“Give me control of a nation’s money supply, and I care not who makes its laws.” – Mayer Amschel Rothschild

Africa has endured for centuries numerous conflicts and injustices. From the Trans-Atlantic slave trade to the subsequent colonization of the continent by European powers, the continent’s natural and human resources were plundered on a massive scale leaving behind a trail of economic destruction that to this day, is yet to be corrected. After the Second World War a lot of African nations started to gain independence. After losing its North African territories France, which had the most colonies in Africa after Britain, was very determined to maintain control of its West and Central African colonies.

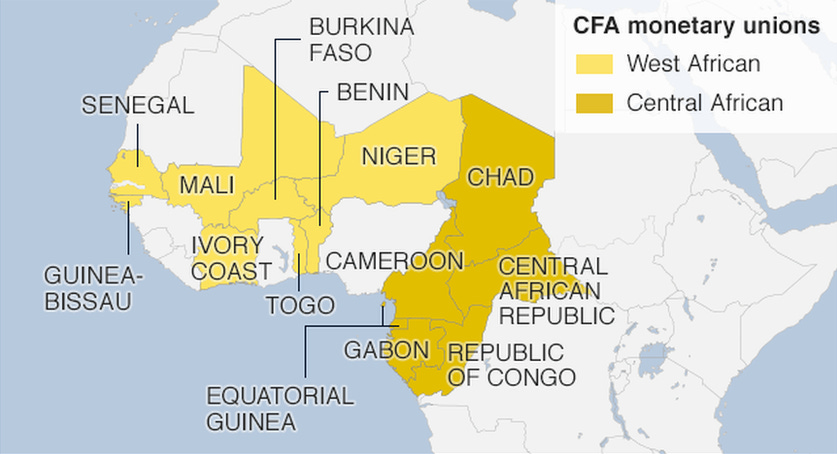

This region comprises of 14 countries and is over 2.5 million square kilometres in size with a population of at least 180 million people. In order to do this the French decided to relinquish political control over their territories whilst retaining monetary control. After France ratified the Bretton Woods Agreement on December 26 1945, the CFA franc was born; which is a Paris controlled currency that is used in these former French colonies in Africa.

At the time, the name meant “franc of the French Colonies of Africa” but was later changed to the “franc of the African Financial Community” for the countries in the West African Monetary Union (WAMU) and as the “franc of Financial Cooperation in Central Africa” to the countries of the Central African Monetary Union (CAMU). According to economist Ndongo Samba Sylla the CFA system has four pillars that underpin it.

Firstly, there is the centralization of reserves. There are two central banks that control each monetary union, one for the West African states, Banque Centrale des États de l’Afrique de l’Ouest (BCEAO), and the Banque des États de l’Afrique Centrale (BEAC) for Central African nations. These central banks hold the foreign exchange reserves (i.e. national savings) of each nation in their respective regions but they are required to deposit 50% of these reserves (currently worth about $11.4 billion) in a special account with the French treasury! These countries have no idea how these reserves are spent or managed while on the other hand France is fully aware of how each country in the CFA region spends its money.

The second pillar is the fixed exchange rate between the CFA and the Euro pegged at a rate of €1: 656 CFA francs. The member countries have no control over this peg and any adjustment of it is done by the French. This fixed rate ultimately makes exports from these countries more expensive on international markets and imports cheaper thus stunting economic growth. It also gives France the privilege of sourcing cheap raw materials in the local currency and reselling finished products to these countries in Euros. A real double whammy indeed. The third pillar is the unlimited convertibility of francs to Euros that is guaranteed by the French, and the final pillar is free movement of capital within the franc zone. The effect of these latter two pillars is that they facilitate capital flight from these countries on a massive scale.

In summary the CFA system has the following drawbacks: it severely limits economic growth and industrialization of member states, increases poverty and unemployment, and impedes trade between member states. Many African leaders over the years who have tried to oppose the CFA system were either assassinated or ousted. President of Togo Sylvanus Olympio and the President of Burkina Faso Thomas Sankara, who were both staunch CFA opponents, were assassinated in 1963 and 1987 respectively. As a result over 180 million people are being denied real opportunities for economic advancement because they are participating in an economic system that is rigged against them. Even multilateral institutions such as the IMF and the World Bank have assisted France in enforcing the CFA system. Monetary imperialism at its finest.

