I am writing this article for my friends and family in the hope that we can all better understand inflation. By taking a deep dive into inflation, what it is, what it is not, and how it works will allow us to better understand how inflation will impact your savings and your ability to continue to provide for your family.

This article is relevant to anyone that earns dollars for a living or relies on earning dollars to feed themselves and their families. Yep, this sounds very broad, but inflation really does affect every single person. The further away you are from “wealthy”, the worse inflation affects you. Inflation is a hidden tax on lower and middle-class people. Please, I urge you to read on and share this article with as many people as you think would benefit from it. I have tried in a vain attempt to minimise its length. Still, unfortunately, it was difficult to relay the important messages in any less time. Again, I urge you to stick with it until the end, where I share with you a few ideas on how to protect yourself from the inflation we are already experiencing.

Most of my friends and family are what are to be considered hard-working, middle-class people. They grind away in their day jobs, swapping their time and effort for currency. I have used a specific word choice in that preceding sentence…. “currency”. I purposefully did not use the word money. Throughout this article, you will see that I will purposefully use the word currency and not the word money. We often use these terms interchangeably, but I explain the difference between these two terms in this article.

We swap our time, sweat and tears for currency, which we then use to swap for goods and services, to make our lives better (or simply to survive). Most of us have mortgages, a moderate amount of debt, and after we pay for food, energy, education, clothing, insurances and other myriad bills and expenses, if we are lucky, we can put a bit aside for a rainy day.

If we are fortunate, we can look further outside of the rainy-day funds, and we can look to perhaps invest any excess currency we accumulate along the way. “Make our money work for us” is a mantra we have heard before. We try and accumulate assets. Assets are what we think of as “stores of value”, and we hope that once we acquire them, the price will appreciate. As a result of this appreciation, our wealth and net worth also appreciate. Everyone has different goals in terms of wealth. Still, most of us are aligned in the general thesis that we want to be able to retire one day (when the government says we can) with enough in the bank to provide a comfortable few years after a lifetime of servitude.

But we need not only be talking about retirement. All of us want to create better lives for ourselves. We want to provide better futures for our children. The way we were brought up was to save our currency. “Put it in the bank; it’s the safest place.”

The major problem with this age-old thesis is that governments are determined to achieve inflation. In fact, they mandate it. Inflation is, I believe, the single most important threat to the working class and their savings. While many of us have a general understanding of what inflation is, the vast majority are ill-prepared for its effects or aware of exactly how much inflation we are experiencing. I hope to be able to shed a little light on this subject. Let’s start with an explanation of inflation and how it affects savings.

Inflation

A quick google search defines inflation as this:

“A persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money.”

This sums up inflation beautifully. A persistent decline in the purchasing power of money(this should say “currency”). Ok, but what does that mean exactly?

When I was a kid, a million dollars seemed like a huge amount of currency. It still sounds like a huge amount of currency, but do we think it would be enough to retire on?

Consumer Price Index

First, let us backtrack slightly. The US Fed Chair Jerome Powell has said that their ideal inflation rate is anywhere from 2–3%. They have also mentioned that they would be willing to let inflation run hot for a while to make up for the lack of inflation over recent years. When the Fed talks about inflation, they are referring to CPI which we will explore further a little later in this article. Thinking back to our definition, inflation is the constant rate of erosion of your purchasing power. If the cost of goods and services goes up by 3% every year, by definition, the purchasing power of your dollars in your bank account erodes by the same amount each year (we must account for interest rates, but we will touch on these soon). As an example, if you were to buy a loaf of bread and it costs $3, but next month it is $3.10. You have just experienced 3.33% inflation. Remember when Grandpa says, “When I was a kid, bread was 2p”. What ‘ole Gramps is talking about is inflation.

