✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What are high yield bonds?

- What’s the high yield spread?

- Default rates and recovery

- Historic and implied default rates

Inspirational Tweet(s):

It helps that fixed income (including treasuries) have rallied in recent months. But the spread move is a big factor, with HY spreads narrowing 20bp today alone (and >150bp from peak in June) pic.twitter.com/Q0V0ww3hlY

— Jens Nordvig 🇩🇰🇺🇸🇺🇦 (@jnordvig) August 12, 2022

As Jens points out in the middle of a thread here, high yield bonds have rallied, and more importantly, high yield credit spreads have narrowed considerably recently. This signals expectations of either a soft landing or softer stance from the Fed. How and why?

Let’s dig in, shall we?

🤑 What are high yield bonds?

First things first, what exactly are high yield bonds? In the most basic terms, these are corporate bonds (bonds issued by companies) that carry a lower credit agency rating and are deemed to be more risky than investment grade bonds.

See, the best companies are rated AAA, and all debt that is rated at BBB- or above is considered investment grade. These are the least likely to default and are deemed the safest investments. Anything below this rating (i.e., BB+ or lower) is considered high yield or junk status.

What is most important to know here is that junk-rated companies must borrow at higher interest rates, as they are deemed more risky to lenders. This higher cost to borrow means a higher cost of operating their business. This means lower margins and therefore a higher sensitivity to weakening economic conditions.

So you know, I’ve written all about this before, and so if you haven’t yet read about ratings and agencies, or if you’d like a refresher, you can find those topics here.

🤏 What’s the high yield spread?

Now that you know that high yield bonds carry a higher interest rate, the next question is how does this change with the markets and what’s the spread everyone is talking about?

Keeping it simple, think of it like this:

When a bond is issued, it is sold with an agreed to interest rate and at face value, or $100. You are effectively loaning the company $100 and they are paying you 8% per year until the bond matures, when they give you your $100 back.

As for selling these bonds to the public, once it has issued, it can trade freely at any price, and everything is quoted referring to that 100 (face or par value) number.

*Note: most bonds are issued in $1000 increments, but I’ve kept the number at $100 for visual simplicity here!

Example:

Peloton issues a bond with an 8% coupon that matures on 9/1/2025, and it is trading in the open market:

PTON Corp 8% Notes due 9/1/2025 trading at 98.5

However, because Peloton is having earnings difficulties, let’s say these bonds have a risk of not being paid. What happens to them in the market?

You got it, they trade lower. And when you buy a bond for less than 100% of par value, then you effectively create a higher return for that investment. This is because if the bond matures, you will receive par (100% of face value) for your investment on top of that coupon.

In this case, if you buy the PTON bonds at 60 (60% of par value), then you are hoping to receive both the 8% coupon for the next two years and face value upon maturity ($100).

Using a bond calculator, you can determine the quoted current yield would then be 13.33%.

And the high yield spread?

Simple. It’s just the average yield of all high yield bonds versus the average of similar maturity US Treasury yields.

So, let’s say that the average high yield bond yield is 8.5% with average maturity of 5 years, and the 5 year US Treasury yield is 3%.

Then high yield spreads, sometimes referred to as junk treasury spreads, are 5.5%

🤕 Default rates and recovery

What really matters about all this is what the spreads are telling us as investors. And in the case above, we are being compensated for the risk of default of high yield bonds an additional 5.5% over the (so-called) risk-free rate of US Treasuries.

8.5% – 3% = 5.5%

But is this enough?

Well, that then depends on how many high yield bonds actually default, and how much recovery is available (i.e., if a company is liquidated in a bankruptcy proceeding, how much will be available to the bondholders to cover their loss).

A typical starting point for recovery assumption is 40%.

We talked all about defaults and recovery rates in a recent newsletter about credit ratings and CDS (credit default swap) prices. You can find that here, if you want more context for defaults and recoveries.

Back to the important question: are current high yield spreads of 421 basis points (or 4.21%) wide enough to compensate bond investors for the additional risk of the underlying companies defaulting and going bankrupt?

*FYI: a basis point or bp (pronounced ‘bip’) is just .01%. Sometimes you will hear yields and spreads quoted in bps instead of percents.

Okay, back to the question: if history is a guide, one would say no. But that’s assuming we are in a recession or headed into one. And it’s assuming a normal pattern of defaults in a recession.

😨 Historic and implied default rates

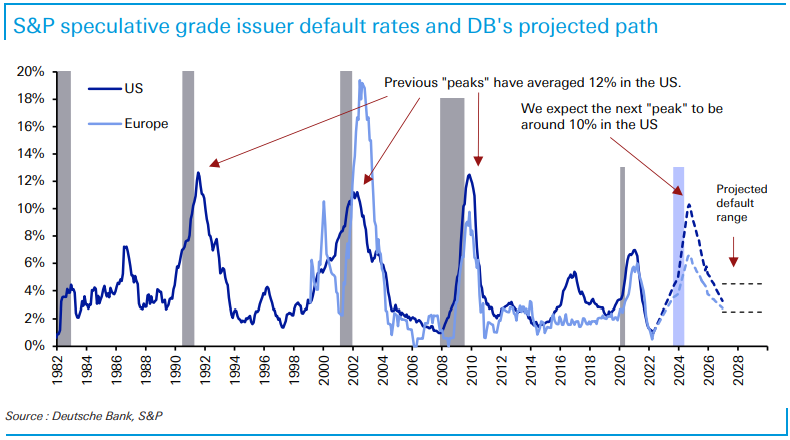

Eight weeks ago, Deutsche Bank issued a report that suggested high yield bonds were all but doomed. Analysts Jim Reid and Karthik Nagalingam projected that a recession next year would push the high yield default rate from historic lows of 1% to 5% by the end of 2023 and then over 10% in 2024.