You may be thinking to yourself that it’s only these “unfortunate people” in Africa that are victims of this monetary colonialism but the reality is that this is not a situation that is unique to them. This is the story of everyone under the fiat monetary system, with the CFA system representing one of the extreme versions of it. As we noted in the preceding essay “What is money?” money is not an invention of the state but it’s the market that converges on a monetary medium to use in transactions. There was no decree or law that mandated the use of gold as money but gold became money on the soundness of its monetary properties. The opposite is true for fiat currencies they became “legal tender” by law (mostly through the barrel of the gun) especially after the gold standard was abandoned post World War I. This gave central banks the monopoly over the issuance of money; a privilege they have enjoyed for more than a century before the invention of Bitcoin.

In this essay we are going to explore the post-1971 global monetary order commonly known as the “petrodollar system.” It is this system that underpins global trade today and anchored the US dollar as the global reserve currency. It’s very likely that you will notice similarities between this system and the CFA system we have just briefly explored. The only difference between the two is that one system only dominates 14 African nations, while another dominates the entire globe.

“I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil.” – Alan Greenspan

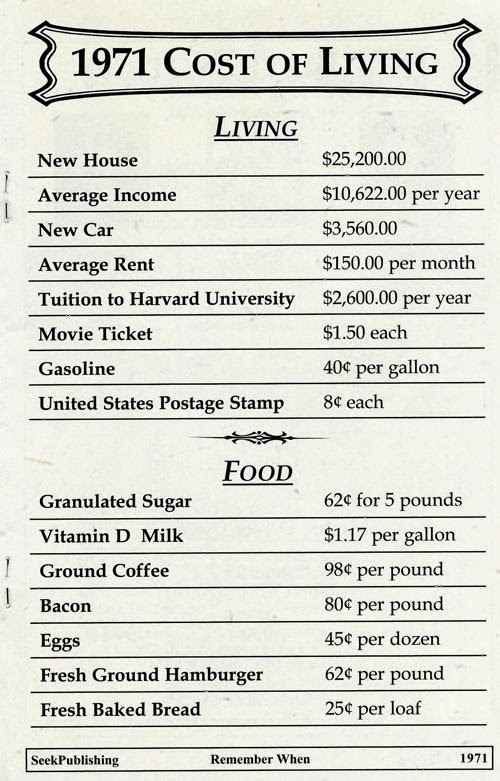

After President Nixon ended the convertibility of the dollar to gold in 1971 all of the world’s currencies became unbacked fiat paper. By 1974 due to a series of geopolitical conflicts the US economy was in a tailspin as the price of oil soared, wages stagnated, gas lines became the norm and inflation was through the roof. President Nixon brokered a deal with the Saudis (and subsequently with OPEC) that gave birth to the petrodollar system that we have today.

The terms of the deal were simple; Saudi Arabia would price and sell its oil exclusively in dollars and in exchange the US would not only buy Saudi oil but they would also provide military support and cooperation to the Saudis. This marriage of the dollar and oil in a sense backed the dollar with oil but not at a predefined rate. The Saudis also agreed to “recycle” these petrodollars from their oil revenues, by buying US treasuries (i.e. US debt) thus financing American spending.

As a result of this deal, a recurring global demand for dollars was created since every country now required dollars to purchase oil. This perpetual demand for dollars eventually led to countries pricing their exports in dollars and thus dollar hegemony in international trade was achieved.

This system does come at a great cost both domestically and abroad. According to financial analyst Lyn Alden, the petrodollar system results in the US continually running trade deficits with the rest of the world in order to pump enough dollars out into the global economy so as to maintain the dollar’s dominant position. As a result of this the deficits are paid for by foreign governments and not domestically. In other words the US has the ability to run astronomical deficits to finance wars and domestic social programs, with other countries picking up part of the tab.

