✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox here

Today’s Bullets:

- What is the Federal Reserve?

- How is the Fed structured?

- The Fed’s Dual Mandate

- QE, QT, and the Money Printing Press

- The Fed Pickle

Inspirational Tweet:

To the Fed's credit, I wouldn't know what to do with this situation either.

When total public+private debt is well over 300% of GDP, it's nearly impossible to have persistently positive real rates. And yet negative real rates are also bad. #longtermdebtcycle pic.twitter.com/sScxakaaeK

— Lyn Alden (@LynAldenContact) August 5, 2022

All eyes are on the Federal Reserve lately, and as Lyn Alden points out here, the Fed finds itself in quite a tough spot right now. A real pickle: raise interest rates and debt costs soar, lower rates and inflation soars, thereby causing deeply negative real rates.

Why does it all matter and what can they do?

Let’s boil it down here today, starting with who exactly ‘the Fed’ is first.

🏛 What is the Federal Reserve?

Most, but not all, countries have a central bank, a separate but centralized body that manages a country’s national monetary policy. The Federal Reserve, officially known as the Federal Reserve System or FRS, is the United States’ central bank.

But everyone just calls it the Fed.

Widely considered the most powerful financial institution in the world, the Fed was established by an act of Congress in 1913 to ‘provide the nation with a safer, more flexible, and more stable monetary and financial system’.

Well. We’ll dig into that a bit later. First, let’s make something clear:

Though created by Congress, the Fed is not a government entity.

To understand how and why, let’s break down the structure of the Fed.

🚧 How is the Fed structured?

Set up with the intention to be anonymous and separated from political pressures, the Fed operates much like a national bank with numerous branches. That said, however, with government appointed-and-employed oversight, there’s no arguing that there are distinct and powerful political influences to the Fed’s decision-making, as you can see from the structure:

- Board of Governors (also known as the Federal Reserve Board (FRB)): Located in Washington, D.C., all seven members are appointed by the President and confirmed by the Senate. Board members and their staff are government employees.

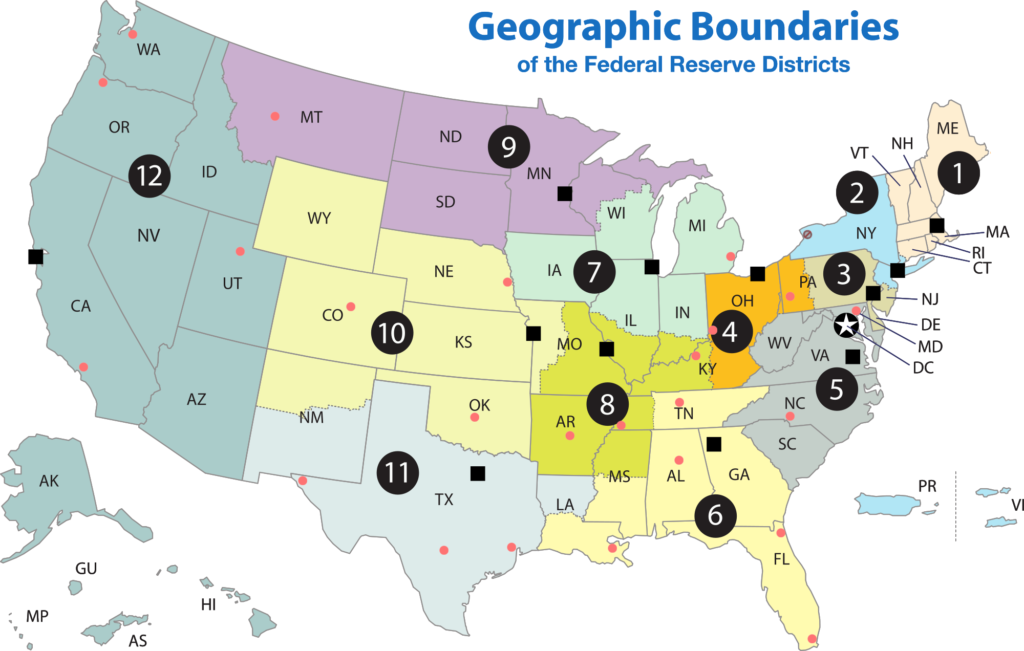

- Regional Reserve Banks: The system’s 12 regional banks (see regional chart below) are based in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco. Regional bank employees are not employed by the government.

