If you’ve spent time studying Bitcoin, most will agree with this statement. If you haven’t, most will be confused. Some may even be angry at the statement. Don’t you check the price of Bitcoin in United States Dollars? Bitcoin is dead, it has crashed. How can you be bullish on Bitcoin?

BUYING: Great question! Well, there are several reasons. First, let’s talk about whos buying Bitcoin. Even though #Bitcoin is down 63% year to date and 73% from the November 2021 all-time high, PLEBS (aka plebeians, aka retail, aka ordinary people) are buying Bitcoin aggressively.

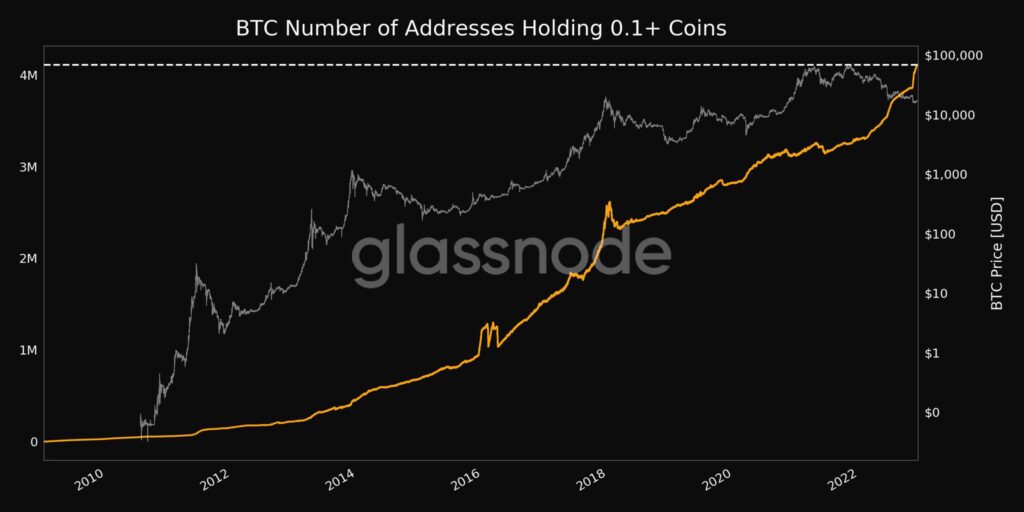

Addresses with great than 1.0 Bitcoin are nearing 1 million users. This trend line has been consistently rising for much of 2022.

Addresses with greater than 0.1 Bitcoin have now exceeded 4 million users. These charts illustrate a consistent demand for Bitcoin, regardless of Bitcoins trading value in United States Dollars (USD). What do these buyers know that others don’t? Why do they continue to accumulate this asset?

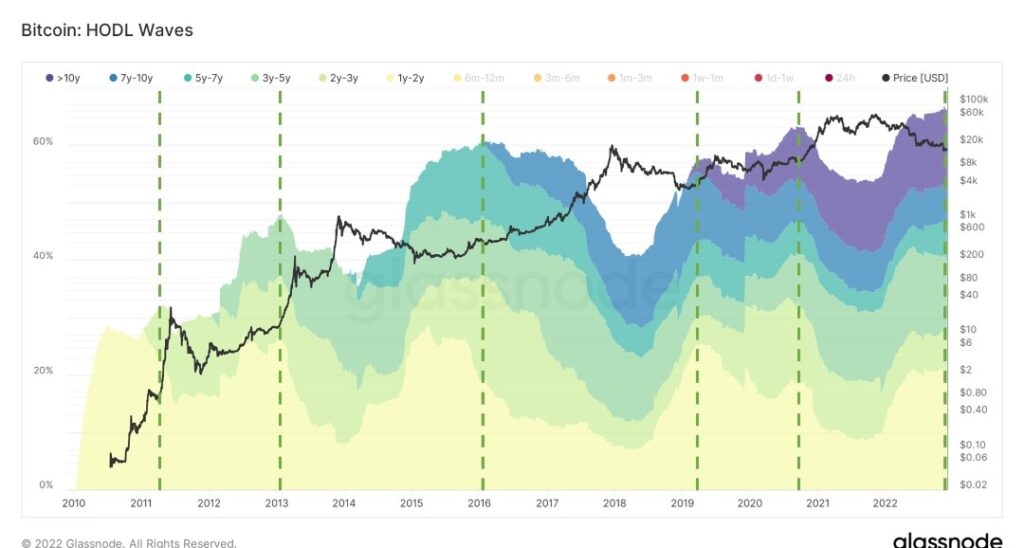

LACK OF SELLING: As I mentioned previously, I am very much aware that the price of Bitcoin (in USD) has crashed. I understand. Despite the crash, 66% of all Bitcoin hasn’t moved in a year. This means that all weak hands and over-leverage are gone.

I’m able to illustrate whos buying and who isn’t selling because the Bitcoin Network is a free, open-source, and public blockchain, where all addresses are publicly available for all to see (pseudo anonymously). This is healthy. The floor/foundation is being set for the next leg up.