Deutsche Bank

Some quick math says that if you own a portfolio of high yield bonds today with an average yield of 7.7%, and if 10% of those default with a recovery of 40%, then your portfolio would return:

(7.7% * 90%) – (10% * 60%) = .93%

Explaining that calculation:

First: you would only receive 90% of the yields in your portfolio, as 10% went into default and won’t pay their coupon (7.7% * 90%) = 6.93%.

Second: The 10% that went into default would be a loss of 10% in your portfolio, as this part of you portfolio would be marked to zero.

However: You would receive partial return of capital in the form of a recovery in bankruptcy, and assuming 40% recovery rate, then you would only lose 60% of this 10% (-10% * 60%) = -6%.

6.93% – 6% = .93%

So if the default rate is any higher or the recovery rate is any lower, you’re at risk of losing money in this portfolio, according to Deutsche Bank.

And this is just the nominal rate. It doesn’t take into account that we are seeing over 8.5% inflation still. Factoring this in, your real rate of return on the portfolio would be about negative 7.6%!

Hold up, you say.

Even if you have zero defaults, with the current rate of inflation of 8.5% and the current average high yield bond yield of 7.7%, isn’t this already a negative yield of 80bps?

Correct.

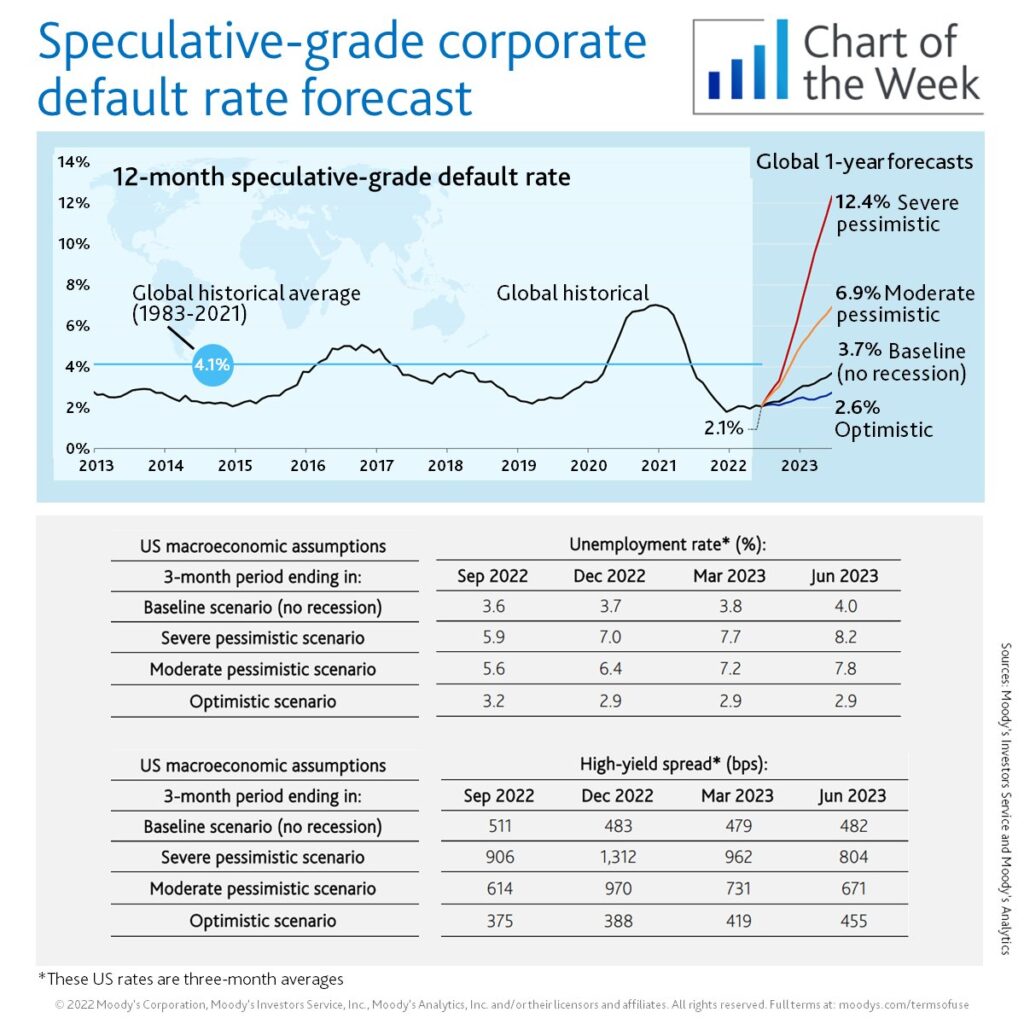

But you will have defaults. And if this recession deepens, there will be more than we are currently seeing. As a reference, here is Moody’s global historic default rate in a chart:

Desperately in search of yield, either investors believe that this recession is going to be fast and super shallow or that the Fed will do everything it can to prevent it having any impact at all. And of course that means an imminent Fed pivot, an end to Quantitative Tightening, and a lower Fed Funds target rate than previously expected.

As for me, I’ll be watching these yields and spreads closely for clues as we approach the next Fed meeting.

That’s it. I hope you feel a little bit smarter knowing about high yield bonds, the spreads to US Treasuries, and what these can tell us about the economy and investor expectations.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James