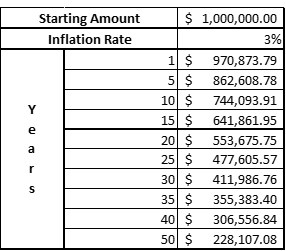

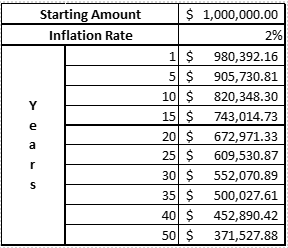

So, what does a 3% interest rate do to our purchasing power over time? Table 1 shows what $1M looks like in purchasing power in the future in today’s dollars. To put it another way, say you are 37years old now and your goal is to save/invest/grow-your-wealth to $1M by the age of 67 for retirement. That $1M in 30years is equivalent to ~$412k if you were to compare it to what it will buy you today. A tiny little inflation rate of only 3% can erode more than half of your purchasing power over 30years. $1M doesn’t seem like all that much to retire on now.

Table 1. $1M in terms of purchasing power with 3% inflation.

Now you might be thinking to yourself, “ohh but Daz you have used the highest of the Fed’s “wish-list” inflation targets”. Well let’s look at 2% then. This is the minimum amount of inflation they deem “acceptable” from their ideal target. Table 2 shows us that 2% doesn’t erode your purchasing power over the same 30years by a whole 50%…sorry about that…. but I think most would agree that at $550k in today’s equivalent purchasing power, the figure is still quite alarming. They are signalling that they aim to reduce your purchasing power each and every year.

Table 2. $1M in terms of purchasing power with 2% inflation.

I should clarify that when the Fed talks about inflation, they refer to Core Consumer Price Index (Core CPI). CPI is a weighted basket of goods they use to track inflation. You may follow the financial media outlets closer than most people and have now thought to yourself that this 2% CPI target is wishful thinking, we haven’t printed numbers that high in decades. Australia’s official CPI print for the year 2020–21 as of March 2021 was 1.1%. The US Core CPI print for the 12mth comparison for April 2021 was 4.1% and May was 5% however. (This article was first published in 2021, the 2022 Figures have seen inflation prints as high as 7.9%). The US is starting to experience higher than expected Core Inflation figures for the first time in years.

There is a major problem with this Core CPI number though, that is that the basket of goods changes over time. The same basket of goods when they started reporting it in the US in 1980 is not the same basket of goods that they report on today. It is like comparing apples with oranges. There are many good arguments supporting why that is, such as the emergence of technology like the internet and mobile phones. However, the problem with technology is that it is inherently deflationary, which means that these services get cheaper and cheaper over time. I remember the good old days of spending upwards of $150/month for my mobile phone, whereas I could call unlimited people and use data endlessly for less than $80 today. The deflationary pressures of technology have put downwards pressure on the average core inflation figures. For every percentage point that technology puts on the downside, it is distorting the figures from other things we need in our lives.

But guess what? Here is the real kicker. The US’s inflation rate does not include Food or Energy costs. You heard correctly. Food and energy are “apparently” too volatile to include in the current calculated basket of goods. The US CPI basket is often referred to as being filled with the things we want (TV’s, mobile phones, computers) not the things we need like hmmmm, say……I don’t know…. food for my kids to eat, or electricity to heat/cool my home? WTAF?

Here is the FAQ about it on their website:

Has the BLS removed food or energy prices in its official measure of inflation?

No. The BLS publishes thousands of CPI indexes each month, including the headline All Items CPI for All Urban Consumers (CPI-U) and the CPI-U for All Items Less Food and Energy. The latter series, widely referred to as the “core” CPI, is closely watched by many economic analysts and policymakers under the belief that food and energy prices are volatile and are subject to price shocks that cannot be damped through monetary policy. However, all consumer goods and services, including food and energy, are represented in the headline CPI.

Source: https://www.bls.gov/cpi/factsheets/common-misconceptions-about-cpi.htm

Let me translate the above for you. We have a butt-load of indices. But we only care about and talk about the “core” inflation rate which does not include food and energy.

