✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What’s FASB?

- Long-Lived Intangible Assets

- MicroStrategy & Paper Losses

- Corporate Treasury Influx?

Inspirational Tweet:

"The Financial Accounting Standards Board on Wednesday said companies should use fair-value accounting for measuring bitcoin and other crypto assets" – @WSJ

This is a major milestone on the road to institutional #bitcoin adoption.https://t.co/b9r8Av9uys

— Michael Saylor⚡️ (@saylor) October 12, 2022

There was a pretty big announcement a few weeks back regarding how companies account for owning Bitcoin. I can’t blame you if you missed it. I mean, accounting is boring.

FASB. Bleh. 🤮

Normally, yes. But this time around is a bit different. The latest Financial Accounting Standards Board vote opens the door for companies to buy and hold Bitcoin in their corporate treasuries without market value penalties.

And this could open the door for Bitcoin to become a widely held corporate treasury asset.

How?

Let’s walk through it, nice and easy, while making accounting a little more fun today, shall we?

🤓 What’s FASB?

First, the Financial Accounting Standards Board, known as FASB (pronounced FAZ-bee), is an independent organization that establishes accounting and financial reporting standards for US-based companies and other organizations in the United States.

The standards that they set are known as the generally accepted accounting principles, or GAAP (pronounced GAP).

As investors, why do we care?

Because the Securities and Exchange Commission—or SEC, our favorite ETF-approving (or rejecting, as it may be) investment oversight entity—recognizes FASB as the official accounting rule maker for US public companies.

And so, the rules (or principles) public companies must follow are known as GAAP.

If companies do not follow these principles, they are said to be out of compliance, and no respectable accounting firm will certify their financials as correct.

🧐 Long-Lived Intangible Assets

At the heart of why the latest FASB ruling matters for Bitcoin, is known as the long-lived intangible asset.

See, FASB originally determined that Bitcoin was to be considered a long-lived intangible asset, much like a patent, copyright, or trademark. Yes, absurd, I agree, as does Michael Saylor and other executives and investors.

The problem with this classification is how the asset is accounted for on a company’s balance sheet. Keeping it simple, here’s how it works:

Say a company buys a drug patent from another company for $100 million.

The company lists this patent as a long-lived intangible asset on its balance sheet at the purchase price of $100 million.

Let’s then say that another company then comes up with a better drug that makes this patent worth less than the purchase price. The original patent is said to be impaired in value.

The patent evaluators now say it is only worth $50 million.

The company must then list the patent on its balance sheet as a $50 million asset and recognize a $50 million loss.

Let’s then say that during the next year, the new better drug ends up making people sick and is taken off the market. People turn back to the original drug and it is just as valuable as it was when the company first purchased it.

As far as accounting is concerned, too bad.

It has been impaired. And until the company sells that patent, the asset must be held at the impaired value of $50 million.

*Note: this example purposefully ignores amortization, etc. to keep it simple for today.

OK, then how exactly does this affect Bitcoin and companies buying Bitcoin with their extra cash?

Let’s see.

✍️ MicroStrategy, BTC, and & Paper Losses

The main problem with treating Bitcoin as a long-lived intangible asset, is that it is actually a liquid asset that is traded on exchanges all around the world. As such, the price changes by the minute, and even every second.

24 hours a day, 365 days a year, Bitcoin’s price is continuously updated.

We all agree that Bitcoin is not a security, and it trades and is updated in price even more often than securities. Gary Gensler, the Chairman of the SEC has stated that he considers Bitcoin a commodity.

It goes to reason, therefore, that Bitcoin should be treated just like other tangible commodities, just like gold or nickel or crude oil.

Yet FASB initially decided that Bitcoin should be considered a long-lived intangible asset.

What this means is that if a company buys Bitcoin, it must list it on its balance sheet at the lower amount of cost or market value.

For example:

A public company uses some of its extra cash to buy $1 million of Bitcoin, and lists the holding as a Digital Asset on its balance sheet, worth $1 million.

Then Bitcoin goes up in price by 20%.

In its financials, the company cannot recognize this increase in value. It must still list its holding of Bitcoin at $1 million.

Then, let’s say that Bitcoin falls 50%, and is now worth 60% of where the company bought it.

In its financials, the company must recognize this decrease as an impairment in value and list its Bitcoin holdings at $600K, with a $400K loss.

Even if Bitcoin subsequently traded back up above the purchase value, $600K would remain the carrying value for the company’s balance sheet going forward. And the only way to revalue for the recovery in price would be to actually sell the Bitcoin and recognize a gain from the sale.

And this is exactly what happened to MicroStrategy.

Michael Saylor bought billions of dollars of Bitcoin, the price increased, and he had to still hold the Bitcoin on MicroStrategy’s Balance Sheet at the purchase price, or cost.