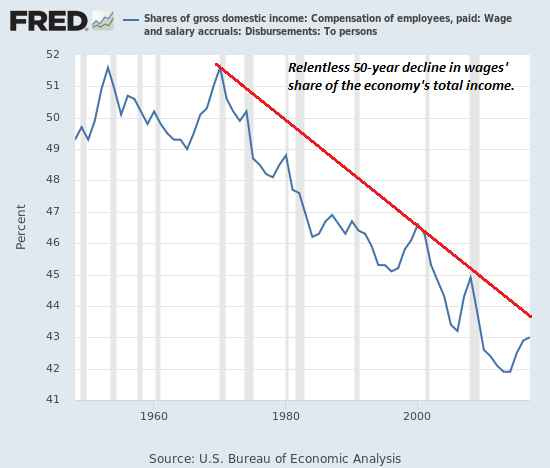

Furthermore dollar hegemony comes at the expense of American blue collar jobs that end up being shipped overseas as a result of increased cost of labour due to a strong dollar. This fuels wealth inequality due to stagnant wages, increase in cost of living and unemployment. In other words the benefits of dollar supremacy are largely enjoyed by financial institutions, asset holders and big business, while the workers bear the costs.

The petrodollar system forces emerging markets to prioritize accumulation of dollars ahead of essential domestic investment in a bid to insulate their economies from currency crises. The majority of trade in emerging market economies is dollar denominated and firms with receipts in a domestic currency acquire unsustainable debt in dollars if the domestic currency falls. This has triggered debt crises across the world like the Latin American debt crisis of the 1980’s. Latin American countries defaulted on their dollar denominated debts as the strengthening of the dollar during that period made servicing their debts impossible. This phenomenon of high dollar denominated debt against low dollar reserves was also the cause of the 1997 Asian crisis and it’s currently plaguing the economies of Argentina and Turkey. It’s also partially the reason why these countries are experiencing runaway inflation.