Guess what else they don’t track? …….. Taxes. Say no more on this one, suffice to say that over 1/3 of my wage goes towards taxes each year. Tax accounts for a large amount of my expenditure and should factor in somewhere when these people use these figures to determine monetary/fiscal policy.

And, of course, the housing figures they use are “some sort” of representation (or misrepresentation) of shelter costs. Still, they don’t account for massive real estate asset bubbles and the affordability or serviceability of ever-increasing debt burdens.

What’s the Real Inflation Rate?

So, with a US core inflation print of 5% for May ’21, imagine what it is really like if we factor everything else in?

Well lucky for us, we don’t have to imagine it. A gentleman by the name of John Williams maintains a site called Shadow Stats (http://www.shadowstats.com/) where he keeps tracks of US CPI figures against what they were like in the 80’s and 90’s. We can see from Figure 1. that the CPI print using the same basket of goods in the 90’s and again in the 80’s are ~8% and ~11% respectively in the latest print and anywhere from 5–10% historically.

Figure 1. CPI print using 1990 and 1980 CPI baskets.

What does an 8% print do to our $1M over thirty years? The result is not good. As we can see in Table 3, with 8% inflation, our $1M is only worth an equivalent of $99k in purchasing terms. Yes, you read that correctly. And in only ten years your purchasing power reduces by more than half!!

Table 3. Inflation at 8%.

Real inflation is what we experience every day, and real inflation is way higher than what their official figures represent. And it is crippling the lower and middle class.

Admittedly, Australia’s CPI figures do actually contain a lot more of “what-we-need” rather than items of “what-we-want”. In saying that, as a household, my family has seen a noticeable increase in grocery bills each week and our health insurance premiums rose 9.67% from last year alone.

It is worth highlighting that the US plays a very influential role in global financial policy. Being the global reserve currency, US Treasury bond rates largely act as the peg for interest rates around the globe, when the US sneezes, everyone else catches a cold.

Interest Rates

It is evident from these previous examples of inflation what we experience in terms of the reduction in our purchasing power is potentially a lot higher than what officials advise. Couple with this, increasingly lower interest rates we receive from our savings deposits in financial institutions. Traditionally, the interest we earned from banks is what protected us against inflation. This isn’t the first time we have seen high inflation, although you would have to be over 50 to remember. But we are near the zero-bound in terms of interest rates, and it is plain to see that our purchasing power is not being protected by the traditional means of having savings in a bank. Not only are our savings not being protected they are being eroded at an ever-alarming rate. My related articles on fiat, bonds and asset bubbles provide further insight into why we have near-zero interest rates (or even negative rates if you live in the EU), and why we are unlikely to see significant interest rate increases in future to curb this inflation. Suffice to say for now that we have created a massive debt bubble that will explode if the Fed allows interest rates to spike, and this could be even more devastating to the global economy. To reiterate, we are not likely to see significantly higher interest rates any time soon and not without significant pain to lower and middle-income earners in the interim.

What do we do about it?

So how do we protect ourselves, our families, and our savings from inflation? Simply put, minimise your exposure to fiat currency. Fiat currency is that which governments (and non-elected entities such as Central/Reserve Banks) can print out of thin air. It is the same stuff that you swap your hard-earned time for day-in-day-out. But they print more and more of it each day, putting more in circulation. Basic supply and demand economics state that an increased demand (i.e more currency in the system), chasing the same amount (if not fewer) of goods will lead to increased prices. It is the Fiat Currency doing most of the damage. It is the central banks’ (remember these are non-elected persons) ability to print currency out of thin air that is one of the main drivers for inflation and the collapse of your purchasing power. If this does not make you at least a little bit angry, I am sorry, I have failed to explain this effectively.

But I digress, back to the question at hand “How do we protect ourselves from inflation?” Put simply, we need to convert our fiat currency into something that will act as a “store-of-value”. Hard Assets and Hard Money serve as “stores-of-value”.