- Federal Open Market Committee (FOMC): Includes the Board of Governors, the president of the Federal Reserve Bank of New York, and the presidents of four other regional Federal Reserve Banks who serve on a rotating basis. The FOMC is charged with conducting the Fed’s monetary policy.

Important to note, the Regional Reserve Banks operate like typical banks, each with its own board of directors, president and first vice president. The board members are selected in combination by the shareholders of the Regional Reserve Banks and the Board of Governors. The president and first vice president are selected by each Regional Reserve Bank board and must be approved by the Board of Governors.

You see how the lines gets pretty blurred quickly, yes?

Even though each branch bank has an ‘independent’ board of directors, a number of these directors are chosen by the federal arm, the Board of Governors. Also, the President and vice presidents must be approved by the federal Board of Governors.

Politics abound.

And that leads us to the actual purpose of all these banks and governors and the system. What is the Fed supposed to actually do?

⚖️ The Fed’s Dual Mandate

First, the Board of Governors (FRB) is responsible for setting bank reserve requirements. This is basically the amount of money banks must hold to maintain sufficient liquidity in case they are faced with unexpected and sudden withdrawals.

Second, the FRB sets the discount rate, the target interest rate charged on overnight loans made between commercial banks and other financial institutions.

Incidentally, I recently wrote a whole newsletter devoted to overnight lending and the repo market. If you have not yet seen that, you can find it here.

The FOMC is responsible for open market operations. This is the actual buying and selling of government securities in the open market.

The committee is also in charge of making monetary policy decisions which are meant to:

- maintain full employment,

- maintain stable prices.

The Fed dual mandate, as it has come to be known.

And how exactly do they do this?

By either raising or lowering the Fed Funds rate (discount rate) or through quantitative easing and/or quantitative tightening.

💸 QE, QT, and the Money Printing Press

Really briefly, quantitative easing or QE is basically the Fed entering the open market and buying US Treasuries. This injects more liquidity (more money) into the financial system.

How?

Simple, really. Commercial banks have cash and Treasuries as reserve assets sitting at their banks, as well as other assets like mortgage backed securities (MBSs). They can buy or sell these Treasuries or MBSs from other banks in the open market.

Enter the Fed.

When the Fed then steps into the open market and brings along with it a heap of new cash, and they are the ones to buy the Treasuries or MBSs from these banks in the open market, they have introduced a new pile of money into system.

The money enters the system, and the Treasuries and MBSs are added to the Fed’s balance sheet.

A note on mechanics. When we say that the Treasury prints money, this is not actual paper money and coins, but rather an electronic accounting entry. The Treasury essentially presses a few buttons to add cash to the Fed’s balance sheet for it to use for these purchases. The purchases then end up on the Regional Reserve Banks’ balance sheets, collectively known as the Fed’s balance sheet.

The money trail:

Treasury → FRB → Regional Reserve Banks → Commercial Banks

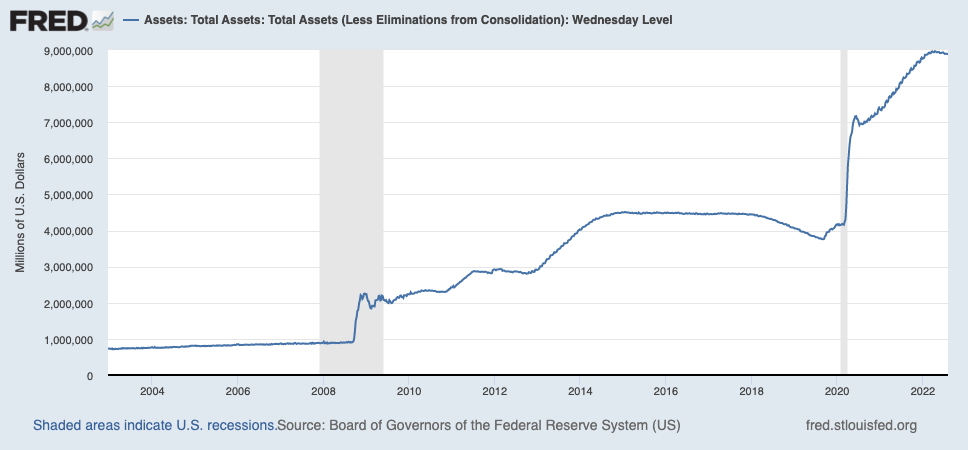

This is exactly what the Fed did in response to the crisis of the pandemic, through QE and purchases of assets in the open market. To the tune of $4.6 trillion over two years.