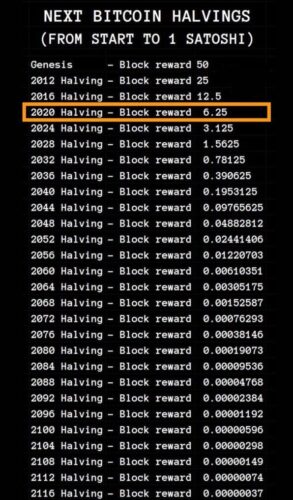

TIMING OF 4-YEAR HALVING CYCLE: Every 4 years the supply of new Bitcoin issued (which is also the reward that all #Bitcoin miners receive for verifying a block) is cut in half. As of today 6.25 BTC are ‘mined’ every 10 minutes. That’s 900 BTC/ day, 328,500 BTC/ year.

In April of 2024, the reward is cut in half to 3.125 Bitcoin every 10 minutes. The total supply of coins remaining % wise matches the block reward. Meaning in 2024 there will only be 6.25% of the total 21,000,000 Bitcoin left to mine. In 2028, there will only be 3.125% of the 21,000,000 Bitcoin supply left to mine.

Let us use 10 years from now as an example. In 2032, the reward will be 0.78125 Bitcoin every 10 minutes. That works out to 112.5 Bitcoin/ day, 41,062.5 Bitcoin/ year. 8 times less Bitcoin to mine than today. Compare this to the supply of fiat money issued by central banks (which is expanding at an exponential rate) and you have quite the juxtaposition between the two systems.

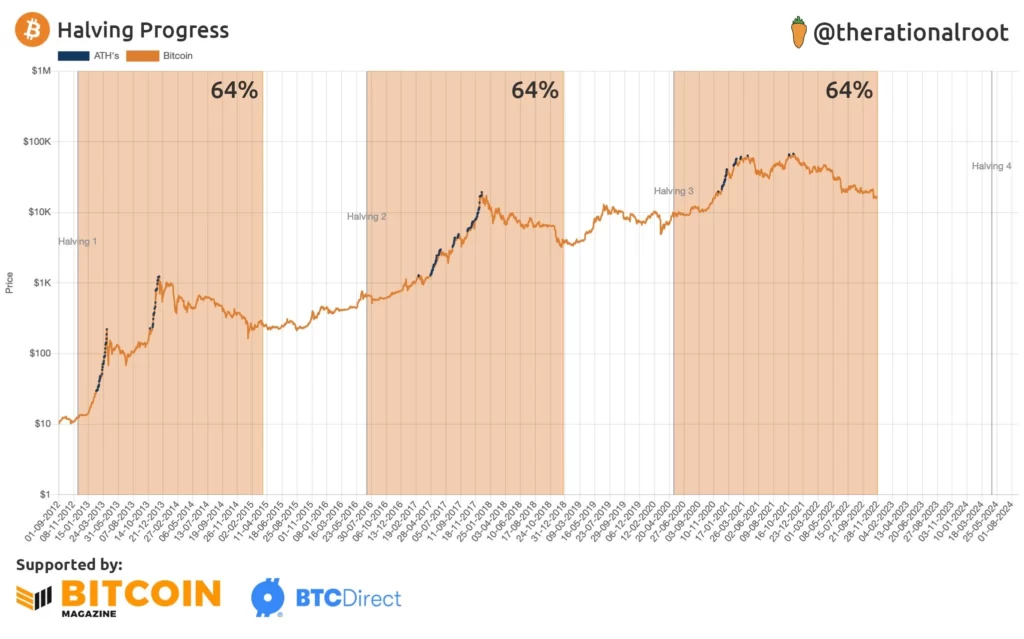

If the last 3 halving cycles are any indication, 64% of the way (in time) toward the NEXT halving marks the bottom of the cycle (in terms of lowest Bitcoin price in USD). 64% occurred at the end of NOV ’22.

LESS BITCOIN ON EXCHANGES: People are also removing their Bitcoin from exchanges and taking self-custody. In March 2020 there were 3,200,000 BTC on exchanges. At the end of November 2022, there were 2,301,548 Bitcoin. Less Bitcoin on exchanges means people are taking self-custody of their Bitcoin. It also means less paper Bitcoin. If everyone purchased their Bitcoin from an exchange and immediately took self-custody in a cold storage wallet you wouldn’t be reading about BlockFi and FTX.

EXCHANGE DEFAULTS: Speaking of exchange defaults, a lot of people lost a lot of money & it’s terrible. Having said that, the point of failure in all this carnage is not Bitcoin or the Bitcoin network. The failure is in the OFF & ON ramps TO BITCOIN.

QUESTIONS ANSWERED here about this🧵(thx for all the engagement!)

1) what do u mean by paper #bitcoin?

2) is all leverage bad?

3) why so sure that a leverage-flush reckoning day will come for bitcoin? Gold investors have waited forever.

