✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- Who is Volcker, anyway?

- What was Volcker’s moment?

- Party like it’s 1980?

- Then what instead?

Inspirational Tweet:

Powell sounded very Volcker-esque in his interview at the Cato Institute's Monetary Conference. Risk assets and the economy will remain on the firing line. The bottom in equities isn't in, and this isn't going to be any soft landing.#RosenbergResearch

— David Rosenberg (@EconguyRosie) September 8, 2022

As David points out, FED Chairman Powell has been channeling Paul Volcker recently, maintaining a pretty hawkish stance. But the thing is, Jerome Powell is no Paul Volcker, and this is not the 80’s, folks.

Let’s walk through the how and why, shall we?

🧐 Who is Volcker, anyway?

First of all, who is this Paul Volcker character we keep hearing about? Like a Federal Reserve superhero or something. Why do we keep hearing his name 40 years after his so-called moment at the Fed?

For starters, Paul Volcker was an economist by study and trade, having studied at Princeton’s School of Public and International Affairs, then Harvard’s Graduate School of Public Administration, and finally at the London School of Economics.

His first job was as an economist at the Federal Reserve Bank of New York. He then worked alternating stints at the US Treasury and Chase Manhattan Bank before returning as the President of the New York Fed. Then, twenty-seven years into his professional career, he was appointed Chairman of the Federal Reserve.

In contrast, Jerome Powell, the current Fed Chairman, is a lawyer and politician by study and trade, having studied politics at Princeton and then law at Georgetown. After a few years as a judge clerk and then an attorney, he moved into mergers and acquisition work at Dillion Read, a New York investment bank. After that, Powell spent some time at the US Treasury where he oversaw investigations of Salomon Brothers investment bank.

Still an attorney, not an economist.

Then he moved back into the private sector, working on mergers and acquisitions, and then for a fund that he founded himself. Powell then pivoted (see what I did there? 😉) and went back to DC to work for a think tank.

Back to politics.

This is where Powell worked to get Congress to raise the debt ceiling in 2011. He was subsequently nominated as a Federal Board Governor by President Obama and in 2017, he took the helm as Chairman of the Fed, nominated by President Trump.

Ok, so now we have an idea of their career and experience differences, let’s get back to Volcker and the 80’s.

🤕 What was Volcker’s moment?

Let’s first state that Volcker was not exactly a hero, no less a superhero, for the US economy. Long before he had his moment, Paul Volcker was one of a handful of key advisors to President Nixon who suggested the US suspend convertibility of the USD into gold back in 1971.

We were officially taken off the gold standard.

This move has been defined as a major contributor to ongoing financial manipulation by the Fed, and, hence, potential fiscal problems for the US.

Flash forward to the 1970’s, and we saw many of those problems manifesting in the US economy.

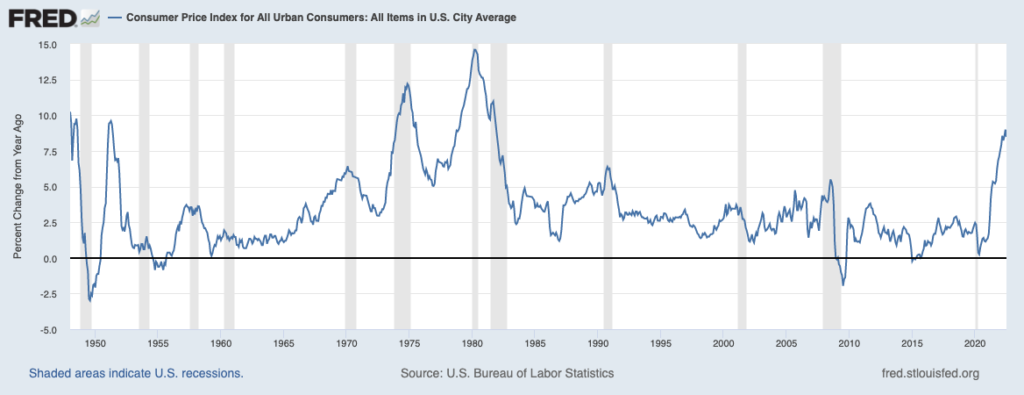

See, before 1965, inflation was quite stable, hovering right around 2%. But increased spending by the government during the Vietnam war caused inflation to start running hot, ticking up over that magic 2% rate. Then, when the US came off the gold standard, it began to escalate. With the OPEC oil embargo in 1973, the price of gas nearly quadrupled and inflation jumped to double digits before settling in around the 7% level over the next number of years.

