genesis block was 50BTC. 210,000 blocks later it was halved to 25, then again to 12.5 and finally, in May 2020 it was halved again to 6.25. Sometime in 2024, it will halve again and so forth until the very last block is mined in approx. the year 2140. We have another 100+ years of mining with block rewards after which the value of the transactions will be enough to sustain mining operations to perpetuity.

NB: The genesis block reward of 50BTC was made unspendible. This was amazing forward thinking on Satoshi’s behalf…We can never accuse him of benefiting from a pre-mine…respect.

The halving is one of the main reasons why we historically see a 4-year long bitcoin price cycle (Figure 3). It coincides with the halving. Some months after the halving event, the price normally soars, before finding a top, having a heavy retrace before continuing on at a much higher price than that realised prior to the halving.

Figure 3: Bitcoin’s 4 year halving cycle. Source: https://www.investopedia.com/bitcoin-halving-4843769

Think about the halving like this; If you run a mining operation, and your operating costs remain unchanged year to year, however, your reward of BTC gets halved, the logic exists that you are less likely to sell your bitcoin for any less than double the price you had previously. Theoretically, the price should at least double every 4 years on this logic. Throw in excess demand as the world adopts it as a pristine collateral, digital bearer asset and as a store-of-value and we have a very robust, “number-go-up-forever” technology.

A Price Dilemma

As the price goes up over time, miners are incentivised to increase their mining capacity. They look for cheap (and they are increasingly looking for renewable) sources of energy to tap into. The more miners that come on board, the more computational power is expended to solve these blocks and the quicker they are solved. This is where the brilliance of the difficulty adjustment lies.

Stepping back for a second to understand the gold industry and gold miners. As the price of gold increases, mining companies are incentivised to increase their operations, trying to dig as much gold out of the ground as they can. As the price increases, new geographical regions become more attractive for investments. As an example, an area that is unprofitable to set up operations and mine at $1200USD/oz gold price might all of a sudden be very profitable at $1500 and worth the investment to get it going.

The problem with these scenarios is that the gold mining companies invariably self-cannibalise their industry by flooding the market with excess supply. As we have seen time and time again in these articles, markets are dictated by supply/demand economics. As the miners are incentivised to dig more out of the ground, flooding the market with this excess supply, if the demand for gold remains unchanged, the increase in supply will lead to a decrease in gold prices. This is how we get boom and bust cycles within commodities markets.

At what price point does it become feasible to process the gold out of seawater? At what price does ocean floor deposit exploration become profitable? At what price point of gold incentivises Elon to try and mine an asteroid? The point I am trying to convey is that the rate of supply (stock-to-flow) of gold is unpredictable as it is heavily contingent on the spot price of gold.

Many economic commentators consider it a real possibility that we will reprice gold as a way to deliver a fast, sharp deflation of the massive debt bubble we are in. They argue that the price of gold may need to be as high as $50,000USD/oz to achieve this. How many more mines and jurisdictions open up at this price, and what impact does that have on our new gold price point?

But Daz, you just said that bitcoin is the same.

As the bitcoin price increases, miners are incentivised to ramp up their operations too. But……we have the difficulty-adjustment. The brilliance of the addition of this bit of code into the protocol cannot be understated. You see, the more computational energy that is thrown at the bitcoin network, the harder the mathematical puzzle becomes to solve through the automated difficulty adjustment. This is all designed to control the release of bitcoin (the flow) on the market to 6.25bitcoin every 10mins during the current epoch of the halving.

The difficulty adjustment is one of many reasons why bitcoin is better at being the store-of-value than gold is. The protocol has resolved the self-cannibalising nature that commodities experience as a result of an increase in prices. It is nothing short of brilliant. The price of bitcoin can keep going up forever and there is no possible dilution of the supply, it is deliberately controlled, within a pre-defined release schedule, until the very last bitcoin is mined circa 2140. Bitcoin is the hardest money that has ever been invented or discovered.

Conclusion

Throughout this series of articles, we have discovered the monetary and currency systems globally and how we are in a never-ending debt spiral. Central banks have no choice but to continue on their never-ending currency printing regimes, and they debase the purchasing power of the dollars you hold at an ever-alarming rate. We have put a good case forward for holding at least some of your portfolio/savings into bitcoin. If there is one point I would like to highlight, its this: Get off zero. Once you take the first step to purchase your first bitcoin, whether that is $1 worth or $1M worth, take the opportunity to further educate yourself about the asset class. The further down the rabbit hole you go, the more you come to realise that there is simply no alternative. Bitcoin will suck in the entire financial system. Take a percentage of your weekly pay, start stacking sats on autopilot every day, iron out the short-term volatility and enjoy the ride up. Bitcoin will continue going up forever, it is a built-in feature of the protocol. (Not financial advice, this is for entertainment and educational purposes only, do your own research).

Thanks for reading

Daz Bea

Twitter: @dazbea1

Recommended Reading:

“Mastering Bitcoin”– Andreas M. Antonopoulos