✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- Who is the ISM?

- What is the PMI?

- Why is the PMI so important?

- What is the PMI telling us today?

Inspirational Tweet:

Hot Take: the labor market is a lagging indicator.

– Access to credit becomes more expensive, & cost of capital = ↑

– Forward looking indicators start to drop (e.g. PMI new orders/inventory); economic growth impulse = ↓

– With a lag, labor market = ↓

''Old'' information.

— Alf (@MacroAlf) June 3, 2022

@MacroAlf makes a great point here, in my opinion, declaring the PMI as a much more useful macro indicator than the unemployment report. Why? Because the PMI is a leading indicator versus the jobs report, which is a lagging indicator.

If none of this makes sense to you, keep reading. We explain it all super simply in just a few minutes of your time below!

👷 Who is the ISM?

Formed in 1915 and originally known as the National Association of Purchasing Agents (NAPA), the Institute for Supply Management (ISM) is the world’s oldest supply management association in the world.

Which does what? (Good question)

NAPA was initially formed to raise awareness of the importance of purchasers to the business world. Then in 1917, during World War I, NAPA helped US President Woodrow Wilson source and buy scarce materials for the war effort. Going forward, NAPA continued to grow its mission of pushing purchasing efficiencies and education through World War II and the Great Depression.

Most significant to our discussion here, NAPA added the infamous Purchasing Manager’s Index (PMI) to its monthly publications in 1948. And then with continued growth through the 20th century, NAPA added certification standards and was rebranded to National Association of Purchasing Management (NAPM).

Eventually, as purchasers became responsible for the supply of goods and services as well as purchasing, NAPM voted to change its name to the Institute for Supply Management (ISM) in 2002. The ISM now has over 50,000 active members in over 100 countries.

OK then, let’s get back to the PMI and its importance.

🧶 What is the PMI?

First, as stated above, the PMI stands for the Purchasing Managers Index and is released on the first business day each month. The index is basically a survey conducted across 17 industries, weighted according to their contribution to US Gross Domestic Product (GDP).

The headline Manufacturing PMI is made up of an equal weighted composite of five underlying surveys:

New Orders, Production, Employment, Supplier Deliveries, and Inventories.

Each report is a set of questions relating to the above, and whether particular activities (new orders, production, etc.) for their organizations have increased, decreased, or remained unchanged from the previous month, giving the simple answers: Better, Same, or Worse. Then, using a diffusion index, the survey takes the percentage of answers of Better and adds .5 of the answers of Same to arrive at the reported index value.

For Example:

If the response is 25 percent Better, 60 percent Same, and 15 percent Worse, the Diffusion Index would be 55 percent:

25% + (.5 x 60%) = 55%

Therefore, an index score of 50 percent indicates no change from the previous month. So, a PMI score above 50 percent generally means that the manufacturing economy is expanding, and below 50 percent means it is declining.

corporatefinanceinstitute.com

👍👎 Why is the PMI so important?

As implied by @MacroAlf in his tweet above, because of the timing of the report and the nature of the data, the PMI being forward looking is one of the leading indicators of economic activity and health of the US economy. Why exactly?

Well, let’s think about it.

Products are made by manufacturers and then sold to businesses or retailers, which are then bought by businesses and consumers. It stands to reason that some of the closely watched indicators for economic health, such as the CPI (Consumer Price Index) or Beige Book Retail Sales Index, are actually lagging indicators of activity. They are released well after the actual sales have occurred, and by then, economic conditions may have already changed. And unemployment is, of course, measuring the labor situation of the recent past, as well.

In contrast, the PMI Index shows purchasing and manufacturing data that is leading up to sales data, and is released at the first business day of every month. Related employment data is included, a well as expected production and inventories, etc. of items that will become CPI and sales data.

🔮 What is the PMI telling us today?

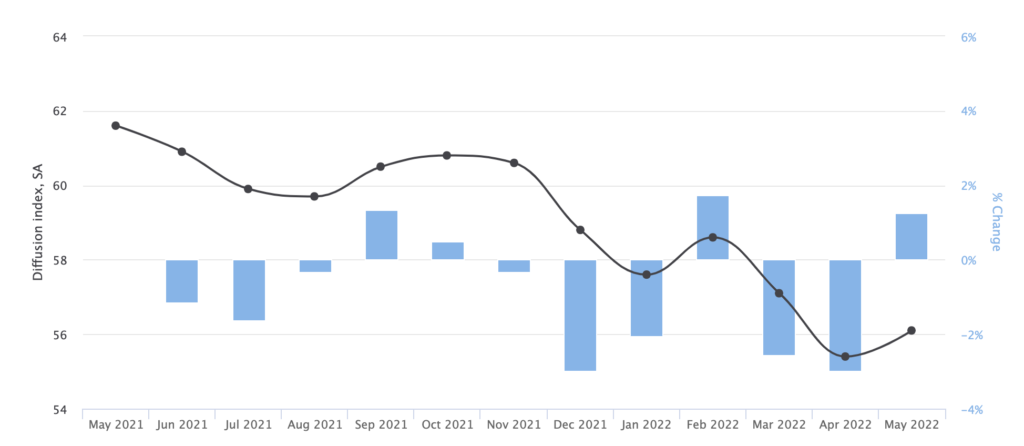

Looking at a chart of the recent scores:

United States – ISM: Purchasing Managers’ Index

moodysanalytics.com

As you can see, the ISM Manufacturing PMI for the US unexpectedly rose to 56.1 in May, up from 55.4 in April, beating consensus forecasts of 54.5.

Looking at underlying data, we see that new orders increased from last month (55.1 vs 53.5), production was higher (54.2 vs 53.6), as were inventories (55.9 vs 51.6). That said, employment fell 1.3 points to 49.6, and prices slid 2.4 points to 82.2. Meanwhile, business sentiment around demand remained optimistic, but supply chain and pricing pressures continued as the largest concerns.

So what does this all mean?

Well, we know higher interest rates on mortgages are already causing a slow down in home building, but a near-term rollover in the economy has not yet materialized in a meaningful way. With both production and inventories up from last month and optimism around demand, manufacturers seem to be expressing confidence that we are not yet heading into a recession.

However, price optimism dropped 2.4 points and employment slipped below the 50 percent line. Perhaps with all the recent supply chain issues (and hints that they are an ongoing concern), manufacturers are willing to over-order raw materials and inventory, front-loading the year just to be sure they have enough merchandise to sell during the third and fourth quarters, the busiest retailing season.

Do I expect a slowdown?

Absolutely. And a buildup of excess inventory would only exacerbate a coming recession. It’s only a matter of when, in my opinion, and I expect the PMI will continue to give us clues to the timing of that reality.

And so, you can be sure that I, and others, will be watching the PMI and other indicators closely and monitoring the underlying data to see what exactly is going on with the US economy in the coming months.

That’s it. I hope you feel a little bit smarter knowing about the ISM and PMI and are ready to start incorporating the Manufacturing PMI into your own macro-economic analyses.

As always, feel free to respond to this newsletter with questions or future topics of interest!

✌️Talk soon,

James

Hi James, thanks for a great article. I’ve recently taken an interest in economics and the monetary system in general.

I would love to get a better understanding of the PMI indicator and the underlying data related to it, and also if you could point me towards any resources for me to better navigate the world of economics, that would be greatly appreciated.

Cheers

Tai