So, now that the Fed added all this liquidity to the system, coupled with the Treasury sending $5 trillion of stimulus checks directly to people, as well as pandemic related supply chain challenges and ongoing energy shortages, we are experiencing exacerbated inflation.

Judging recent economic data and consumer sentiment numbers, this inflation is negatively affecting people and will create major pain for them if it continues to accelerate higher.

🧐 The Fed Pickle

The Fed has attempted to fight the ongoing inflation by raising the Fed Fund rate from .25% to 2.33% this year. Additionally, the Fed is, albeit slowly, starting to sell some of its assets each month, implementing quantitative tightening (QT) as their other tool to combat inflation.

Quantitative easing is buying assets, adding cash to the system.

Quantitative tightening is selling assets, removing cash from the system.

However, while the Fed has acted, US GDP readings have come in negative for the last two quarters, suggesting we are already in a recession. A number of other data readings, including lower housing prices, rising consumer credit levels, and weakening consumer confidence seem to support this reality.

As a note, in a conflicting report, the latest employment numbers came in with a huge surprise to the upside, suggesting the opposite. But when you dig into the numbers, you see there are many part-time additions and second job holders, so perhaps they were not quite as robust as the headline. Also, job losses are sometimes the last indication of a recession and often occur after we have already entered one.

Meanwhile, energy costs have remained high enough and housing is a lagging indicator, so the inflation reading of Consumer Price Index (CPI) could come in high yet again.

As we watch Jerome Powell, the other Fed governors, and Regional Banks’ Presidents fumble with their messaging, trying to assure everyone they are most concerned about the inflation numbers, and circling back to Lyn’s post above, it is obvious they know they are in a pickle.

See, with the nation indebted 3X what we earn as a country (GDP), raising rates much more could induce a major meltdown of the US economy. If they raise rates too high, the economy grinds to a halt, and the country enters a deep recession. People lose their jobs, they are unable to pay their mortgages, car payments, credit card debt, etc., and enough defaults then cause other defaults in a form of contagion.

This also means a lower GDP. Which means lower tax receipts. Which means less money for the US government to pay off their own debt (US Treasuries). This, along with a higher cost to replace any debt that is maturing, since the US already operates in a deficit and must issue additional debt at higher rates in order to continue operating financially at the federal level. This is known as kicking the proverbial debt can down the road, making it a much larger problem only to worry about later.

And if they don’t raise rates?

First, they don’t leave themselves much room to lower them later, if we do indeed enter a deeper recession. Or worse, with demand unchecked, we could see continued and eventually super or even hyper-inflation. A currency crushing event that requires a total reset of a nation’s financial system.

Look at the likes of Lebanon, Sudan, and Venezuela, all of which are suffering from massive inflation just this year. Turkey, a G-20 country is not far behind.

So, yes, it could happen. And as it stands, mathematically, it is virtually inevitable for all fiat based currencies to eventually fall under the crush of debt in the future. This is why I feel Bitcoin is so important to have, even as a small allocation, in an investor’s portfolio. To understand more fully why, I wrote a thread recently all about that, you can find it here:

As a risk trader, I’m always concerned about 'Tail Risks'.

And #Bitcoin hedges against the biggest tail risk we’ve ever faced in the history of the modern financial world:

An all out collapse of fiat currencies.

How? Let’s break it down nice and easy here 👇🧵

— James Lavish (@jameslavish) February 15, 2022

Phew. That’s it. A little bit longer today, but an important one. I hope you feel a bit smarter knowing about the Fed, understanding how it works, and the pickle in which it now finds itself.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James