Hard Assets

Hard assets are assets that cannot be created out of thin air (i.e printed by a central bank). Real estate is an example of a hard asset, they can’t make more land out of thin air. However, most people can’t afford to just go and buy a few houses without leveraging themselves (borrowing). Borrowing is not good in this type of environment. It is true that inflation should lead to increases in wages. However, any increases in wages will severely lag the realised inflation we experience. In this circumstance, if you are too exposed to debt, you may struggle to service this debt in the interim as the cost of goods and services rise. It may be wise to reduce any debt wherever you can. Too much debt may mean you lose it all.

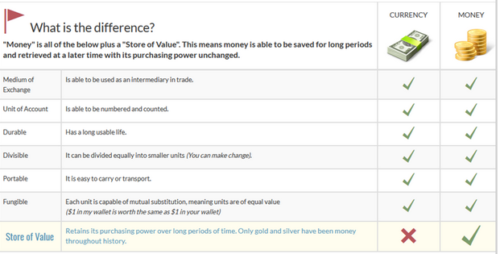

The best way for us lower/middle-income earners to protect ourselves from inflation is through hard money. Did you notice I used the word “money” that time? That is because this time when I say money I mean money. Let’s have a look at the fundamental principles of money and the principles of currency. Figure 2 shows that currency and money share many principles. All but one which is the most important principle, that is the principle of money being a store of value.

Figure 2. The Principles of Currency and Money

Money, as a store of value, should be something that you can earn by swapping your time for it, but, once you have it and once you hold it, it should maintain (or even increase) in purchasing power over time.

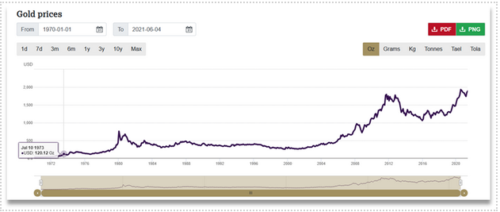

Precious metals, in particular Gold and Silver, have served the function of sound, hard money for thousands of years. Not much has changed. The introduction of the fiat currency standard we now face has seen their use diminished over time. One thing that has remained true for Gold and Silver, they have maintained or increased their purchasing power. Let’s look at the price of gold in USD over time (figure 3), you don’t need to be an expert in math or accounting to see that the chart goes up. Albeit with some periods of sideways price action, the overall trend is up. One way we can look at it is not that it has gone up in price, it is that its purchasing power has increased over time when we compare it to the USD.

Figure 3. Gold price in USD.

Gold and Silver have been shunned in most investment playbooks over the past decades. It has been labelled names such as a barbarous relic or a pet rock. It is true that Gold and Silver have failed to compete with other investment vehicles such as the stock market over shorter periods of time. The argument against gold and solver is that they do not “yield” anything. What that means is that they do not let off free-cash-flow, they do not pay a dividend or pay any interest, and therefore they give you no income. And while this is true, we have not really needed hard monies in the past as much as we do today. We have not lived in a high-inflation-low interest environment before. I agree that if you can get 5% or 6% interest in a bank and inflation is only 3%, owning gold does not make a lot of sense. But we are not living in that environment.

As discussed already, interest rates are near zero (let us for argument’s sake say interest rates are 1%, which my banks are nowhere near btw, but let us give them the benefit of the doubt) and inflation is anywhere from 5–10% (let’s settle for 5% to be illustrative). We can use the following formula to work out our real rate of return:

Real Rate of Return = Interest Rate - Inflation Rate

For our first (fantasy) example with an interest rate of 5% and an inflation rate of 3% our Real rate of return would be 2%. That means our purchasing power would be increasing by 2% year on year, this is good (not great, but good).

In our second example (real-world example) with an interest rate of 1% and an inflation rate of 5%, our real rate of return is –4%. That means our purchasing power is reduced by 4% year on year, this is not good.

So, if we compare a guaranteed reduction in purchasing power of –4% as a “reward” for having our money in the bank, why don’t we say “Fuck You” to the banks and hold hard money like gold which will go up in value over time? When we compare the possibility of increased purchasing power versus the guaranteed alternative of a reduction in purchasing power, this should be an easy decision.