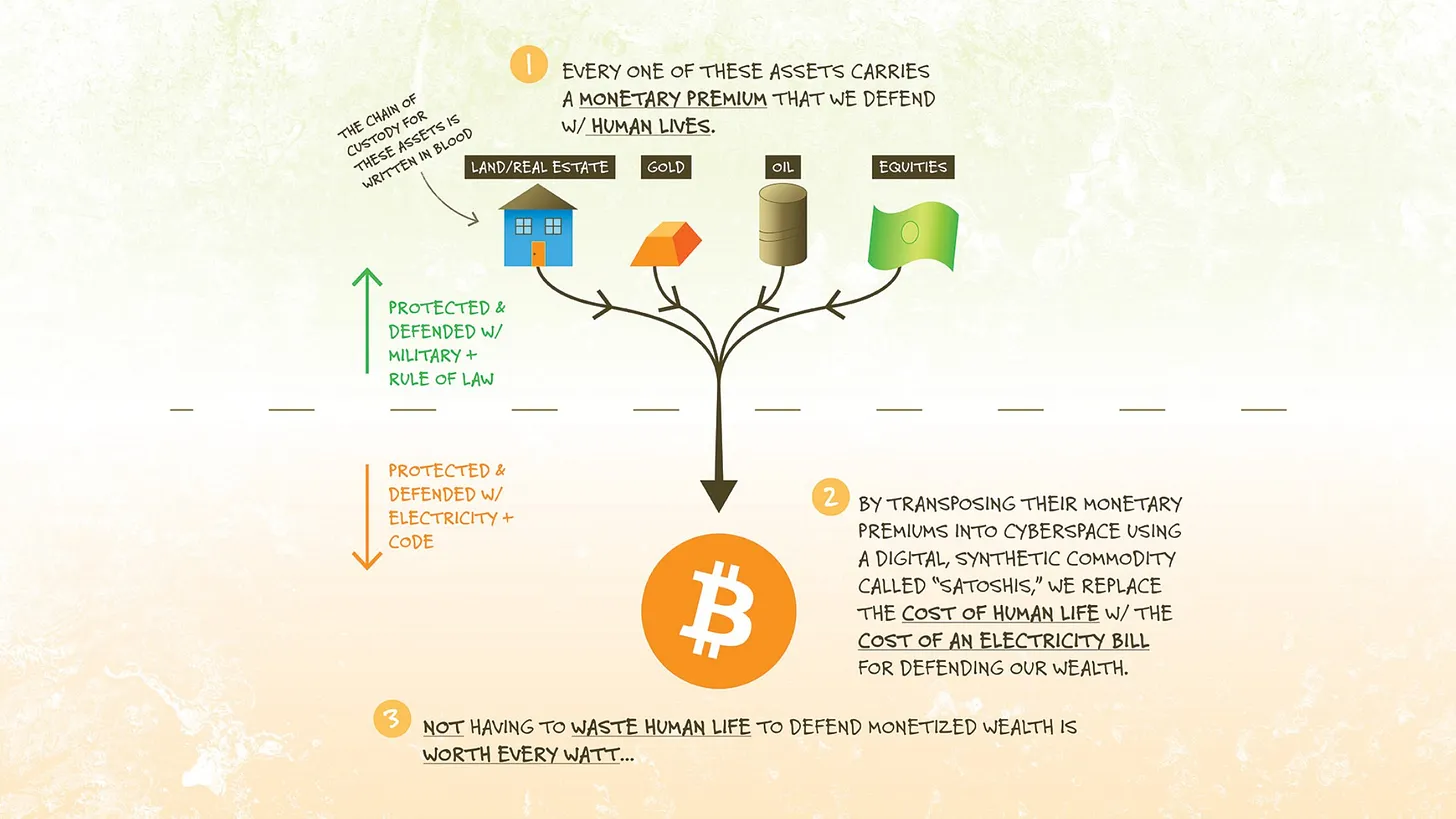

In November 2000 Saddam Hussein tried to buck this petrodollar system and decided to sell Iraq’s oil in Euros instead of in dollars. By February 2003 he had sold approximately €26 billion worth of oil however the US invaded Iraq and overthrew Saddam that same year. Iraq was back to selling oil in dollars by June of that same year. The petro-euro died an early death and everything went back to “normal”. Parallels can be drawn between this and the CFA system we discussed above. Both of these fiat money systems are backed by military might and sustaining them comes at the cost of thousands of lives. In sharp contrast to fiat, Bitcoin is sustained by a robust network of miners, strong monetary properties, and decentralized node operators glued together by the conversion of electrical energy to monetary energy. Participation in the Bitcoin network is completely voluntary. No violence or coercion required.

The whole point of assembling the pieces of this puzzle is meant to get you to see and understand the effects that the current monetary system has had on you directly or indirectly. Due to a combination of the opaque nature of the financial system, misinformed media, lack of financial education and the prevalence of “fed speak” it’s very difficult to really figure out the root cause of most societal financial ills.

Most of the world’s biggest problems are worsened by attempting to solve them from the same economic system that is responsible for their creation. This is also true at an individual level as well. Knowing the inherent flaws in the design and operation of this monetary order is an important first step in insuring yourself against them. Now that we have briefly looked at the petrodollar system and its flaws it’s time to also look at why Bitcoin is the best defence system to shield your wealth from these systemic flaws.

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” – Thomas Jefferson

In 1958 Guinea attempted to claim its monetary autonomy from the French by leaving the CFA system. In a passionate speech Sekou Touré said to the French president, Charles de Gaulle, who was visiting at the time; “We would rather have poverty in freedom than opulence in slavery.” Guinea left the CFA system shortly thereafter. Over a 2 month period the French pulled out of Guinea taking everything with them from light bulbs to sewage pipe plans and they even went as far as burning essential medicines. The message to their other territories was clear but this was just the beginning of the retribution.

The next step was to destabilize the Guinea and undermine any efforts of economic prosperity through a covert operation that became known as Operation Persil, where they counterfeited Guinean bank notes and flooded them into the country. The intention was to cause hyperinflation and economic collapse and subsequently armed insurgencies against the Guinean government. The French produced banknotes proved to be more resistant to the humidity of the Guinean climate better than the official bank notes, thus economic instability in the country was successfully triggered and the Guinean economy collapsed.