The Fed raised rates in increments in an attempt to tame inflation, but by 1979 surging energy and food prices once again sent inflation to the 9 to 10% level, peaking at nearly 15%.

Some context.

When Volcker assumed the Chair at the Fed in 1979, US GDP was 3.2%, unemployment was 6.0%, and inflation was 11.3%.

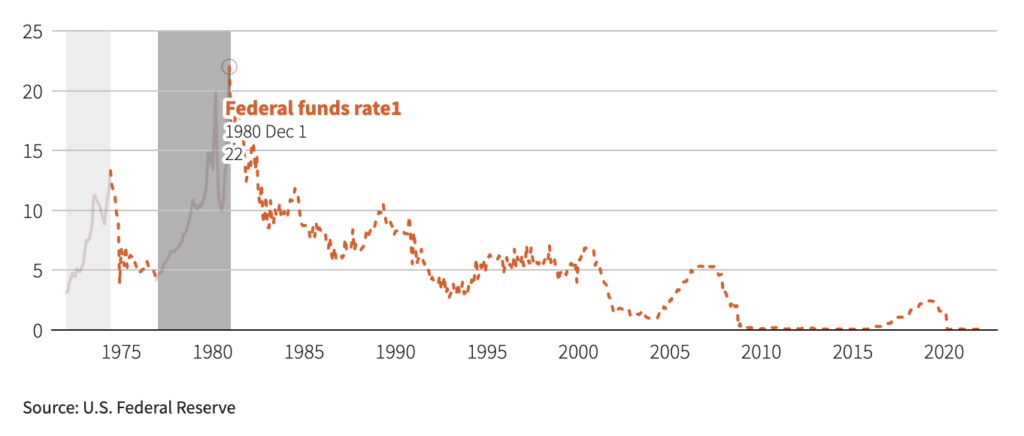

In order to tackle inflation, even if it meant inducing a recession, Volcker began to raise the Fed Funds target rate aggressively, and in a series of raises, temporary reductions, and more raises, he pushed the Fed Funds rate to 20%.

As you can see from the chart below, the effective Fed Funds Rate (what the market actually prices in from the target rate) reached 22% in December of 1980.

Bold. Aggressive. Effective.

By 1982, GDP was -1.8%, unemployment was 10.8%, and inflation was 6.2%.

The economy was firmly in a recession, people were protesting against the Fed, and prices were calming down, so Volcker backed off, reducing rates again.

The Volcker pivot.

And by 1983, GDP was back to 4.6%, unemployment was 8.3%, and inflation 3.2%.

Mission accomplished.

Inflation since the 1990’s has remained relatively in check, hovering around the 2 to 3% level.

Until now, of course.

With GDP projected to come in at 2.8% in the third quarter, unemployment at historic lows of 3.5%, and inflation at 8.5%, some people are calling for another Volcker Moment. A shock raise of rates by current Fed Chair Powell to match the strength of Volcker and meet the challenge of taming inflation once and for all.

Not so fast, armchair economists. Because today is not 1980, and the result could be absolutely devastating to the US economy and ultimately collapse the US Treasury.

Let’s visit why, next.

🥳 Party like it’s 1980?

If you’ve been following me on Twitter and reading The Informationist Newsletter recently, you’ve heard me sounding a warning bell about the sheer amount of debt the US has on its balance sheet. This, coupled with decreasing revenues from capital gains and corporate taxes, has produced a hefty deficit for the Treasury that it can only meet by issuing additional debt.

To put it simply, we are a nation now built on borrowing. Period.

For reference, in 1980, the US federal debt to GDP was 30%.

Today, it’s 125%.

Since we’re no longer on the gold standard, the United States has had virtually no check against the rate at which the money supply can be expanded. In other words, it can print money at will. And it can borrow endlessly.

If you have not read about the US debt spiral, I highly encourage you to take just a few minutes to learn about the precarious position we find ourselves in here.

For the TL;DR crowd, I’ll make it super simple for you.

The US perpetually operates in a deficit. As the deficit grows, it simply issues more debt to fill the gap between revenues (taxes) and expenses (entitlements + defense + misc.).

One problem.