4) can't traders hedge the risk? (haha, no) https://t.co/DsD3OupfOc— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) December 19, 2021

Caitlin Long sounded the alarm about ‘paper’ Bitcoin last year in an excellent thread found on Twitter (dated December 19, 2021). Many thought they bought Bitcoin, only to now realize they had purchased an ‘IOU’. It’s been hard to watch the paper Bitcoin market unwind, but it isn’t Bitcoin the asset that has caused these exchanges to melt down. It has been unethical & immoral individuals. Long-term, fewer scams & paper Bitcoin claims are good for Bitcoin. Defaults highlight the importance of proof of work & proof of reserves. Bitcoin is open source. You say your exchange has 10,000 Bitcoin, show me the address. Show me your work. The days of trusting PEOPLE are done. Verify.

BITCOIN NOT CRYPTO: One thing that’s becoming very clear to people as ‘crypto’ tokens keep blowing up. There is Bitcoin & everything else. Michael Saylor explains the differences between the two asset classes in the video below.

Bitcoin is an ethical commodity, all of the other tokens are unregistered securities. If a person can make a decision it’s not a commodity, it’s a security.

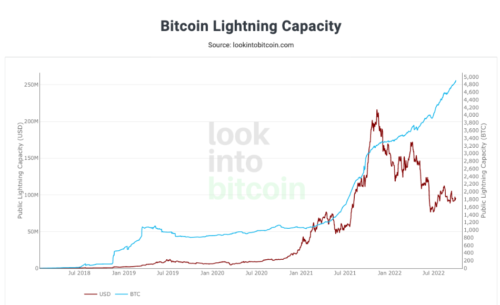

LIGHTINING NETWORK (LN) GROWTH: The Bitcoin network is also showing growth on the 2nd layer lightning network. Over the last 12 months, as the USD price declined, the capacity of the lighting network has grown to 5,000 BTC. The Lightning Network allows users to send and receive money faster and with lower fees than the base layer of the Bitcoin Network. The more capacity of the network, the more liquidity is on hand.

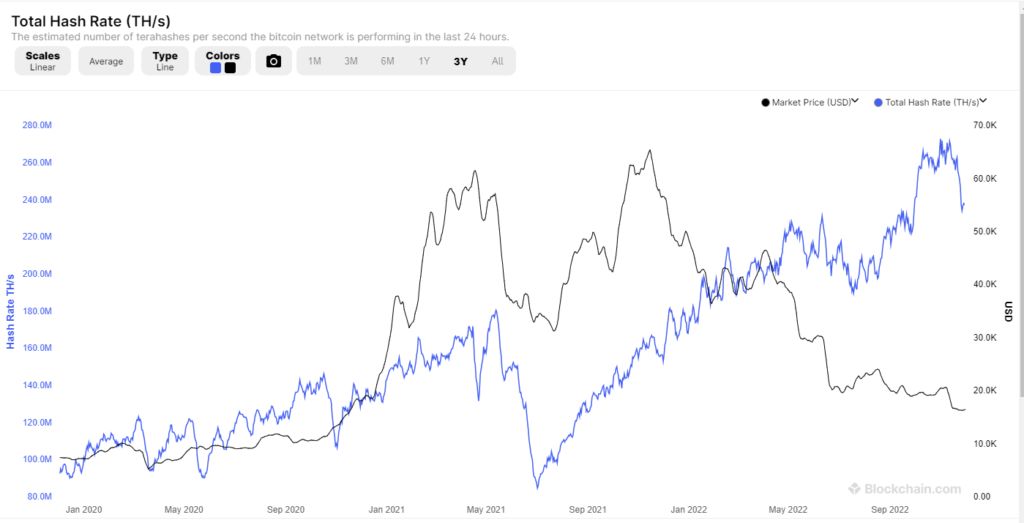

HASH RATE (HR): Bitcoin’s hash rate refers to the amount of computing power that’s being contributed to the network through ‘mining’. The first miner to find the solution to the problem receives the next block of bitcoin rewards. Bitcoin hash rate is generally considered to be a health indicator of the network. A higher hash rate (high processing power) typically means greater security for the Bitcoin network. Despite the last 12 months of price decline, the hash rate of the network is rising.

CONTINUED BITCOIN ADOPTION: Bitcoin is now legal tender in 2 countries (El Salvador & Central African Republic). Brazil passed a bill LAST WEEK regulating Bitcoin. Africa’s first Bitcoin conference took place in Ghana in early December.

Bitcoin is for everyone, including your enemies. Russia’s head of Congress finance committee has indicated Bitcoin will ‘definitely’ be legal next year, while demand for mining has skyrocketed. Bitcoin is a real-life game theory.

I want to reiterate that all of the growth items I’ve touched upon here have occurred WHILE the price has corrected by 73%. This is what people that haven’t dug in & learned about #Bitcoin are missing. There is a groundswell of growth occurring RIGHT NOW. Most check the #Bitcoin price in USD & formulate their opinions solely on this ONE point of info (like my best friend Jim). They are missing everything I’ve highlighted above.

Most think Bitcoin has died. In reality, it’s never been more ALIVE.

*Disclaimer: This article should not be taken as legal investing advice, I am wrong 100% of the time. The choice is yours whether to invest in any asset or not (Do your own research).

Want to check out more of our articles, click here to head back to our homepage.