Executing such an operation would be impossible in a country with Bitcoin as legal tender as there is a maximum supply of 21 million Bitcoin that will ever exist. This supply cap not only limits central banks from inflating the money supply at whim but it also prevents external aggressors from deploying this form of economic warfare. Bitcoin becomes of strategic national importance when also viewed as a national defence system.

Perhaps the nation states under the CFA system need to consider recognizing Bitcoin as legal tender as a crucial step of attaining monetary independence from France thus ensuring the economic prosperity of their people. Unlike fiat currencies, Bitcoin cannot be colonized or counterfeited.

“I skate to where the puck is going to be, not where it has been.” – Wayne Gretzky

Last year in 2021 in an unprecedented and unexpected move El Salvador became the first sovereign nation in the world to recognize Bitcoin as legal tender. In addition to that El Salvador began to acquire Bitcoin to add to its national reserves. This move has been met with sharp criticism from the World Bank and the IMF for obvious reasons. As of September 2021, less than 3 weeks after the launch of the Chivo Bitcoin wallet by the Salvadoran government, the app already had more than 2.1 million active users according to a tweet by President Nayib Bukele. By January 2022 this had risen to 4 million users out of a population of 6.5 million people. Considering that 70% of the country is unbanked this was a huge achievement.

El Salvador is also set to roll out Bitcoin bonds in March 2022 in order to raise $1 billion, with half being used to acquire more Bitcoin and the rest being utilized to build Bitcoin mining infrastructure. The significance is this move becomes apparent when one considers the problems with the petrodollar system that we have explored; as well as the fact that El Salvador went through a currency crisis when the Colon collapsed before dollarizing in 2001. In addition 22% of its GDP comes from remittances and they are heavily reliant on imports. This is a topic that will be covered in depth in a future essay.

Fidelity Digital Assets in their report titled, “Research Round-Up: 2021 Trends and Their Potential Future Impact,” made the following observation concerning Bitcoin that is worthy of note;

“History has shown capital flows to where it is treated best and embracing innovation leads to more wealth and prosperity. We also think there is very high stakes game theory at play here, whereby if Bitcoin adoption increases, the countries that secure some Bitcoin today will be better off competitively than their peers. Therefore, even if other countries do not believe in the investment thesis or adoption of Bitcoin, they will be forced to acquire some as a form of insurance. In other words, a small cost can be paid today as a hedge compared to a potentially much larger cost years in the future. We therefore wouldn’t be surprised to see other sovereign nation states acquire Bitcoin in 2022 and perhaps even see a central bank make an acquisition.”

Based on this remark by Fidelity we can conclude that more nation states are set to follow in El Salvador’s footsteps in 2022 and beyond. . Russia has announced plans to recognize Bitcoin as a foreign currency and regulate it as such. Given the current tensions between Russia and the West it would not be far-fetched to imagine a scenario where the Russian Central Bank would add Bitcoin to its treasury.It makes more sense to hold an appreciating asset like Bitcoin in the national treasury than US treasuries that are yielding a maximum of 2.24% against a 7.5% inflation rate.

Companies like Tesla and Microstrategy have also added Bitcoin to their balance sheets as a treasury reserve asset. In fact as of time of writing over 1.5 million Bitcoin is held by nation states, public and private companies representing about 7.24% of the 21 million Bitcoin that will ever exist. As the threat of inflation continues to manifest more and more corporations are expected to acquire Bitcoin as it is the best performing inflation hedge.

The same holds true for you as an individual. Why would park your savings in a fiat currency that is designed to depreciate over time versus Bitcoin which by design appreciates over time? Consider this thought for a moment; if the world has over 50 million millionaires against a total of 21 million Bitcoin, that effectively means that there aren’t enough Bitcoin for every millionaire on earth to own 1 full Bitcoin. Wouldn’t it make sense to get some in the meantime?