Now for full disclosure here, Silver is way more volatile than Gold. Volatility means that Silver is subject to manic price swings. Gold takes a little more to get excited. Be prepared for volatility, but with volatility can come greater reward. For those who like a little more risk, you can add silver to your investment strategy. For those who don’t like price swings, stick to the gold. I am also not advocating to go and put every single cent you have in Gold or Silver. Anywhere from 10–20% of your liquid worth (i.e currency available to invest) is enough to hedge yourself against inflation. Go a bit harder if you understand this more of course but 10% is a good starting position.

The Gold/Silver ratio is a ratio you can track and follow to help you size up if you should be buying Gold instead of Silver or vice versa. If the Gold/Silver ratio is below 50, buy more gold than silver, if it is above 50, buy more silver than gold. Ideally, you would want to end up with a total allocation of something like 70% of your precious metal’s investment being in Gold and around 30% in Silver.

Physical metal is the best way to own precious metals. This means buying it from a bullion dealer or mint directly and holding it in your hot little hand. There is nothing better than the security and peace of mind you get by knowing you have access to hard money at all times.

Personally, I am not a huge fan of having this sort of wealth and exposure in my home. There are 3rd party private vaults you can use (I prefer these over safety deposit boxes at banks), or I prefer to use a combination of allocated and unallocated holdings with a reputable Bullion Dealer (many will argue against this and I totally get the argument of trusting a 3rd party, however, this is a personal choice for me, if you have a way of holding physical metal securely yourself, that is the ideal scenario). The difference between allocated and unallocated storage comes down to how they manage your metals internally at the dealer. Allocated usually means your metals are numbered (serialised) and allocated specifically to you as the owner. Whereas unallocated means they will allocate the metals you purchase to a non-serial-numbered stack of bullion inside the vault, e.g if 100 customers buy 100oz’s of gold total, then 100oz’s are simply added to their unallocated section of the storage vaults.

There are also some very handy modern-day solutions to purchase precious metals with the introduction of cryptocurrencies. Many bullion dealers now tokenise gold and silver. To demonstrate this, Ainslie Bullion in Brisbane, Australia, have ERC-20 tokens (if you don’t know what this means, stick around for future articles or google Ethereum ERC-20 tokens) for Gold and Silver. These ticker symbol for these tokens are AGS (Silver) and AUS (Gold). Ainslie will tokenise a kilo of Gold by putting a kilo bar of physical gold into their vault and releasing 1000 tokens (claims) for this bar with each token representing 1g of Gold. You can then purchase fractionalised tokens of gold on crypto exchanges like CoinSpot. This unlocks the ability for everyday people to get exposure to gold and silver investing that otherwise would not be able to afford to. Not everyone has $2400AUD available to drop on an ounce of gold in one hit. This means you can buy 1c of gold at a time if you wish. By dollar-cost averaging you can buy a little bit every single day. There is a slight premium that you pay above the normal spot price of a physical ounce of gold (spot price is the price you see on the news when they report on the price of gold), but the convenience of being able to buy small portions whenever I want is a reasonable compromise. Plus, the spot price you pay for physical metal does not usually include shipping or insurances, so your landed price would be higher than the quoted spot price anyway. Having tokenised gold also allows you to sell it quickly if you need to. Physical metal is a little more cumbersome to sell when the time comes. The downside, you are putting trust in a blockchain called Etheruem. Not all blockchains are created equal, and that leads us to our next item.

So far, we have looked at both Gold and Silver as being good stores of value for your savings. Bitcoin is also an excellent store of value. Yes, it can be extremely volatile, but it is volatile to the upside. Meaning that it goes up on average over time. Bitcoin can have huge swings high and low, but year on year it has averaged ~200% appreciation. So, on average, for every year you have held bitcoin, you have doubled your money.