As interest rates rise, the cost of borrowing rises as well. To put pencil to paper on that, here’s the current US budget situation, as estimated by the Congressional Budget Office (CBO):

$4.8T taxes – $3.7T entitlements – $800B defense = $300B leftover for interest expense

Current interest expense on $30T of Treasuries = $400B

300B – 400B = -100B

(oops)

Now imagine Powell and the Fed getting tough, really tough, on inflation. Imagine him taking interest rates up, way up, like Volcker did. Let’s say he jacked up the target rate to 10%.

The annual interest cost on replacing the current $30T of debt at 10% would be $3T dollars.

That’s $2.7T over budget. And that’s before a massive reduction in capital gains tax revenues from the market crash it would cause, as well as the plummeting of corporate taxes due to increased borrowing costs and decreased company profitability.

What’s worse, the Treasury would have to then issue an additional $2.7T of debt to cover that gap, at the new 10% interest rate.

Though, in reality, the replacement cost would be higher as longer maturities would have higher interest rates than the Fed Funds target rate.

Obviously never going to happen.

Ok, then, what if, since our rates have been so low for so long that we use comparable percentage of moves hikes rather than absolute percentage hikes to the Fed Funds target rate.

Right now, we’re sitting at 2.5% at the high end of the Fed Funds target rate.

Let’s say Powell does what Volcker did and he doubles that in two or three hikes, all the way up to 5%. And let’s say the average replacement cost of Treasury debt would then be 6%.

Replacing $30T of debt at 6% would cost $1.8T in interest annually. That’s $1.5T over budget (remember, as of now, there’s only $300B budgeted for interest expenses).

Again, this is also before the reduced tax revenues for that budget. In reality revenues would be far lower than even this estimate. And this is also before the Fed has sold barely any of the $5.7T of Treasuries it has on its balance sheet for its QT program.

Hiking rates up to 5% would induce much higher unemployment, severely affect the mortgage and housing market, and would significantly affect consumers’ ability to pay their variable interest rate debts. Forget soft-ish landing, as Powell keeps saying he wants. This would be a nose-dive crash of the economy that could take a decade or more to recover from.

Bottom line, it’s not going to happen, either.

Remember, Volcker’s approach was shocking, and it was done in a series of moves over the course of nearly three years. Far too much (almost 50%) of US debt would mature and need to be replaced in that timeframe today.

If Powell truly pulled a Volcker shock and hiked rates to corresponding 1980 levels and hold them there even for two years, the US economy, the US Treasury market, and the US Treasury itself would simply collapse.

🤨 Then what instead?

The way I see it, the Fed has limited options. Powell can hike rates just enough to appear tough on inflation, without causing a market crash and thereby tanking the US tax revenues. He can hike two, maybe three more times, but only to a terminal rate (final highest rate of this cycle) of about 3.5 to 4% at absolute most.

Even if the inflation rate does not come back to the stated target of 2%, Powell may back off while pointing to the direction of change in the inflation rate. The Fed may just quietly accept a 3 to 4% ongoing inflation rate and declare victory.

And then he will quickly do what Volcker did in 1982, but this time he will have to do it sooner. By late 2023 instead.

He will have to pivot and begin to lower rates again.

Why?

It’s just math, my friends. Math that is not in the Fed’s or Treasury’s favor.

Higher inflation, they can stomach. Especially as it helps inflate away past debt with cheaper future dollars to pay the interest and principle off. And besides, the last thing Powell wants to do is crash the economy into a depression and cause the whole house of debt to crater and end the borrowing charade.

So as an investor, what can you do?

You’ve heard me say it before, I think it is essential to own hard monies and assets that can hold their value over a long period of time. Holding some cash in these times of uncertainty is wise, especially if you have short term needs, as well choosing value stocks, if you wish to remain in the market. But owning gold, silver, and Bitcoin will help in either a US Treasury meltdown/hyperinflation scenario, or, much more likely, for when the pivot comes and QE infinity begins.

Which we all expect, eventually will.

That’s it. I hope you feel a little bit smarter knowing about Volcker and his moment and how 2022 is different from 1982!

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James

I’m 63 years old, so I lived the Paul V’s tenure. He along with Jimmy Carter seem to be the last people in those position who did the right thing instead of the politically-expedient. You would do well to study the 1970s and the 1980s. When I graduated from college in the early 1980s I was worried about finding work (double-digit unemployment) and affording to live (double-digit inflation). It can happen again. The FED and the Federal Government (other than a few years in the late 1990s) hasn’t been fiscally-responsible. We need to change this situation and start electing people who want to serve the country instead of themselves.