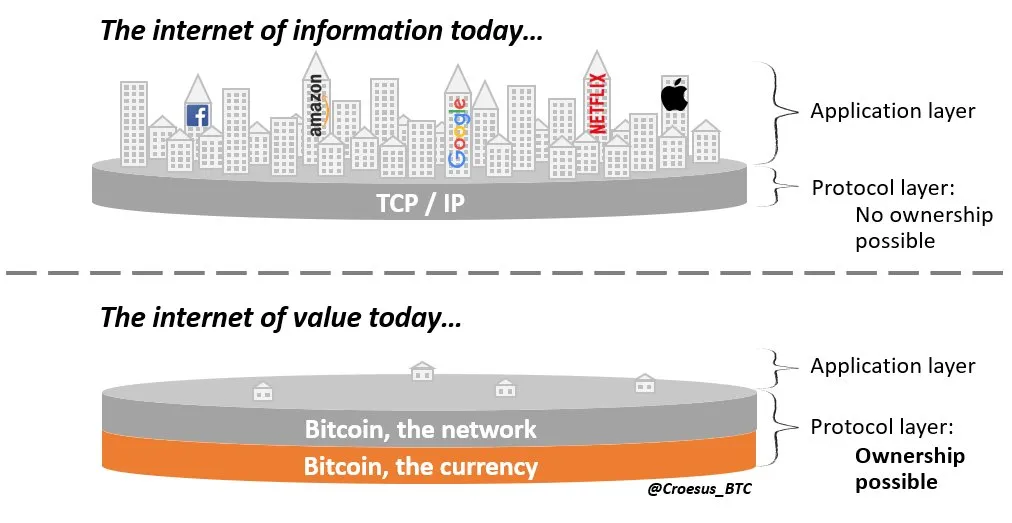

Apart from that, owning Bitcoin is analogous to owning a piece of the internet itself (aka as the internet of value) plus a global settlement layer. This is something that was not possible in the internet of information. Think of it as being able to own the foundational layer of the internet and getting exposure to all of the innovation on top of it (e.g.,Google, Facebook, Netflix etc.) without having to bet on a specific company. In order to fully understand the full magnitude of this opportunity that Bitcoin presents, a paradigm shift in this area is an absolute necessity.

One of the best ways to frame Bitcoin and thus understand it better, is as a defence system for your wealth against the inherent weaknesses of the fiat monetary system. Bitcoin is also a glimpse into the future and is honest money which is the foundation for the internet of value. Bitcoin is a parallel system for resisting all forms of monetary repression and a savings technology for the preservation of value across time. After studying historical episodes of inflation a few observations stood out: No one affected gets compensated, policymakers play the blame game without taking any responsibility and neither will they apologize.

Today the cracks in the petrodollar system have become more apparent than ever as it seems the world is moving towards gradual de-dollarization. China and Russia recently concluded a 30 year gas deal that will see Russia supplying China with gas and settlement will be in Euros not dollars. In fact, dollar denominated transactions between the two countries now make up only 33% down from 98% seven years ago. As the push for reducing fossil fuel usage and as more renewable energy sources gain traction, what will be the fate of the dollar and its oil peg in a world that no longer revolves around oil?

The US’s share of global GDP has shrunk over the years from over 40% after World War II to about 15% currently. As the global economy continues to grow larger and energy markets with it, it’s no longer practical to trade in a single currency that only represents 15% of the pie. In its current form the petrodollar system’s days are numbered and there’s no single country’s currency that’s big enough to replace it. Once again Bitcoin has a shot at perfectly filling this role to become the next global reserve asset. No one knows when the petrodollar system will collapse but in the meantime all you can do is take action to protect yourself.

Acknowledgements

1. BTC, Croesus. Twitter. [Online] [Cited: 12 February 2022.]

With #Bitcoin, it's possible to take an ownership stake in the entire Internet of Value.

This was never possible with the Internet of Information.

This is one of the tricky paradigm shifts new investors must wrap their heads around to understand Bitcoin's full magnitude. pic.twitter.com/bVs2ZqG3gw

— Croesus 🔴 (@Croesus_BTC) March 3, 2021

2. Lowrey, Jason. Twitter. [Online] [Cited: 12 February 2022.]

Few understand…#Bitcoin pic.twitter.com/qBlefa14AM

— Jason Lowery (@JasonPLowery) February 10, 2022

3. Fidelity Digital Assets. Fidelity Digital Assets. Bitcoin First. [Online] [Cited: 12 February 2022.]