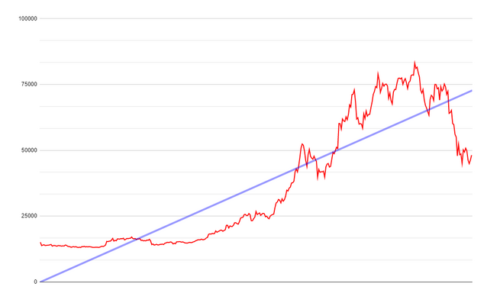

As an example, we just had a massive down-trend in the bitcoin price (which presents a great buying opportunity btw) from $65,000USD all the way down to as low as $30k in a little over a month. (published in 2021). There are many good arguments as to why we experienced this recent downtrend, if you are interested in reading a bit about this you can read an article about why this may have happened ***Insert Link*** here. But, if you deploy a dollar-cost-averaging strategy to your bitcoin purchases over time, you will be buying all of the highs as well as all of the lows so you will benefit from the mean average of the number going up.

Here is a great example of the power of dollar-cost-averaging, this is a non-sugar-coated realistic example of performance, as I am including the recent 50% drawn down in price action in this example. In this example, if you were to have set up a dollar-cost-averaging strategy to auto-purchase $10USD of Bitcoin from the 1st of June 2020 to the 1st June 2021. You would have invested $3650USD over that period. You would now be the proud owner of 0.21084968BTC (or 21,084,968 Satoshi’s). Those 21,084,968 Satoshi’s are worth $7483.61 (using the price of bitcoin on 01/06/2021) for a cool 114% profit of $4193.61.

For the Aussies, your $10AUD per day for 365days meant you spent $3650AUD, receiving 0.15250842BTC (15,250,842 Satoshi’s). This would be worth $7198.40 for 97% profit of $3568.40.

I think everyone would agree this is slightly better than the banks negative-yielding interest rate.

Dollar-cost-averaging removes all the volatility out of the asset price over time. When we use dollar-cost-averaging you smooth out the curve, your purchasing becomes the nice linear blue trendline you see in Figure 4 below.

Figure 4.Daily Price Action of Bitcoin 01/06/2020 to 01/06/2021 and the resultant trendline.

But how do we know the number will keep going up? There are a number of reasons that the price of bitcoin will keep going up, for now, simply know that hedge funds, money managers, financial institutions, family offices and even countries (yes countries i.e El Salvador) are all starting to accumulate bitcoin. We call buying bitcoin “stacking sats” (meaning: stacking satoshi’s), a big wave of institutional adoption is coming, and it is our opportunity to try and accumulate it before them now. There will only ever be 21million Bitcoin, the 21millionth bitcoin will not be mined until the year 2140, and there are around 18.5million in circulation as of 2021. There is an ever-increasing demand for bitcoin with a dwindling supply (the exact opposite of what we see with fiat currency). More demand with fixed supply means the price will continue to appreciate.

But……don’t go aping in like a savage. We still need to exercise some caution. I do not recommend putting every single dollar you have into bitcoin (not financial advice). It does come with some risk, and you do not want to be on the receiving end of a massive 80% drawdown (they do and can happen). Once you make a purchase, promise yourself it is the beginning of your educational journey so that you hold conviction with what bitcoin is and what it solves. This could be the single best piece of advice I can give you, learn about bitcoin so that you don’t get shaken out of your position if it does have a big drawdown. It is still an immature asset class in terms of time and adoption, but this is swiftly changing. There are incredibly good reasons why the wealthy are starting to accumulate bitcoin. They know about this fiat system and its problems too, they wrote the playbook.

Now you might even be thinking “I simply can’t afford $3600” per year like in my example. That is cool, you do not have to. The awesome thing about bitcoin is that you can buy 1sat if you want to. That is 0.00000001BTC which is worth a fraction of a cent (a purchase of such a low amount would of course be subject to the limitations of the exchange you choose to use) but on CoinSpot Australia I have purchased $0.01 of bitcoin, gold, and silver tokens just to prove that I could. That means that it is accessible to absolutely everyone. You can take a position as big or as small as you like.