Then, when Bitcoin fell in value, MicroStrategy had to recognize the impairment, and list a loss on its balance sheet. Furthermore, when Bitcoin recovered in price, MicroStrategy could not recognize this recovery, and they had to keep the value on its books at that impaired level.

Even though Bitcoin had since recovered much of the value.

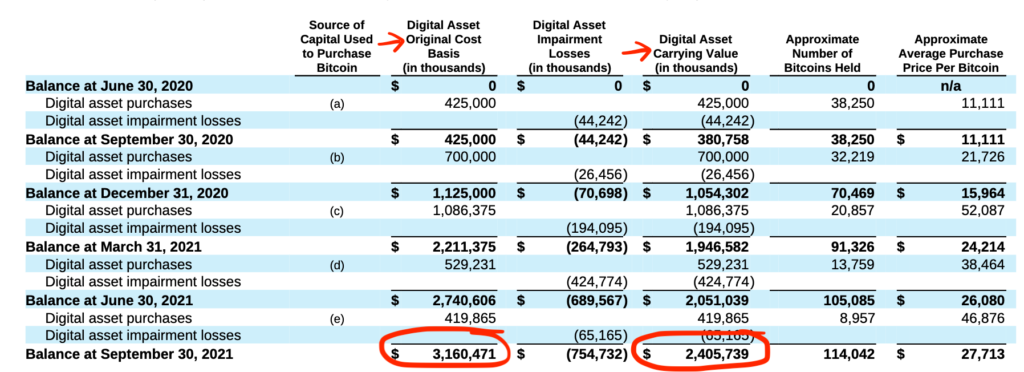

MSTR 10-Q 09/30/2021

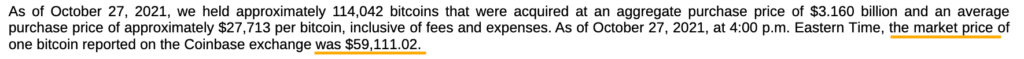

And so instead of listing the value where it was now trading in the markets, MicroStrategy had to just include a footnote to show what the actual trading value was at the time of the financial statement, instead.

MSTR 10-Q 09/30/2021

Mainstream media loved this and honed in on it, criticizing Saylor and repeating the word impaired in headlines over and over again.

So, you can see why so many companies have been reluctant to buy any Bitcoin in their treasuries, even if they were positively predisposed to the asset as an investment for a portion of their cash.

With the latest ruling, this issue has been eliminated for companies.

Going forward, if a company buys Bitcoin, they will use a recognized exchange value to mark the asset every quarter, just like they would with a stock or a bond or a commodity that trades on a public exchange.

Bitcoin goes up, it can be recognized.

Bitcoin goes down, it is accounted for.

Bitcoin recovers, it is recognized.

And with this ruling, it is most likely that any profits or losses will then flow through to the income statement and be recognized, too. Another important feature.

🤩 Corporate Treasuries Incoming?

Great! So, now there will be a rush of companies ready to invest and pour their treasury cash into Bitcoin then, right?

Right?

Well, this is significant accounting barrier that has been removed, yes. But it first must be determined by FASB how they migrate to this new standard, and exactly when.

Plus, there are other considerations for companies, such as tax regulations and risk profiles of investments. While it is true that Bitcoin has fared well over the last number of months and over the long term, especially when compared to many public stocks and bonds, the other truth is that it remains a volatile asset.

And though any experienced investor understands that volatility is attractive with an appreciating asset, the fact is that the professional upside for a CEO or CFO who invests a company’s hard-earned cash in an asset that may depreciate in value in the short term is limited.

Because most companies are widely held and not controlled by one majority holder (unlike Michael Saylor and MicroStrategy), the career risk for those in charge is just too great for them to dive in and allocate a percentage of their treasury cash to Bitcoin in lieu of say US Treasury bonds (USTs).

Why?

USTs are widely understood, they are widely considered safe. At least in that they would never go to zero.

Well, not in the short term anyway. 😉

And so, this short-term thinking and worry over shareholder backlash prevents most company executives from stepping beyond their entrenched thinking of old.

That said, there will be more executives who recognize Bitcoin as hard money. There will be those who see how Bitcoin is a better long term investment than bonds. There will be those who allocate a portion of their company’s treasury to Bitcoin in lieu of fiat-based, debasing USTs or inflation-melting cash.

And it is my belief that these will be the executives who outperform the rest over the long term. Providing their shareholders don’t remain shortsighted and focused on short term risks only.

As they say, timing is everything.

And the timing of this ruling coupled with the probability of a market recovery in the next year or so, could make some of these executives look like outright geniuses.

That’s it. I hope you feel a little bit smarter knowing about FASB and the recent Bitcoin ruling.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

Thanks again and talk soon!

✌️James