Bitcoin is not a “get-rich-quick” scheme, you won’t buy some bitcoin today and be able to retire next year, it is a savings vehicle. This does not mean that your net wealth cannot appreciate meaningfully though, mine sure has. Just start using bitcoin gold and silver as your savings accounts, even if you can only afford $5/week. Skip the morning latte and start stacking Sats.

If you do have a larger sum of currency and you would like to get exposure to bitcoin now, why not take 50% of that sum and buy bitcoin now, you now have “skin-in-the-game” as the pro’s like to say, then dollar cost average the other 50% over a timeframe that makes sense to you. That way, if it goes down another 10% tomorrow, you can just scoop up some cheaper Sats, but if it runs back up to all-time-highs again next month, you will not have missed the boat on those gains.

I will leave the discussion about bitcoin here for now, as I said there will be many more articles and educational pieces coming over the coming weeks and months to teach you about this amazing asset class. It is empowering the global financial system. El Salvador has announced it as legal tender. Bitcoin is helping to “bank the unbanked” people of the world. People who do not get stimulus checks. People who rely on remittances from their family abroad (remittances that get taxed 30% on their way to these impoverished countries). But these are articles and topics for another day. Reach out to me if you want to further your education, I have a ton of books, podcasts and resources to recommend.

Conclusion

Regardless of the medium you choose to guard yourself against inflation, I firmly believe that all of us need to start taking action now. What I have shared is scalable to whatever size your bank account balance is. This works from $10 to $1M and beyond. You can start saving in hard money that will not go down in value over the long term. Use these hard monies to save so that you are better positioned to purchase other assets in the long term. Just remember that every dollar you have in the bank now is guaranteed to go backwards in purchasing power, it is simply math.

However, do not overinvest, you still need currency to pay your bills and it is always good practice to keep some dry-powder (some funds in the bank) for that rainy day should you ever need it in a hurry. But, with any excess currency you are saving, in the hope of bettering your life, you need to start thinking about parking that currency somewhere that does not erode over time. And if you haven’t started your savings journey yet, there is no better time to start than now.

Thank you for taking the time to read this far and please…… Just start stacking.

Daz Bea

Is there a statistic or study anywhere that shows what percent of CPI inflation as well as the increase in cost (inflation) of food and energy is due to the expanded money supply vs. market conditions? In a discussion with someone my position was that the expansion of the money supply is the main driver of the decrease in purchasing power/increasing prices. But their counter was that it was due to market conditions and supply and demand and I don’t have a understanding or fair rebuttal to that. Looking for any clarification and education so myself and the other can learn. With gratitude!

Hey Mitchell,

That is such a great question, and I wish I had a link to that resource. First, because money is one of the most complex systems, it is hard to pinpoint each factor’s exact impact on inflation. Therefore it is almost impossible to quantify monetary expansion’s exact impact on inflation. And, even if we did have that data, I don’t believe the central bank/government would want us to know this information.

As it stands, you’ll notice that the media consistently portrays inflation as an external cause, such as the war in Ukraine. The central banks never take ownership as it would make them look incompetent. However, in saying that, you could direct your friend to the chart of M1 money supply (https://fred.stlouisfed.org/series/M1SL). M1 consists of the currency and demand deposits—such as chequing and savings bank accounts. What the chart is telling us is that 75.7% of US dollars in existence were created from January 2020 to December 2021. Although supply shock issues contribute to inflation, monetary printing is definitely a significant contributor. It is also important to note that our world is inherently deflationary without monetary printing and supply shocks. Technology over time allows us to get more for less. You could check out demand-pull and supply-push inflation as this explains the two types of inflation. Monetary printing is a demand-pull inflation of sorts as you create demand by stimulating the economy with money, and with demand, prices rise. I hope that helps.

Thanks Seb, really appreciate you (team) replying to all questions!